A Maryland Self-Employed Independent Sales Contractor Agreement, also known as a 1099 agreement, is a legally binding contract between a company or individual hiring an independent sales contractor and the contractor themselves. This agreement outlines the terms and conditions of the working relationship, including the rights and responsibilities of both parties, compensation details, and any additional provisions specific to the state of Maryland. In Maryland, there are different types of Self-Employed Independent Sales Contractor Agreements that can be customized to suit the specific needs of different businesses. These agreements can be tailored for various industries such as real estate, telecommunications, technology, and more. Here are some examples of specific types of Maryland Self-Employed Independent Sales Contractor Agreements: 1. Real Estate Sales Contractor Agreement: This type of agreement is commonly used in the real estate industry, where independent sales contractors are hired to sell properties on behalf of a real estate agency or developer. It includes provisions related to commissions, target sales goals, marketing strategies, and rules for client interaction. 2. Direct Sales Contractor Agreement: This agreement is often utilized in the direct sales industry, where independent contractors are hired to promote and sell products or services directly to consumers. It typically includes provisions related to commission structures, territory limitations, product training, and sales quotas. 3. Software Sales Contractor Agreement: This particular agreement focuses on the software industry, where independent sales contractors are responsible for selling software licenses or services on behalf of a software company. It may include provisions regarding sales targets, sales territories, marketing materials, license agreements, and technical support. 4. Independent Contractor Non-Disclosure Agreement: This agreement is an addendum to a standard Self-Employed Independent Sales Contractor Agreement in Maryland and is designed to protect sensitive information shared between the contracting parties. It outlines the obligations of the independent contractor to maintain confidentiality and prohibits the disclosure of trade secrets or other proprietary information. Regardless of the type of Maryland Self-Employed Independent Sales Contractor Agreement, it is crucial for both parties to thoroughly review and understand the terms before signing the contract. Consulting with an attorney who specializes in employment law or contract law in Maryland is highly recommended ensuring compliance with state laws and to address any specific considerations relevant to the industry or business involved. This will help protect the interests of both the hiring company and the independent sales contractor throughout their working relationship.

Maryland Self-Employed Independent Sales Contractor Agreement

Description

How to fill out Maryland Self-Employed Independent Sales Contractor Agreement?

US Legal Forms - one of the greatest libraries of legitimate types in the States - gives a wide range of legitimate record themes you may down load or produce. Using the web site, you can get a huge number of types for company and specific reasons, categorized by groups, claims, or keywords.You will discover the latest models of types just like the Maryland Self-Employed Independent Sales Contractor Agreement within minutes.

If you already possess a registration, log in and down load Maryland Self-Employed Independent Sales Contractor Agreement in the US Legal Forms library. The Download button can look on each and every form you view. You gain access to all earlier downloaded types inside the My Forms tab of your profile.

If you wish to use US Legal Forms the first time, here are basic guidelines to help you get started:

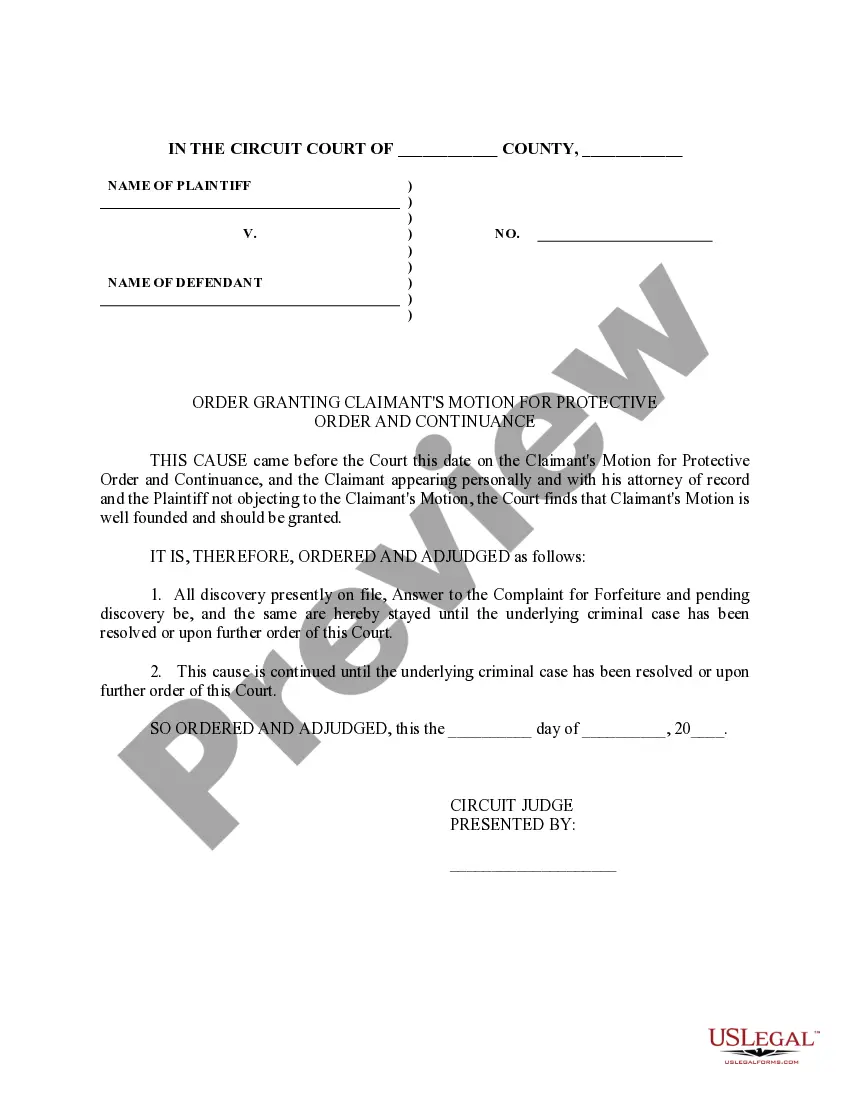

- Be sure to have picked out the correct form to your metropolis/state. Click on the Preview button to review the form`s content material. Read the form information to actually have chosen the right form.

- If the form does not satisfy your specifications, use the Search field at the top of the monitor to obtain the one which does.

- Should you be satisfied with the form, confirm your option by simply clicking the Buy now button. Then, pick the pricing prepare you want and provide your accreditations to sign up for the profile.

- Process the transaction. Make use of charge card or PayPal profile to perform the transaction.

- Pick the formatting and down load the form in your system.

- Make modifications. Load, change and produce and indication the downloaded Maryland Self-Employed Independent Sales Contractor Agreement.

Each template you included with your bank account lacks an expiry date and is also your own property eternally. So, if you want to down load or produce an additional version, just check out the My Forms segment and then click in the form you will need.

Gain access to the Maryland Self-Employed Independent Sales Contractor Agreement with US Legal Forms, the most comprehensive library of legitimate record themes. Use a huge number of professional and state-specific themes that fulfill your small business or specific needs and specifications.