Maryland Self-Employed Awning Services Contract

Description

How to fill out Maryland Self-Employed Awning Services Contract?

You may commit hours on the web searching for the lawful document format that fits the federal and state needs you need. US Legal Forms provides thousands of lawful kinds that are analyzed by experts. You can easily acquire or printing the Maryland Self-Employed Awning Services Contract from your service.

If you currently have a US Legal Forms account, you are able to log in and then click the Download button. Next, you are able to full, edit, printing, or indicator the Maryland Self-Employed Awning Services Contract. Every single lawful document format you buy is the one you have forever. To have yet another duplicate for any acquired kind, go to the My Forms tab and then click the related button.

Should you use the US Legal Forms web site for the first time, stick to the basic directions listed below:

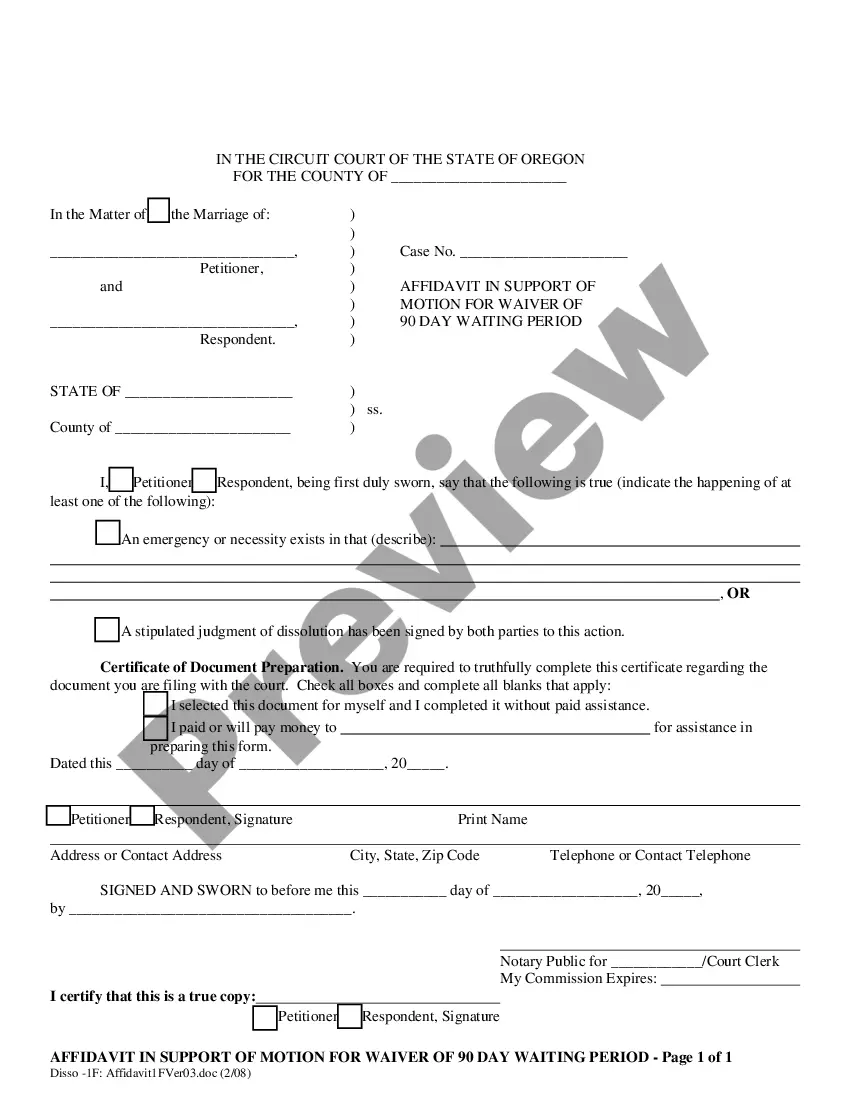

- Initially, make certain you have selected the right document format for that region/metropolis of your liking. See the kind information to ensure you have picked the correct kind. If offered, take advantage of the Review button to check with the document format as well.

- If you would like discover yet another model of the kind, take advantage of the Lookup field to find the format that meets your requirements and needs.

- Once you have identified the format you desire, click Acquire now to carry on.

- Find the costs strategy you desire, type your qualifications, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You may use your Visa or Mastercard or PayPal account to pay for the lawful kind.

- Find the file format of the document and acquire it in your device.

- Make changes in your document if required. You may full, edit and indicator and printing Maryland Self-Employed Awning Services Contract.

Download and printing thousands of document layouts while using US Legal Forms Internet site, which provides the biggest selection of lawful kinds. Use specialist and state-certain layouts to take on your business or specific requires.

Form popularity

FAQ

1099 employees are generally individuals who are in an independent trade, business, or profession in which they offer their services to the general public (not just a single customer or employer), including: Doctors. Dentists.

The contract should describe, in detail, the products to be used and how the work will be performed, i.e., size, color, who will be doing what work, amounts of materials provided, manufacturer model number, etc. There must be a detailed, written payment schedule in the contract.

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

Subcontractor is a person who is awarded a portion of an existing contract by a principal or general contractor. Subcontractor performs work under a contract with a general contractor, rather than the employer who hired the general contractor.

Pandemic Unemployment Assistance (PUA)Provides benefits for claimants who are ineligible for regular UI and unemployed due to a COVID-19 related reason. This includes gig workers, independent contractors, the self-employed, and those with insufficient work history.

A subcontractor receives a portion of what the contractor earns for an overall job. Contractors receive payment per job or by the hour. As a contractor, you a receive 1099 form, and the IRS determines if a worker is a contractor or an employee.

To be declared an independent contractor the individual (1) must be free from control and direction over his work both in fact and pursuant to the contract between the employer and contractor; (2) must be customarily engaged in independent business or contracting; and (3) the work must be outside the usual course of

5 Key Elements Every Construction Contract Should Contain1) The project's scope.2) The cost and payment terms.3) The project's time frame.4) Protection against lien law.5) Dispute resolution clauses.

What Your Remodeling Contract Should SayCheck Contract Basics. The basic job of a contractor agreement is to spell out the scope of the project's work.Set a Payment Schedule.Schedule Start and End Dates.Specify Change Orders.Research Your Arbitration Options.Turn Down the Contractor's Warranty.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.