Maryland Transfer Agreement between Savvies Communications Corp. and Bridge Information Systems, Inc. Keywords: Maryland, transfer agreement, Savvies Communications Corp., Bridge Information Systems, assets, liabilities Overview: The Maryland Transfer Agreement is a legally binding document that outlines the terms and conditions for the transfer of certain assets and liabilities between two parties — Savvis Communications Corp. and Bridge Information Systems, Inc. This agreement facilitates the smooth transition of ownership and responsibilities, ensuring the safeguarding of interests and obligations of both entities involved. Types of Maryland Transfer Agreements: 1. Asset Transfer Agreement: This type of agreement focuses on the transfer of specific assets from one party to another. It clearly defines the assets being transferred, their condition, and any existing encumbrances or liabilities associated with them. The agreement also outlines the payment terms and any warranties or representations related to the assets being transferred. 2. Liabilities Transfer Agreement: A liabilities transfer agreement primarily deals with the transfer of certain obligations and liabilities from one party to another. It identifies the specific liabilities being assumed, such as debts, contracts, or legal responsibilities, and clearly outlines the assumptions and responsibilities of the acquiring party. It also addresses any necessary consents or approvals required for the liability transfer. Key Elements of a Maryland Transfer Agreement: 1. Parties involved: The agreement should clearly identify the transferring party, Savvies Communications Corp., and the acquiring party, Bridge Information Systems, Inc. The legal names and addresses of both parties must be provided to ensure mutual understanding and recognition. 2. Asset description: In the case of an asset transfer agreement, a detailed description of the assets being transferred must be provided. This includes itemizing the assets, their current condition, any encumbrances, applicable warranties, and any additional liabilities or obligations associated with them. 3. Liabilities description: For a liabilities transfer agreement, a comprehensive description of the liabilities being assumed is required. This covers debts, contracts, pending litigation, or any other legal obligations. The agreement should clearly outline the scope and nature of the liabilities being transferred. 4. Purchase price or consideration: The Maryland Transfer Agreement will specify the consideration agreed upon by both parties. This includes the purchase price or other compensation mechanisms involved in the transfer of assets and liabilities. The payment terms, such as installments or lump-sum, must be clearly stated. 5. Representations and warranties: Both parties will typically provide certain representations and warranties to ensure the accuracy and validity of the transfer. These may include confirming that all assets are free from any encumbrances, ensuring full disclosure of liabilities, or providing financial statements and tax compliance information. 6. Indemnification: Indemnification provisions allocate responsibility for any third-party claims or losses arising from the assets or liabilities being transferred. The agreement should clearly outline the indemnification obligations of the parties to protect their respective interests. 7. Governing law and jurisdiction: As a Maryland Transfer Agreement, it will specify that Maryland law governs the interpretation, validity, and enforcement of the agreement. Parties may also agree on the jurisdiction where any disputes will be resolved. Conclusion: The Maryland Transfer Agreement between Savvies Communications Corp. and Bridge Information Systems, Inc. is a crucial legal document that lays out the terms and conditions for the transfer of certain assets and liabilities. Whether focusing on asset transfers or liabilities assumption, these agreements facilitate a smooth transition while protecting the interests of both parties involved.

Maryland Transfer Agreement between Savvis Communications Corp. and Bridge Information Systems, Inc. regarding the transfer of certain assets and liabilities

Description

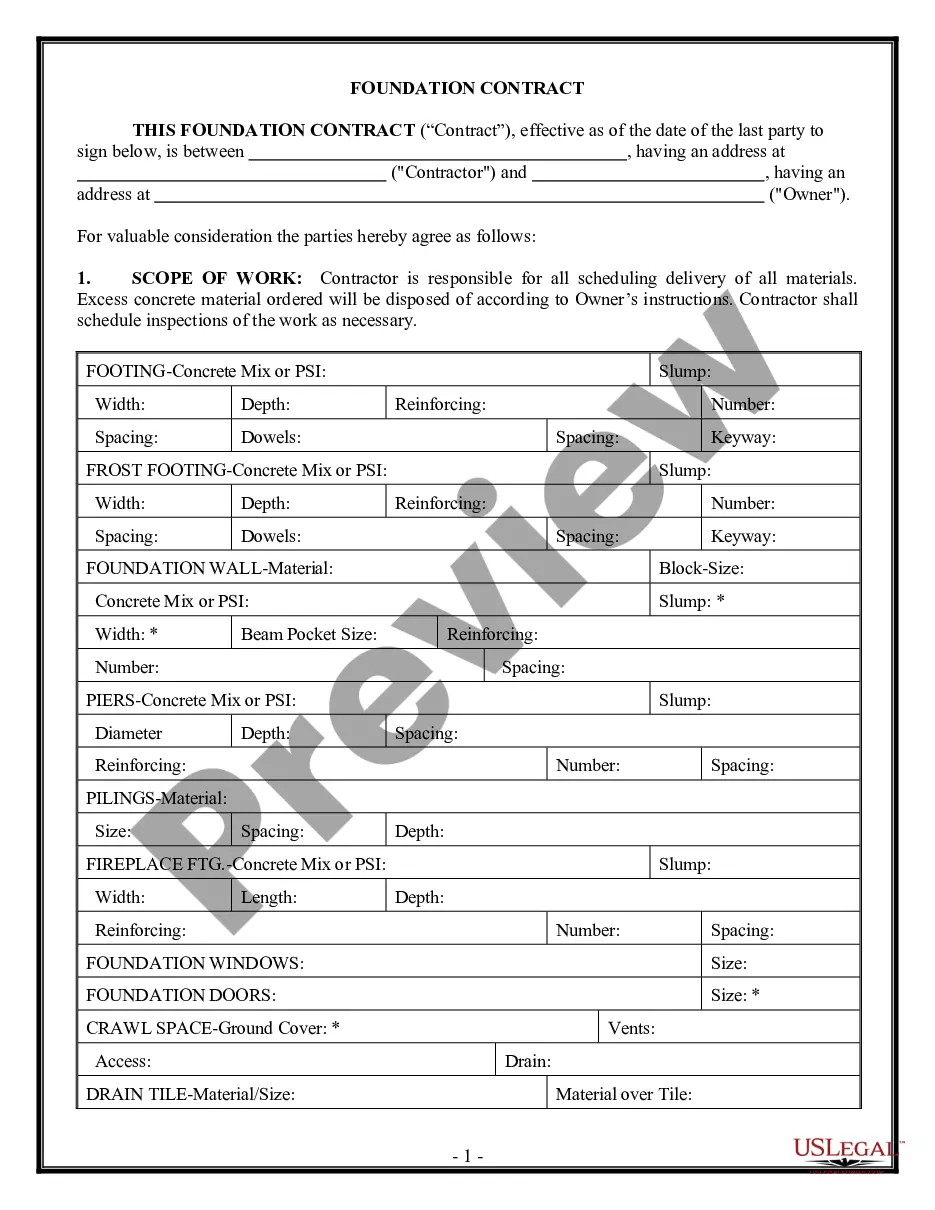

How to fill out Maryland Transfer Agreement Between Savvis Communications Corp. And Bridge Information Systems, Inc. Regarding The Transfer Of Certain Assets And Liabilities?

Discovering the right lawful file template could be a struggle. Obviously, there are tons of layouts available online, but how can you find the lawful develop you require? Make use of the US Legal Forms web site. The service gives thousands of layouts, like the Maryland Transfer Agreement between Savvis Communications Corp. and Bridge Information Systems, Inc. regarding the transfer of certain assets and liabilities, which can be used for enterprise and personal requires. All the types are checked out by pros and meet up with federal and state demands.

Should you be already listed, log in for your accounts and then click the Obtain switch to obtain the Maryland Transfer Agreement between Savvis Communications Corp. and Bridge Information Systems, Inc. regarding the transfer of certain assets and liabilities. Utilize your accounts to search from the lawful types you might have bought earlier. Check out the My Forms tab of your accounts and have one more version of your file you require.

Should you be a new end user of US Legal Forms, listed below are simple directions that you can comply with:

- Initial, be sure you have selected the appropriate develop for the area/area. It is possible to look through the shape utilizing the Review switch and look at the shape outline to ensure this is the right one for you.

- In the event the develop does not meet up with your expectations, use the Seach area to find the appropriate develop.

- Once you are certain the shape is proper, click on the Acquire now switch to obtain the develop.

- Select the pricing prepare you desire and enter the required info. Build your accounts and pay for your order with your PayPal accounts or charge card.

- Pick the data file formatting and obtain the lawful file template for your gadget.

- Complete, change and print out and indication the received Maryland Transfer Agreement between Savvis Communications Corp. and Bridge Information Systems, Inc. regarding the transfer of certain assets and liabilities.

US Legal Forms is the biggest library of lawful types that you will find numerous file layouts. Make use of the company to obtain appropriately-manufactured paperwork that comply with express demands.