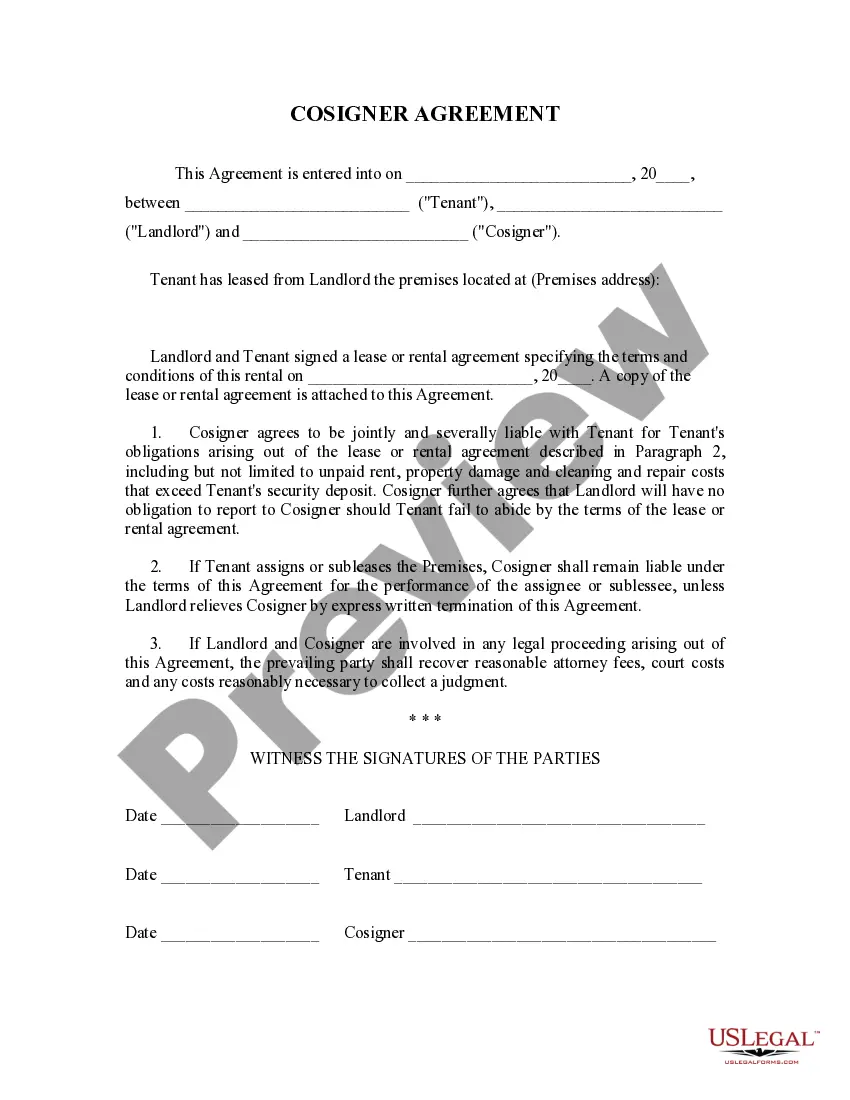

The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Maine Landlord Tenant Lease Co-Signer Agreement

Description

How to fill out Maine Landlord Tenant Lease Co-Signer Agreement?

Welcome to the biggest legal documents library, US Legal Forms. Here you will find any sample such as Maine Landlord Tenant Lease Co-Signer Agreement forms and download them (as many of them as you want/need). Make official files in a couple of hours, instead of days or weeks, without having to spend an arm and a leg with an legal professional. Get the state-specific example in a few clicks and feel confident understanding that it was drafted by our accredited legal professionals.

If you’re already a subscribed consumer, just log in to your account and click Download near the Maine Landlord Tenant Lease Co-Signer Agreement you require. Due to the fact US Legal Forms is web-based, you’ll generally have access to your downloaded forms, no matter the device you’re utilizing. Find them inside the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check our guidelines listed below to get started:

- If this is a state-specific document, check its applicability in your state.

- See the description (if offered) to learn if it’s the proper template.

- See much more content with the Preview feature.

- If the document matches your requirements, click Buy Now.

- To create your account, choose a pricing plan.

- Use a card or PayPal account to register.

- Save the document in the format you need (Word or PDF).

- Print the file and fill it with your/your business’s info.

After you’ve filled out the Maine Landlord Tenant Lease Co-Signer Agreement, send away it to your attorney for confirmation. It’s an extra step but a necessary one for making confident you’re fully covered. Join US Legal Forms now and access a mass amount of reusable samples.

Form popularity

FAQ

1Ask the owner whether he allows for co-signers.2Schedule a meeting with the owner and your co-signer.3Sign the lease or rental agreement once the co-signer passes the property owner's requirements.4Ask the landlord whether he objects to another tenant moving into the home.How to Add a Co-Signer to a Lease - Home Guides\nhomeguides.sfgate.com > add-cosigner-lease-51603

Bank of America® Cash Back Rewards Credit Card. Bank of AmericaA® Premium RewardsA® Credit Card. Business Advantage Cash Rewards credit card. Discover itA® Student Cash Back. Journey Student Rewards from Capital One. Discover itA® Student chrome.

Yes, authorized users do build credit. You can actually build a good or excellent credit score just as an authorized user on a credit card. When you become an authorized user, the account is added to your credit report, which means on-time payments by the primary cardholder will help you build good credit history.

Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.You will owe more debt: Your debt could also increase since the consignee's debt will appear on your credit report.

A co-signer is someone with good credit and income who guarantees that they will pay your credit card balance if you default. There are two big caveats when it comes to co-signers, however: Most major credit card issuers don't allow for co-signers, even on student credit cards.

Cosigning for a credit card is similar to cosigning for a loan. You, as cosigner, become responsible if the primary account holder is unable to make payments. You'll be liable for any unresolved debt on the credit card that the primary account holder cannot pay.

A co-signer is someone who adds their name to the primary borrower's loan application, agreeing to be legally responsible for the loan amount, and any additional fees, should the borrower be unable to pay. Most people want or need a co-signer because they can't qualify for the loan by themselves.

How does being a co-signer affect my credit score? Being a co-signer itself does not affect your credit score. Your score may, however, be negatively affected if the main account holder misses payments.You will owe more debt: Your debt could also increase since the consignee's debt will appear on your credit report.

An authorized user's credit history won't affect yours While you are responsible for the purchases and activity of the authorized user on your account, simply adding them to your account won't affect your credit one way or another.