Maryland Online Marketing Agreement

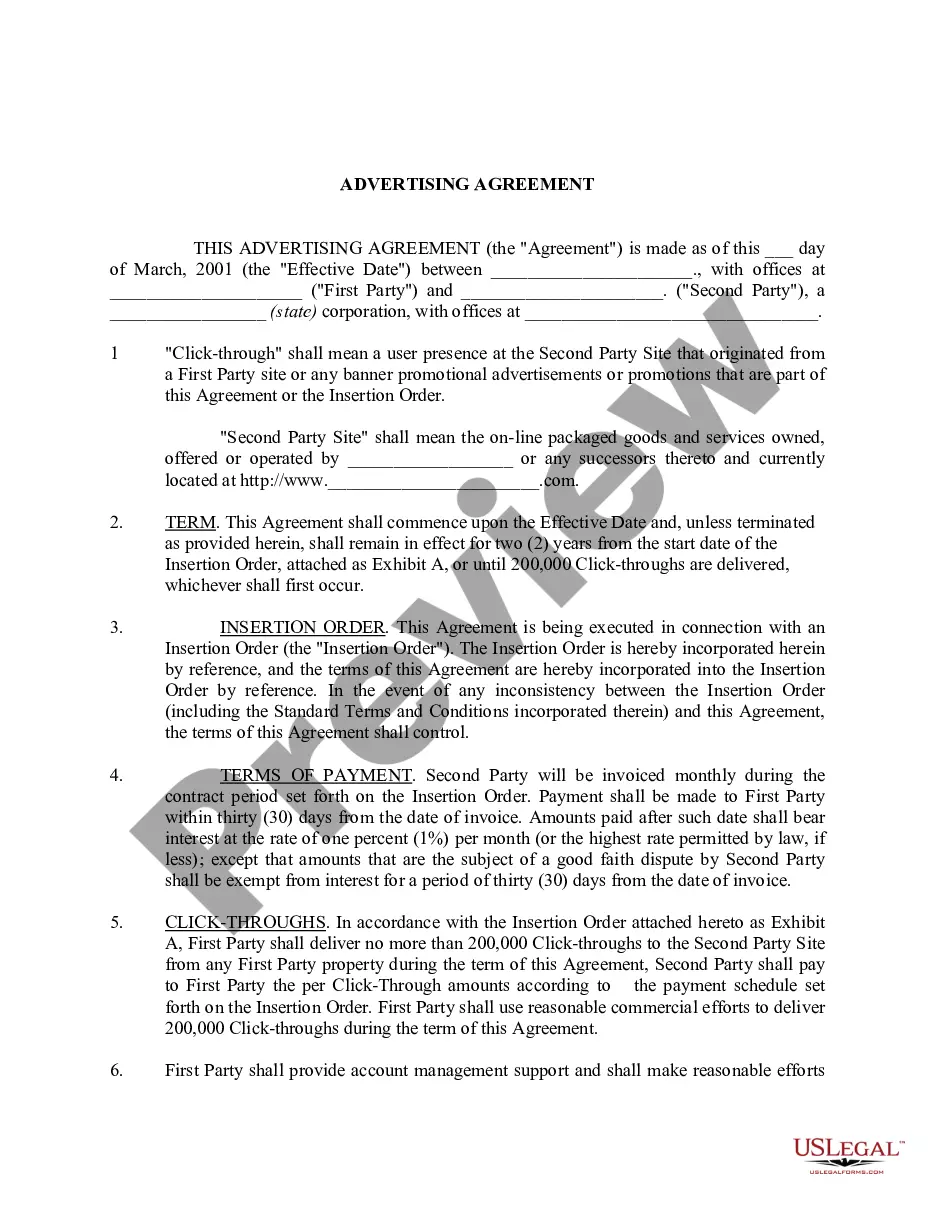

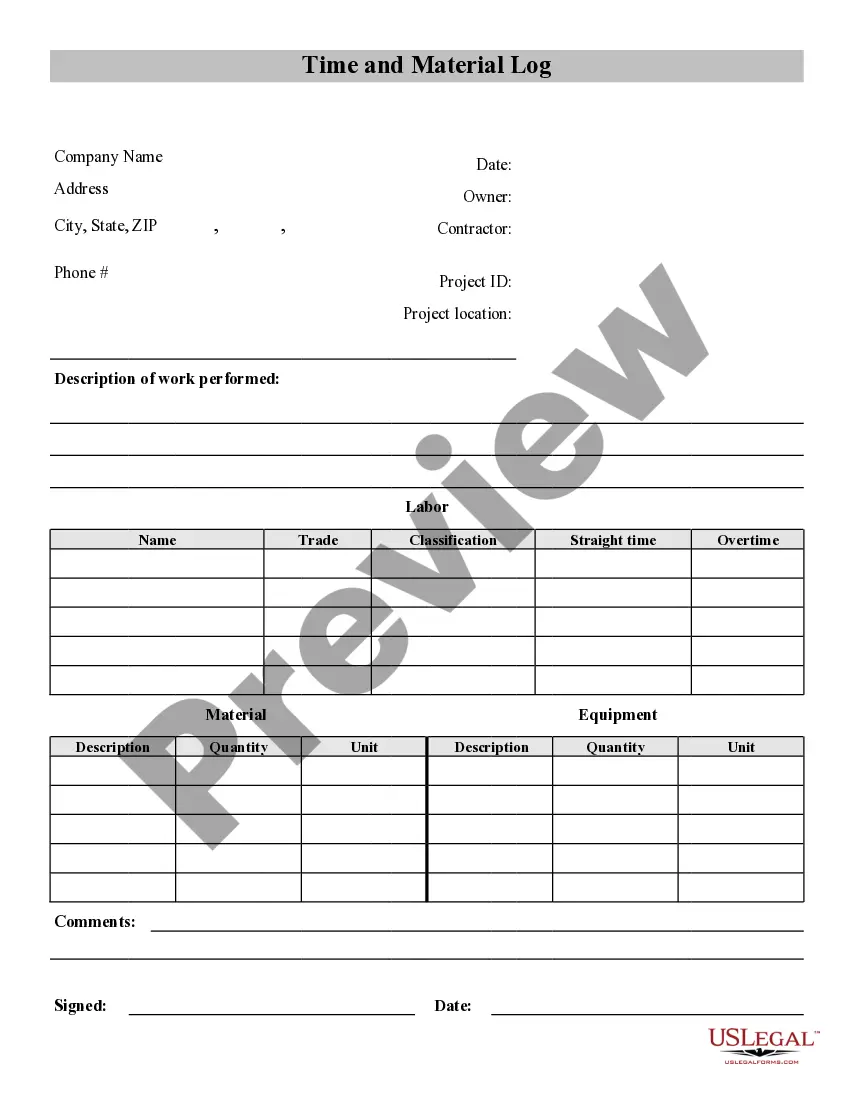

Description

How to fill out Online Marketing Agreement?

Are you currently in a situation in which you will need papers for either company or person reasons just about every day time? There are a variety of legal record themes available online, but getting ones you can rely on is not easy. US Legal Forms gives a large number of kind themes, like the Maryland Online Marketing Agreement, which are composed to fulfill federal and state requirements.

When you are presently acquainted with US Legal Forms web site and get your account, merely log in. Afterward, you are able to acquire the Maryland Online Marketing Agreement template.

Should you not provide an bank account and wish to begin using US Legal Forms, abide by these steps:

- Obtain the kind you need and make sure it is to the correct metropolis/region.

- Use the Preview switch to examine the shape.

- Browse the outline to actually have selected the appropriate kind.

- In case the kind is not what you`re searching for, use the Research discipline to find the kind that meets your needs and requirements.

- Whenever you obtain the correct kind, just click Purchase now.

- Pick the costs plan you would like, submit the required information to produce your account, and pay for the order with your PayPal or credit card.

- Pick a hassle-free file structure and acquire your duplicate.

Get all of the record themes you have purchased in the My Forms food selection. You may get a further duplicate of Maryland Online Marketing Agreement any time, if necessary. Just go through the essential kind to acquire or print out the record template.

Use US Legal Forms, one of the most comprehensive assortment of legal kinds, to save some time and stay away from errors. The services gives expertly produced legal record themes which you can use for a range of reasons. Create your account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

Since Maryland initially began taxing digital goods in early 2021, there have been significant updates to both the statutes and procedural guidance on the scope of digital good taxation.

California. No, they do not generally require a sales tax on digital products/downloads that do not have a physical storage medium.

There are 23 states that do not tax digital products. 4 states do not have a retail sales tax at all; these include: Delaware, Montana, New Hampshire and Oregon. For the states that tax digital products, the tax rate varies from 1% to 7%, depending upon the state and the type of digital good.

Purpose of Form Form 510D is used by a pass-through entity (PTE) to declare and remit estimated tax for nonresi- dents.

The digital advertising gross revenues tax is imposed on persons with global annual gross revenues of at least $100,000,000 and deriving gross revenues from digital advertising in Maryland of at least $1,000,000. Tax rates vary from 2.5% to 10% depending on the taxpayer's global annual gross revenue.

Some goods are exempt from sales tax under Maryland law. Examples include most non-prepared food items, prescription and over-the-counter medicines, and medical supplies.

Since Maryland initially began taxing digital goods in early 2021, there have been significant updates to both the statutes and procedural guidance on the scope of digital good taxation.