Description: The Maryland Subscription Agreement for an Equity Fund is a legally-binding contract between an investor and an equity fund looking to raise capital. It outlines the terms and conditions under which the investor will subscribe to purchase equity shares in the fund. This agreement is specific to the Maryland jurisdiction and ensures compliance with state laws and regulations governing investment activities. The Subscription Agreement for an Equity Fund typically includes important details such as the investor's personal information, the subscription amount, the number of shares being purchased, and the payment terms. It also specifies the rights and obligations of both the investor and the equity fund, establishing a framework for their relationship. Within Maryland, there may be different types of Subscription Agreements for Equity Funds based on the specific nature of the fund or the investment strategy employed. Some of these variations include: 1. General Maryland Subscription Agreement for an Equity Fund: This is the standard agreement that covers most equity funds irrespective of their investment focus or sector. It outlines the basic terms and conditions applicable to all investors participating in the fund. 2. Sector-Specific Maryland Subscription Agreement for an Equity Fund: Certain equity funds may specialize in particular sectors such as technology, real estate, or healthcare. In such cases, a sector-specific agreement may be created to address industry-specific considerations and disclosures relevant to investors in that sector. 3. Maryland Subscription Agreement for a Venture Capital Fund: Venture capital funds, which focus on early-stage companies with high growth potential, often have specific requirements and provisions. A separate agreement may be employed to address the unique characteristics associated with investing in and managing venture capital investments. 4. Maryland Subscription Agreement for a Private Equity Fund: Private equity funds primarily invest in established companies with potential for significant expansion or restructuring. Due to the distinct nature of private equity investments, a customized subscription agreement might be necessary to cover the specific intricacies of these types of investments. In conclusion, the Maryland Subscription Agreement for an Equity Fund is a vital legal document that governs the relationship between an investor and an equity fund. Understanding the different types of subscription agreements available for various types of equity funds ensures that the terms and conditions precisely align with the specific investment strategy and nature of the fund. It is essential for investors and funds alike to consult with legal professionals to ensure compliance with Maryland laws and regulations.

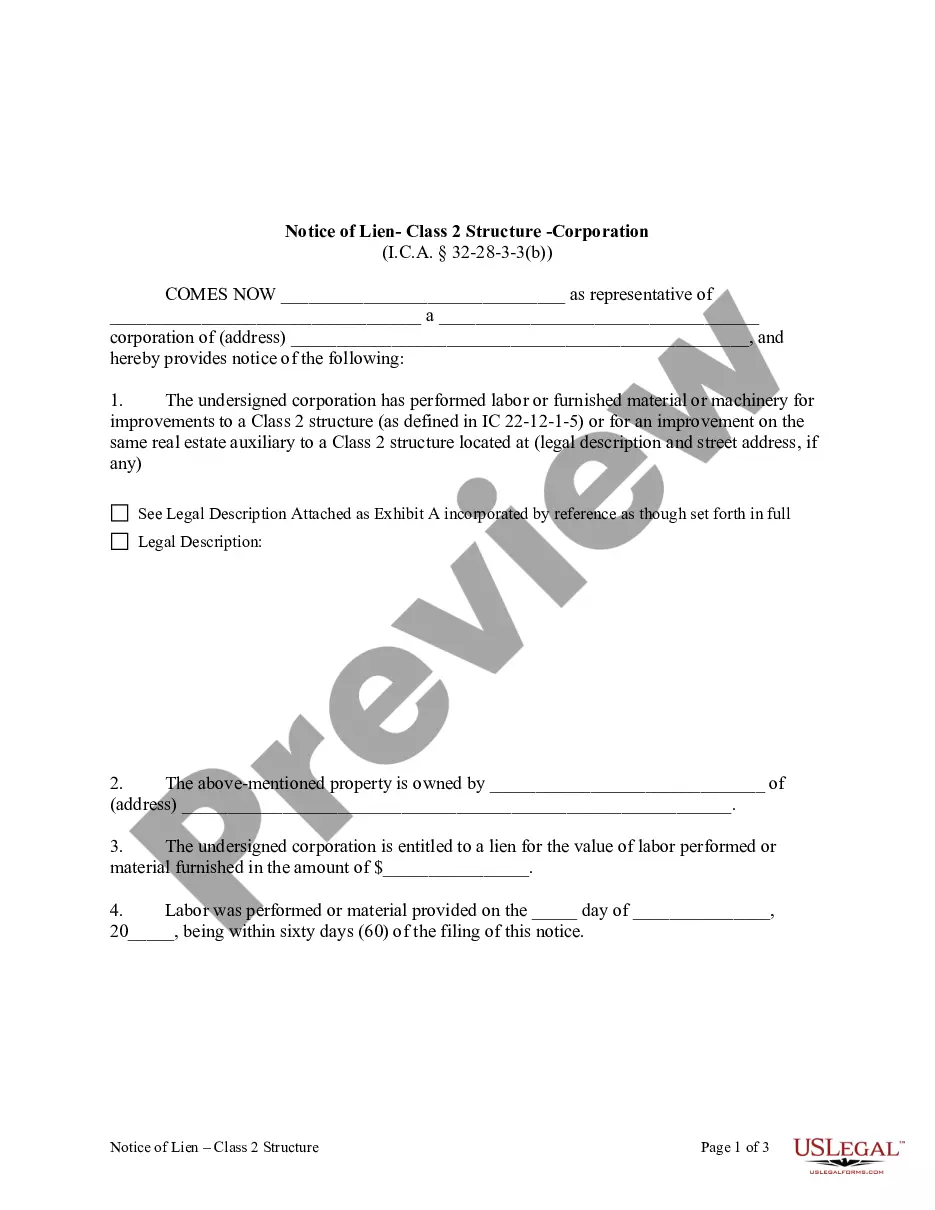

Subscription Agreement Private Equity Fund

Description

How to fill out Maryland Subscription Agreement For An Equity Fund?

You may spend time on the Internet attempting to find the legitimate record web template that fits the state and federal specifications you need. US Legal Forms offers thousands of legitimate forms that are analyzed by pros. It is possible to acquire or print the Maryland Subscription Agreement for an Equity Fund from my support.

If you already possess a US Legal Forms bank account, it is possible to log in and click the Down load option. Following that, it is possible to comprehensive, revise, print, or sign the Maryland Subscription Agreement for an Equity Fund. Every legitimate record web template you buy is yours eternally. To get an additional backup associated with a bought form, visit the My Forms tab and click the corresponding option.

Should you use the US Legal Forms internet site initially, stick to the basic directions below:

- Initial, ensure that you have chosen the best record web template for your area/city that you pick. Browse the form information to ensure you have picked out the proper form. If accessible, use the Review option to search throughout the record web template at the same time.

- If you would like locate an additional edition from the form, use the Lookup industry to obtain the web template that suits you and specifications.

- After you have discovered the web template you would like, simply click Acquire now to proceed.

- Select the pricing program you would like, type in your references, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You may use your credit card or PayPal bank account to purchase the legitimate form.

- Select the file format from the record and acquire it in your gadget.

- Make modifications in your record if possible. You may comprehensive, revise and sign and print Maryland Subscription Agreement for an Equity Fund.

Down load and print thousands of record themes while using US Legal Forms website, which offers the biggest assortment of legitimate forms. Use specialist and state-distinct themes to deal with your organization or specific needs.

Form popularity

FAQ

Business Model Flexibility Contracts have traditionally been the backbone of B2B relationships, providing a rigid structure for the delivery of goods and services. In contrast, subscriptions offer a more flexible and customer-centric approach, enabling businesses to tailor their offerings to better meet client needs.

Subscription Documents mean any subscription agreements (or the equivalent), investor questionnaires, purchase applications, related agreements and similar materials (and any forms, correspondence and other documents ancillary thereto) relating to a Fund's investments in Portfolio Funds.

What is the purpose of a Subscription Agreement? Essentially, the Subscription Agreement ensures the suitability of the investor to invest and acts as a legally binding agreement between the investor and the sponsor.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

While there is no legal requirement to have one, there are many important advantages to consider. A Subscription Agreement ensures that your users are fully informed about what they should (and should not) do when using your service.

It is a legally binding letter needed while issuing shares and normally takes a few minutes to do all the formalities.

When do you need a subscription agreement? Although a subscription agreement isn't mandatory, it is a useful document as it will clearly record the terms on which a person (the subscriber) agrees to purchase shares from the company. It can also be an important document to keep for tax purposes.

Specifically, the ?Subscription Agreement for Future Equity ? Discount only? enables investors to pay in advance the subscription price for company shares/quotas (typically pre-seed and seed funding) with such shares/quotas to be issued by the company receiving the investment at a later date, so that valuation of the ...