Maryland Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

Description

How to fill out Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

Are you currently in the situation the place you will need documents for either enterprise or individual functions just about every day? There are a lot of authorized record templates accessible on the Internet, but discovering types you can depend on isn`t easy. US Legal Forms delivers a huge number of type templates, such as the Maryland Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files, that happen to be written to meet federal and state requirements.

If you are already knowledgeable about US Legal Forms internet site and possess your account, simply log in. Following that, you can down load the Maryland Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files format.

Unless you have an profile and wish to begin using US Legal Forms, abide by these steps:

- Get the type you require and make sure it is for the right area/state.

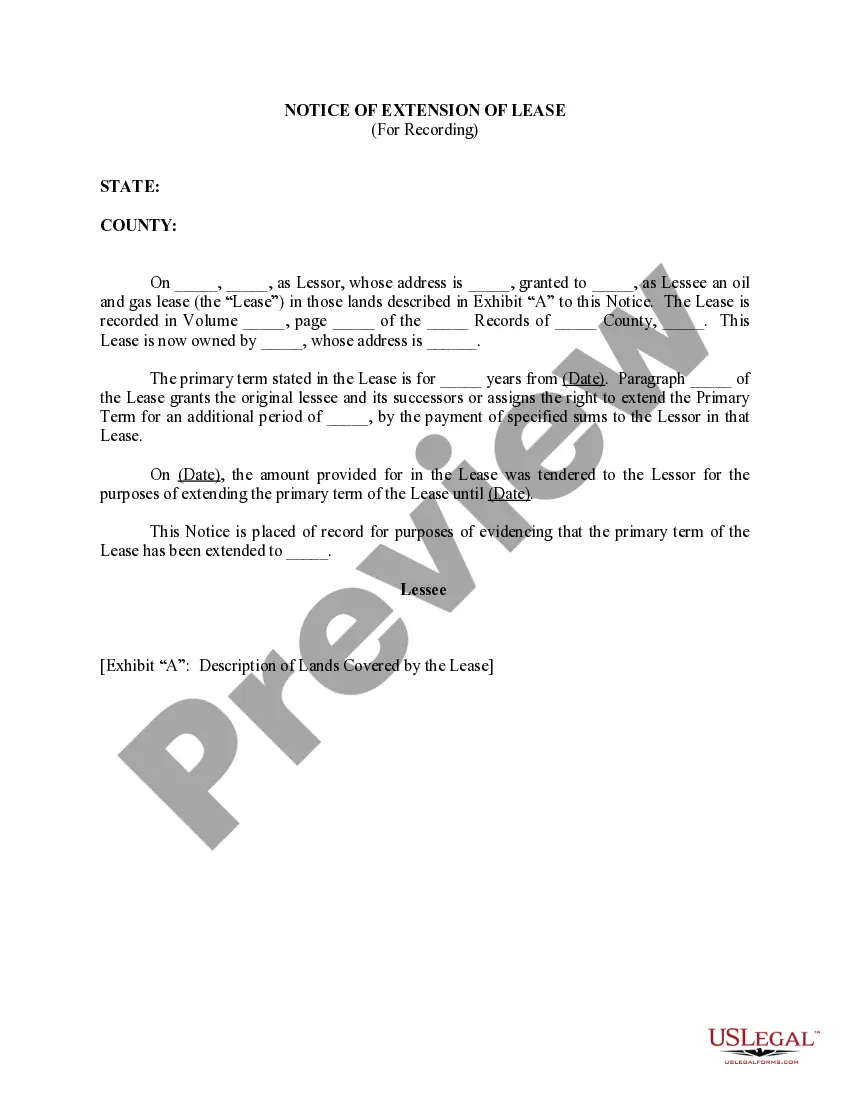

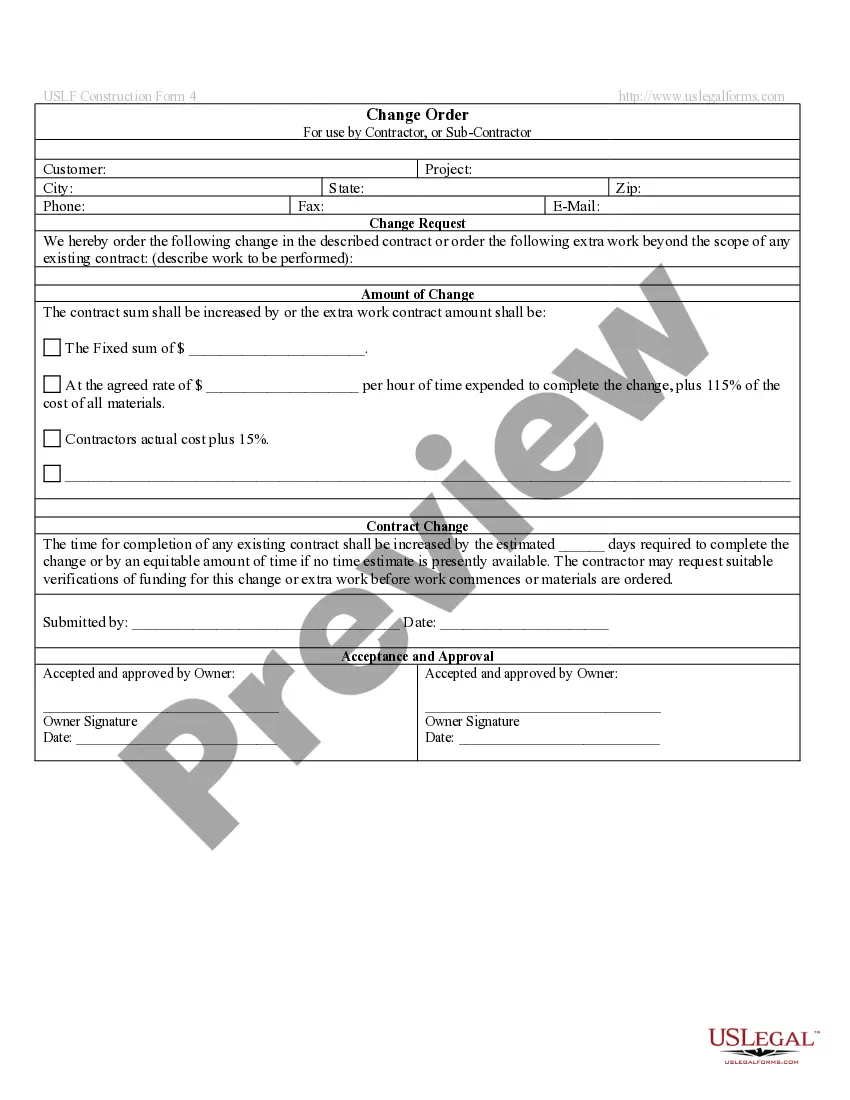

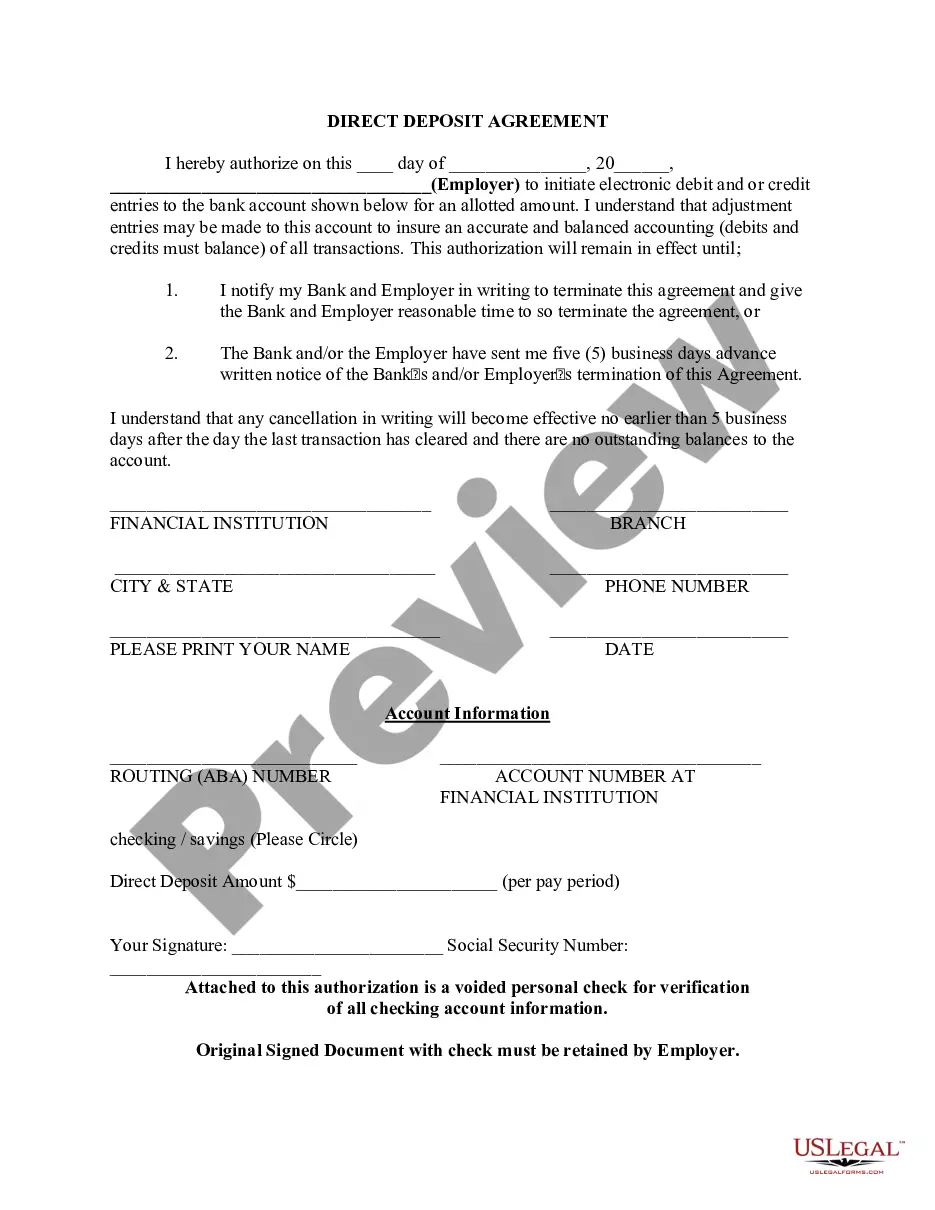

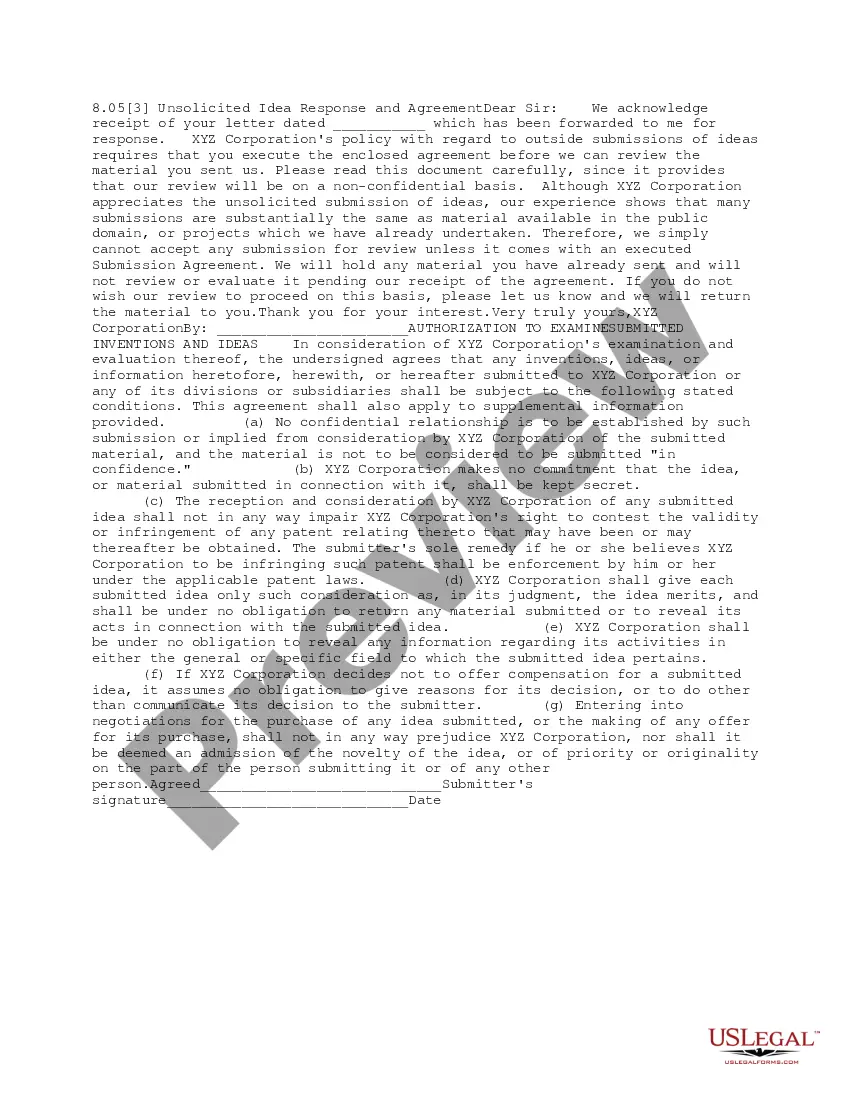

- Use the Preview key to review the shape.

- Read the outline to actually have selected the proper type.

- In the event the type isn`t what you are searching for, take advantage of the Lookup industry to obtain the type that meets your needs and requirements.

- When you get the right type, just click Acquire now.

- Pick the pricing prepare you desire, fill in the necessary information to generate your account, and pay for your order making use of your PayPal or bank card.

- Choose a convenient data file structure and down load your copy.

Locate all of the record templates you have purchased in the My Forms menus. You can obtain a more copy of Maryland Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files anytime, if necessary. Just click on the necessary type to down load or printing the record format.

Use US Legal Forms, by far the most extensive collection of authorized forms, in order to save some time and stay away from faults. The support delivers expertly produced authorized record templates which can be used for an array of functions. Produce your account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

So, to sum it up: the title is like a certificate of ownership, while the UCC 1 financing statement is like a public notice of a security interest. It's kind of like saying, "I own this thing, but I owe someone else money for it, so don't mess with it unless you want to deal with them too!"

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically when the security interest attaches.

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

?How to File UCC Documents with the Department Filing Fees: Filings of 8 or fewer pages cost $25 and filings of 9 or more pages cost $75. If you have further questions please email the UCC division at sdat.ucc@maryland.gov or call at 410-767-1459.

?UCC? stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default. However, in many cases, the terms UCC lien and UCC filing are used interchangeably.

Let's briefly look at each of these requirements. Value is Given for the Security Interest. ... Debtor Has Rights in the Collateral. ... The Debtor Authenticates a Security Agreement. ... Filing a Financing Statement to Perfect the Security Interest. ... Possessing the Collateral to Perfect the Security Interest.

Methods to Remove a UCC Filing Ask the lender to terminate the lien upon payoff. Visit your secretary of state's office. Dispute any inaccurate information on your business credit report.

If you need to remove a UCC filing form your credit report, ask the lender to file for its removal. In order to do this, they need to file a UCC-3 Financing Statement Amendment. You can also just wait it out. Depending on how long you have been with the lender, the filing may be removed within a few months.