Maryland Affidavit of Heirship - Descent

Description

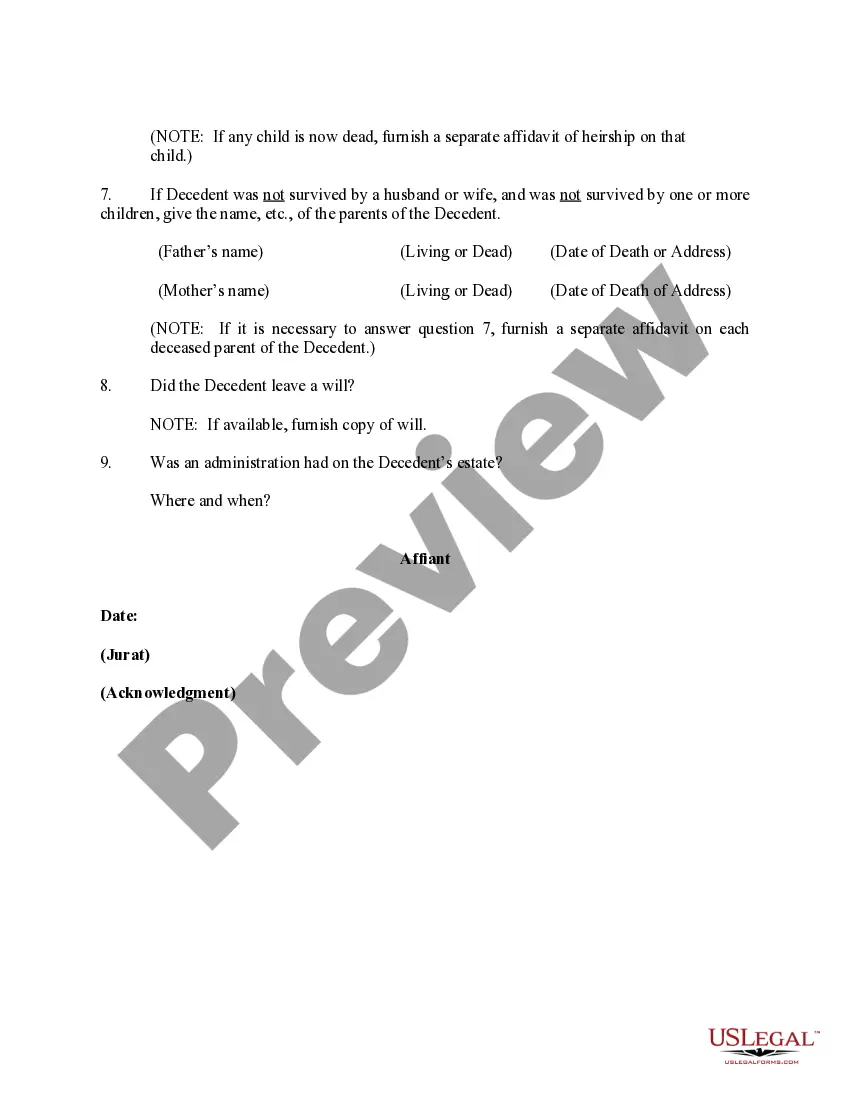

How to fill out Affidavit Of Heirship - Descent?

If you wish to full, download, or printing lawful record themes, use US Legal Forms, the greatest variety of lawful forms, that can be found on-line. Utilize the site`s simple and easy practical search to obtain the paperwork you will need. A variety of themes for company and personal reasons are categorized by types and says, or keywords. Use US Legal Forms to obtain the Maryland Affidavit of Heirship - Descent in just a handful of clicks.

In case you are presently a US Legal Forms client, log in in your account and then click the Download key to have the Maryland Affidavit of Heirship - Descent. You may also accessibility forms you earlier saved in the My Forms tab of your own account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the shape to the proper city/land.

- Step 2. Take advantage of the Review solution to look over the form`s content material. Never neglect to see the description.

- Step 3. In case you are unsatisfied with all the type, take advantage of the Research industry near the top of the screen to discover other versions of your lawful type format.

- Step 4. Upon having identified the shape you will need, select the Purchase now key. Opt for the prices strategy you like and add your credentials to sign up for the account.

- Step 5. Approach the financial transaction. You may use your Мisa or Ьastercard or PayPal account to finish the financial transaction.

- Step 6. Choose the structure of your lawful type and download it on the system.

- Step 7. Total, modify and printing or indicator the Maryland Affidavit of Heirship - Descent.

Each and every lawful record format you purchase is yours permanently. You might have acces to every single type you saved with your acccount. Click the My Forms segment and choose a type to printing or download once more.

Be competitive and download, and printing the Maryland Affidavit of Heirship - Descent with US Legal Forms. There are millions of specialist and status-distinct forms you may use for your personal company or personal needs.

Form popularity

FAQ

You should add together the totals for assets, changes, and income, then take away the totals for liabilities and expenses. This final figure should then be divided into the appropriate portions and then assigned to the list of beneficiaries.

Property outside of probate include assets like a family home that is owned as Joint Tenants because the surviving joint tenant becomes the owner of the property. Another example is Tenancy by the Entirety where assets are owned by a married couple. Beneficiary Designations on assets is yet another example.

Step 1: Figure out who will be the estate representative. The first thing is to figure out who will be the representative of the estate. If there is a will, the representative is the executor named in the will. If there is no will, it depends whether the case needs to go to probate court or not.

Ideally, you should be able to close the estate within 13 months of the decedent's death. However, depending on the size and complexity of the estate, it may take longer. In any case, it's important to keep meticulous records throughout the process to prove to the court that you've fulfilled all your fiduciary duties.

How to Close an Estate in Maryland: A Comprehensive Guide Open the Probate Process: First, the executor needs to file the will and a petition to open probate with the Register of Wills. ... Take Inventory of the Estate: ... Notify Creditors and Pay Debts: ... Distribute the Assets and Pay Inheritance Taxes: ... Close the Estate:

First Account-WITHIN NINE MONTHS from the date of appointment, the First Account must be filed. The Account must include the inventoried assets and all activity of the administration.

No. The only time the property of a person who passes away goes through the probate process is if the decedent held property just in his or her name alone.

Generally, the Intestacy statutes provide for property to be distributed to a decedent's closest living relatives, i.e., to a surviving spouse and children, if there are any; to children in equal shares if there is no surviving spouse; to parents if there are no spouse and children; and so on to more distant relatives.