Title: Understanding the Maryland Sample Founder Stock Purchase Agreement between Machine Communications, Inc. and Peter D. Olson: A Comprehensive Overview Introduction: In the realm of business, the founders of a company often enter into legal agreements to establish ownership rights and outline certain provisions. This article delves into the details of the Maryland Sample Founder Stock Purchase Agreement executed between Machine Communications, Inc., and Peter D. Olson. We explore the various types of agreements in this context, shedding light on key aspects and relevant keywords. 1. Definition of Founder Stock Purchase Agreement: A Founder Stock Purchase Agreement is a legally binding document that enables a company's founders to purchase shares in their own company. It outlines the terms, conditions, and the stock purchase price for the founders' allocation of shares. 2. Machine Communications, Inc.: Machine Communications, Inc., is a well-established company, potentially operating in various industries, such as telecommunications, networking solutions, or technology services. The agreement discussed here involves their founders, where Peter D. Olson is a significant stakeholder. 3. Parties Involved: The key parties involved in the Maryland Sample Founder Stock Purchase Agreement are Machine Communications, Inc., acting as the company, and Peter D. Olson, serving as a founder and potentially a shareholder. 4. Types of Maryland Sample Founder Stock Purchase Agreement: While the specific types of agreements within the Maryland Sample Founder Stock Purchase Agreement might vary, they typically include the following: a. Vesting of Shares: The agreement might encompass provisions related to vesting schedules, indicating how Peter D. Olson's shares will fully transfer ownership over a predetermined period. b. Purchase Price: This section establishes the agreed-upon price per share or the valuation method used to determine the price of the stock being purchased by Peter D. Olson. These details are critical for continued negotiations and protection of each party's interests. c. Intellectual Property Rights: Given that founders play a pivotal role in developing a company's core ideas and technologies, this agreement could address the assignment of intellectual property rights to Machine Communications, Inc. d. Rights and Restrictions: Here, the agreement might outline the rights and restrictions associated with the founder's shares, such as voting rights, dividend distributions, drag-along rights, tag-along rights, and anti-dilution provisions. e. Termination and Exit Strategy: In the event of a founder's departure, the agreement may define the terms and conditions of stock repurchase by Machine Communications, Inc. or its shareholders. f. Governing Law and Jurisdiction: To ensure proper enforcement and compliance, Maryland state laws typically govern the Founder Stock Purchase Agreement, including the selection of jurisdiction in case of potential legal disputes. Conclusion: The Maryland Sample Founder Stock Purchase Agreement between Machine Communications, Inc. and Peter D. Olson showcases the complexity involved in establishing ownership and equity within a company. By understanding the various types of agreements and the terms they entail, both parties can protect their rights and foster a successful business relationship. It is crucial to consult legal professionals and adapt the agreement to fit specific circumstances, ensuring a mutually beneficial arrangement.

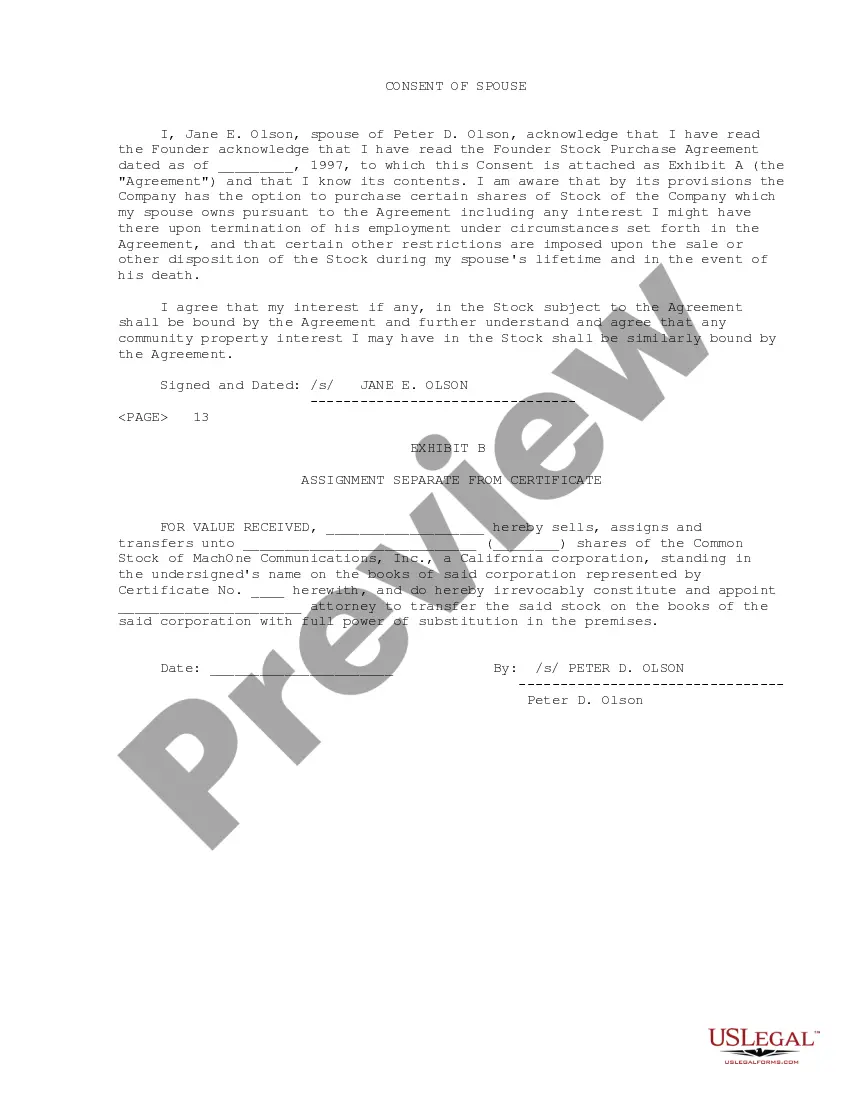

Maryland Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Maryland Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Choosing the best legal document template can be quite a have a problem. Obviously, there are tons of templates available on the net, but how do you get the legal form you require? Take advantage of the US Legal Forms internet site. The services gives a huge number of templates, including the Maryland Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, which you can use for business and private needs. All the types are inspected by specialists and satisfy federal and state demands.

Should you be currently listed, log in in your bank account and click the Obtain button to have the Maryland Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson. Make use of your bank account to check from the legal types you may have acquired in the past. Visit the My Forms tab of your respective bank account and get another version in the document you require.

Should you be a fresh customer of US Legal Forms, listed here are basic directions that you can comply with:

- First, make certain you have selected the correct form for your personal city/area. You may look through the form making use of the Preview button and read the form outline to ensure it will be the best for you.

- If the form will not satisfy your expectations, take advantage of the Seach area to find the correct form.

- Once you are positive that the form is suitable, click on the Acquire now button to have the form.

- Pick the pricing strategy you want and type in the necessary information and facts. Make your bank account and pay money for an order making use of your PayPal bank account or credit card.

- Choose the file formatting and down load the legal document template in your product.

- Total, revise and printing and indicator the obtained Maryland Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson.

US Legal Forms is the largest local library of legal types that you will find a variety of document templates. Take advantage of the service to down load expertly-produced paperwork that comply with condition demands.