Maryland Pooling and Servicing Agreement (PSA) of Ameriquest Mortgage Securities, Inc. is a legal contract that governs the securitization and servicing of mortgage loans. This agreement establishes the rights and obligations of the various parties involved, including the originator, sponsors, depositor, and the trustee. Ameriquest Mortgage Securities, Inc. is a financial institution that specializes in mortgage lending and securitization. The company gathers a pool of mortgage loans that meet specific criteria and places them into a trust. This trust issues mortgage-backed securities (MBS), which are then sold to investors. The Maryland PSA outlines the terms under which the mortgage loans are pooled together, placed in the trust, and subsequently serviced. It includes details regarding the rights of the investors, the payment structure, distribution of cash flows, and the responsibilities of the service. The PSA also includes provisions for the allocation of income and losses, the establishment of reserve funds, and procedures for loan modifications, foreclosure, and default. It sets forth the reporting requirements for the service, including the provision of regular updates on the performance and status of the underlying mortgage loans. Different types of Maryland Pooling and Servicing Agreements may exist based on the specific pool of mortgage loans and the terms negotiated between Ameriquest Mortgage Securities, Inc. and the investors. These agreements could be structured for residential or commercial mortgage-backed securities, and they may differ in terms of duration, interest rates, and branching. In summary, the Maryland Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. is a legal document that defines how mortgage loans are pooled, securitized, and serviced by Ameriquest. It is a crucial framework that protects the interests of the investors and ensures the efficient management of the mortgage-backed securities.

Maryland Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.

Description

How to fill out Pooling And Servicing Agreement Of Ameriquest Mortgage Securities, Inc.?

You are able to commit several hours on the web looking for the authorized record format which fits the state and federal requirements you need. US Legal Forms supplies thousands of authorized forms which can be reviewed by professionals. You can easily obtain or produce the Maryland Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc. from our support.

If you have a US Legal Forms profile, it is possible to log in and then click the Acquire switch. Next, it is possible to comprehensive, change, produce, or sign the Maryland Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc.. Every authorized record format you buy is your own property eternally. To acquire one more backup of the acquired kind, go to the My Forms tab and then click the related switch.

Should you use the US Legal Forms website the first time, keep to the easy instructions under:

- Very first, be sure that you have selected the correct record format to the region/metropolis of your choice. See the kind information to make sure you have selected the right kind. If offered, utilize the Preview switch to check from the record format as well.

- If you want to find one more edition of your kind, utilize the Lookup area to find the format that fits your needs and requirements.

- Upon having discovered the format you would like, just click Acquire now to move forward.

- Pick the prices plan you would like, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the transaction. You may use your bank card or PayPal profile to fund the authorized kind.

- Pick the formatting of your record and obtain it for your system.

- Make modifications for your record if needed. You are able to comprehensive, change and sign and produce Maryland Pooling and Servicing Agreement of Ameriquest Mortgage Securities, Inc..

Acquire and produce thousands of record web templates making use of the US Legal Forms site, that provides the biggest collection of authorized forms. Use specialist and state-particular web templates to handle your company or person needs.

Form popularity

FAQ

Status: CLOSED. Long Beach was closed by Washington Mutual in 2007. History: Originally a California-based savings and loan, founded in 1979, Long Beach Bank became a federally chartered thrift institution in 1990. In October 1994, it became Long Beach Mortgage Co.

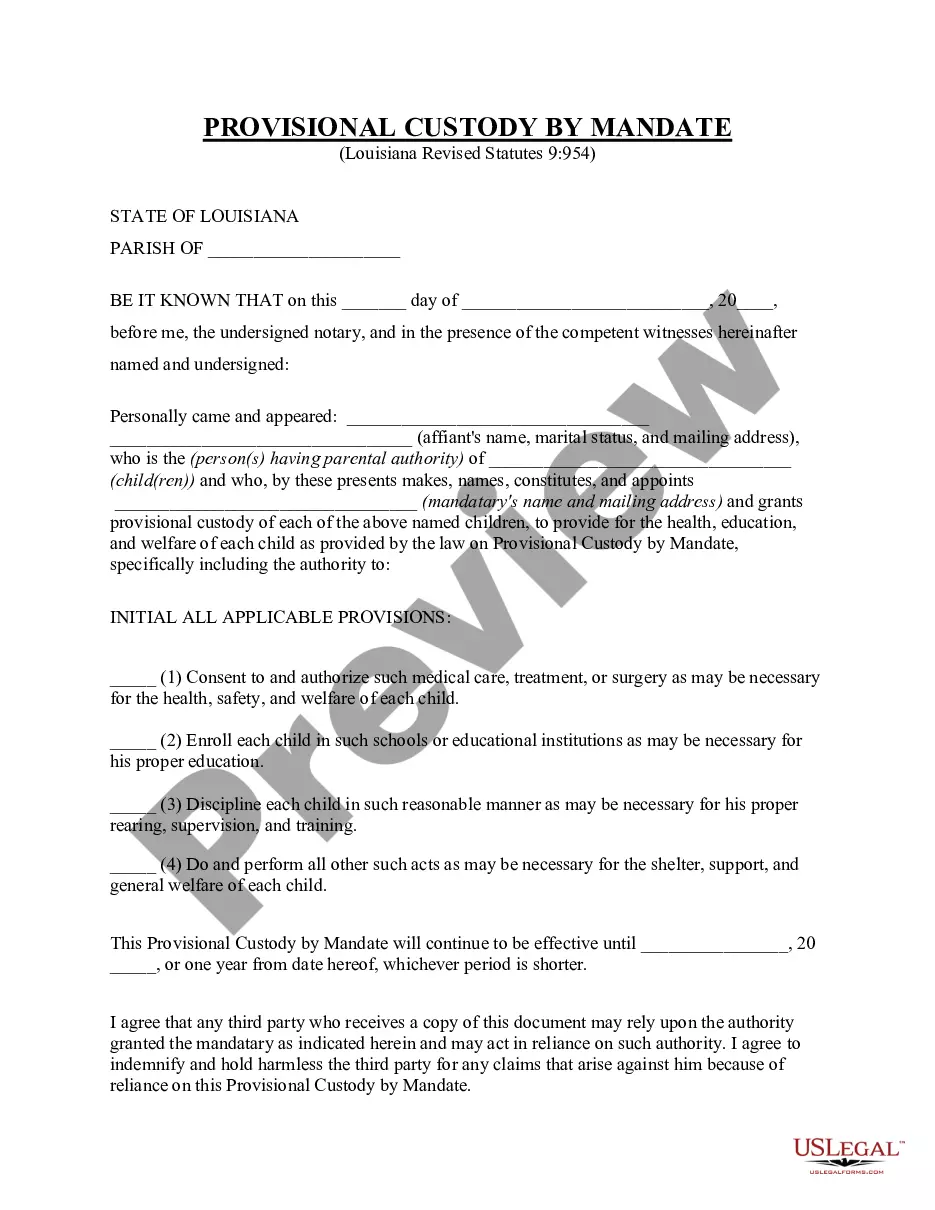

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

Employer Identification No.) 1100 TOWN & COUNTRY ROAD, SUITE 1100 ORANGE, CALIFORNIA 92868 (Address of principal executive offices) (Zip Code) Registrant's Telephone Number, Including Area Code: (714) 541-9960 Item 5.

On September 1, 2007, Citigroup completed its acquisition of Argent Mortgage and AMC Mortgage Services, shutting down Ameriquest Mortgage.