Maryland Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund

Description

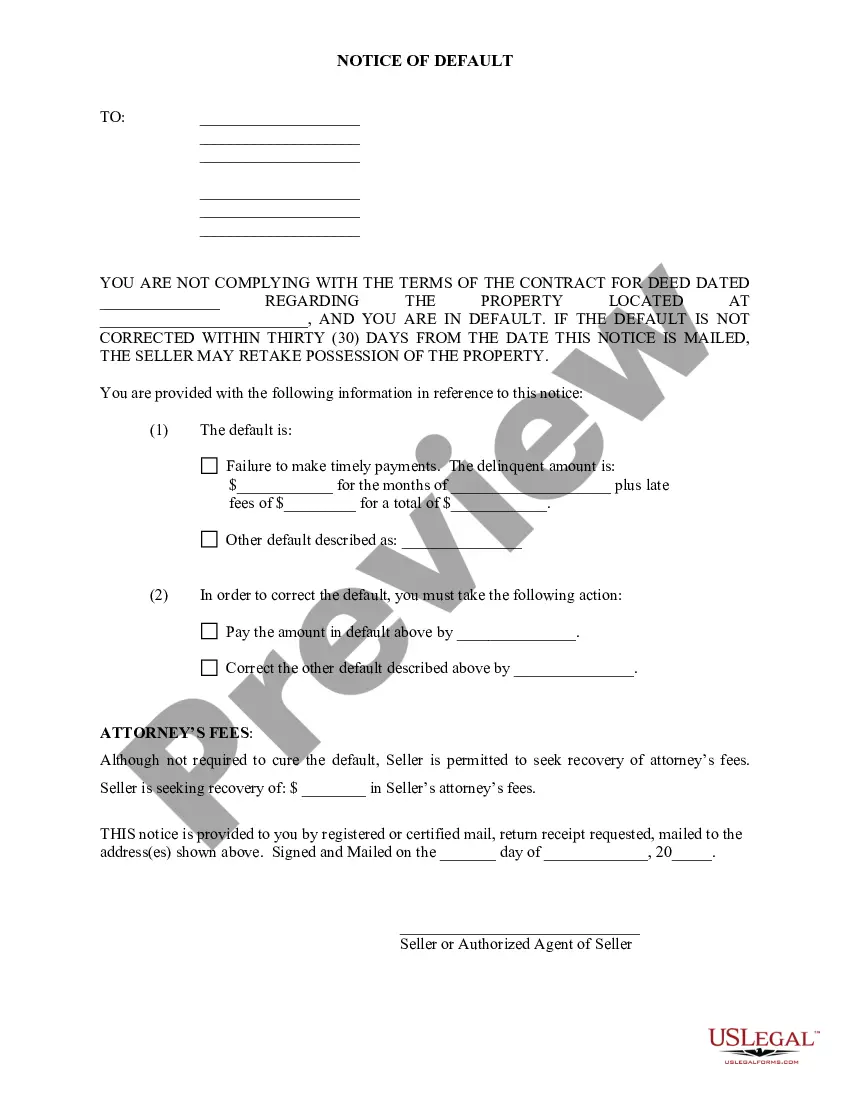

How to fill out Plan Of Reorganization Between Franklin Gold Fund And Franklin Gold And Precious Metals Fund?

If you have to complete, acquire, or print legitimate document templates, use US Legal Forms, the greatest selection of legitimate kinds, that can be found online. Make use of the site`s simple and easy hassle-free look for to obtain the paperwork you will need. Different templates for business and personal reasons are categorized by types and suggests, or key phrases. Use US Legal Forms to obtain the Maryland Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund with a few clicks.

When you are already a US Legal Forms customer, log in in your profile and then click the Acquire button to find the Maryland Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund. You can even access kinds you earlier saved from the My Forms tab of your respective profile.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that proper area/land.

- Step 2. Make use of the Preview choice to examine the form`s articles. Do not overlook to read through the description.

- Step 3. When you are not happy together with the type, use the Search area at the top of the display screen to locate other models of your legitimate type design.

- Step 4. Once you have identified the shape you will need, click the Buy now button. Opt for the costs plan you favor and include your qualifications to register for the profile.

- Step 5. Procedure the transaction. You may use your credit card or PayPal profile to perform the transaction.

- Step 6. Find the file format of your legitimate type and acquire it on your own product.

- Step 7. Full, edit and print or indication the Maryland Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund.

Each and every legitimate document design you acquire is the one you have eternally. You have acces to each type you saved in your acccount. Click on the My Forms section and select a type to print or acquire once more.

Be competitive and acquire, and print the Maryland Plan of Reorganization between Franklin Gold Fund and Franklin Gold and Precious Metals Fund with US Legal Forms. There are many expert and condition-certain kinds you may use for the business or personal needs.

Form popularity

FAQ

About VanEck Rare Earth/Strat Mtls ETF The index includes companies primarily engaged in a variety of activities that are related to the producing, refining and recycling of rare earth and strategic metals and minerals.

Here are the best Equity Precious Metals funds iShares MSCI Global Silver&Mtls Mnrs ETF. iShares MSCI Global Gold Miners ETF. VanEck Rare Earth/Strat Mtls ETF. VanEck Gold Miners ETF. VanEck Junior Gold Miners ETF. ETFMG Prime Junior Silver Miners ETF. Global X Silver Miners ETF.

Abrdn Standard Physical Precious Metals Basket Shares ETF As of late 2021, the fund's net assets were approximately 57% gold, 26% silver, 12% palladium, and 4% platinum. The ETF provides broad exposure to a basket of precious metals for a reasonable cost, given its 0.6% expense ratio.

Quarterly Asset Summary Statements are available online by logging into your account and clicking the ?Statements & Tax Documents? link under the ?Transactions? drop-down menu.

Investing in precious metals like gold and palladium comes with some benefits over investing in stocks, such as being a hedge against inflation, having intrinsic value, no credit risk, a high level of liquidity, bringing diversity to a portfolio, and ease of purchasing.

Moreover, the Vanguard Precious Metals and Mining Fund is best suited for long-term investors seeking an investment that primarily holds foreign securities in the precious metals and mining sector.