A Maryland Partition Deed for Mineral / Royalty Interests is a legal document that allows for the division or separation of ownership rights in mineral or royalty interests located in Maryland. This deed is commonly used when multiple individuals or entities hold an undivided interest in such assets and wish to establish separate ownership rights. The partition process ensures that each party receives their fair share of mineral or royalty interests based on their ownership percentage. This deed is crucial when co-owners want to clarify their rights, responsibilities, and boundaries related to the extraction, management, or distribution of the resources. There are two primary types of Maryland Partition Deeds for Mineral / Royalty Interests: 1. Voluntary Partition Deed: This type of partition deed is executed when all the parties involved willingly agree to divide their ownership interests. It requires the consent and cooperation of all co-owners. By voluntarily partitioning the interests, each party gains individual control and ownership of a specific portion, allowing them to independently manage and benefit from the mineral or royalty rights. 2. Court-Ordered Partition Deed: In certain cases, co-owners may be unable to reach a mutual agreement on the division of mineral or royalty interests. In such instances, any party can seek relief from the court and request a court-ordered partition. The court will then conduct a hearing, assess the interests and claims of all parties involved, and determine the fair and equitable distribution of the assets. While these two types of Maryland Partition Deeds for Mineral / Royalty Interests encompass the basic framework, there may be variations depending on specific circumstances, property types, and legal requirements. It is strongly advised to consult with legal professionals experienced in Maryland real estate law and mineral interests to ensure compliance and accuracy when drafting or executing such partition deeds.

Maryland Partition Deed for Mineral / Royalty Interests

Description

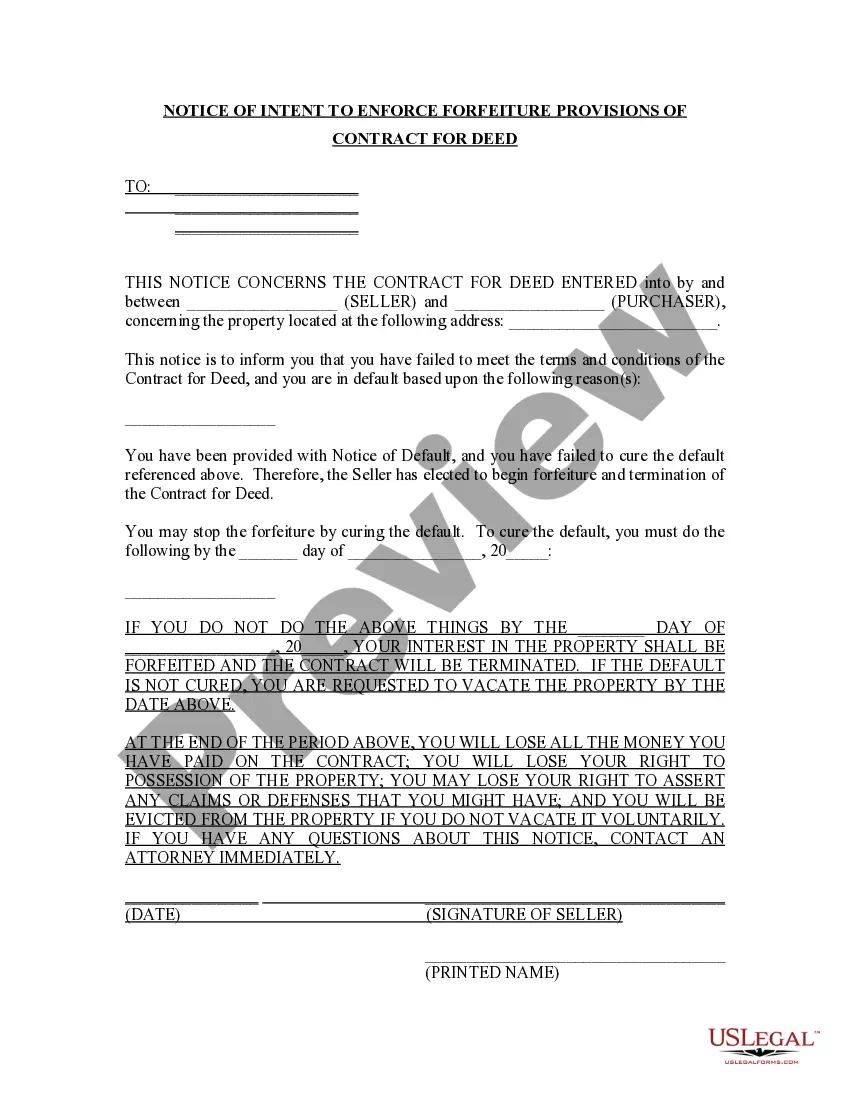

How to fill out Maryland Partition Deed For Mineral / Royalty Interests?

Have you been within a place that you require papers for possibly business or personal functions just about every day? There are a variety of lawful record layouts available online, but getting types you can rely on isn`t easy. US Legal Forms gives thousands of form layouts, much like the Maryland Partition Deed for Mineral / Royalty Interests, which can be created to satisfy federal and state needs.

If you are currently informed about US Legal Forms website and get a free account, merely log in. After that, you are able to download the Maryland Partition Deed for Mineral / Royalty Interests template.

If you do not provide an profile and would like to start using US Legal Forms, adopt these measures:

- Get the form you require and ensure it is for your correct area/area.

- Take advantage of the Preview switch to review the form.

- Read the description to actually have selected the correct form.

- In case the form isn`t what you`re looking for, utilize the Look for discipline to get the form that meets your requirements and needs.

- When you obtain the correct form, just click Purchase now.

- Select the costs program you want, complete the specified info to generate your bank account, and buy the order with your PayPal or bank card.

- Choose a convenient document structure and download your version.

Locate every one of the record layouts you possess bought in the My Forms menu. You may get a further version of Maryland Partition Deed for Mineral / Royalty Interests any time, if possible. Just go through the essential form to download or print the record template.

Use US Legal Forms, probably the most substantial assortment of lawful varieties, in order to save efforts and prevent faults. The service gives skillfully manufactured lawful record layouts that you can use for an array of functions. Produce a free account on US Legal Forms and commence generating your daily life easier.

Form popularity

FAQ

Hear this out loud PauseMineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Hear this out loud PauseOwning a property's ?mineral rights? refers to ownership of the mineral deposits under the surface of a piece of land. The rights to the minerals usually belong to the owner of the surface property, or surface estate. In Texas, though, those rights can be transferred to another party.

Hear this out loud PauseA Texas mineral deed with general warranty, used to convey all of the grantor's oil, gas, and other minerals under real property. This Standard Document has integrated notes with explanations and drafting tips.

Hear this out loud PauseMineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

Hear this out loud PauseA Texas mineral deed with general warranty, used to convey all of the grantor's oil, gas, and other minerals under real property. This Standard Document has integrated notes with explanations and drafting tips.

Hear this out loud PauseYou will need to sign the mineral deed form in front of a notary to confirm its authenticity, have it notarized, and have it recorded. The recorder of the deed can send a copy back to us, and you will keep a copy. And you are done!

Hear this out loud PauseThe mineral rights on Texas land can be separated from the surface estate. As an investor, you can buy a unified estate including surface rights and below surface rights, or a split estate, only including the mineral estates.

Hear this out loud PauseIf you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.