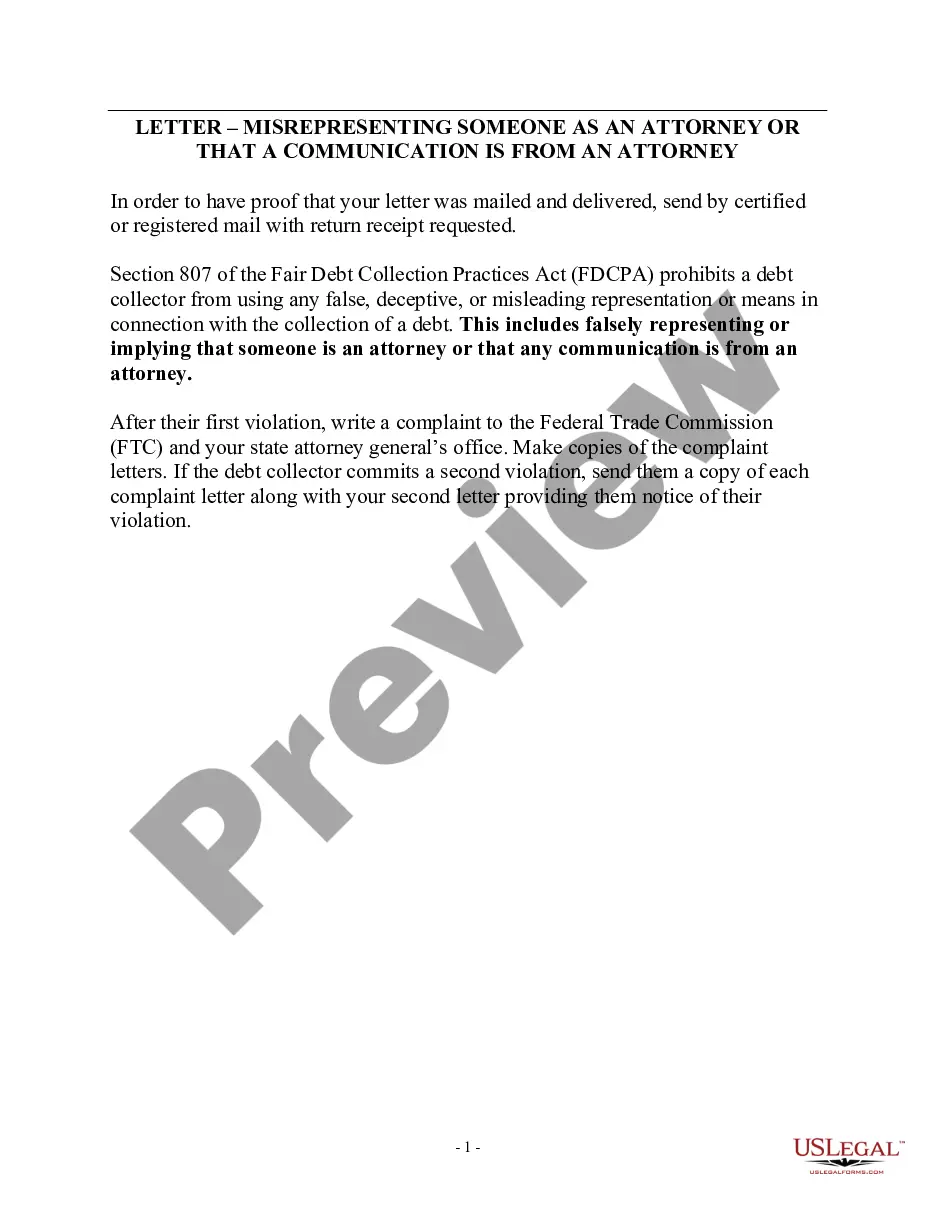

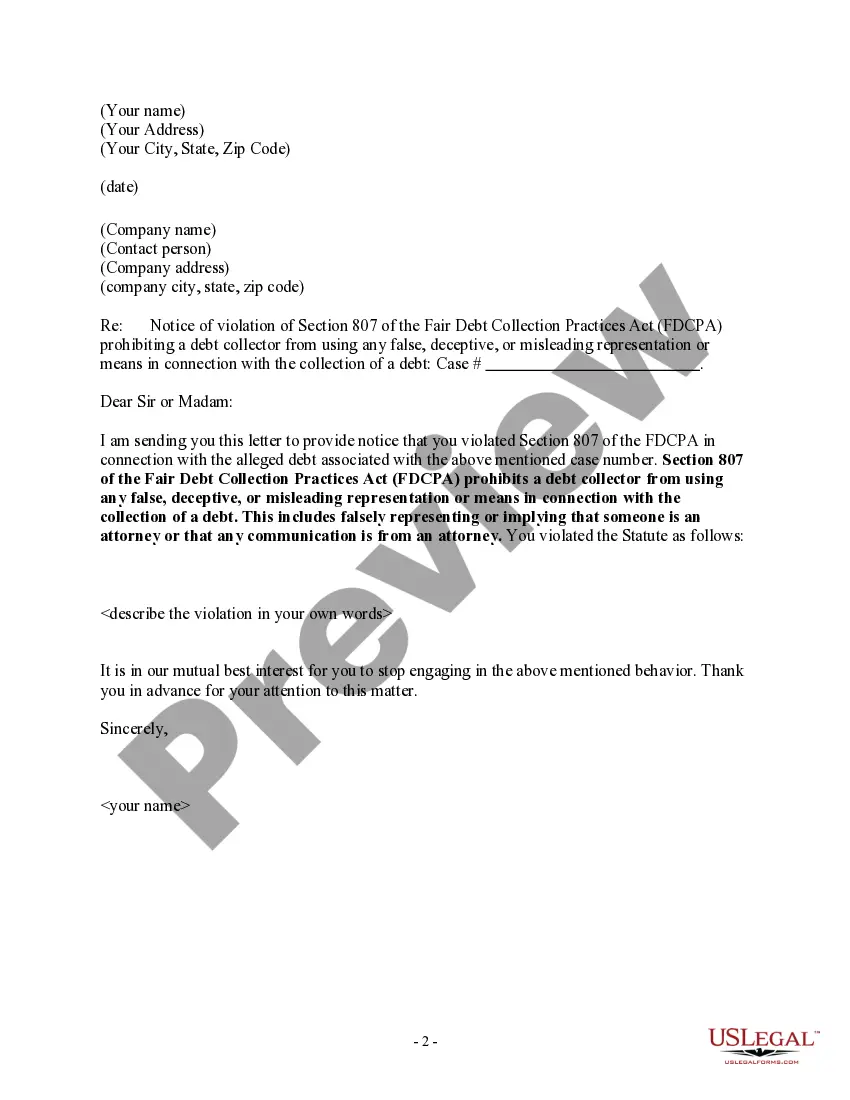

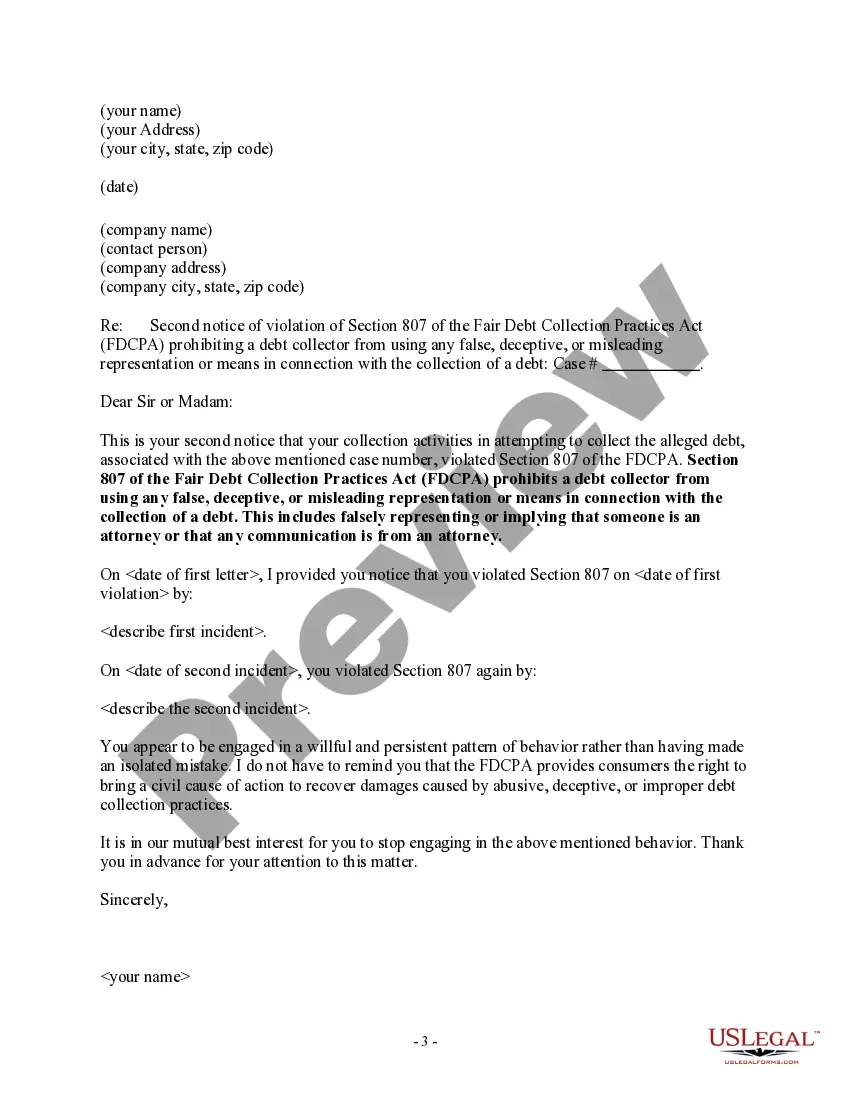

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that someone is an attorney or that any communication is from an attorney.

Maryland Notice to Debt Collector - Misrepresenting Someone as an Attorney

Description

How to fill out Notice To Debt Collector - Misrepresenting Someone As An Attorney?

Choosing the right lawful file format can be quite a have difficulties. Of course, there are plenty of layouts accessible on the Internet, but how do you get the lawful type you want? Utilize the US Legal Forms web site. The support delivers a huge number of layouts, such as the Maryland Notice to Debt Collector - Misrepresenting Someone as an Attorney, which you can use for organization and personal needs. Every one of the types are examined by experts and fulfill federal and state demands.

Should you be already registered, log in to the bank account and click the Download option to have the Maryland Notice to Debt Collector - Misrepresenting Someone as an Attorney. Use your bank account to search from the lawful types you may have acquired previously. Check out the My Forms tab of the bank account and have one more backup from the file you want.

Should you be a new user of US Legal Forms, listed below are straightforward guidelines that you should follow:

- Initially, make certain you have selected the right type to your town/county. You are able to examine the shape while using Preview option and read the shape description to make sure this is the best for you.

- In case the type does not fulfill your preferences, utilize the Seach discipline to find the correct type.

- When you are positive that the shape would work, click on the Purchase now option to have the type.

- Opt for the pricing prepare you need and enter the needed information and facts. Make your bank account and pay for the order making use of your PayPal bank account or bank card.

- Opt for the submit format and obtain the lawful file format to the device.

- Total, edit and print out and indication the received Maryland Notice to Debt Collector - Misrepresenting Someone as an Attorney.

US Legal Forms will be the greatest catalogue of lawful types that you can discover various file layouts. Utilize the service to obtain professionally-created papers that follow condition demands.

Form popularity

FAQ

Are debt collectors persistently trying to get you to pay what you owe them? Use this 11-word phrase to stop debt collectors: ?Please cease and desist all calls and contact with me immediately.? You can use this phrase over the phone, in an email or letter, or both.

You have two tools you can use to dispute a debt: first, a debt validation letter the debt collector is required to send you, outlining the debt and your rights around disputing it; then, a debt verification letter. You can submit a written request to get more information and temporarily halt collection efforts.

When It's Not Your Debt Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing. ... Dispute the debt on your credit report. ... Lodge a complaint. ... Respond to a lawsuit. ... Hire an attorney.

You may also report your complaint to the FTC. The FTC enforces the federal Fair Debt Collection Practices Act, which prohibits abusive, unfair, or deceptive debt collection practices.

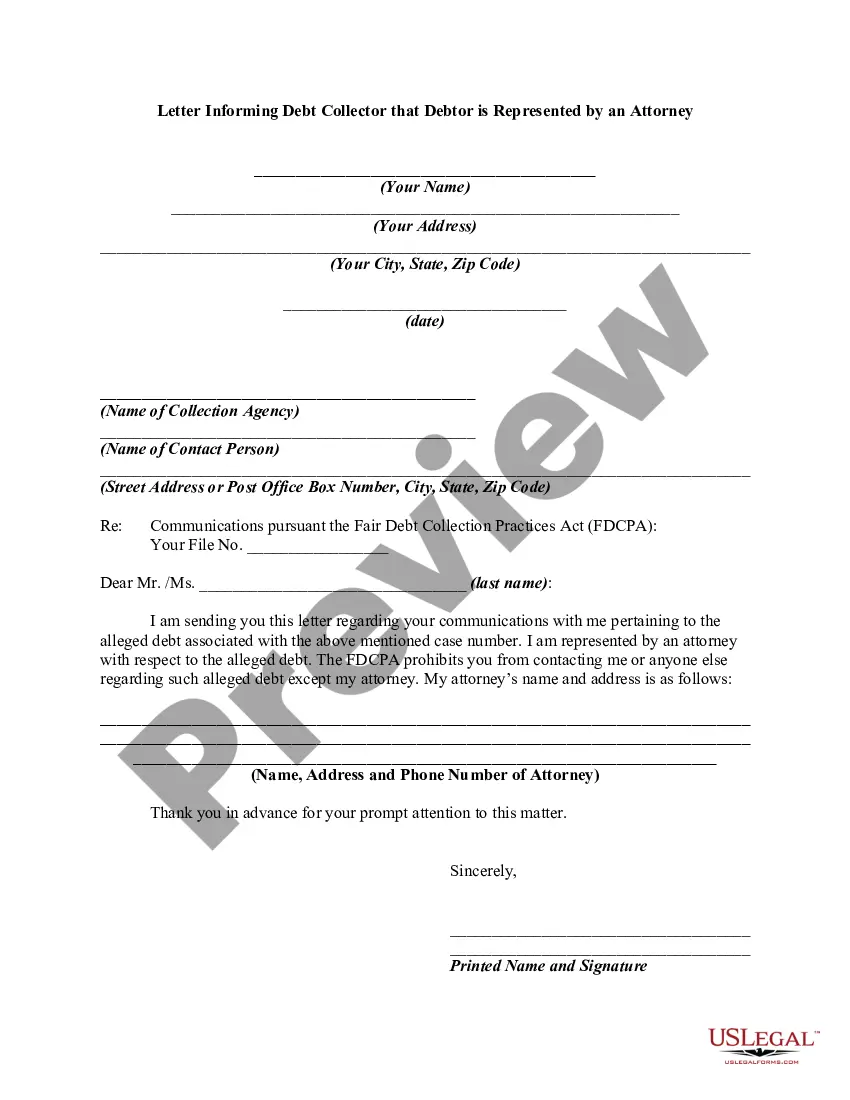

Under federal law, a debt collector must go through your attorney if they know that you have one, so it's a good idea ? if you get legal representation ? to tell the collector the name of the attorney who is representing you and how to contact them.

If you believe you already paid the debt, do not owe the debt, the amount is incorrect, or that it's not even your debt, you may send a written request to the debt collector to dispute the debt or receive more information.

File a complaint The DFPI regulates debt collection in the state of California. If a debt collector is contacting you or if a debt collector is lying or threatening you, you can quickly and easily file a complaint on the DFPI File a Complaint Webpage.

Here's what every debt letter should include: Date of the letter. Lawyer's name, firm, and address. Client's name and address. A subject line that states its purpose. The precise amount the client owed your firm and the date when the payment was due. Instructions on how to pay the debt and the new deadline.