Maryland Permission For Deputy or Agent To Access Safe Deposit Box

Description

How to fill out Maryland Permission For Deputy Or Agent To Access Safe Deposit Box?

Finding the right authorized record template might be a battle. Naturally, there are plenty of themes accessible on the Internet, but how would you get the authorized develop you want? Utilize the US Legal Forms web site. The assistance gives thousands of themes, like the Maryland Permission For Deputy or Agent To Access Safe Deposit Box, which you can use for company and private needs. All the types are inspected by pros and meet up with state and federal requirements.

Should you be previously authorized, log in to the bank account and click on the Acquire option to obtain the Maryland Permission For Deputy or Agent To Access Safe Deposit Box. Use your bank account to appear through the authorized types you might have bought formerly. Check out the My Forms tab of the bank account and acquire an additional backup of the record you want.

Should you be a fresh customer of US Legal Forms, allow me to share simple recommendations that you should follow:

- First, be sure you have chosen the proper develop to your metropolis/region. You can look through the form using the Preview option and browse the form description to make certain this is basically the best for you.

- When the develop is not going to meet up with your expectations, take advantage of the Seach area to find the appropriate develop.

- When you are certain the form is proper, select the Acquire now option to obtain the develop.

- Pick the costs prepare you would like and type in the necessary information and facts. Build your bank account and purchase an order using your PayPal bank account or Visa or Mastercard.

- Select the data file structure and obtain the authorized record template to the product.

- Complete, edit and produce and signal the acquired Maryland Permission For Deputy or Agent To Access Safe Deposit Box.

US Legal Forms may be the biggest collection of authorized types in which you will find various record themes. Utilize the company to obtain professionally-produced files that follow condition requirements.

Form popularity

FAQ

Dual control: Two peopleusually a bank employee and the renterare required to open the box. In this way, no one person can ever open the box and remove the contents. Authorized signature: When the safe deposit account is opened, all persons authorized to access the box sign a signature card.

You'd think that an executor, spouse, family member of the deceased, or anyone with a key can walk into the bank and open a safe deposit box. But, that's not the way it works. In most states, safe deposit boxes are sealed and cannot be accessed when the original renter passes away.

Every bank branch requires a signed signature card for each person (regardless of whether or not they have an account with the branch) who wants access to your safe deposit box. The people who attempt to access your box must sign their name before they enter the bank vault.

Every bank branch requires a signed signature card for each person (regardless of whether or not they have an account with the branch) who wants access to your safe deposit box. The people who attempt to access your box must sign their name before they enter the bank vault.

Concerned About Theft by Bank Employees Its contents are guarded by the bank with a "triple-redundant" security system. First, the safe deposit box is in a secure area, in the bank vault. Bank customers are not allowed open access to this area. You must sign in with bank security staff to enter the vault.

Cash. You may wonder if it's OK to put cash in a safe deposit box. Experts warn there are several reasons you shouldn't stash cash in a safe deposit box: If you need the money in an emergency, but the bank is closed, you're out of luck.

For example, if an individual brings in 50 prepaid debit cards and wishes to store them in a safety deposit box, the bank will typically require to know the amount stored on the prepaid debit cards, and may deny the application for the safety deposit box based on the liability if the amount is significant.

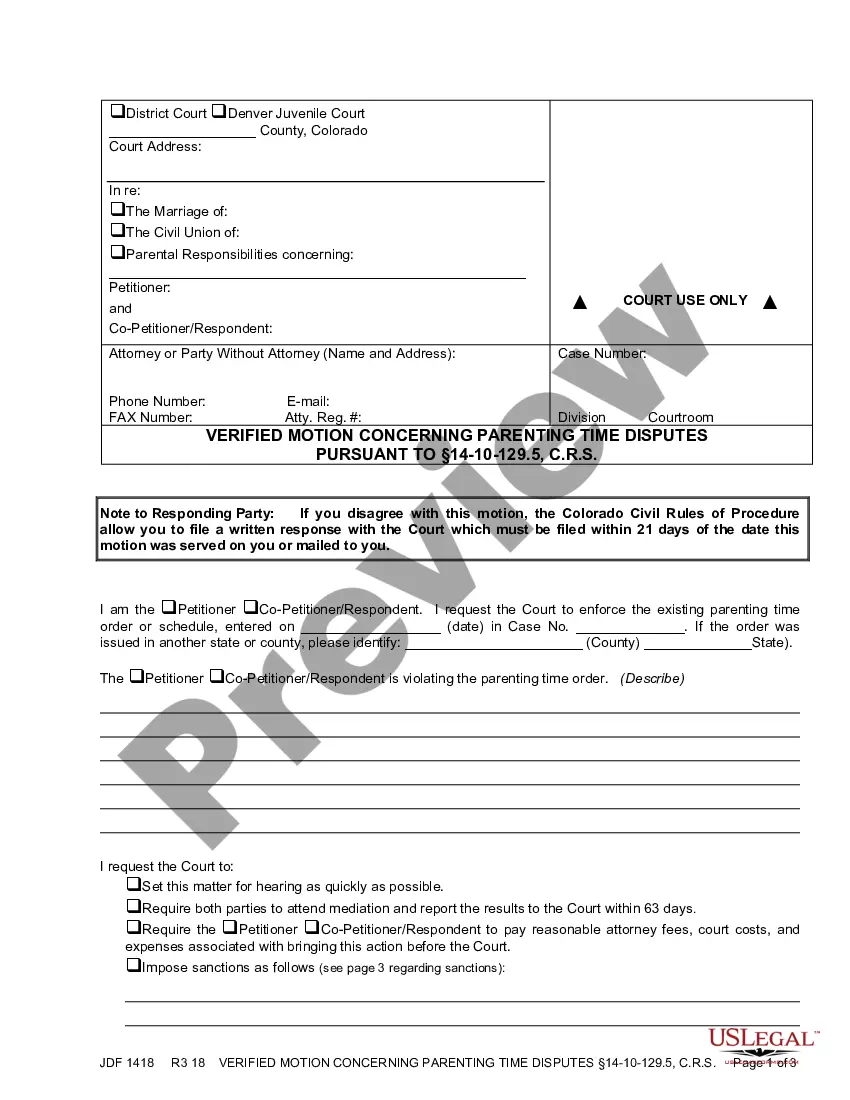

You can appoint a deputy or agent who can have access to your box however, this appointment must occur in the presence of a bank employee. The reason being a deputy or agent role, much like a Power of Attorney, can be granted or revoked at any time, and this role is automatically terminated if you die.

Come to the bank with your safe deposit box key. You will need to sign an admission slip to get access to the Safe Deposit area of the vault. A Safe Deposit Area attendant will take you to the vault. With the bank's Guard Key and your key, open your Safe Deposit Box slot.