Maryland Stock Option Agreement is a legal document that outlines the terms and conditions related to stock options issued by Northern Bank of Commerce to Cowling Ban corporation, based in Maryland. This agreement provides guidelines for the purchase and sale of specific stocks at predetermined prices and within specified timeframes. The Maryland Stock Option Agreement between Northern Bank of Commerce and Cowling Ban corporation is designed to provide Cowling Ban corporation with the opportunity to purchase a specific number of shares of Northern Bank of Commerce's stock at a predetermined price, known as the exercise price. This agreement enables Cowling Ban corporation to invest in Northern Bank of Commerce's stock and potentially benefit from any increase in its value. The key elements of a Maryland Stock Option Agreement typically include the grant date, the exercise price, the expiration date, the vesting period, and the total number of stock options granted. The grant date refers to the date on which the stock options are awarded to Cowling Ban corporation. The exercise price, also known as the strike price, is the price at which the shares can be purchased by Cowling Ban corporation in the future. The expiration date signifies the final date on which the stock options can be exercised, beyond which they become invalid. The vesting period indicates the duration during which the stock options become available for exercise. This period may vary based on the terms negotiated between the parties involved. There can be various types of Maryland Stock Option Agreements between Northern Bank of Commerce and Cowling Ban corporation, including: 1. Non-Qualified Stock Option (NO) Agreement: This type of agreement provides Cowling Ban corporation with the flexibility to purchase the company's stock at a predetermined price. SOS are not subject to specific tax advantages and are often used for compensation purposes. 2. Incentive Stock Option (ISO) Agreement: This agreement grants Cowling Ban corporation the right to purchase Northern Bank of Commerce's stock under specific tax advantages. SOS typically offer tax benefits if certain requirements, such as a holding period and employment status, are met. 3. Restricted Stock Unit (RSU) Agreement: In this type of agreement, stock options are awarded to Cowling Ban corporation as a form of compensation. However, the shares are subject to certain restrictions or vesting periods, which require Cowling Ban corporation to fulfill specific criteria or remain with the company for a predetermined period to fully benefit from the stock options. These are some key aspects and types of Maryland Stock Option Agreements that can exist between Northern Bank of Commerce and Cowling Ban corporation. It is essential for both parties to understand and comply with the terms and conditions outlined in the agreement to ensure a smooth and mutually beneficial stock option transaction.

Maryland Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation

Description

How to fill out Maryland Stock Option Agreement Between Northern Bank Of Commerce And Cowlitz Bancorporation?

If you want to total, obtain, or produce legal document layouts, use US Legal Forms, the most important variety of legal kinds, which can be found on-line. Make use of the site`s simple and practical search to discover the documents you need. Numerous layouts for enterprise and specific reasons are categorized by classes and states, or keywords and phrases. Use US Legal Forms to discover the Maryland Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation within a couple of clicks.

In case you are previously a US Legal Forms consumer, log in in your accounts and then click the Acquire key to get the Maryland Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation. Also you can access kinds you formerly acquired in the My Forms tab of your accounts.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

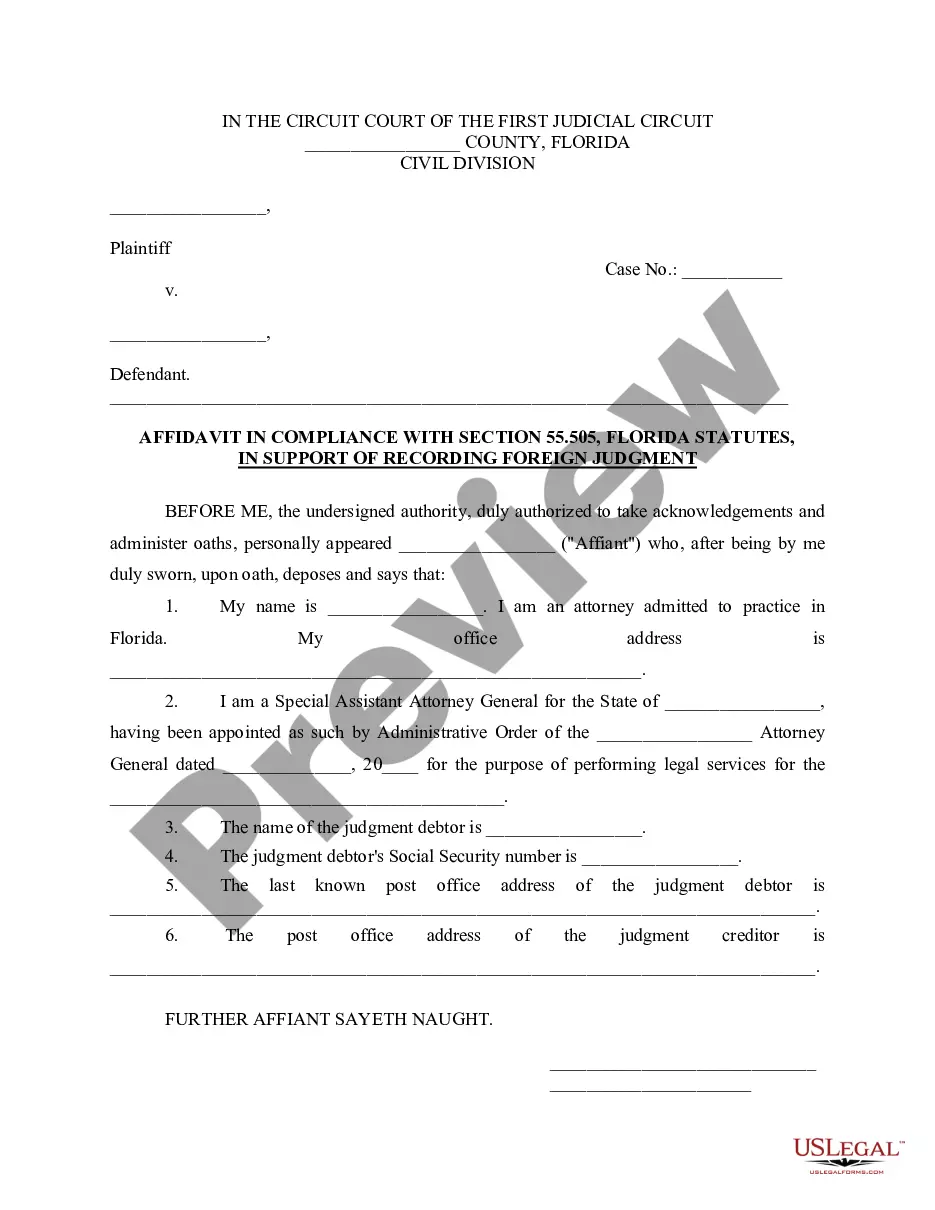

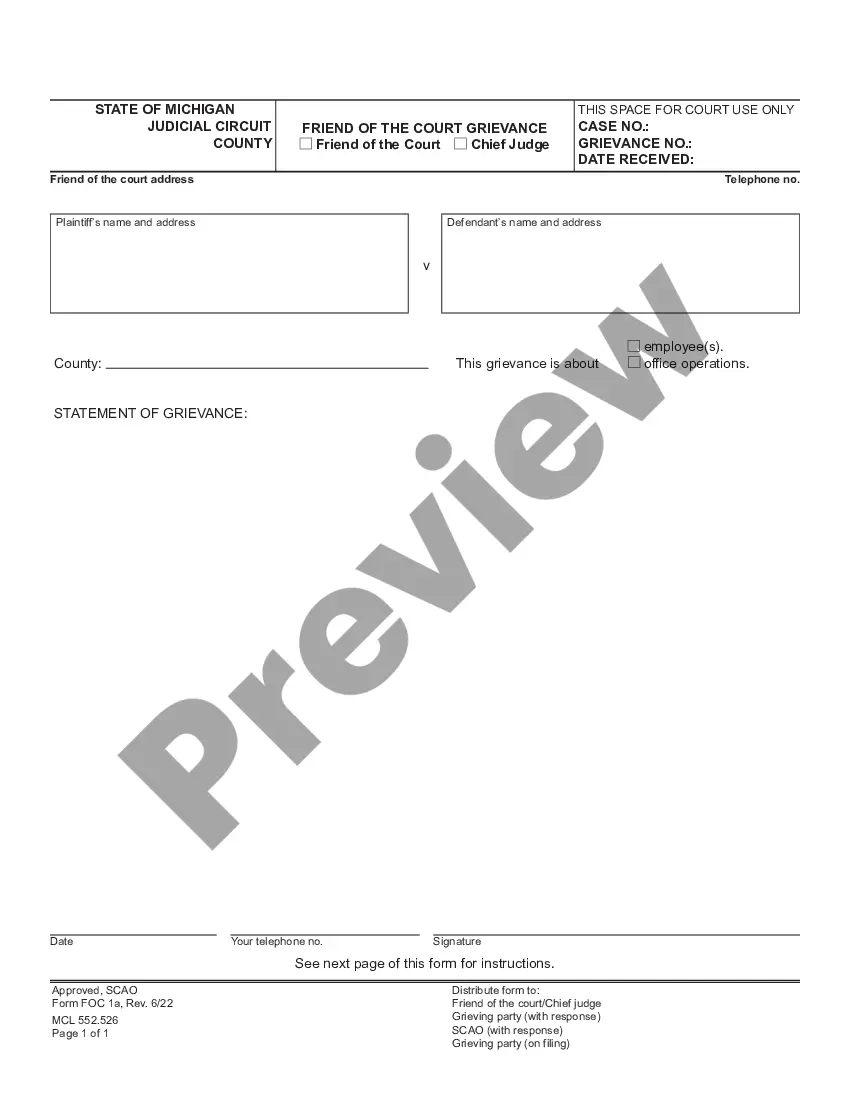

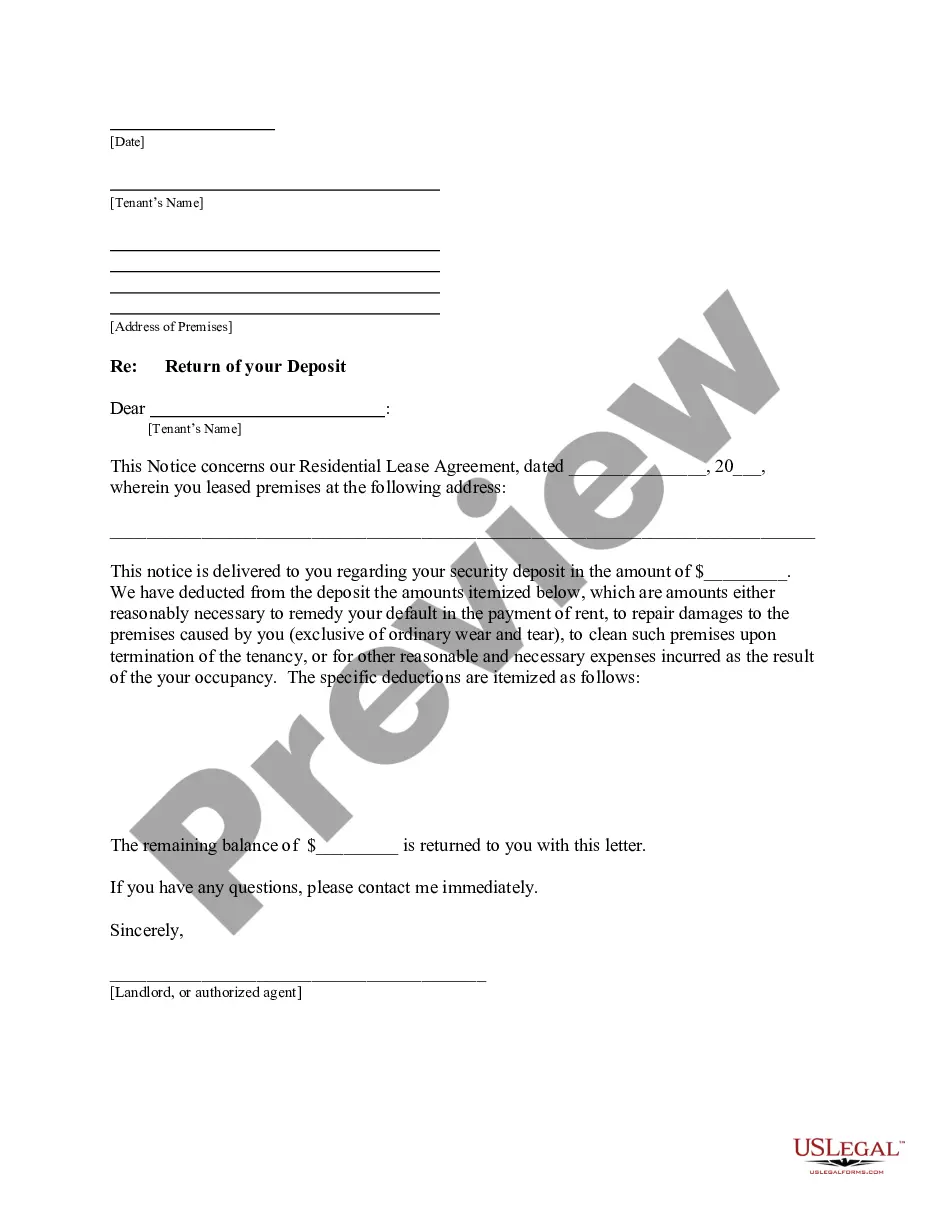

- Step 1. Be sure you have chosen the form for that correct area/country.

- Step 2. Use the Review solution to check out the form`s information. Never overlook to read through the description.

- Step 3. In case you are unsatisfied using the form, make use of the Lookup area at the top of the monitor to discover other variations from the legal form design.

- Step 4. After you have identified the form you need, click the Acquire now key. Choose the costs program you like and add your qualifications to sign up on an accounts.

- Step 5. Approach the financial transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the financial transaction.

- Step 6. Choose the format from the legal form and obtain it in your device.

- Step 7. Full, edit and produce or sign the Maryland Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation.

Every single legal document design you get is your own forever. You may have acces to every single form you acquired with your acccount. Select the My Forms area and choose a form to produce or obtain once more.

Remain competitive and obtain, and produce the Maryland Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation with US Legal Forms. There are thousands of specialist and status-distinct kinds you can utilize for your personal enterprise or specific needs.

Form popularity

More info

DATED ... NATIONAL COMMERCE BANCORPORATION. (Tennessee). $2.00 par common. NATIONAL COMPUTER ... NORTHERN BANK OF COMMERCE. $1.00 par common. NORTHERN TRUST CORPORATION ... Dec 22, 2006 — If the merger is completed, United shareholders will receive 0.6825 shares of U.S. Bancorp common stock for each share of United common stock ... Sep 30, 2003 — PERCENT OF AVG EARNING ASSETS: Interest Income (TE). 6.03. 6.82. 6.70. 7.89. 8.44. Interest Expense. 1.86. 2.46. 2.38. 3.61. 3.99. Mar 31, 2005 — PERCENT OF AVG EARNING ASSETS: Interest Income (TE). 5.94. 5.74. 5.75. 5.95. 6.70. Interest Expense. 1.74. 1.56. 1.57. 1.79. 2.38. by JW Weyerhaeuser · 2012 — ... for the categories of stocks: banned stocks with traded options, banned stocks without traded options, and the non-banned S&P 500 control group. ... a sociopath, Mobility scooter hire, Castile eu4 cant attack ottoman, Manor houses to stay in england, How to kick out a tenant! Capitol cleaners dover ...