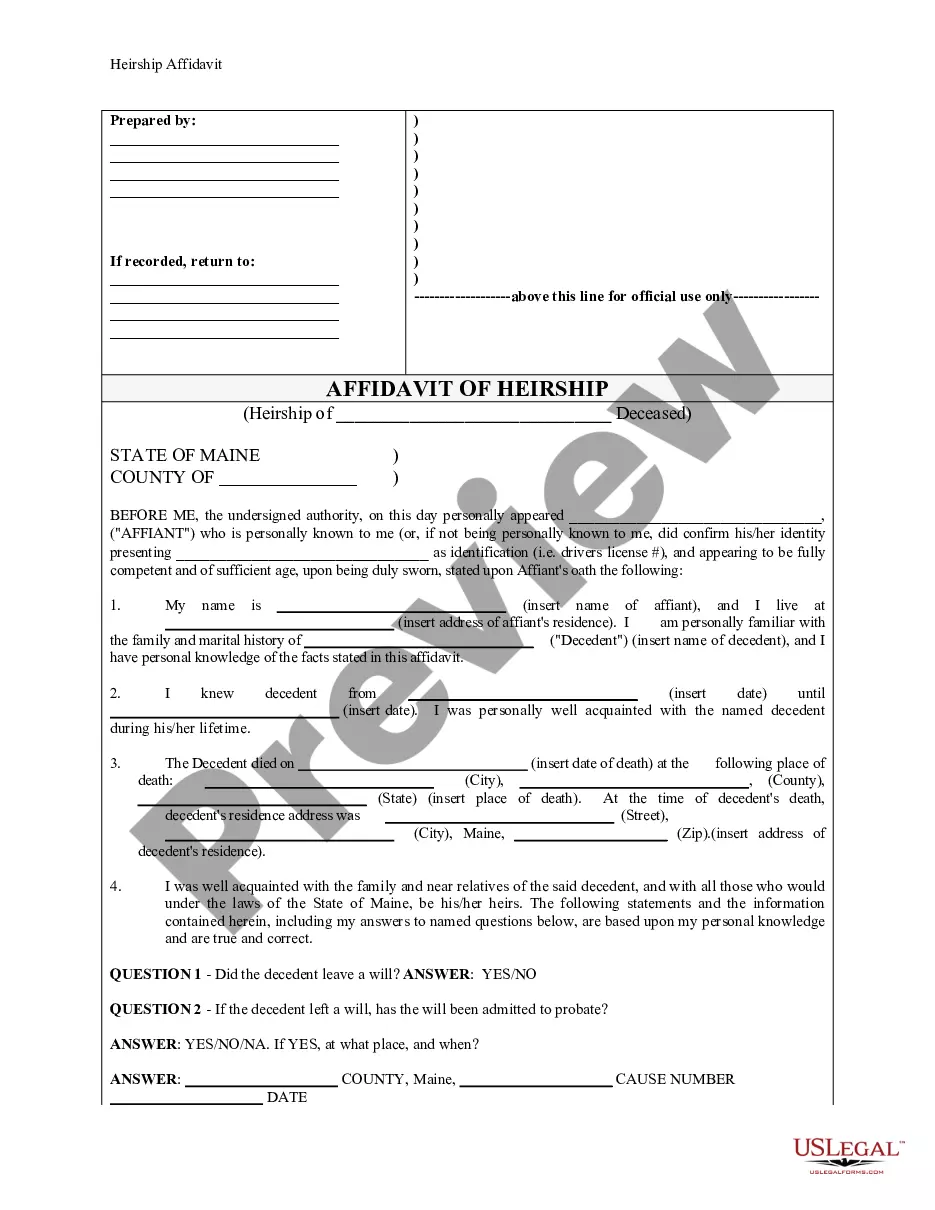

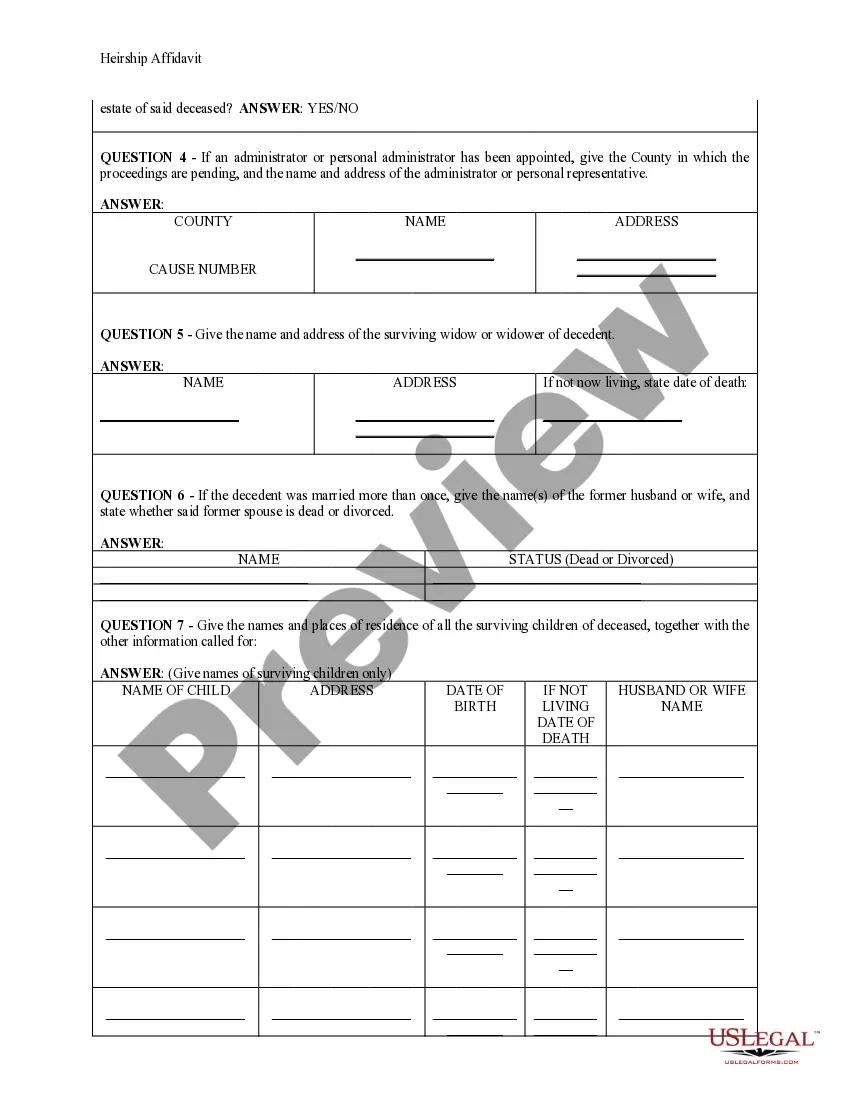

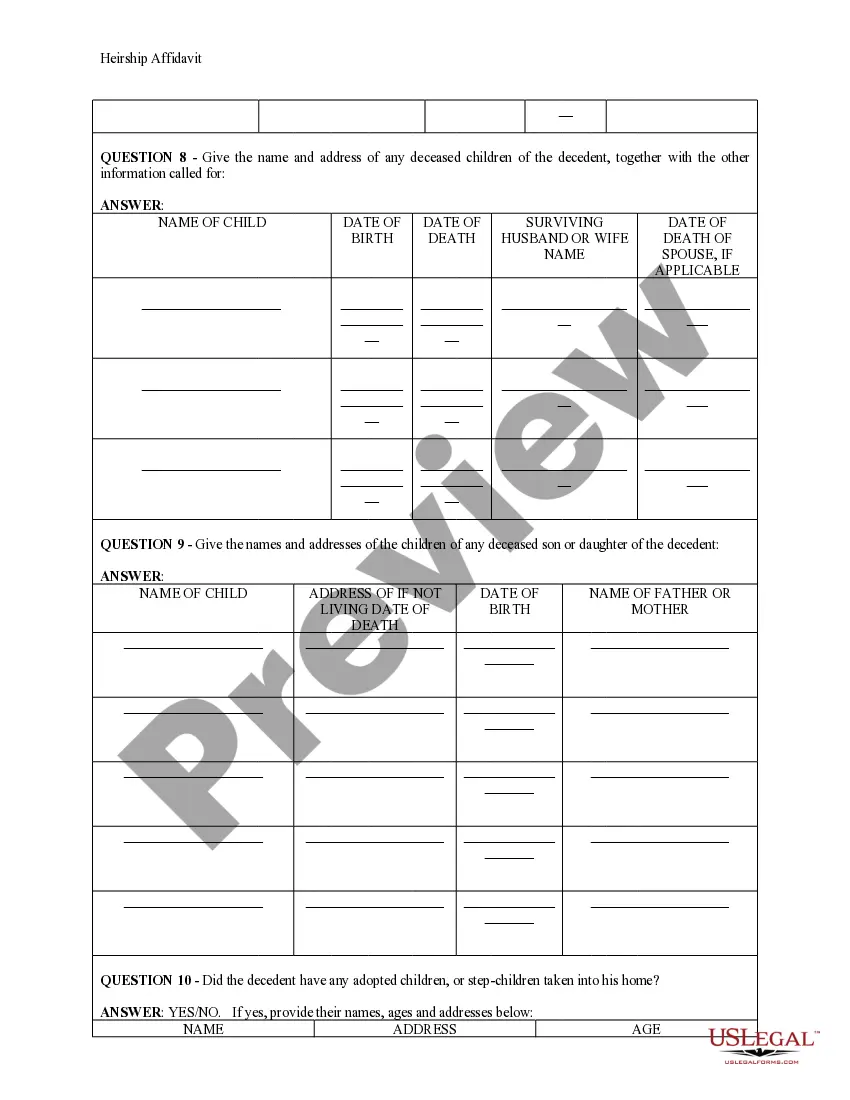

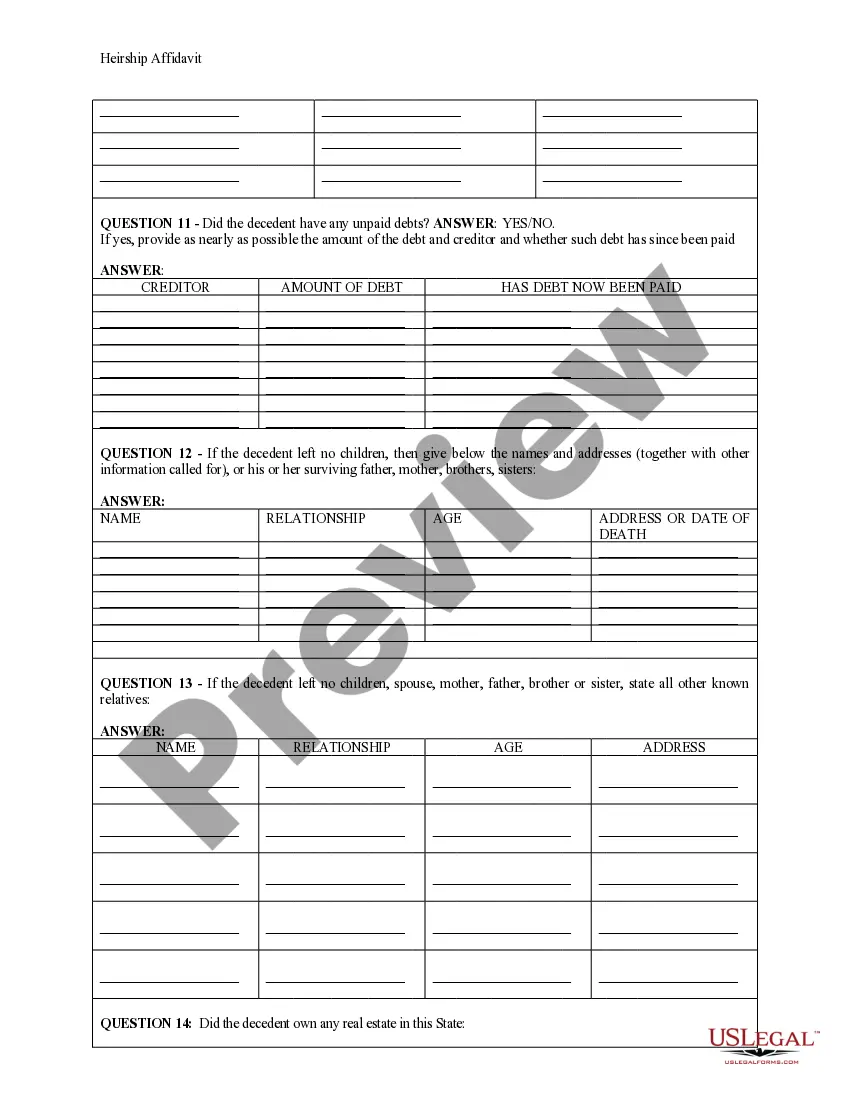

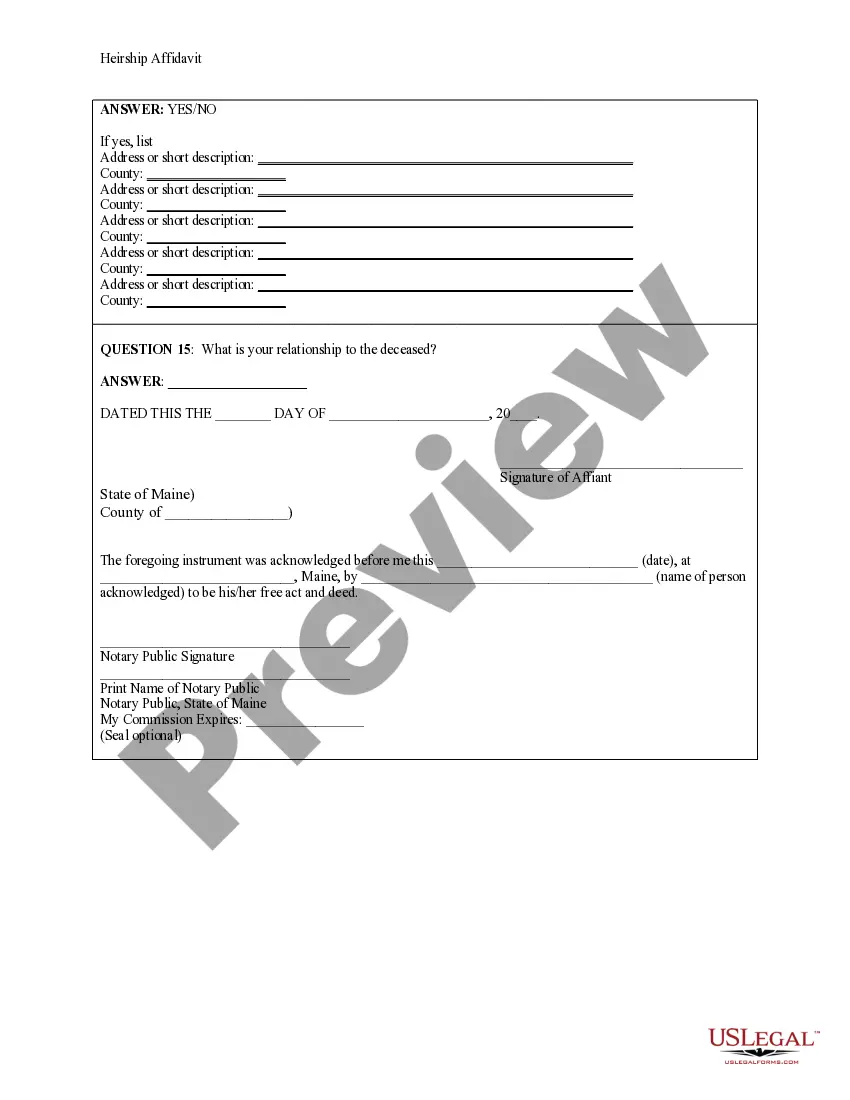

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heirship affidvait to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Maine Heirship Affidavit - Descent

Description

How to fill out Maine Heirship Affidavit - Descent?

You are welcome to the biggest legal files library, US Legal Forms. Right here you can find any sample including Maine Heirship Affidavit - Descent templates and save them (as many of them as you want/need to have). Get ready official documents with a few hours, rather than days or even weeks, without spending an arm and a leg with an lawyer or attorney. Get the state-specific form in a couple of clicks and be confident knowing that it was drafted by our state-certified attorneys.

If you’re already a subscribed consumer, just log in to your account and click Download near the Maine Heirship Affidavit - Descent you require. Because US Legal Forms is web-based, you’ll generally get access to your saved files, no matter the device you’re using. Find them within the My Forms tab.

If you don't have an account yet, what exactly are you waiting for? Check out our instructions below to begin:

- If this is a state-specific sample, check out its validity in your state.

- See the description (if offered) to learn if it’s the correct template.

- See a lot more content with the Preview feature.

- If the sample fulfills all of your needs, just click Buy Now.

- To make your account, pick a pricing plan.

- Use a credit card or PayPal account to sign up.

- Save the template in the format you want (Word or PDF).

- Print out the document and fill it out with your/your business’s info.

As soon as you’ve completed the Maine Heirship Affidavit - Descent, send it to your attorney for confirmation. It’s an additional step but an essential one for making certain you’re fully covered. Become a member of US Legal Forms now and get access to a mass amount of reusable examples.

Form popularity

FAQ

1. This form should be completed by someone other than an Heir. This person should be someone who is familiar with the family history of the deceased (decedent), and who will obtain no benefit from the Estate. The person who fills out the form is referred to as the AFFIANT.

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

An affidavit of heirship should be signed by two disinterested witnesses. To qualify as a disinterested witness, one must be knowledgeable about the deceased and his or her family history, but cannot benefit financially from the estate.

A fee of $15 for the first page and $4 for each additional page is common. Ask if you can file the two affidavits of heirship as one document. Some counties let you file the two affidavits of heirship as one document if the decedent and property descriptions are the same.

An affidavit of heirship must be filed with the real property records in the county where the land is located. Call the county clerk and ask how much their filing fees are. The filing fees vary from county to county.

Harris County Civil Courthouse. 201 Caroline, Suite 800. (713) 274-8585.

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

When a person who owns real property dies intestate, and there is no survivor mentioned in the deed, the heirs of the decedent, must file an affidavit of descent to establish their chain of title to the property. This affidavit, is known as an affidavit of descent.