Maryland Deed and Assignment from Trustee to Trust Beneficiaries

Description

How to fill out Deed And Assignment From Trustee To Trust Beneficiaries?

US Legal Forms - one of many biggest libraries of lawful kinds in America - offers a variety of lawful file themes you can download or print out. Making use of the web site, you will get thousands of kinds for enterprise and person uses, sorted by types, suggests, or key phrases.You will discover the most recent versions of kinds much like the Maryland Deed and Assignment from Trustee to Trust Beneficiaries within minutes.

If you already possess a membership, log in and download Maryland Deed and Assignment from Trustee to Trust Beneficiaries through the US Legal Forms local library. The Download button can look on each and every develop you see. You have accessibility to all formerly saved kinds in the My Forms tab of the profile.

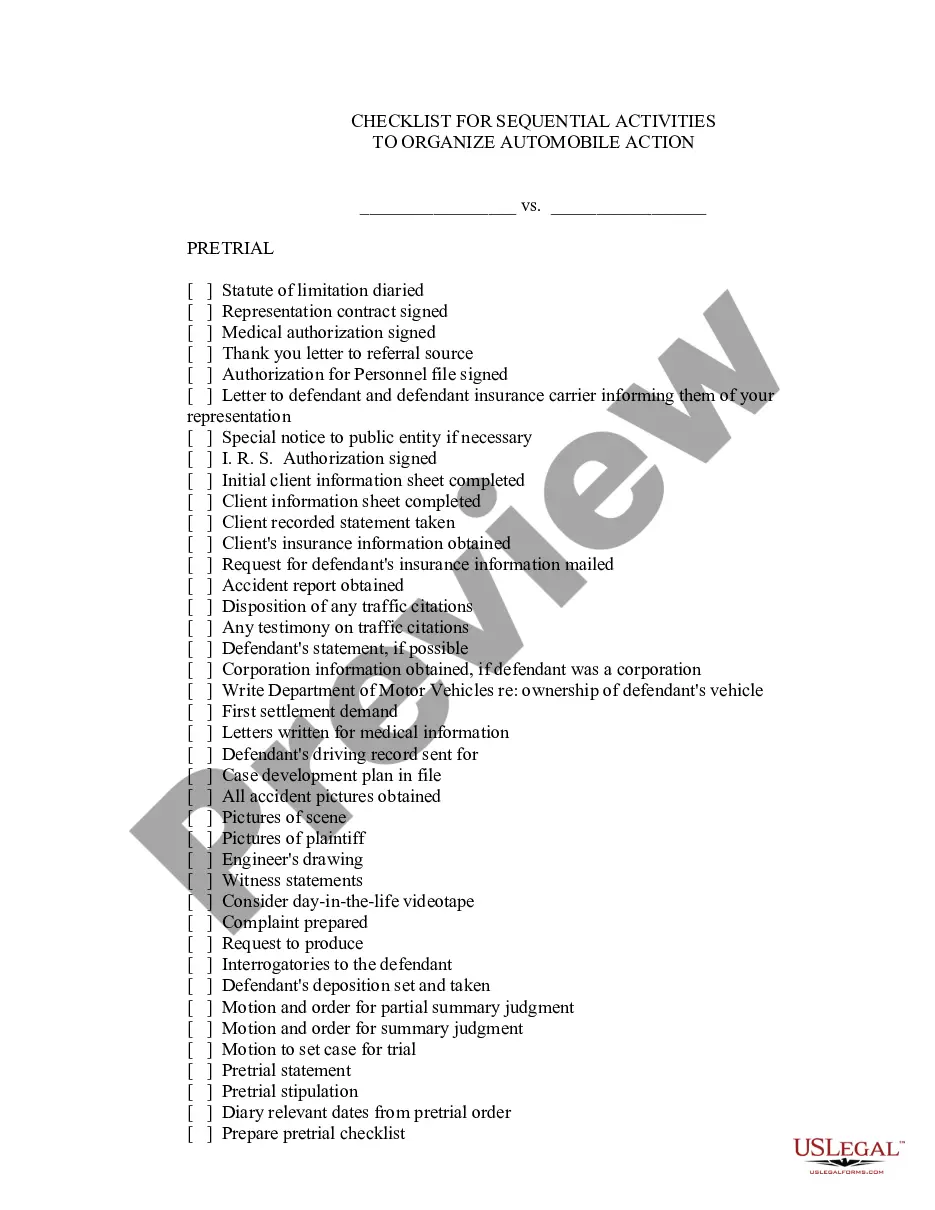

If you would like use US Legal Forms the very first time, listed below are easy guidelines to obtain started out:

- Ensure you have chosen the proper develop to your city/county. Go through the Review button to review the form`s information. Look at the develop outline to ensure that you have chosen the proper develop.

- When the develop doesn`t suit your demands, utilize the Search area at the top of the screen to find the the one that does.

- If you are pleased with the shape, confirm your decision by simply clicking the Get now button. Then, pick the pricing strategy you want and offer your references to register for the profile.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal profile to finish the financial transaction.

- Find the file format and download the shape in your gadget.

- Make alterations. Fill up, edit and print out and indicator the saved Maryland Deed and Assignment from Trustee to Trust Beneficiaries.

Each and every design you put into your bank account does not have an expiration day and is yours eternally. So, if you wish to download or print out one more version, just visit the My Forms section and then click in the develop you require.

Get access to the Maryland Deed and Assignment from Trustee to Trust Beneficiaries with US Legal Forms, probably the most considerable local library of lawful file themes. Use thousands of skilled and state-specific themes that satisfy your small business or person requires and demands.

Form popularity

FAQ

Beneficiaries of a trust typically pay taxes on the distributions they receive from a trust's income rather than the trust paying the tax. However, beneficiaries aren't subject to taxes on distributions from the trust's principal, the original sum of money put into the trust.

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes.

Bank accounts, retirement accounts, and life insurance will automatically transfer an inheritance if beneficiaries are designated. Listing beneficiaries on these accounts can be the easiest and quickest way to transfer those assets outside probate court.

In Maryland, real estate can be transferred via a TOD deed, also known as a beneficiary deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

The trustee can transfer real estate to the beneficiary by having a new deed written up or selling the property and giving them the money, writing them a check or giving them cash.

To create a living trust in Maryland you create a Declaration of Trust which is a written document. Oral trusts are valid in Maryland but are very difficult to enforce and manage. You sign the Declaration in front of a notary public. Assets are then transferred into the trust to fund the trust.

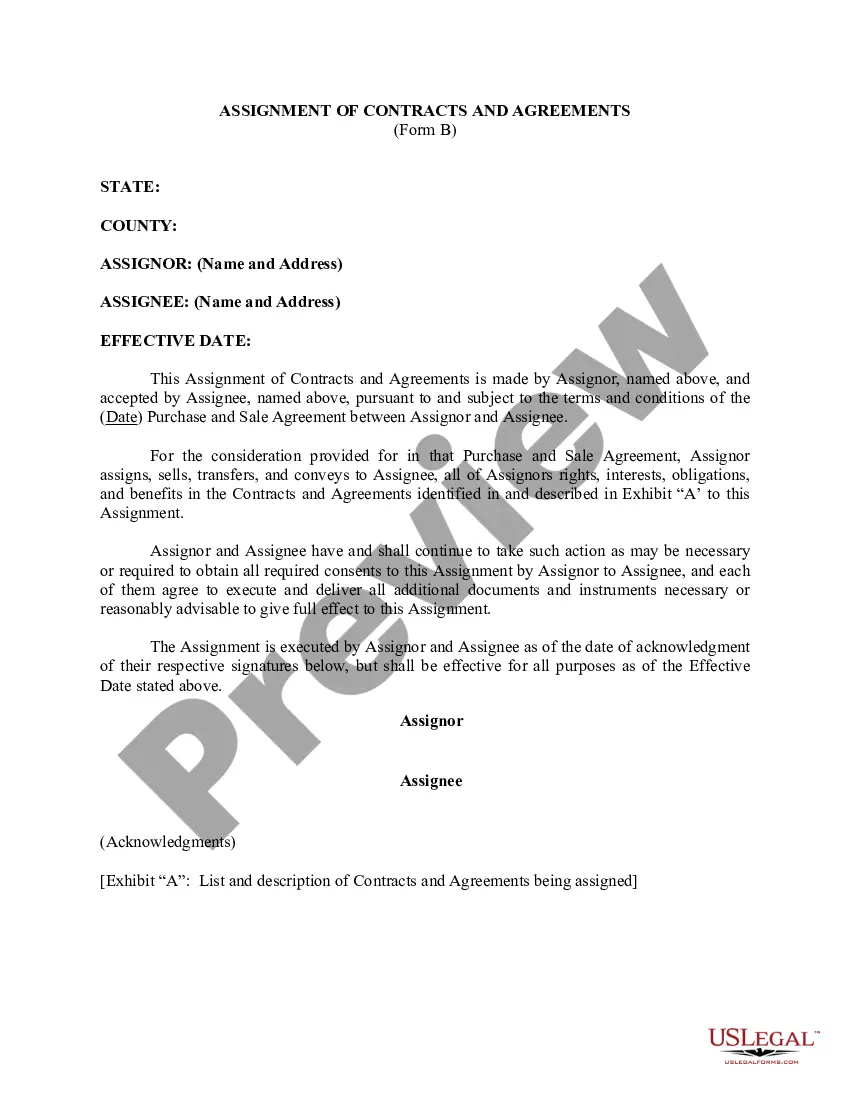

This Deed of Trust (the ?Trust Deed?) sets out the terms and conditions upon which: [Settlor Name] (the ?Settlor?), of [Settlor Address], settles that property set out in Schedule A (the ?Property?) upon [Trustee Name] (the ?Trustee?), being a Company duly registered under the laws of [state] with registered number [ ...

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes.