Maryland Due Diligence Field Review and Checklist is an essential process that ensures a thorough investigation and examination of a property or business before any transaction or investment takes place. This comprehensive review is crucial in identifying potential risks, financial obligations, and legal issues associated with a property, thereby minimizing any potential adverse effects and maximizing informed decision-making. The Maryland Due Diligence Field Review and Checklist entail a series of critical assessments and evaluations that cover various aspects of the property or business under consideration. These include legal, financial, technical, operational, environmental, and regulatory aspects. By conducting a systematic analysis using this checklist, investors and buyers can gain a comprehensive understanding of the property's current condition and potential future performance. Different types of Maryland Due Diligence Field Review and Checklist can be classified based on the specific area of evaluation and the nature of the property or business being examined. Here are some of the common types: 1. Legal Due Diligence: This type of field review involves an examination of legal documentation such as property titles, leases, contracts, licenses, and permits. It aims to identify any potential legal issues, disputes, outstanding litigation, or zoning restrictions that may affect the property's transfer or future operations. 2. Financial Due Diligence: This aspect focuses on assessing the financial health and stability of the property or business. It includes a thorough review of financial statements, tax records, accounting practices, debts, mortgages, and financial projections. The goal is to determine the property's value, profitability, cash flow, and potential financial risks. 3. Technical Due Diligence: This type of review concentrates on evaluating the physical condition and performance of a property. It involves inspections of structures, buildings, systems, and equipment to identify any structural deficiencies, maintenance requirements, or potential hazards. Technical due diligence is commonly applied in real estate transactions or the acquisition of industrial or manufacturing facilities. 4. Environmental Due Diligence: This assessment examines the environmental impact and compliance of the property. It aims to identify any potential contamination or liability issues caused by hazardous materials, pollutants, or improper disposal practices. Environmental due diligence ensures compliance with federal and state regulations, assesses remediation costs, and safeguards against any legal or financial liabilities. 5. Regulatory Due Diligence: This type of review focuses on identifying and understanding the regulatory aspects that may affect the property or business. It encompasses zoning regulations, building codes, permits, licenses, health and safety requirements, and compliance with industry-specific regulations. Regulatory due diligence ensures that the property or business operations comply with all necessary legal and operational standards. Conducting a Maryland Due Diligence Field Review and Checklist is crucial for buyers, investors, lenders, and sellers alike. It provides them with invaluable information and insights into the potential risks and opportunities associated with a property or business in Maryland. By carefully examining all relevant aspects, stakeholders can make informed decisions, negotiate better terms, and mitigate potential liabilities, ultimately ensuring a successful investment or transaction.

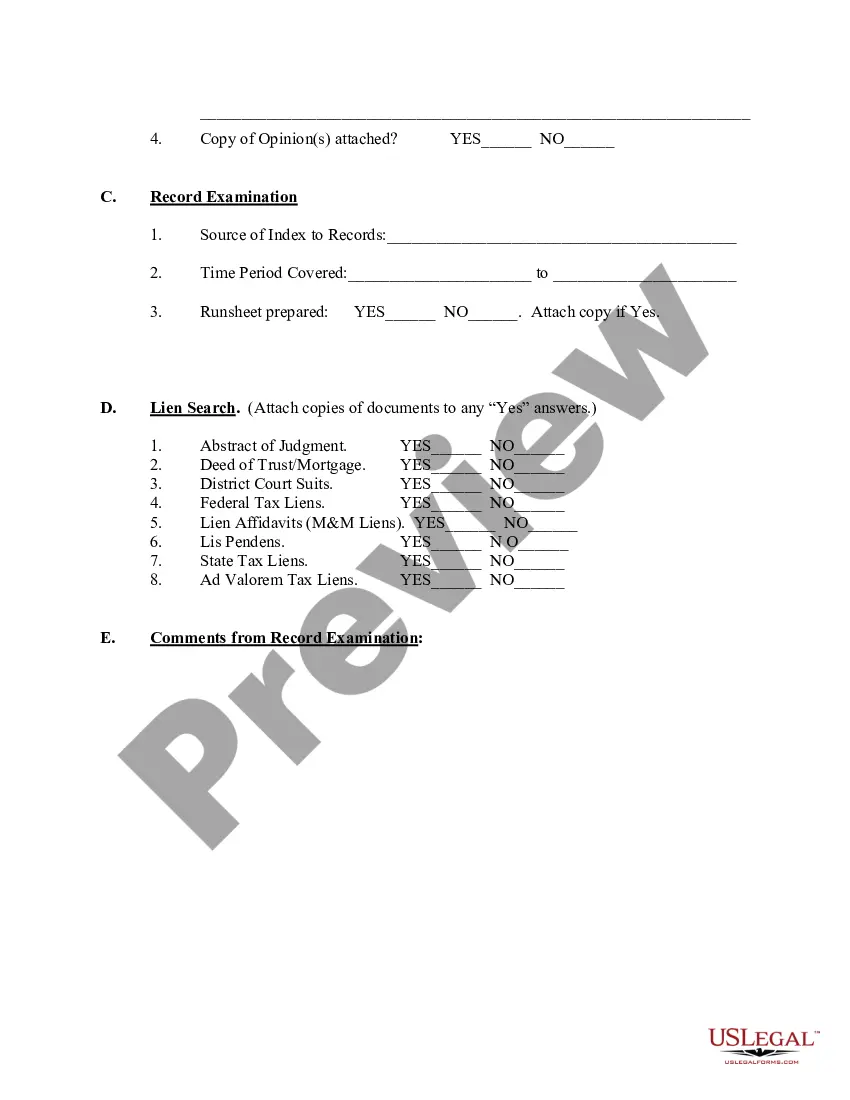

Maryland Due Diligence Field Review and Checklist

Description

How to fill out Maryland Due Diligence Field Review And Checklist?

Are you within a placement that you will need papers for sometimes business or specific functions just about every time? There are a lot of legal document themes available on the net, but finding ones you can trust isn`t straightforward. US Legal Forms delivers a huge number of develop themes, just like the Maryland Due Diligence Field Review and Checklist, that happen to be composed to meet federal and state requirements.

If you are already informed about US Legal Forms website and have your account, simply log in. Afterward, you can down load the Maryland Due Diligence Field Review and Checklist web template.

Unless you come with an bank account and want to begin to use US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is for your right town/area.

- Take advantage of the Review option to review the shape.

- Read the description to ensure that you have selected the appropriate develop.

- If the develop isn`t what you`re looking for, utilize the Look for area to discover the develop that meets your needs and requirements.

- Once you obtain the right develop, just click Purchase now.

- Choose the rates prepare you would like, fill in the necessary details to produce your money, and buy the transaction using your PayPal or bank card.

- Select a handy paper format and down load your copy.

Get all the document themes you may have purchased in the My Forms menu. You can obtain a extra copy of Maryland Due Diligence Field Review and Checklist whenever, if possible. Just click the required develop to down load or print the document web template.

Use US Legal Forms, by far the most considerable assortment of legal forms, to save efforts and avoid errors. The service delivers appropriately produced legal document themes which can be used for a selection of functions. Produce your account on US Legal Forms and initiate creating your life easier.