Maryland Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association

Description

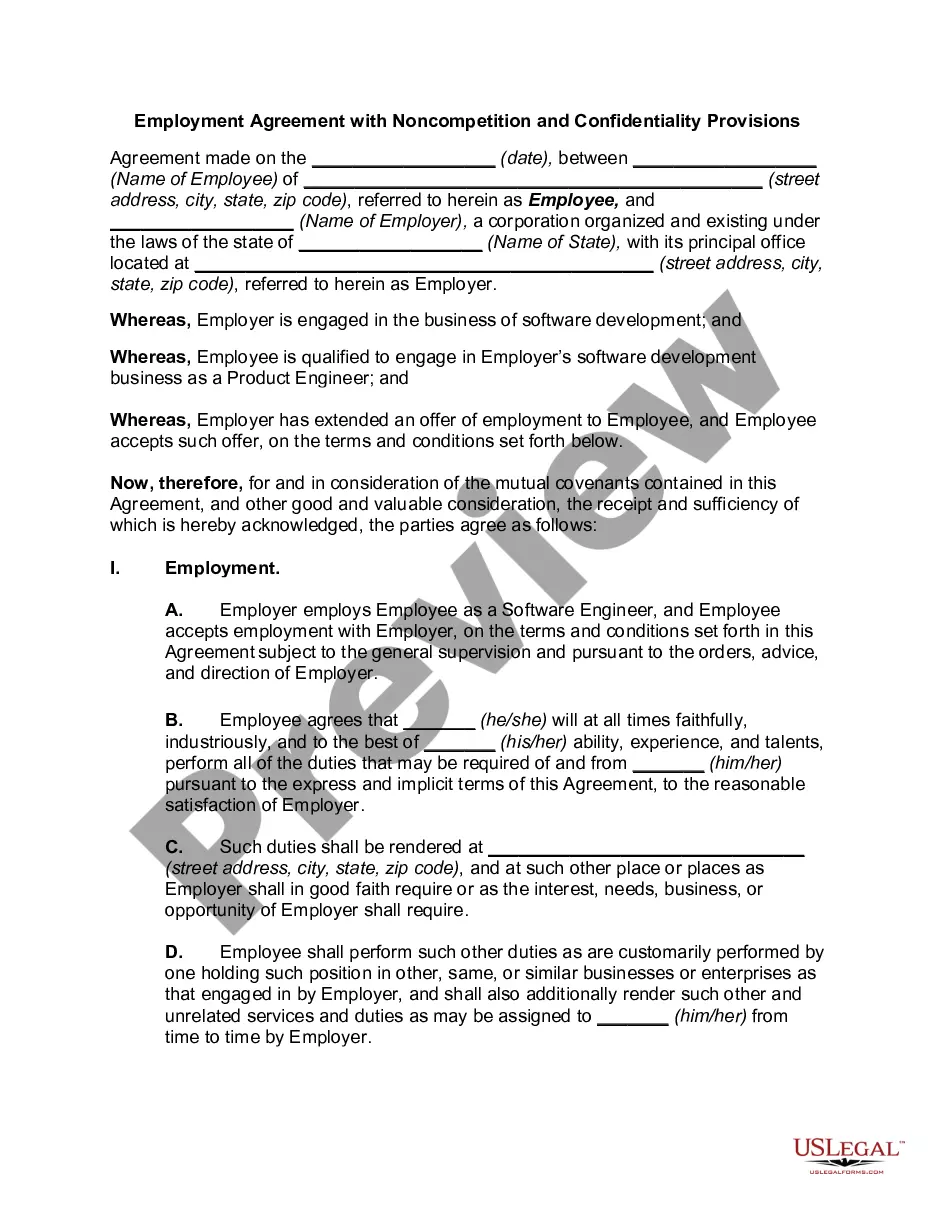

How to fill out Pooling And Servicing Agreement Between Greenpoint Credit, LLC And Bank One, National Association?

US Legal Forms - one of the greatest libraries of legal types in the United States - delivers an array of legal document themes you may acquire or printing. Making use of the web site, you may get 1000s of types for enterprise and person purposes, sorted by classes, states, or search phrases.You will discover the most recent types of types such as the Maryland Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association within minutes.

If you already possess a subscription, log in and acquire Maryland Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association through the US Legal Forms collection. The Acquire switch can look on every single develop you perspective. You gain access to all formerly downloaded types within the My Forms tab of your own accounts.

If you would like use US Legal Forms initially, listed below are straightforward instructions to obtain started off:

- Be sure you have picked the proper develop for your personal area/region. Go through the Preview switch to review the form`s articles. Read the develop description to actually have selected the proper develop.

- In case the develop does not fit your demands, utilize the Lookup field towards the top of the screen to get the the one that does.

- When you are content with the form, verify your selection by clicking the Acquire now switch. Then, opt for the prices program you want and provide your accreditations to sign up on an accounts.

- Process the transaction. Utilize your Visa or Mastercard or PayPal accounts to finish the transaction.

- Find the format and acquire the form on your own system.

- Make alterations. Fill up, revise and printing and indicator the downloaded Maryland Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association.

Every single design you included in your account does not have an expiry date and is also your own for a long time. So, in order to acquire or printing one more copy, just proceed to the My Forms portion and click on around the develop you will need.

Obtain access to the Maryland Pooling and Servicing Agreement between Greenpoint Credit, LLC and Bank One, National Association with US Legal Forms, by far the most considerable collection of legal document themes. Use 1000s of specialist and condition-specific themes that meet up with your business or person requires and demands.

Form popularity

FAQ

Mortgage Servicing Rights (MSR) Definition Mortgage servicing rights surface when the original mortgage lender sells the right to service a mortgage to another party. This third party, a mortgage servicing company, specializes in specific mortgage functions, all done through a contractual agreement.

In guidance to examination staff, the Office of the Comptroller of the Currency describes MSRs or mortgage servicing assets (MSAs) as ?complex, intangible assets that arise from owning the rights to service mortgage loans that have been securitized or sold to third-party investors.

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages.

Excess MSR means an interest in an MSR, representing a portion of the interest payment collected from a pool of mortgage loans, net of a basic servicing fee paid to the mortgage servicer. An MSR is made up of two components: a basic servicing fee and an excess servicing fee.

Homeowners are often transferred to SPS once they become delinquent on their mortgage payments. Many lenders try to protect their brand when it comes to foreclosing on homeowners.

Mortgage servicing rights (MSR) are a specific arrangement where a third party promises to collect mortgage payments on behalf of a lender in exchange for a fee.

Your loan servicer typically processes your loan payments, responds to borrower inquiries, keeps track of principal and interest paid, manages your escrow account (if you have one). The loan servicer may initiate foreclosure under certain circumstances.