Maryland Subordination of Lien (Deed of Trust/Mortgage) is a legal process that allows a property owner to prioritize the payment of certain liens over others. This is often done to secure the interests of lenders and promote smooth transactions when selling or refinancing a property. Here, we will dive into the details of Maryland Subordination of Lien, discussing its purpose, types, and relevant keywords associated with this procedure. The primary purpose of Maryland Subordination of Lien is to establish a clear order of priority among different liens on a property. Liens are legal claims against a property, typically related to outstanding debts, taxes, or other financial obligations. When multiple liens exist, such as a first mortgage lien and a second mortgage lien, the Subordination of Lien process becomes crucial in determining which creditor gets paid first in the event of foreclosure or sale of the property. Essentially, Subordination of Lien in Maryland allows a higher-ranking lien holder to grant permission to a lower-ranking lien holder to move up in priority for payment. This agreement is formalized through a written document known as the Subordination Agreement, which must be signed by all parties involved and recorded with the appropriate county land records. Now, let's take a closer look at the different types of Maryland Subordination of Lien: 1. First Lien Subordination: This type of subordination occurs when a first mortgage holder allows a lower-ranking lien holder, such as a second mortgage lender or judgment creditor, to take priority over their lien. This is commonly done to facilitate a home equity loan or when refinancing an existing mortgage. 2. Construction Loan Subordination: When a property owner applies for a construction loan, the lender providing the funds may require an existing mortgage holder to subordinate their lien to the new construction loan lien. This ensures the construction lender has priority over the existing mortgage in case of default. 3. Intercreditor Subordination: In situations where multiple creditors have different levels of priority, an intercreditor subordination can be used to establish a specific ranking among them. This type of subordination is often seen in commercial real estate transactions involving multiple lenders or parties with varying liens on the property. Keywords associated with Maryland Subordination of Lien (Deed of Trust/Mortgage) include: Maryland subordination agreement, lien priority, first lien holder, second lien holder, construction loan, refinancing, intercreditor subordination, mortgage subordination, mortgage priority, and state-specific regulations. It is important to consult with a qualified attorney or legal professional experienced in real estate and lien matters to navigate the complexities of Maryland Subordination of Lien, as the process may vary based on individual circumstances and local regulations.

Maryland Subordination of Lien (Deed of Trust/Mortgage)

Description

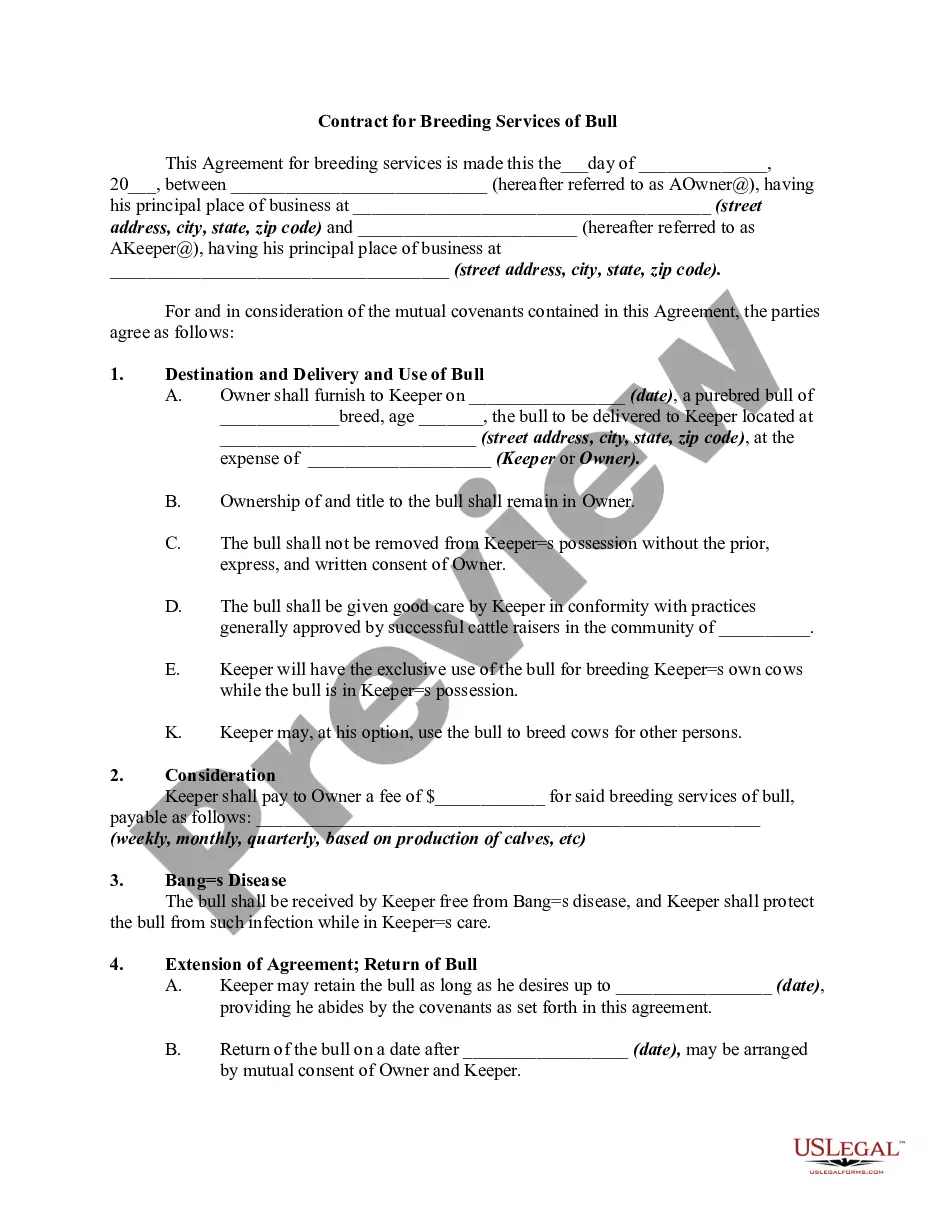

How to fill out Maryland Subordination Of Lien (Deed Of Trust/Mortgage)?

If you wish to total, down load, or produce lawful record themes, use US Legal Forms, the greatest assortment of lawful varieties, which can be found on-line. Use the site`s simple and easy handy search to find the documents you need. Different themes for enterprise and person purposes are categorized by classes and says, or search phrases. Use US Legal Forms to find the Maryland Subordination of Lien (Deed of Trust/Mortgage) in a handful of mouse clicks.

Should you be presently a US Legal Forms customer, log in to your accounts and click the Down load key to have the Maryland Subordination of Lien (Deed of Trust/Mortgage). Also you can access varieties you earlier acquired inside the My Forms tab of your respective accounts.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that correct town/land.

- Step 2. Take advantage of the Preview choice to look through the form`s content material. Never neglect to see the description.

- Step 3. Should you be unhappy with all the type, use the Research discipline near the top of the monitor to find other types in the lawful type design.

- Step 4. Upon having located the form you need, click on the Buy now key. Choose the pricing strategy you favor and add your references to register on an accounts.

- Step 5. Method the transaction. You may use your credit card or PayPal accounts to perform the transaction.

- Step 6. Select the file format in the lawful type and down load it on the device.

- Step 7. Full, revise and produce or sign the Maryland Subordination of Lien (Deed of Trust/Mortgage).

Every single lawful record design you purchase is yours for a long time. You have acces to each type you acquired in your acccount. Select the My Forms segment and choose a type to produce or down load yet again.

Contend and down load, and produce the Maryland Subordination of Lien (Deed of Trust/Mortgage) with US Legal Forms. There are millions of skilled and state-specific varieties you can use for your personal enterprise or person requires.