Maryland Producer Agreement - Self-Employed Independent Contractor

Description

How to fill out Maryland Producer Agreement - Self-Employed Independent Contractor?

Finding the right lawful document web template can be quite a battle. Naturally, there are a lot of themes available online, but how would you discover the lawful kind you want? Take advantage of the US Legal Forms web site. The support gives 1000s of themes, like the Maryland Producer Agreement - Self-Employed Independent Contractor, which can be used for company and private demands. All the varieties are examined by specialists and meet up with federal and state demands.

Should you be currently listed, log in in your profile and then click the Down load switch to obtain the Maryland Producer Agreement - Self-Employed Independent Contractor. Utilize your profile to check through the lawful varieties you possess ordered previously. Go to the My Forms tab of your profile and acquire one more version in the document you want.

Should you be a fresh customer of US Legal Forms, listed below are simple instructions for you to comply with:

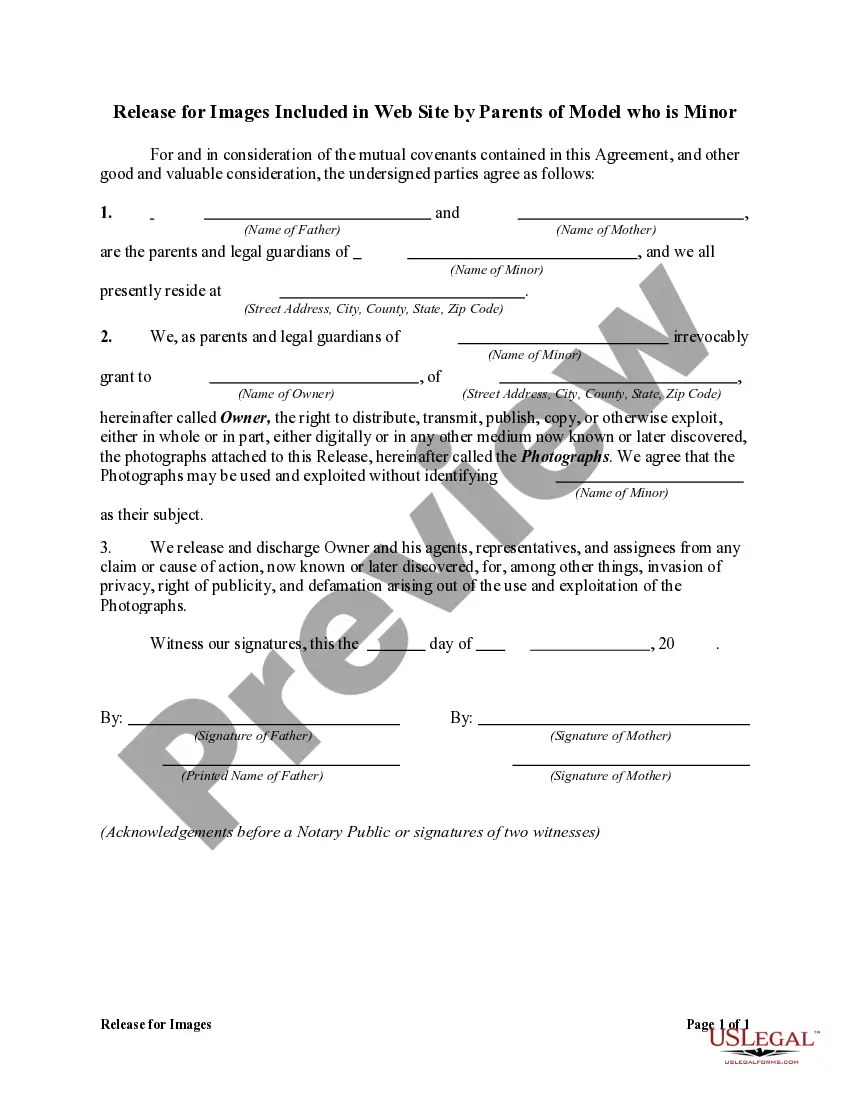

- Very first, ensure you have chosen the correct kind to your town/region. You may look over the shape utilizing the Review switch and browse the shape information to ensure this is the right one for you.

- If the kind is not going to meet up with your expectations, use the Seach field to get the appropriate kind.

- Once you are certain that the shape is acceptable, select the Get now switch to obtain the kind.

- Opt for the costs plan you need and type in the needed info. Create your profile and pay for your order using your PayPal profile or credit card.

- Opt for the file formatting and download the lawful document web template in your product.

- Comprehensive, edit and print out and indication the received Maryland Producer Agreement - Self-Employed Independent Contractor.

US Legal Forms is definitely the most significant catalogue of lawful varieties where you can see a variety of document themes. Take advantage of the service to download appropriately-manufactured files that comply with condition demands.

Form popularity

FAQ

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

However, for the most part, under the Federal regulations (and most states including California), a crew member on a film or other similar type production should never be categorized as an independent contractor they are really employees and are subject to federal and state withholding (from their paychecks) as

As an independent he still has to sign non-compete and non-disclosure agreements. But Cress strongly recommends that producers treat their crew as employees. A payroll service can take care of the taxes, insurance, and legality.

The state of Maryland does not require general contractors to obtain a license to do business. It is not necessary to have a license if you are doing electrical, plumbing, or HVACR work or are working on home improvement projects. A license is issued by the Department of Labor, Licensing and Regulation (DLLR).

An independent contractor is a person who runs a one-owner business. Most independent contractors are sole proprietors who personally own their business and its assets. But an increasing number of independent contractors are forming single-member limited liability companies (SMLLC) to own and operate their businesses.

Producer is retained only for the purposes and to the extent set forth in this agreement, and Producer's relationship to the Agency shall be that of an independent contractor.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.