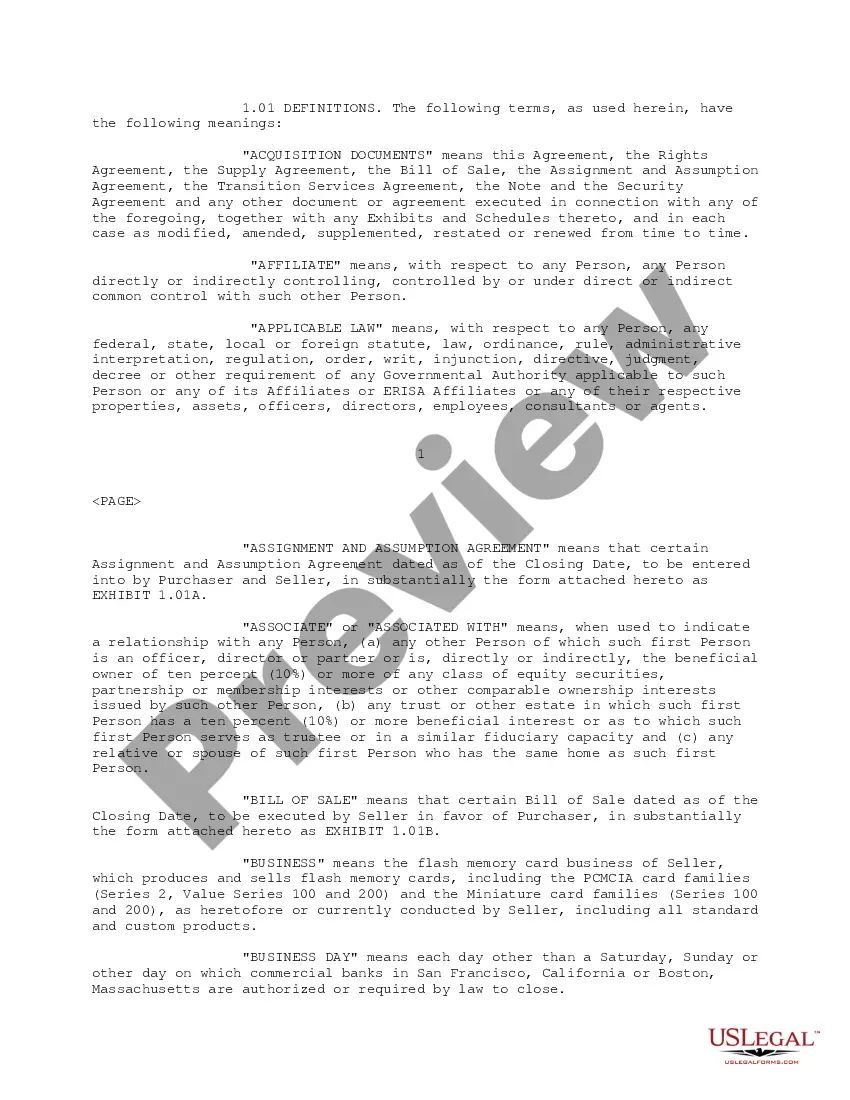

Maryland Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample

Description

How to fill out Sample Asset Purchase Agreement Between Centennial Technologies, Inc. And Intel Corporation - Sample?

US Legal Forms - one of many biggest libraries of legitimate forms in the USA - delivers a wide range of legitimate record templates you are able to obtain or print out. Making use of the website, you can get 1000s of forms for organization and personal reasons, sorted by classes, claims, or keywords and phrases.You can find the most recent types of forms such as the Maryland Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample within minutes.

If you currently have a membership, log in and obtain Maryland Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample in the US Legal Forms library. The Acquire option can look on every kind you perspective. You have accessibility to all in the past downloaded forms from the My Forms tab of the account.

If you wish to use US Legal Forms the first time, listed here are simple directions to help you get started out:

- Make sure you have picked the proper kind for your personal area/county. Click the Preview option to review the form`s articles. Read the kind explanation to ensure that you have chosen the correct kind.

- In case the kind doesn`t satisfy your specifications, make use of the Research discipline on top of the monitor to get the the one that does.

- Should you be pleased with the shape, confirm your selection by clicking on the Get now option. Then, choose the rates prepare you prefer and provide your accreditations to register for the account.

- Approach the purchase. Make use of your charge card or PayPal account to complete the purchase.

- Choose the formatting and obtain the shape on the product.

- Make adjustments. Fill out, change and print out and indicator the downloaded Maryland Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample.

Each and every design you added to your money lacks an expiration particular date and is also your own eternally. So, if you would like obtain or print out one more copy, just visit the My Forms segment and click on on the kind you require.

Gain access to the Maryland Sample Asset Purchase Agreement between Centennial Technologies, Inc. and Intel Corporation - Sample with US Legal Forms, one of the most substantial library of legitimate record templates. Use 1000s of professional and state-distinct templates that satisfy your company or personal requirements and specifications.

Form popularity

FAQ

What's the Difference? Generally speaking, an asset purchase is when an individual, either with an existing entity or by forming a new entity (LLC or Corporation), buys the assets of a business without buying the business itself. Asset Purchases entail buying everything that the business owns (the Assets).

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

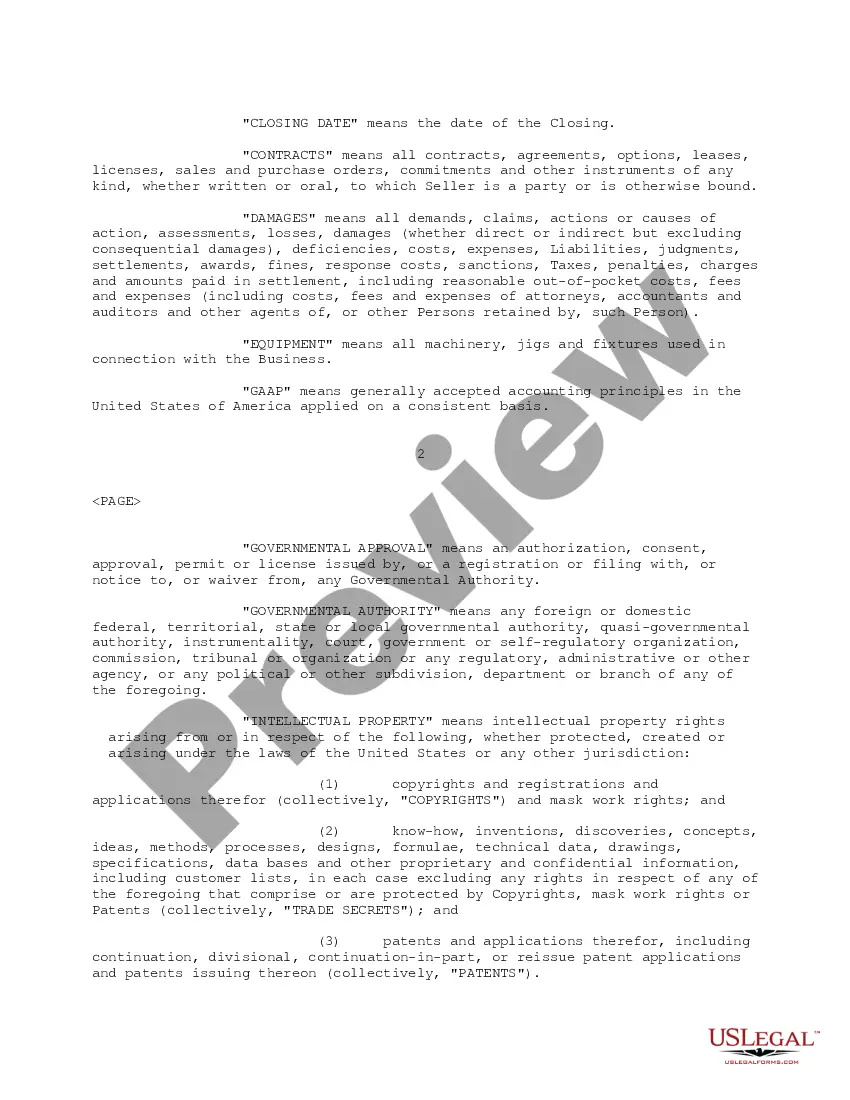

The purpose of an asset purchase agreement It lets your business get exactly the assets it wants without purchasing anything it does not. It also helps a business limit the potential liabilities it could face. For example, asset purchase agreements are commonly used to purchase: Intellectual property.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

In an asset sale, the employment relationship is terminated and a new one is created. This means that the seller needs to do all the things that an employer would normally do when terminating an employee, including paying out final wages and vacation pay (where required by contract or state law).

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.