This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new corporation. The form contains basic information concerning the corporation, normally including the corporate name, number of shares to be issued, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

Maine Articles of Incorporation for Domestic For-Profit Corporation

Description

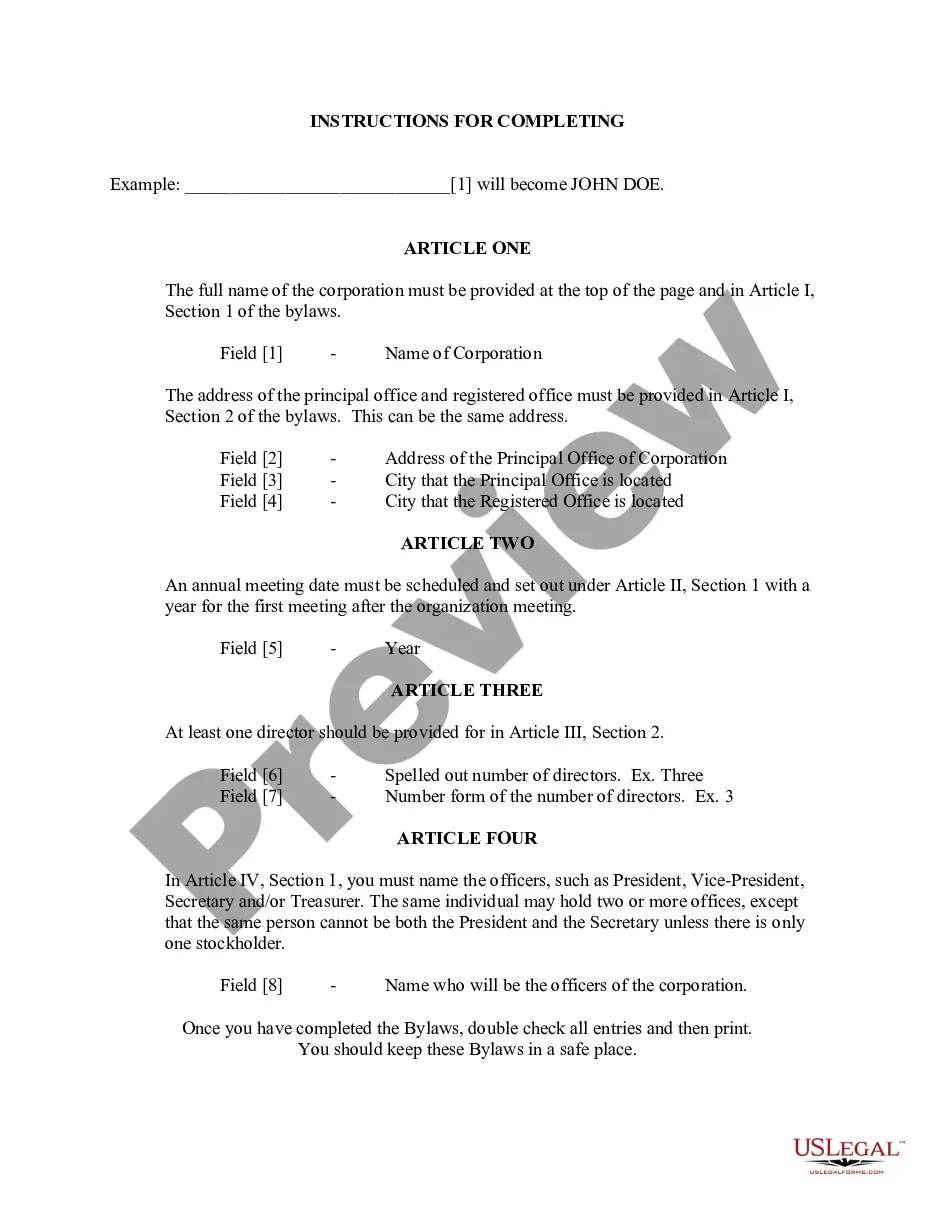

How to fill out Maine Articles Of Incorporation For Domestic For-Profit Corporation?

You are welcome to the greatest legal documents library, US Legal Forms. Here you can get any example such as Maine Articles of Incorporation for Domestic For-Profit Corporation forms and download them (as many of them as you want/require). Prepare official papers within a couple of hours, rather than days or even weeks, without spending an arm and a leg on an lawyer. Get your state-specific example in a couple of clicks and feel assured knowing that it was drafted by our qualified lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maine Articles of Incorporation for Domestic For-Profit Corporation you require. Because US Legal Forms is web-based, you’ll always have access to your downloaded templates, no matter the device you’re using. Locate them within the My Forms tab.

If you don't come with an account yet, what exactly are you waiting for? Check out our guidelines listed below to get started:

- If this is a state-specific sample, check its applicability in your state.

- View the description (if readily available) to learn if it’s the correct example.

- See more content with the Preview function.

- If the sample meets all of your needs, just click Buy Now.

- To create your account, pick a pricing plan.

- Use a credit card or PayPal account to register.

- Save the template in the format you require (Word or PDF).

- Print the document and fill it with your/your business’s information.

Once you’ve filled out the Maine Articles of Incorporation for Domestic For-Profit Corporation, send out it to your lawyer for verification. It’s an extra step but an essential one for making certain you’re totally covered. Sign up for US Legal Forms now and get access to a mass amount of reusable samples.

Form popularity

FAQ

If you've incorporated as a business As an LLC, LLP, S-Corp or C-Corp, you must file an annual report, normally with your state's Secretary of State. This applies no matter how big or small your business is. Typically, sole proprietors and partnerships do not have to file an annual report.

How much does it cost to form an LLC in Maine? The Maine Secretary of State charges a $175 fee to file the Certificate of Formation. You can reserve your LLC name with the Maine Secretary of State for $20.

Every LLC that is doing business or organized in California must pay an annual tax of $800. This yearly tax will be due, even if you are not conducting business, until you cancel your LLC. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

LLC Taxes in CaliforniaCalifornia LLCs must pay an annual $800 LLC tax. California LLC taxes are due by April 15th, just like federal taxes, and should be paid to the California Franchise Tax Board. You must pay this tax even if your LLC doesn't earn any income.

In most states, you will have to renew the LLC and file an annual report. The state fees to renew an LLC range from $0 to $500 annually.

Annual reports became a regulatory requirement for public companies following the stock market crash of 1929, when lawmakers mandated standardized corporate financial reporting. The intent of the required annual report is to provide public disclosure of a company's operating and financial activities over the past year.

As a side note, if you forget to renew the LLC, the company will generally be listed as inactive or administratively dissolved on the public record. If this is the case, don't panic; it just means the State hasplaced the LLC on the inactive list because of non-payment of fees.

A limited liability company (LLC) is a popular business form for small businesses because it protects their owners, called members, from personal liability.Once formed, the company generally exists indefinitely and can operate for as long as desired. When the owners want to close the business, they must dissolve it.

An LLC must have at least one member. The operating agreement for a single-member LLC will be simple. One member has all of the benefits and burdens of ownership and controls all decisions.