Maryland Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

Are you currently inside a place the place you require paperwork for possibly enterprise or person purposes nearly every time? There are tons of authorized file templates available on the net, but locating types you can rely on isn`t simple. US Legal Forms delivers a huge number of kind templates, just like the Maryland Request for Copy of Tax Form or Individual Income Tax Account Information, which can be composed to meet state and federal demands.

If you are presently familiar with US Legal Forms internet site and possess your account, basically log in. Next, you are able to down load the Maryland Request for Copy of Tax Form or Individual Income Tax Account Information template.

Unless you offer an profile and need to start using US Legal Forms, abide by these steps:

- Discover the kind you want and ensure it is for your proper metropolis/state.

- Utilize the Preview option to examine the shape.

- Look at the information to actually have selected the appropriate kind.

- In case the kind isn`t what you`re trying to find, utilize the Search area to get the kind that fits your needs and demands.

- If you obtain the proper kind, click on Get now.

- Pick the prices plan you desire, fill in the desired info to make your bank account, and pay for the transaction with your PayPal or bank card.

- Choose a practical document formatting and down load your duplicate.

Discover each of the file templates you have bought in the My Forms food list. You can get a further duplicate of Maryland Request for Copy of Tax Form or Individual Income Tax Account Information whenever, if necessary. Just click the essential kind to down load or printing the file template.

Use US Legal Forms, the most considerable collection of authorized forms, to conserve some time and prevent faults. The services delivers skillfully created authorized file templates which you can use for an array of purposes. Generate your account on US Legal Forms and begin generating your daily life easier.

Form popularity

FAQ

How to Download ITR-V Acknowledgement? Step 1: Go to the income tax India website at .incometax.gov.in and log in. Step 2: Select the 'e-File'>'Income Tax Returns'>'View Filed Returns' option to see e-filed tax returns. Step 3: To download ITR-V click on the 'Download Form' button of the relevant assessment year.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

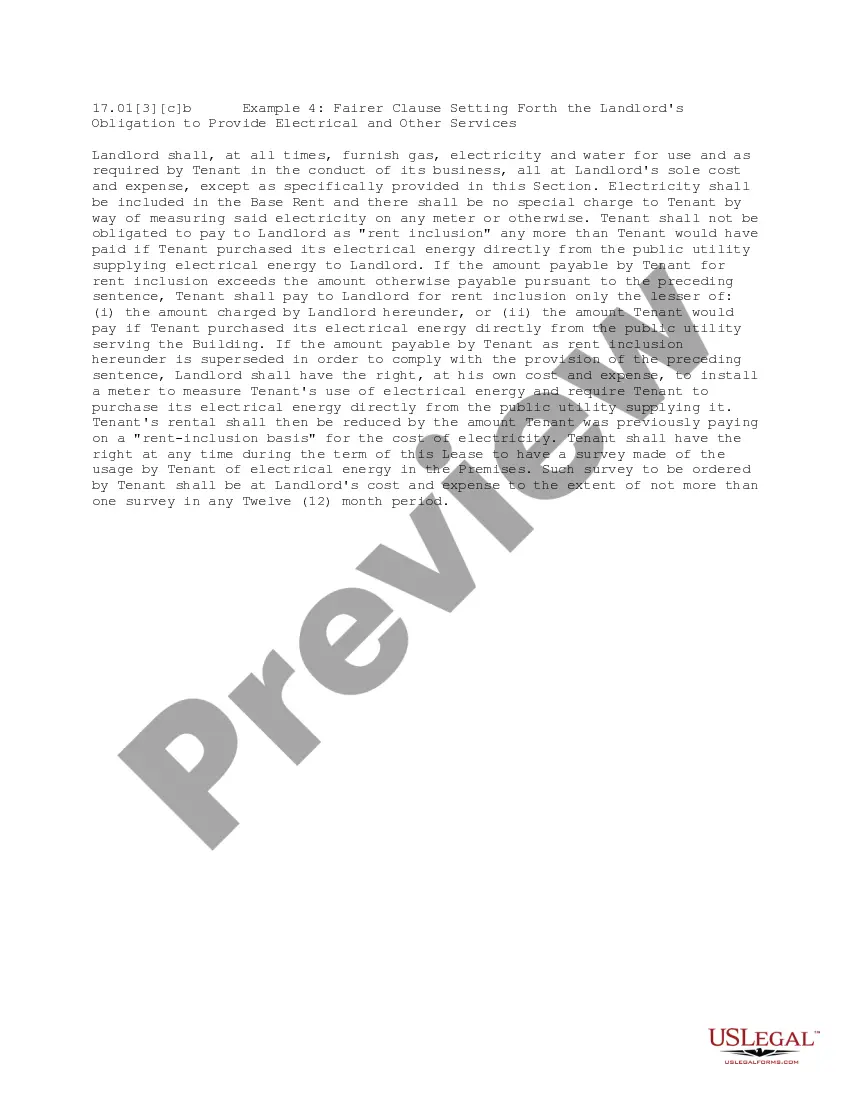

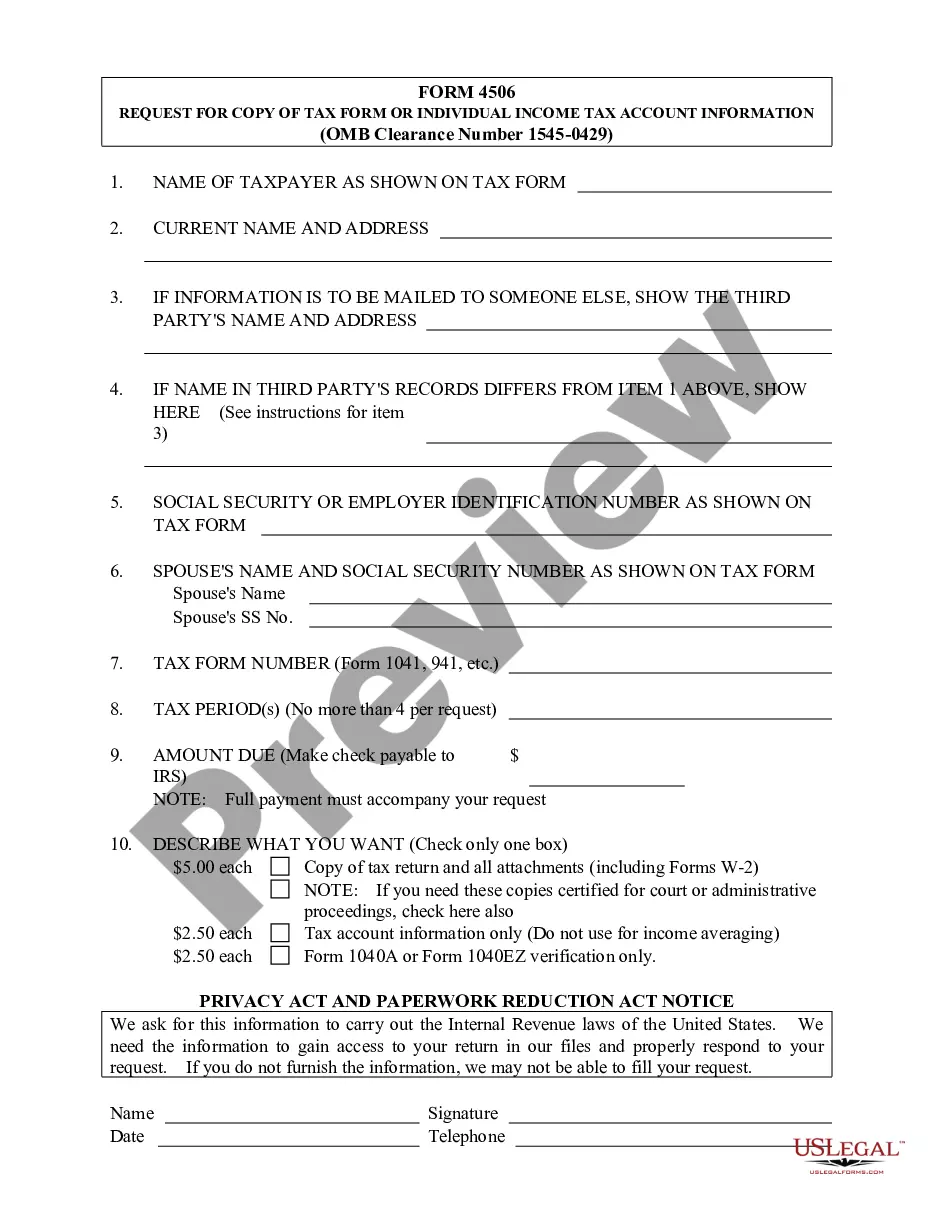

To get a complete copy of a previously filed tax return, along with all attachments (including Form W-2), submit Form 4506, Request for Copy of Tax Return. Refer to the form for instructions and for the processing fee.

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

Use Form 4506 to request a copy of your tax return. You can also designate (on line 5) a third party to receive the tax return.

You can request copies of your IRS tax returns from the most recent seven tax years. To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2023, the IRS charges $43 for each return you request.

We recommend requesting a transcript online since that's the fastest method. If you can't get your transcript online, you can request a tax return or tax account transcript by mail instead.

You can access your tax records through account. If you are the victim of return preparer fraud or misconduct, you will need to demonstrate it to the IRS.