Maryland Collections Agreement - Self-Employed Independent Contractor

Description

How to fill out Maryland Collections Agreement - Self-Employed Independent Contractor?

If you want to comprehensive, down load, or print out lawful record layouts, use US Legal Forms, the biggest selection of lawful varieties, which can be found on-line. Take advantage of the site`s simple and practical look for to find the paperwork you need. A variety of layouts for company and person uses are categorized by types and suggests, or keywords. Use US Legal Forms to find the Maryland Collections Agreement - Self-Employed Independent Contractor with a few mouse clicks.

When you are presently a US Legal Forms customer, log in to the account and click on the Acquire switch to obtain the Maryland Collections Agreement - Self-Employed Independent Contractor. You can even accessibility varieties you in the past acquired within the My Forms tab of the account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for that right area/region.

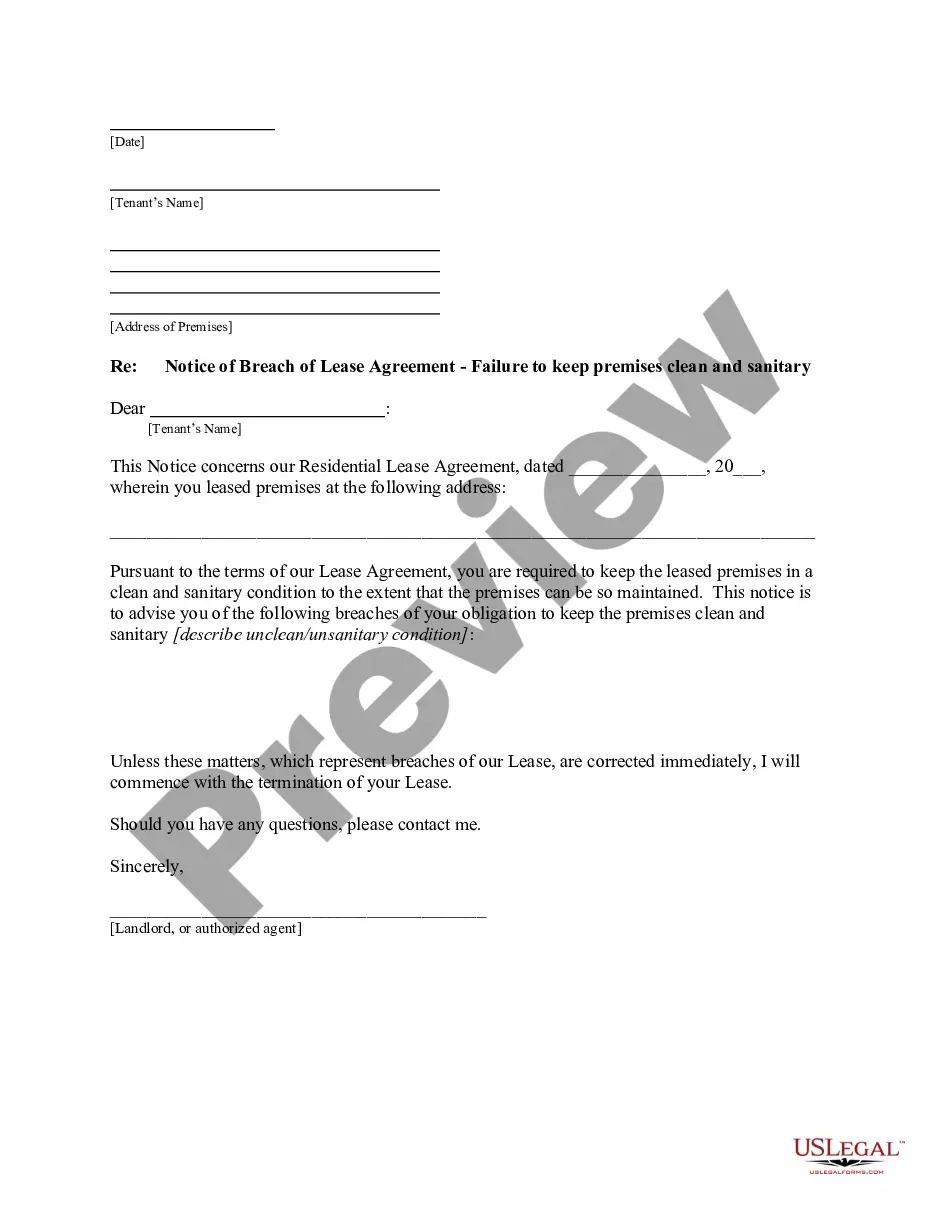

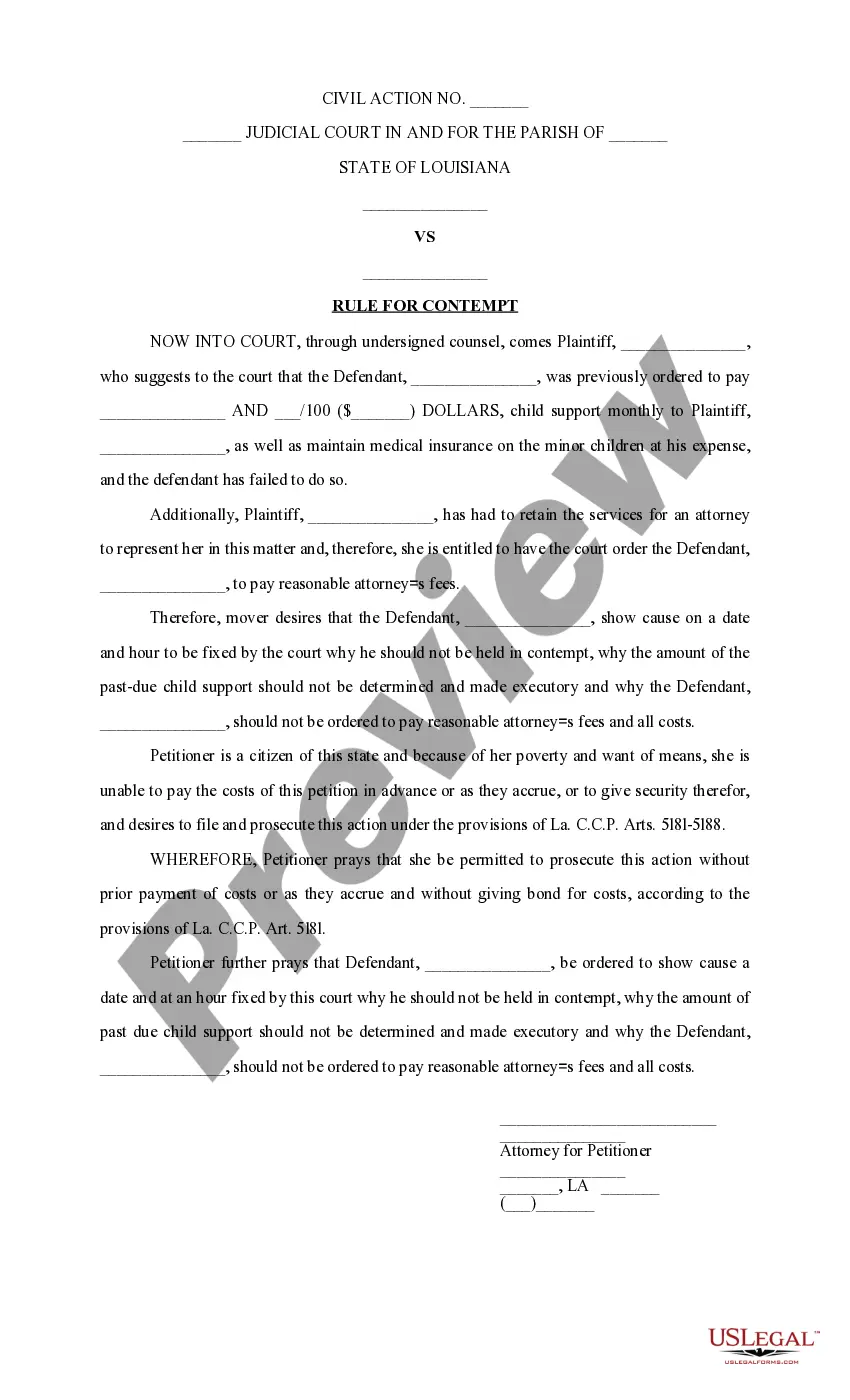

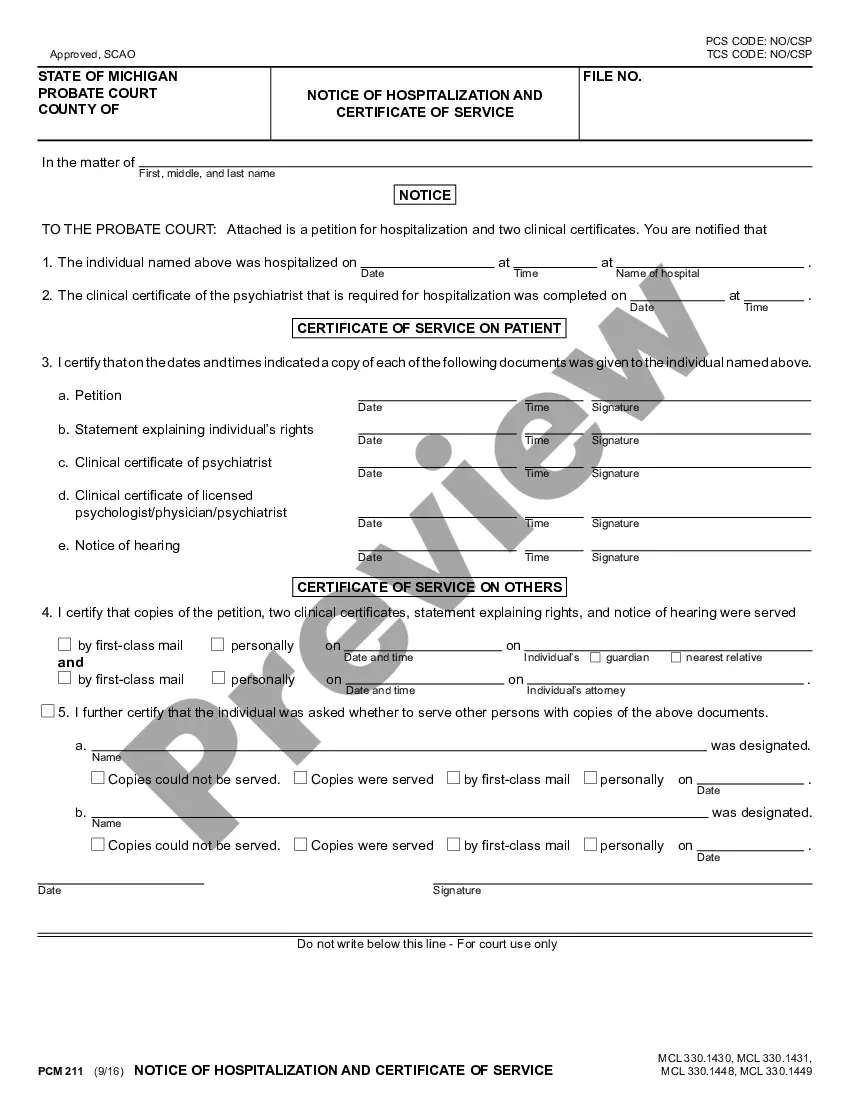

- Step 2. Take advantage of the Review solution to look through the form`s content. Never forget about to read the information.

- Step 3. When you are not satisfied with all the type, utilize the Search discipline near the top of the display screen to locate other variations of your lawful type web template.

- Step 4. Upon having located the shape you need, click the Buy now switch. Choose the costs strategy you favor and add your references to register for an account.

- Step 5. Method the financial transaction. You can utilize your Мisa or Ьastercard or PayPal account to complete the financial transaction.

- Step 6. Find the structure of your lawful type and down load it on the device.

- Step 7. Comprehensive, change and print out or indication the Maryland Collections Agreement - Self-Employed Independent Contractor.

Each lawful record web template you get is the one you have eternally. You have acces to every type you acquired in your acccount. Go through the My Forms area and decide on a type to print out or down load yet again.

Contend and down load, and print out the Maryland Collections Agreement - Self-Employed Independent Contractor with US Legal Forms. There are many skilled and status-specific varieties you can use for your company or person demands.

Form popularity

FAQ

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Do independent contractors qualify for unemployment insurance? Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

The state of Maryland does not require general contractors to obtain a license to do business. It is not necessary to have a license if you are doing electrical, plumbing, or HVACR work or are working on home improvement projects. A license is issued by the Department of Labor, Licensing and Regulation (DLLR).

Pandemic Unemployment Assistance (PUA)Provides benefits for claimants who are ineligible for regular UI and unemployed due to a COVID-19 related reason. This includes gig workers, independent contractors, the self-employed, and those with insufficient work history.

Workers in Maryland who are independent contractors are not entitled to unemployment benefits if their contract expires or the company or individual who hired them lets them go.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

A) Yes. There is a special program which provides benefits to those who are not traditionally eligible for unemployment insurance, which includes gig workers (Uber, Lyft, AirBnB hosts, etc.), freelancers, and independent contractors.

Although independent contractors do not have the right to workers' compensation benefits in Maryland, there are some cases in which employers have misclassified a worker as an independent contractor when the worker is actually an employee.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.