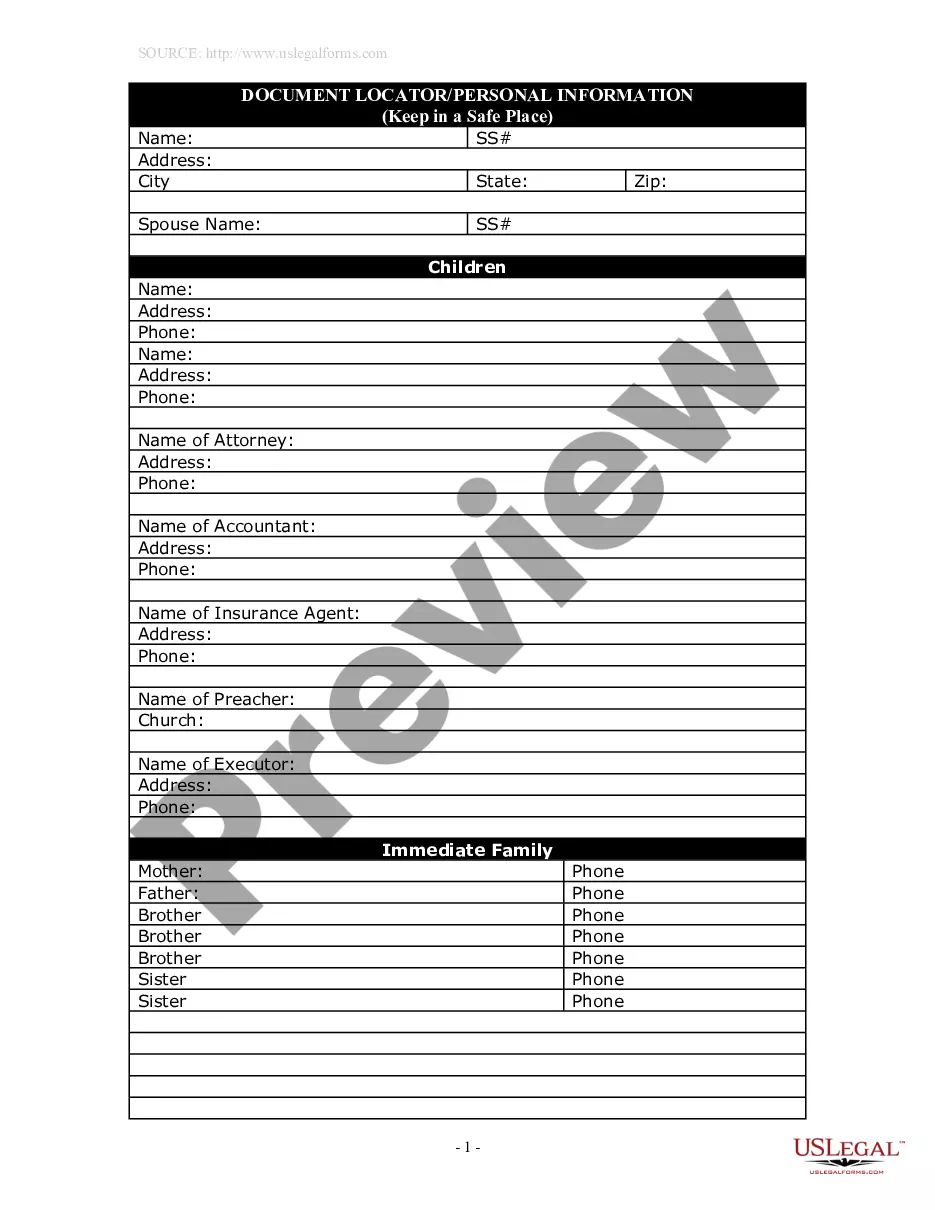

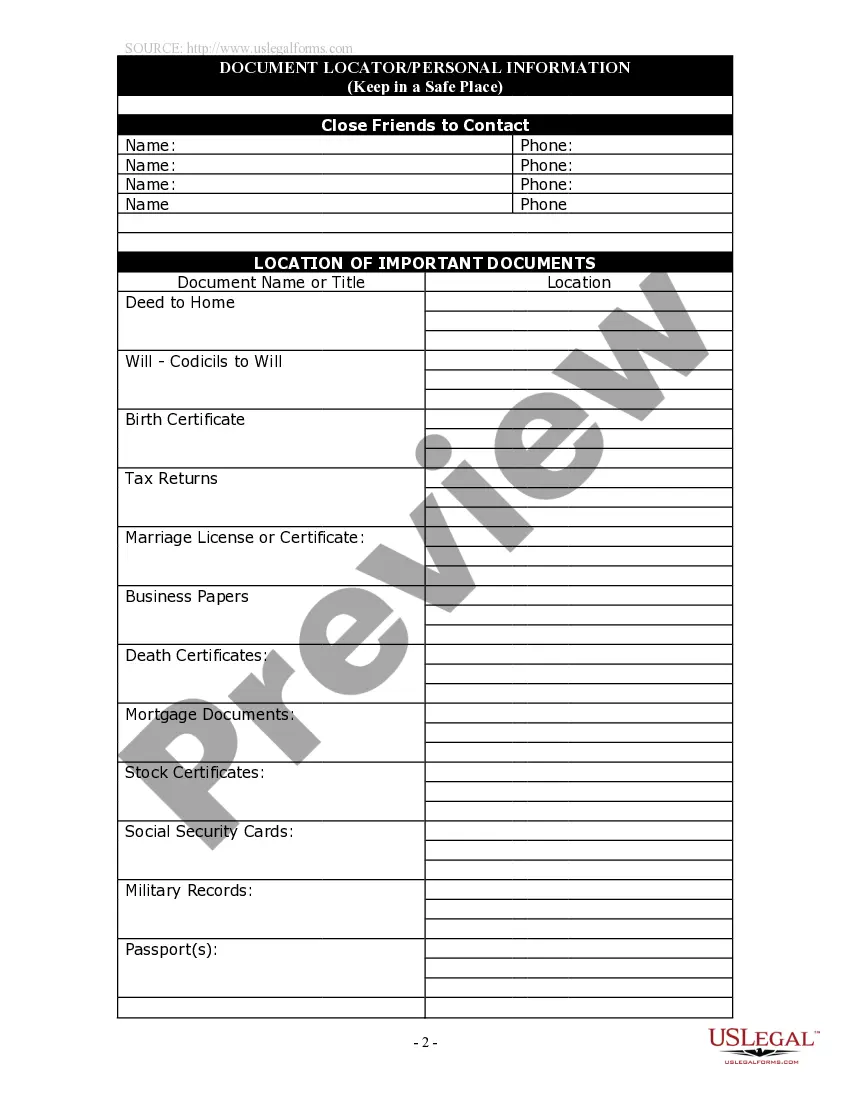

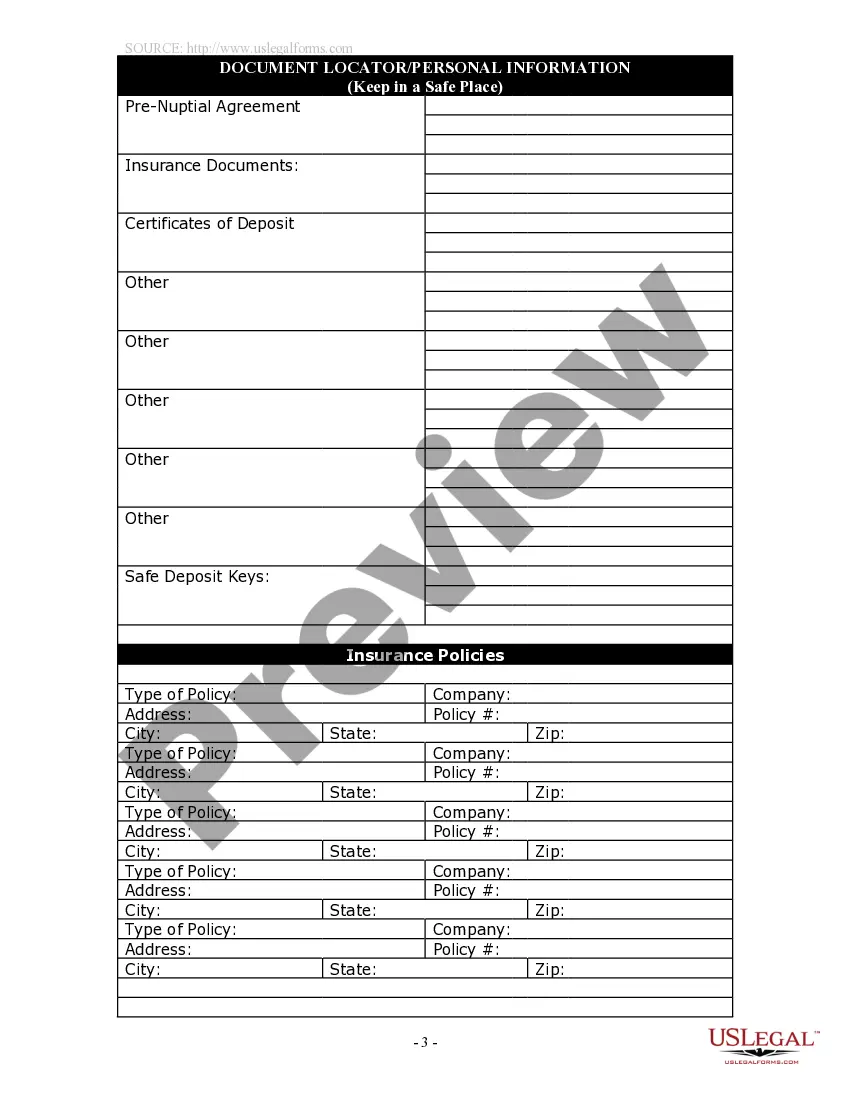

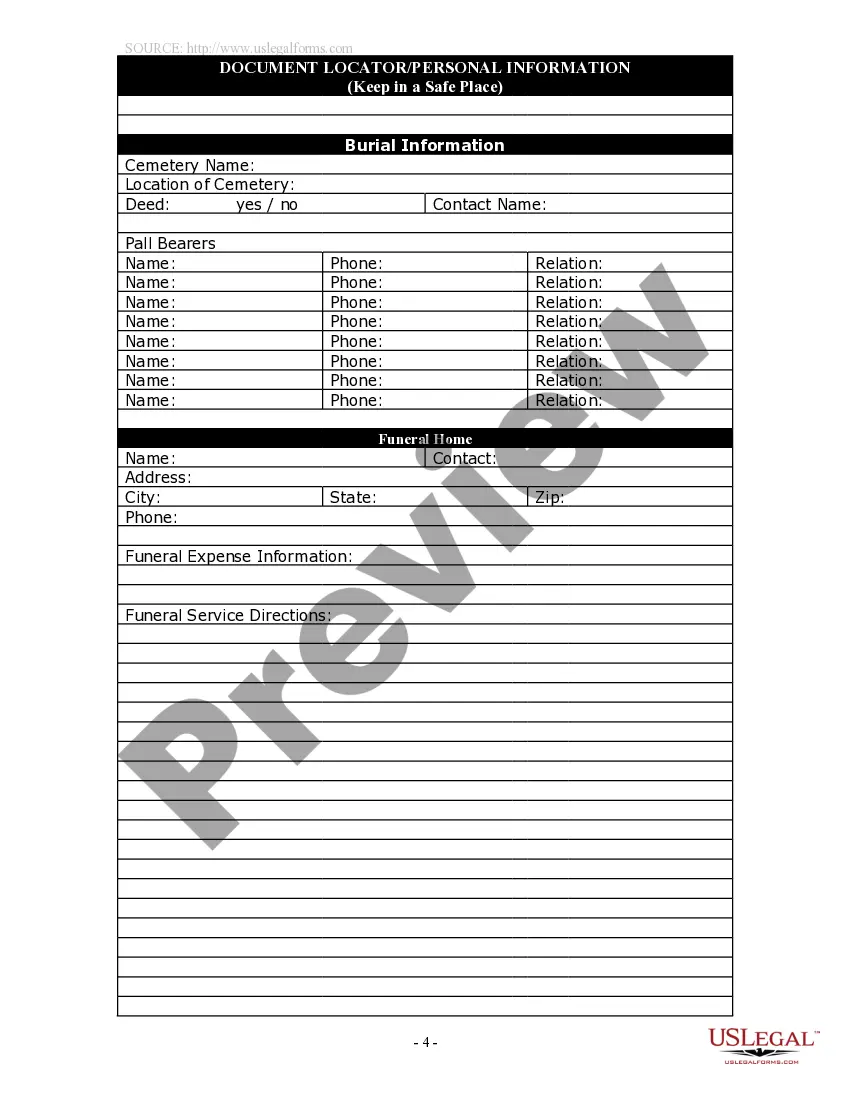

Maryland Document Locator and Personal Information Package including burial information form

Description

How to fill out Maryland Document Locator And Personal Information Package Including Burial Information Form?

You are invited to the largest legal document repository, US Legal Forms.

Here you can locate any example such as Maryland Document Locator and Personal Information Package including burial information form documents and save them (as many as you need).

Prepare official documents in a few hours, instead of days or weeks, without spending a fortune on a lawyer or attorney.

Once you've completed the Maryland Document Locator and Personal Information Package including burial information form, submit it to your attorney for confirmation. It’s an additional step but necessary for ensuring you’re completely protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- Obtain your state-specific template in just a few clicks and feel assured knowing it was created by our experienced attorneys.

- If you’re already a registered user, just sign in to your account and click Download next to the Maryland Document Locator and Personal Information Package including burial information form you need.

- Since US Legal Forms is an online service, you’ll always have access to your saved forms, no matter what device you are using.

- Find them in the My documents section.

- If you haven't created an account yet, what are you waiting for.

- Follow our instructions below to get started.

- If this is a state-specific document, verify its legality in your residing state.

- Review the description (if available) to determine if it’s the correct template.

Form popularity

FAQ

You may download it for free at: http://www.adobe.com/go/getreader/ . If you need further assistance, you may contact Taxpayer Service at 410-260-7980 from Central Maryland or at 1-800-MD-TAXES from elsewhere.

You may download it for free at: http://www.adobe.com/go/getreader/ . If you need further assistance, you may contact Taxpayer Service at 410-260-7980 from Central Maryland or at 1-800-MD-TAXES from elsewhere.

The Form PV is a payment voucher you will send with your check. or money order for any balance due in the Total Amount Due line of your Forms 502 and 505, Estimated Tax Payments and Extension Payments.

502. 2018. Pass-Through Entity Return of Income and Return of Nonresident Withholding Tax.

Single filers whose gross income meets or exceeds $10,150 and married taxpayers filing jointly with gross income at or above $20,300 are required to file Maryland tax returns.

During the tax filing season, many libraries and post offices offer free tax forms to taxpayers. Some libraries also have copies of commonly requested publications. Many large grocery stores, copy centers and office supply stores have forms you can photocopy or print from a CD.

Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

To access online forms, select "Individuals" at the top of the IRS website and then the "Forms and Publications" link located on the left hand side of the page. You will then see a list of printable forms, including the 1040, 1040-EZ, 4868 form for an extension of time and Schedule A for itemized deductions.