This due diligence workform is used to review property information and title commitments and policies in business transactions.

1099g Maryland

Description

How to fill out Maryland Fee Interest Workform?

US Legal Forms - among the most significant libraries of legitimate forms in the States - offers a wide range of legitimate document layouts you are able to download or print out. Using the site, you can get 1000s of forms for organization and individual reasons, sorted by groups, suggests, or search phrases.You can find the latest versions of forms such as the Maryland Fee Interest Workform in seconds.

If you already have a subscription, log in and download Maryland Fee Interest Workform in the US Legal Forms local library. The Down load button can look on each develop you perspective. You have access to all earlier saved forms from the My Forms tab of your own bank account.

In order to use US Legal Forms the very first time, allow me to share straightforward guidelines to help you began:

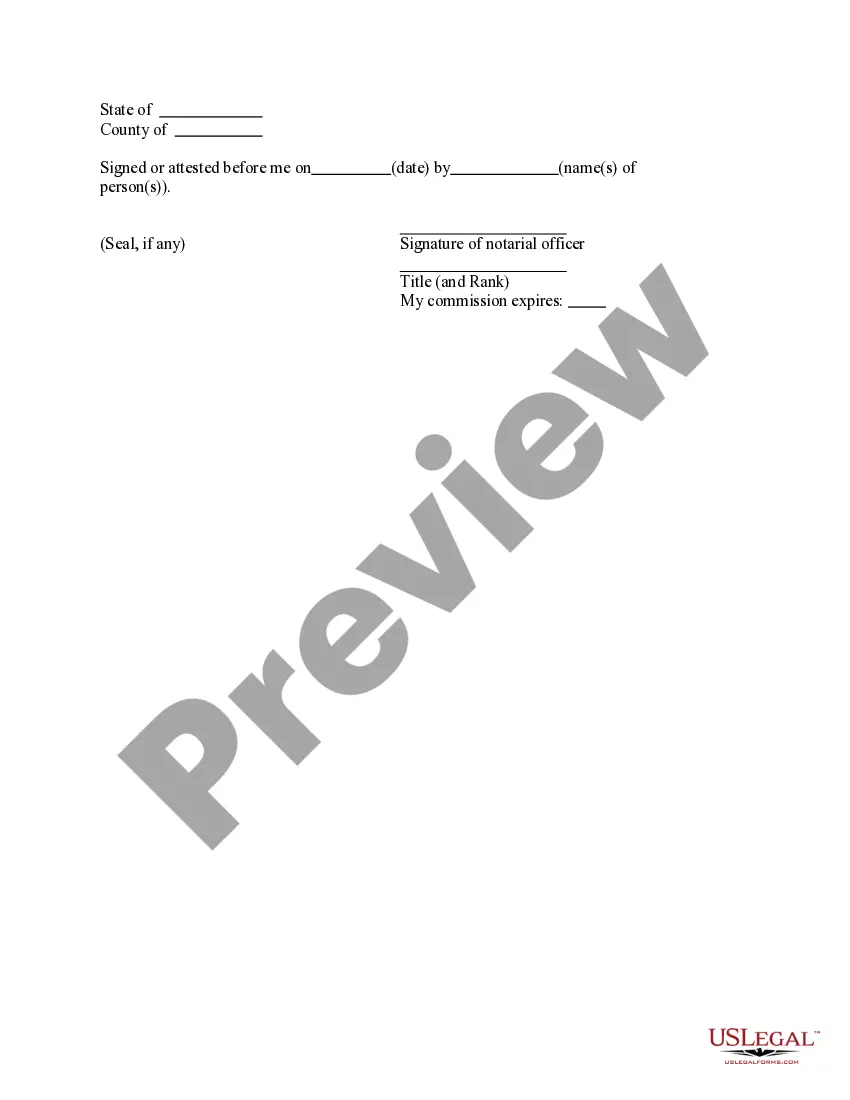

- Ensure you have picked the correct develop for your personal metropolis/county. Click the Review button to check the form`s content. See the develop outline to ensure that you have selected the proper develop.

- If the develop doesn`t fit your needs, make use of the Search field near the top of the monitor to get the the one that does.

- In case you are happy with the form, verify your option by clicking the Acquire now button. Then, choose the costs program you want and supply your qualifications to register to have an bank account.

- Approach the deal. Use your Visa or Mastercard or PayPal bank account to finish the deal.

- Choose the format and download the form on your product.

- Make changes. Fill out, edit and print out and sign the saved Maryland Fee Interest Workform.

Every template you put into your bank account does not have an expiry time and is also yours for a long time. So, if you want to download or print out an additional duplicate, just proceed to the My Forms portion and then click around the develop you want.

Obtain access to the Maryland Fee Interest Workform with US Legal Forms, probably the most extensive local library of legitimate document layouts. Use 1000s of specialist and state-specific layouts that satisfy your business or individual needs and needs.

Form popularity

FAQ

You must file your Maryland Amended Form 502X electronically to claim, or change information related to, business income tax credits from Form 500CR. Changes made as part of an amended return are subject to audit for up to three years from the date that the amended return is filed.

Choose the Right Income Tax FormIf you are a Maryland resident, you can file long Form 502 and 502B if your federal adjusted gross income is less than $100,000. If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR.

This form may be used by both resident and nonresident individuals. If you received unemployment compensation, or if you received a Coronavirus Relief Payment, use this form to subtract those amounts from your federal adjusted gross income to determine your Maryland adjusted gross income.

In addition, some Forms 1040, 1040-A, 1040-EZ, and 1041 cannot be e-filed if they have attached forms, schedules, or documents that IRS does not accept electronically.

Form 1099G is an information return - not a tax bill or a refund. If you received a Maryland income tax refund last year, we're required by federal law to send you Form 1099G to report that the state refund may have to be reported as income on your federal tax return.

Penalty and Interest Charges Your assessment will depend on the amount of taxes that we believe you owe. Maryland law requires us to charge interest at the annual rate of 11% during calendar year 2019, 10.5% during calendar year 2020, 10% during calendar year 2021, and 9.5% during calendar year 2022.

Any flow through of interest on obligations and securities of the State of Maryland and its political subdivisions is not taxable and, therefore, does not have to be added to federal adjusted gross income on the Maryland return.

You can file both your Maryland and federal tax returns online using approved software on your personal computer.

Fiduciary Filing Information Nonresident fiduciaries must also file Form 504NR which is used to calculate their nonresident tax. At this time, fiduciary tax returns cannot be filed electronically.

An amended tax return cannot be filed electronically; you need to complete and mail a Form 1040X for your federal return and a Form MD 502X for your Maryland return.

More info

IEEE Newsroom.