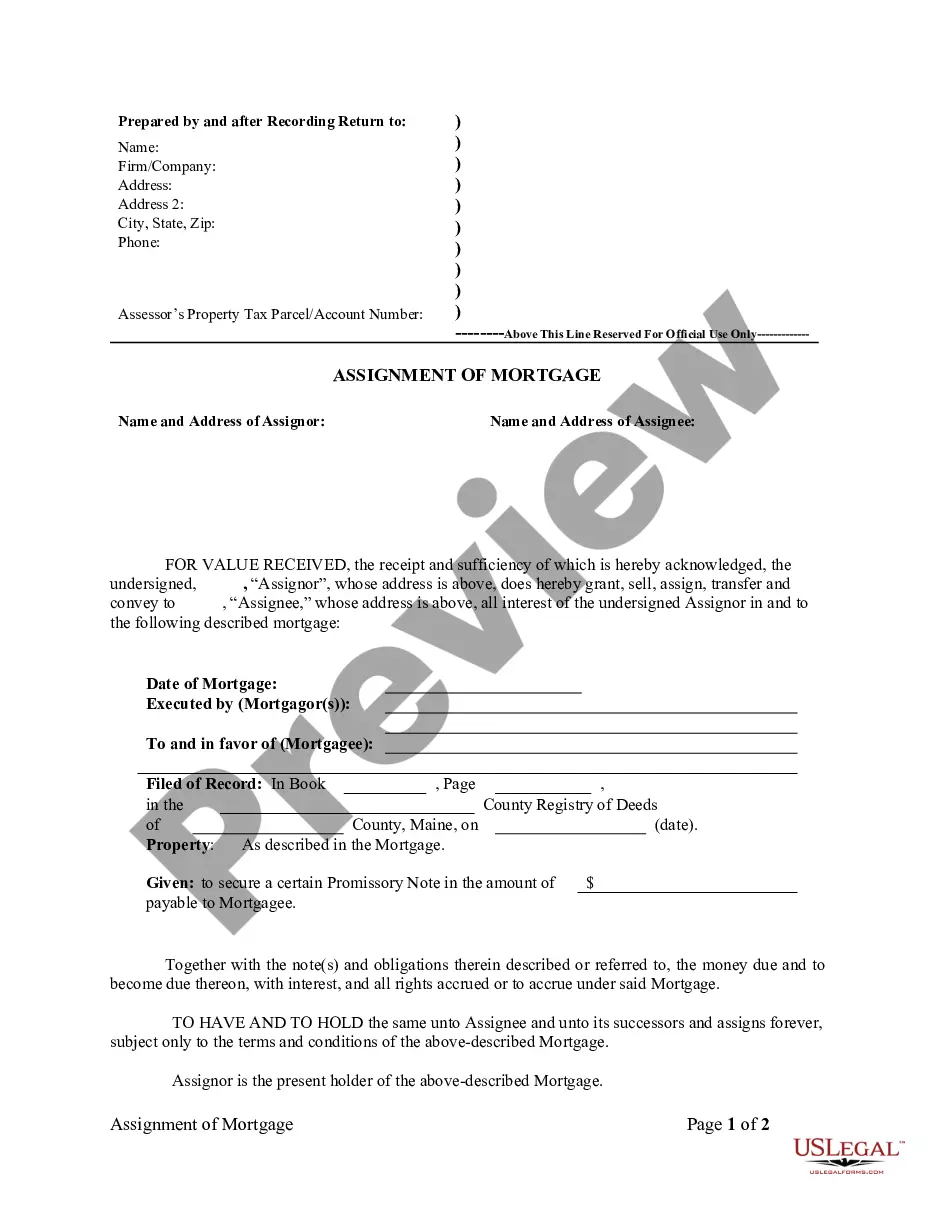

Assignment of Mortgage by Corporate Mortgage Holder

Assignments Generally: Lenders, or holders

of mortgages or deeds of trust, often assign mortgages or deeds of trust

to other lenders, or third parties. When this is done the assignee

(person who received the assignment) steps into the place of the original

lender or assignor. To effectuate an assignment, the general rules

is that the assignment must be in proper written format and recorded to

provide notice of the assignment.

Satisfactions Generally: Once a mortgage

or deed of trust is paid, the holder of the mortgage is required to satisfy

the mortgage or deed of trust of record to show that the mortgage or deed

of trust is no longer a lien on the property. The general rule is that

the satisfaction must be in proper written format and recorded to provide

notice of the satisfaction. If the lender fails to record a satisfaction

within set time limits, the lender may be responsible for damages set by

statute for failure to timely cancel the lien. Depending on your state,

a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance.

Some states still recognize marginal satisfaction but this is slowly being

phased out. A marginal satisfaction is where the holder of the mortgage

physically goes to the recording office and enters a satisfaction on the

face of the the recorded mortgage, which is attested by the clerk.

Maine Law

Execution of Assignment or Satisfaction: Must

be signed by the mortgagee.

Assignment: An assignment must be in writing

and recorded.

Demand to Satisfy: None required. Mortgagee

has 60 days from payoff of mortgage to record satisfaction or else suffer

liability.

Recording Satisfaction: A mortgage only

may be discharged by a written instrument acknowledging the satisfaction

thereof and signed and acknowledged by the mortgagee or by the mortgagee's

duly authorized officer or agent, personal representative or assignee.

Marginal Satisfaction: Not allowed. Satisfaction

must be by separate written instrument.

Penalty: If a satisfied mortgage is not

recorded as such by mortgagee within 60 days following satisfaction thereof,

mortgagee becomes liable to aggreived parties for damages equal to exemplary

damages of $200 per week after expiration of the 60 days, up to an aggregate

maximum of $5,000 for all aggrieved parties or the actual loss sustained

by the aggrieved party, whichever is greater, and attorney fees.

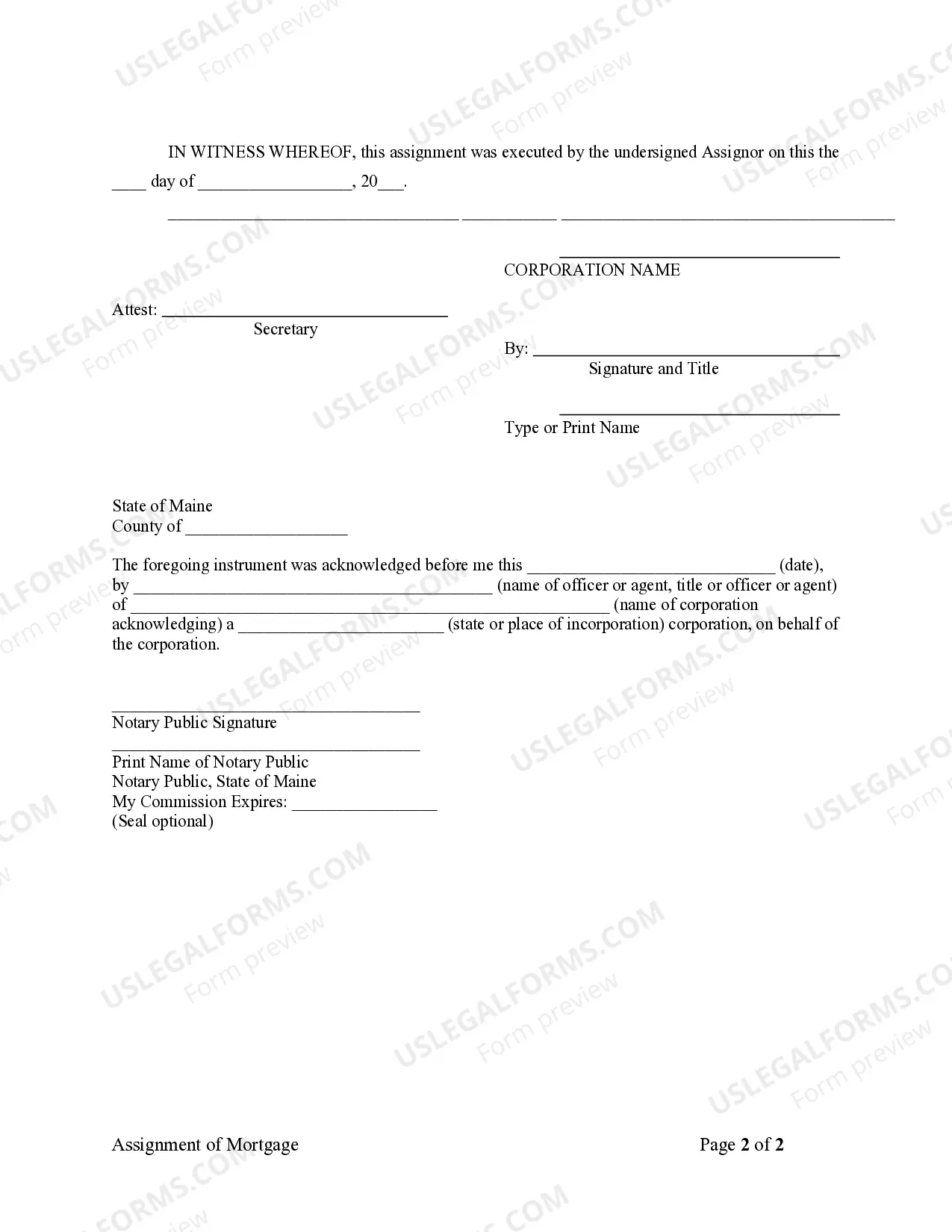

Acknowledgment: An assignment or satisfaction

must contain a proper Maine acknowledgment, or other acknowledgment approved

by Statute.

Maine Statutes

§ 551. Entry on record; neglect to discharge

A mortgage only may be discharged by a written instrument acknowledging

the satisfaction thereof and signed and acknowledged by the mortgagee

or by the mortgagee's duly authorized officer or agent, personal representative

or assignee. The instrument must recite the name or identity of the

mortgagee and mortgagor, or their successors in interest and the record

location of the mortgage discharged. The instrument, when recorded,

has the same effect as a deed of release duly acknowledged and recorded.

Within 60 days after full performance of the conditions of the

mortgage, the mortgagee shall record a valid and complete release of mortgage

together with any instrument of assignment necessary to establish the mortgagee's

record ownership of the mortgage. As used in this paragraph, the term

"mortgagee" means both the owner of the mortgage at the time it is satisfied

and any servicer who receives the final payment satisfying the debt. If

a release is not transmitted to the registry of deeds within 60 days, the

owner and any such servicer are jointly and severally liable to an aggrieved

party for damages equal to exemplary damages of $200 per week after expiration

of the 60 days, up to an aggregate maximum of $5,000 for all aggrieved

parties or the actual loss sustained by the aggrieved party, whichever

is greater. If multiple aggrieved parties seek exemplary damages, the

court shall equitably allocate the maximum amount. The mortgagee is also

liable for court costs and reasonable attorney's fees in any successful

action to enforce the liability. The mortgagee may charge the mortgagor

for any recording fees incurred in recording the release of mortgage.

With respect to a mortgage securing an open-end line of credit,

the 60-day period to deliver a release commences after the mortgagor delivers

to the address designated for payments under the line of credit a written

request to terminate the line and the mortgage together with payment in

full of all amounts secured by the mortgage. The mortgagee may designate

in writing a different address for delivery of written notices under this

paragraph.

All discharges of recorded mortgages, attachments or liens of

any nature must be recorded by a written instrument, and except for

termination statements filed pursuant to Title 11, section 9-404, acknowledged

in same manner as other instruments presented for record and no such discharges

may be permitted by entry in the margin of the instrument to be discharged.

All discharges of recorded mortgages, attachments or liens of any

nature must be recorded by a written instrument and, except for termination

statements filed pursuant to Title 11, section 9-1513, acknowledged in

same manner as other instruments presented for record and no such discharges

may be permitted by entry in the margin of the instrument to be discharged.

§ 552. Validation

All marginal discharges of mortgages recorded prior to April 1,

1974, duly attested by the register of deeds as being recorded from discharge

in margin of original mortgage, are validated and have the same effect

as if made as provided in section 551.

§ 553-A. Discharge by attorney

1. Affidavit. A recorded mortgage on a residential owner-occupied

one-to-4-family dwelling may be discharged in the office of the registry

of deeds by an attorney-at-law licensed to practice in the State if the

mortgagee, after receipt of payment of the mortgage in accordance with

the payoff statement furnished to the mortgagor by the mortgagee, fails

to make that discharge or to execute and acknowledge a deed of release

of the mortgage. The attorney shall execute and record an affidavit in

the registry of deeds affirming that.

A. The affiant is an attorney-at-law in good standing and licensed

to practice in the State;

B. The affidavit is made at the request of the mortgagor or the

mortgagor's executor, administrator, successor, assignee or transferee

or the transferee's mortgagee;

C. The mortgagee has provided a payoff statement with respect to

the loan secured by the mortgage;

D. The mortgagee has received payment that has been proved by a

bank check, certified check or attorney client funds account check negotiated

by the mortgagee or by evidence of receipt of payment by the mortgagee;

E. More than 30 days have elapsed since the payment was received

by the mortgagee; and

F. The mortgagee has received written notification by certified

mail 15 days in advance, sent to the mortgagee's last known address,that

the affiant intends to execute and record an affidavit in accordance with

this section, enclosing a copy of the proposed affidavit; the mortgagee

has not delivered a discharge or deed of release in response to the notification;

and the mortgagor has complied with any request made by the mortgagee for

additional payment at least 15 days before the date of the affidavit.

2. Name; address; mortgagee; mortgagor. The affidavit must include

the names and addresses of the mortgagor and the mortgagee, the date of

the mortgage, the title reference and similar information with respect

to recorded assignment of the mortgage.

3. Copy. The affiant shall attach to the affidavit the following,

certifying that each copy is a true copy of the original document:

A. Photostatic copies of the documentary evidence that payment has

been received by the mortgagee, including the mortgagee's endorsement of

a bank check, certified check or attorney client funds account check; and

B. A photostatic copy of the payoff statement if that statement

is made in writing.

4. Effect. An affidavit recorded under this section has the same

effect as a recorded discharge.

5. Exception. A mortgage may not be discharged as provided by this

section if the holder of the mortgage at the time a discharge is sought

is a financial institution or credit union authorized to do business in

the State as defined in Title 9-B, section 131, subsection 12-A or 17-A.