Title: Understanding Maryland Credit Agreement for Extension of Credit: A Comprehensive Overview Introduction: The Maryland Credit Agreement plays a crucial role in facilitating the extension of credit, ensuring clear terms and conditions are agreed upon by all parties involved. This detailed description aims to provide a comprehensive understanding of the Maryland Credit Agreement, its importance, and its various types, if applicable. Key Terms: 1. Maryland Credit Agreement: A legally binding contract between a creditor and a borrower, outlining the terms, conditions, and obligations associated with extending credit in the state of Maryland. 2. Extension of Credit: The act of providing funds or resources to a borrower, allowing them to access financial capital, goods, or services, often on the basis of repayment over time, such as loans or lines of credit. 3. Creditor: The individual, financial institution, or company providing credit to the borrower, often subject to Maryland state laws and regulations. 4. Borrower: The individual, business, or entity obtaining credit from the creditor, subject to complying with the terms set forth in the Maryland Credit Agreement. 5. Maryland State Law: Refers to the legal framework and regulations governing the extension of credit within the state of Maryland, ensuring the protection of both creditors and borrowers. Types of Maryland Credit Agreements: 1. Unsecured Credit Agreement: This type of agreement does not require collateral as security; instead, it relies solely on the borrower's creditworthiness. Terms may include interest rates, repayment schedules, and any associated fees. 2. Secured Credit Agreement: In contrast to unsecured credit agreements, this type requires borrowers to provide collateral, such as real estate, vehicles, or other valuable assets, as security against the credit extended. Failure to repay the credit may lead to the creditor seizing the collateral. 3. Revolving Credit Agreement: This agreement allows borrowers to access credit up to a predetermined limit, often associated with a credit card or line of credit. Borrowers have the flexibility to borrow, repay, and re-borrow within the specified limit, subject to interest charges. 4. Installment Credit Agreement: This type of credit agreement requires borrowers to repay the borrowed amount, along with accrued interest, in fixed, periodic installments over a specified period. Examples include auto loans, student loans, or mortgages. 5. Open-End Credit Agreement: This credit agreement gives borrowers the ability to access credit without predetermined limits. Common examples include retail store credit cards or pre-approved credit lines. 6. Closed-End Credit Agreement: These agreements provide borrowers with a specific amount of credit for a predetermined purpose. Once the borrowed amount is repaid, the credit agreement terminates. Conclusion: The Maryland Credit Agreement is a vital legal instrument governing the extension of credit within the state. By understanding the various types of credit agreements offered, such as unsecured, secured, revolving, installment, open-end, and closed-end, both creditors and borrowers can ensure adherence to Maryland state laws, protect their interests, and engage in financial transactions with confidence.

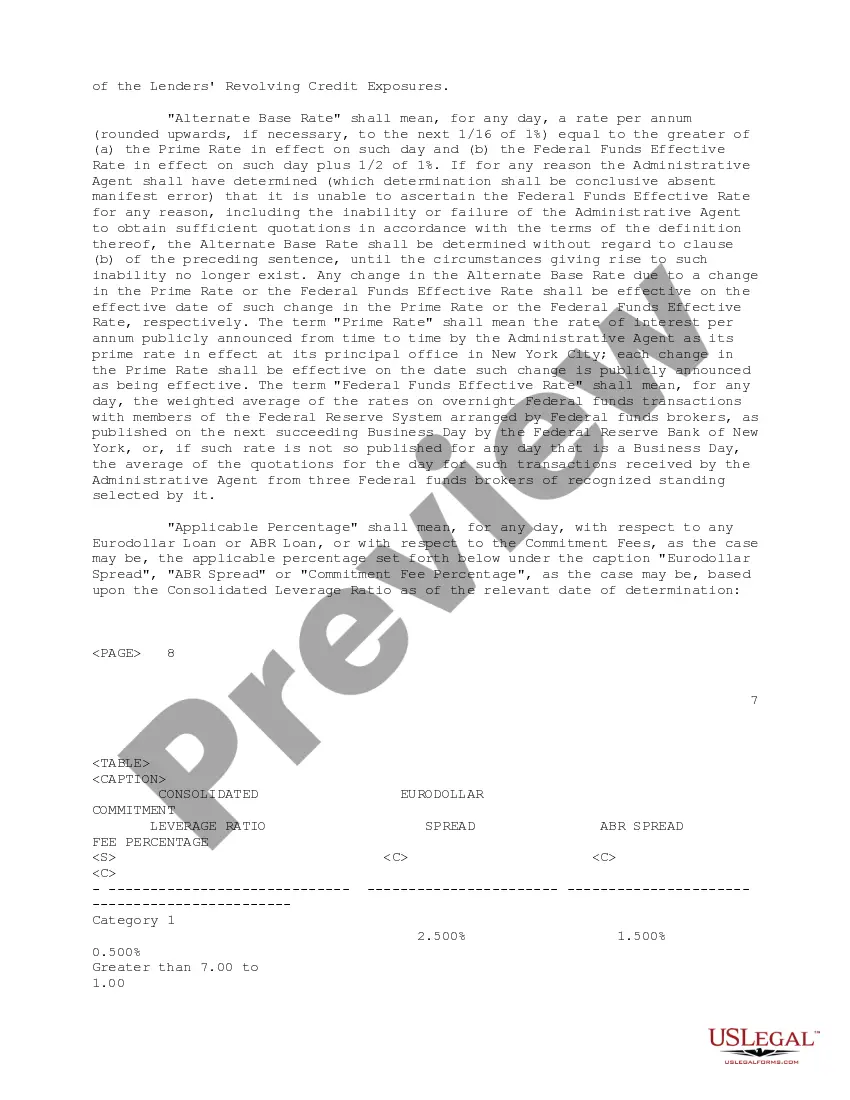

Maryland Credit Agreement regarding extension of credit

Description

How to fill out Credit Agreement Regarding Extension Of Credit?

Choosing the best authorized document template could be a struggle. Of course, there are tons of web templates available on the net, but how would you get the authorized form you need? Make use of the US Legal Forms website. The service offers a large number of web templates, like the Maryland Credit Agreement regarding extension of credit, that you can use for company and personal demands. Every one of the forms are checked out by professionals and meet federal and state needs.

If you are presently listed, log in to your bank account and then click the Down load switch to have the Maryland Credit Agreement regarding extension of credit. Use your bank account to appear throughout the authorized forms you possess ordered previously. Go to the My Forms tab of your own bank account and get another version in the document you need.

If you are a whole new user of US Legal Forms, here are easy recommendations that you should follow:

- First, make sure you have selected the proper form for the metropolis/region. You can examine the form while using Preview switch and study the form explanation to ensure this is the right one for you.

- In case the form fails to meet your preferences, make use of the Seach industry to discover the appropriate form.

- Once you are certain that the form is suitable, select the Buy now switch to have the form.

- Pick the costs program you desire and type in the required info. Build your bank account and pay money for the order with your PayPal bank account or charge card.

- Choose the data file formatting and download the authorized document template to your gadget.

- Complete, change and print and indication the obtained Maryland Credit Agreement regarding extension of credit.

US Legal Forms will be the largest collection of authorized forms where you can find numerous document web templates. Make use of the service to download expertly-produced documents that follow state needs.

Form popularity

FAQ

A loan gives you a lump sum of money that you repay over a period of time. A line of credit lets you borrow money up to a limit, pay it back, and borrow again.

A credit agreement is a legal document that outlines the terms of your loan, between you and the lender. Whether you're taking out a mortgage, a personal loan or Car Finance, the creditor is legally required to provide a credit agreement and it must be signed by both parties.

Lenders must provide a full disclosure of all of the loan's terms in the credit agreement. That can include the annual interest rate (APR), how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

Contact the lender to tell them you want to cancel - this is called 'giving notice'. It's best to do this in writing but your credit agreement will tell you who to contact and how. If you've received money already then you must pay it back - the lender must give you 30 days to do this.

A creditor is an individual or institution that extends credit to another party to borrow money usually by a loan agreement or contract.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

Loans and credits are different finance mechanisms. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of money, which can be used as required, using the entire amount borrowed, part of it or none at all.