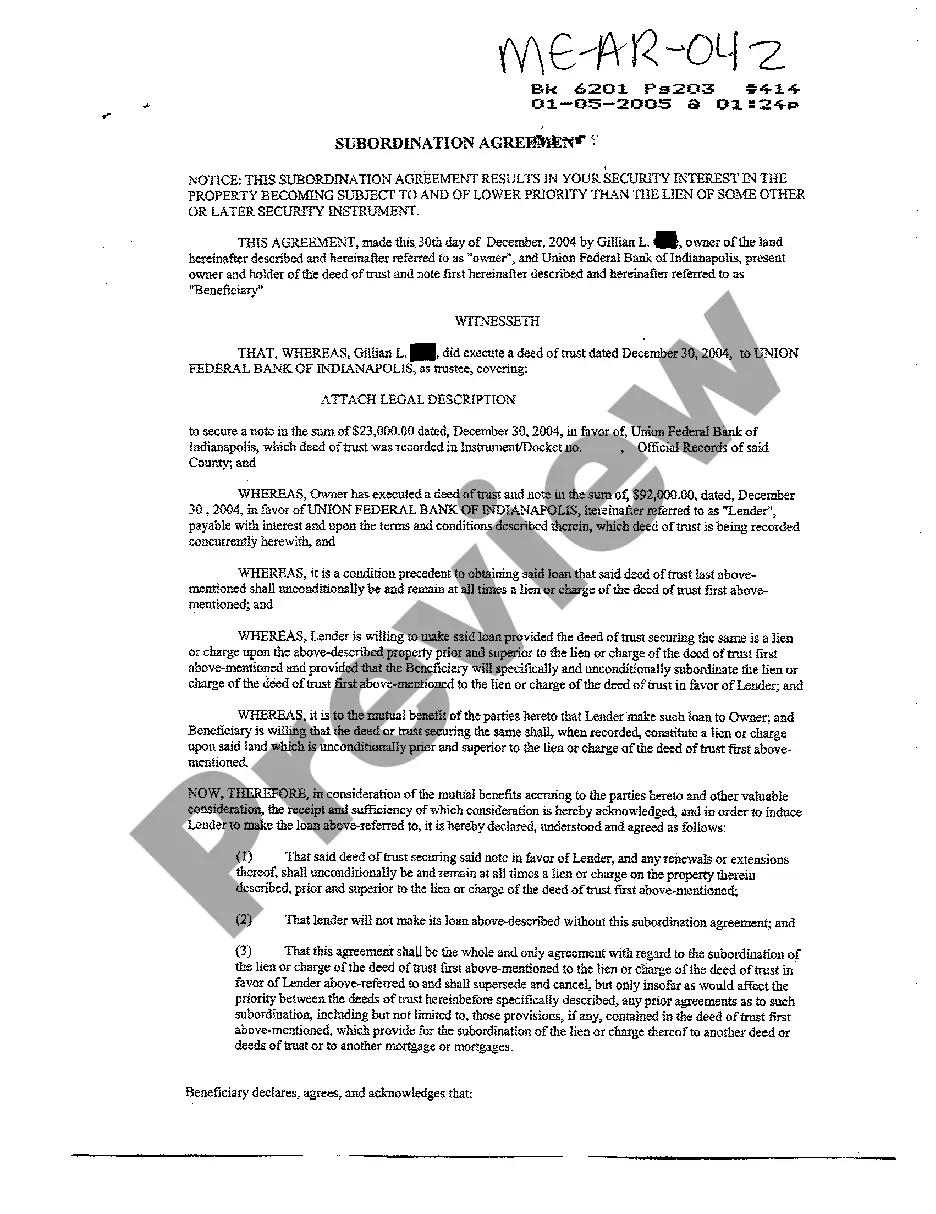

Maine Subordination Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maine Subordination Agreement?

You are invited to the most important legal documentation repository, US Legal Forms.

Here, you can discover various examples such as Maine Subordination Agreement templates and download them (as many as you prefer or need).

Prepare official paperwork in just a few hours, instead of days or even weeks, without spending a fortune on a legal professional.

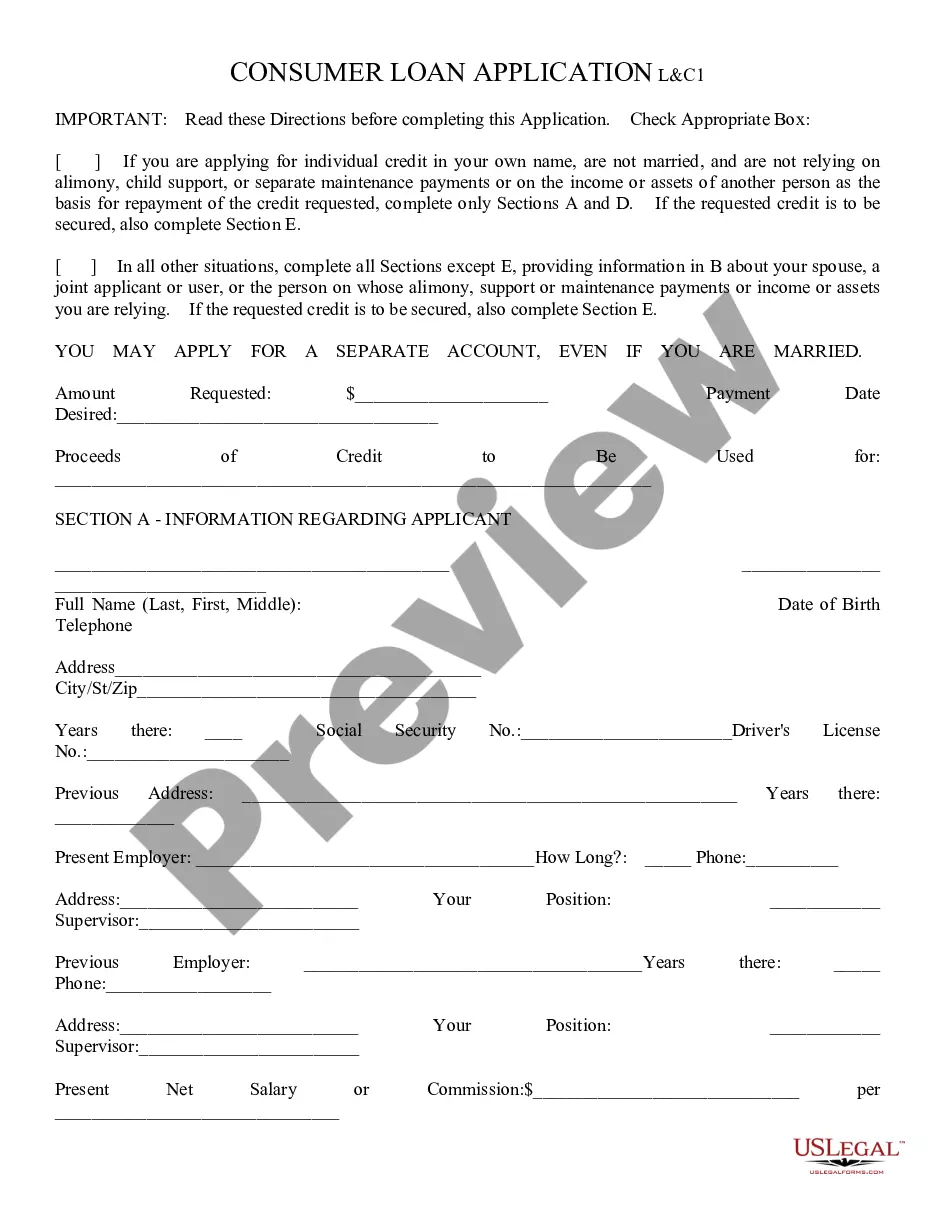

If the example fulfills all your prerequisites, simply click Buy Now. To establish your account, choose a pricing plan. Use a credit card or PayPal to subscribe. Download the document in your preferred format (Word or PDF). Print the document and complete it with your or your business's information. Once you’ve filled out the Maine Subordination Agreement, send it to your attorney for validation. It’s an additional step but a vital one to ensure you’re fully protected. Join US Legal Forms today and gain access to a substantial collection of reusable examples.

- Obtain the state-specific example with just a few clicks and feel assured knowing it was created by our state-certified legal experts.

- If you’re an existing subscriber, simply Log In to your account and then select Download next to the Maine Subordination Agreement you need.

- Since US Legal Forms is an online platform, you’ll always have access to your saved templates, regardless of the device you’re using.

- View them in the My documents section.

- If you haven't registered yet, what are you waiting for? Follow the instructions below to get started.

- If this is a document specific to your state, verify its validity in your state.

- Review the description (if available) to ascertain if it meets your requirements.

- Explore more details using the Preview option.

Form popularity

FAQ

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance.Through subordination, lenders assign a lien position to these loans. Generally, your mortgage is assigned the first lien position while your HELOC becomes the second lien.

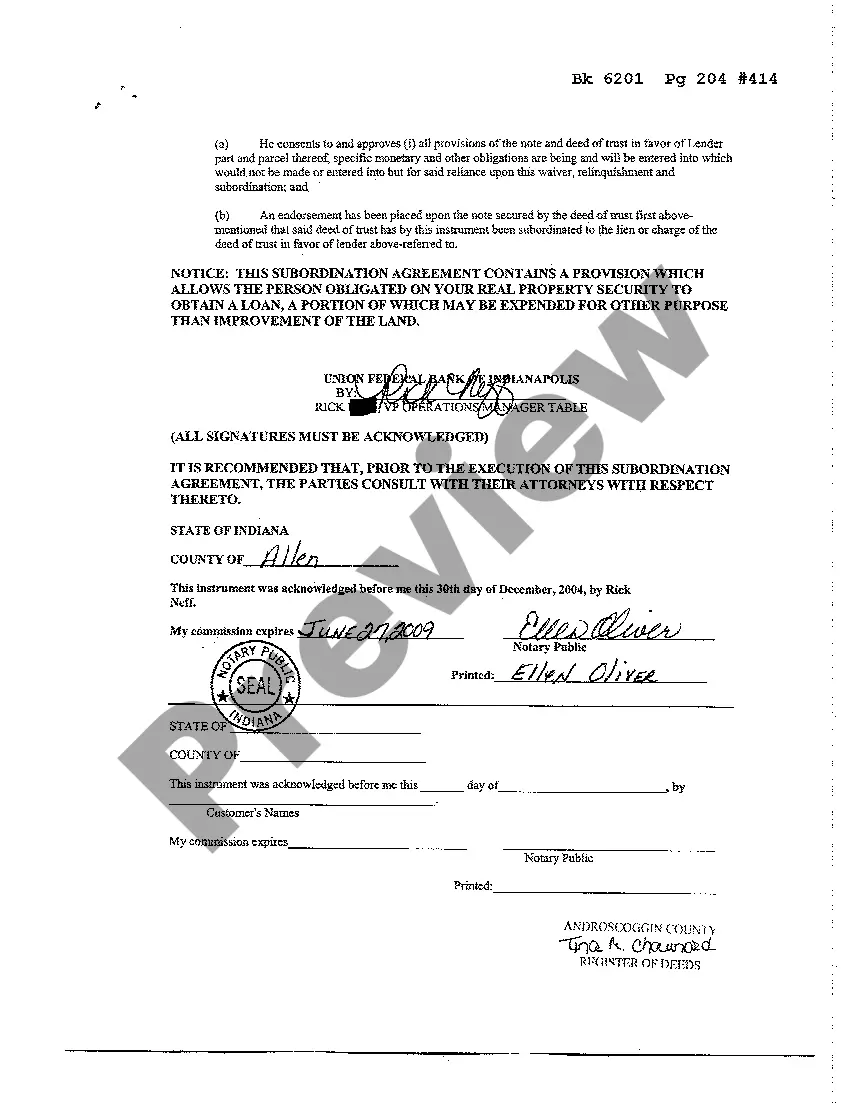

Unless there is a subordination agreement, it is virtually impossible to refinance your first mortgage. The document agreeing to the subordination must be signed by the lender and the borrower and requires notarization.

The signed agreement must be acknowledged by a notary and recorded in the official records of the county to be enforceable.

But as property values are going up and the demand for refinance isn't as much, it seems that the subordination process has gotten a little easier. Typically, it takes two to three weeks to get the resubordination paperwork through, and it is likely to set you back $200 to $300.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

When a Borrower wishes to refinance the property, they must request a subordination request to the Lender. The Lender will subordinate their loan only when there is no cash out as part of the refinance.

: placement in a lower class, rank, or position : the act or process of subordinating someone or something or the state of being subordinated As a prescriptive text, moreover, the Bible has been interpreted as justifying the subordination of women to men.