Maryland Oil and Gas Division Order

Description

How to fill out Oil And Gas Division Order?

You can spend hrs on-line attempting to find the authorized record web template that fits the federal and state specifications you require. US Legal Forms supplies thousands of authorized varieties which are analyzed by specialists. It is possible to down load or produce the Maryland Oil and Gas Division Order from our assistance.

If you currently have a US Legal Forms account, you can log in and click the Obtain key. Following that, you can comprehensive, modify, produce, or sign the Maryland Oil and Gas Division Order. Each and every authorized record web template you get is your own property eternally. To obtain one more duplicate of the obtained type, proceed to the My Forms tab and click the related key.

If you are using the US Legal Forms website the first time, adhere to the simple recommendations beneath:

- Initial, be sure that you have selected the correct record web template for the county/area that you pick. See the type outline to ensure you have picked out the proper type. If readily available, use the Preview key to look from the record web template also.

- If you want to discover one more edition of the type, use the Research area to discover the web template that meets your needs and specifications.

- Upon having discovered the web template you desire, click on Purchase now to carry on.

- Select the rates prepare you desire, type in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal account to purchase the authorized type.

- Select the format of the record and down load it to your product.

- Make alterations to your record if possible. You can comprehensive, modify and sign and produce Maryland Oil and Gas Division Order.

Obtain and produce thousands of record web templates utilizing the US Legal Forms Internet site, which offers the largest selection of authorized varieties. Use professional and condition-distinct web templates to deal with your company or specific demands.

Form popularity

FAQ

A division order analyst works for a petroleum company and oversees company records. As a division order analyst, you establish, prepare, review, approve, and maintain documents regarding production and land ownership for royalty owners. You generally work as a part of the land department at an oil company.

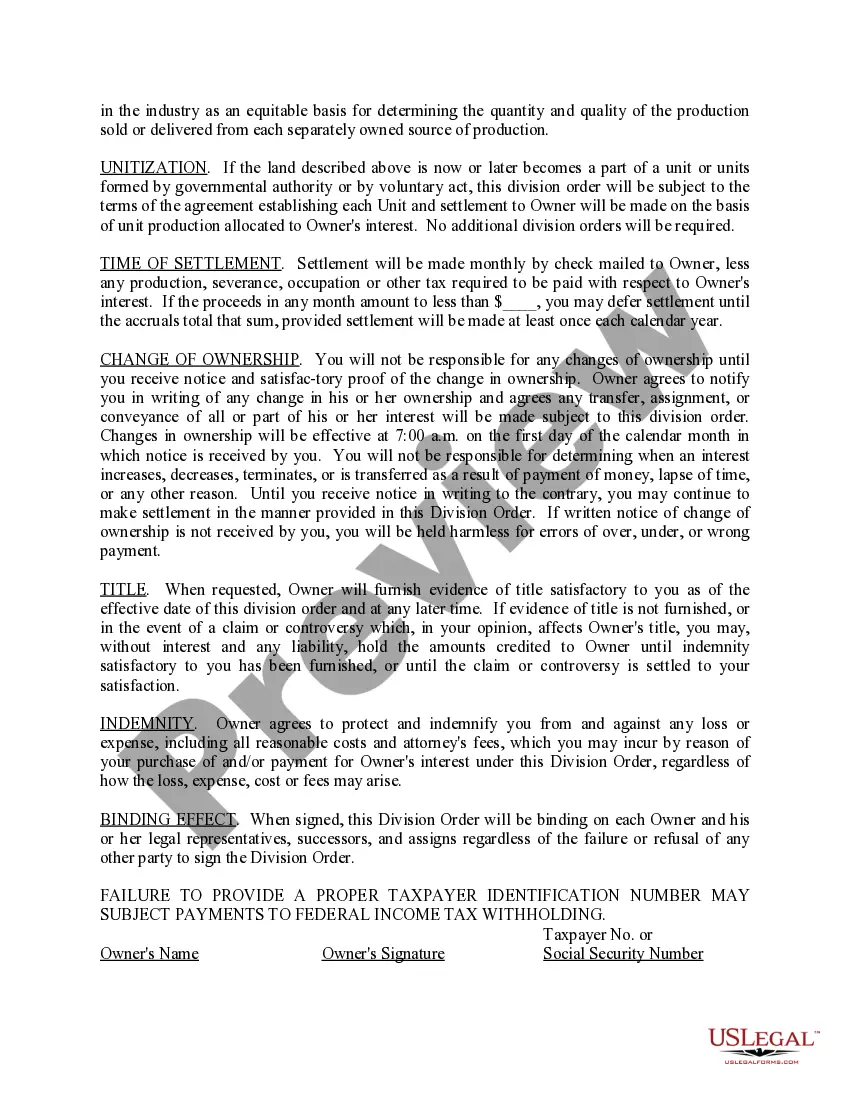

A division order is a contract between you and the operator (an oil and gas company). Typically, receiving a division order means that the operator is about to drill, or that the operator has already drilled a well and your minerals are producing.

The Division Order is a document whereby the revenue distributor (either the Operator or the 1st Purchaser) and the recipient (the royalty owner) agree on the exact decimal interest (Net Revenue Interest or NRI) owned within a well, lease, production unit, or field-wide unit.

A Division Order is an instrument which sets forth the proportional ownership in produced hydrocarbons, including crude oil, natural gas, and NGL's. Sometimes the Division Order is referred to as a division of interest.

A Division order is an instrument that records an owner's interest in a specific well. It should include the name of the well, the well number, interest type, and your decimal interest.

To put it another way the formula is: lessor's acres in unit ÷ total number of acres in unit × lessor's ownership interest × lessor's royalty percentage = lessor's decimal interest.

The division order describes the minerals, it asks for information about yourself, and often asks you to agree to certain things related to the payment of royalties. But beware, in Oklahoma you are not required to sign and return a division order. In fact, you may be unnecessarily impairing or giving away your rights.

The payor may not require a division order, however, that requires much more than is necessary for it to verify the interest you claim to be entitled to. You may insist that the payor submit a division order containing no more than is required by Texas law.