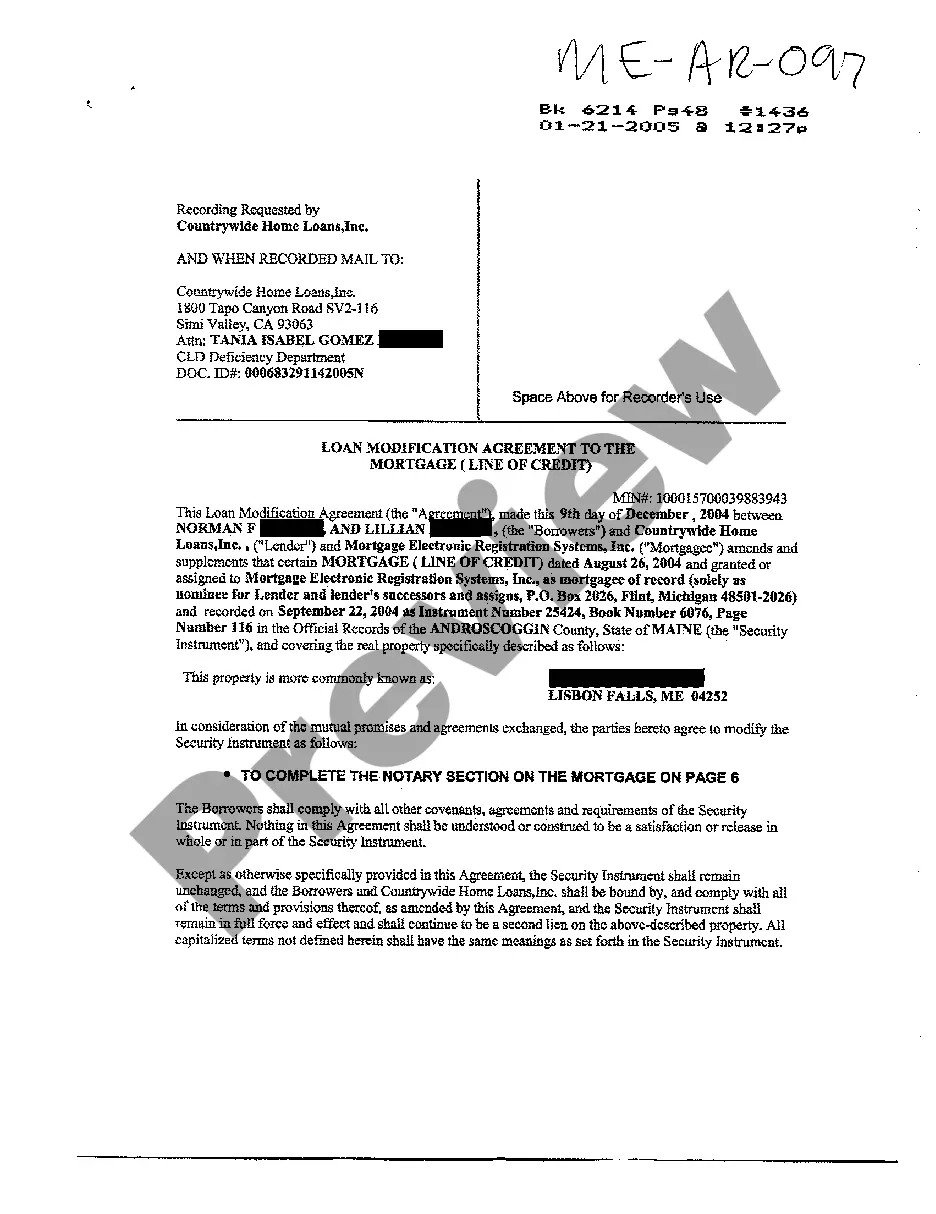

Maine Loan Modification Agreement To The Mortgage

Description

How to fill out Maine Loan Modification Agreement To The Mortgage?

You are welcome to the largest legal documents library, US Legal Forms. Here you will find any template including Maine Loan Modification Agreement To The Mortgage templates and download them (as many of them as you want/need to have). Get ready official documents in a several hours, rather than days or weeks, without having to spend an arm and a leg on an lawyer. Get the state-specific sample in clicks and be assured knowing that it was drafted by our accredited attorneys.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maine Loan Modification Agreement To The Mortgage you need. Due to the fact US Legal Forms is online solution, you’ll always get access to your saved files, regardless of the device you’re utilizing. Locate them inside the My Forms tab.

If you don't have an account yet, just what are you waiting for? Check our guidelines listed below to get started:

- If this is a state-specific sample, check out its applicability in your state.

- Look at the description (if offered) to learn if it’s the correct template.

- See more content with the Preview option.

- If the document fulfills all your requirements, click Buy Now.

- To create an account, pick a pricing plan.

- Use a card or PayPal account to subscribe.

- Download the template in the format you need (Word or PDF).

- Print the document and complete it with your/your business’s info.

Once you’ve filled out the Maine Loan Modification Agreement To The Mortgage, send away it to your lawyer for confirmation. It’s an extra step but a necessary one for being confident you’re fully covered. Join US Legal Forms now and access a mass amount of reusable samples.

Form popularity

FAQ

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

Loan modification is when a lender agrees to alter the terms of a homeowner's mortgage to help them avoid default and keep their house during times of financial hardship. The goal of a mortgage loan modification is to reduce the borrower's payments so they can afford their loan month-to-month.

An income and expenses financial worksheet. tax returns (often, two years' worth) recent pay stubs or a profit and loss statement. proof of any other income (including alimony, child support, Social Security, disability, etc.) recent bank statements, and.

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

Technically, a loan modification should not have any negative impact on your credit score.If that's the case, those the Consumer Data Industry Association missed or partial payments will damage your credit, but the loan modification itself will not.

When you take a loan modification, you change the terms of your loan directly through your lender. Most lenders agree to modifications only if you're at immediate risk of foreclosure. A loan modification can also help you change the terms of your loan if your home loan is underwater.

You have to be suffering a financial hardship. You have to show you cannot afford your current mortgage payments. You have to be able to show that you can stay current on a modified payment schedule.

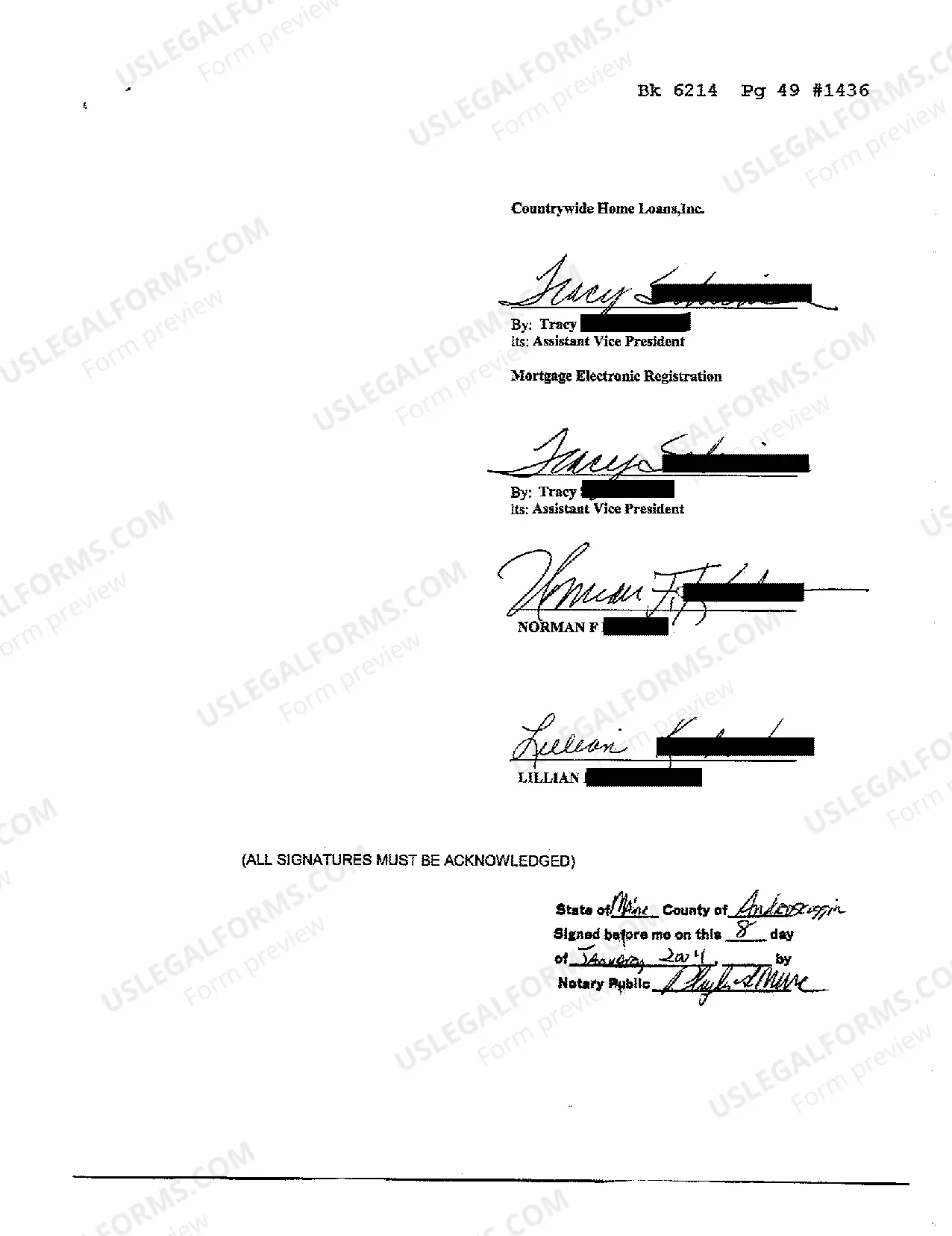

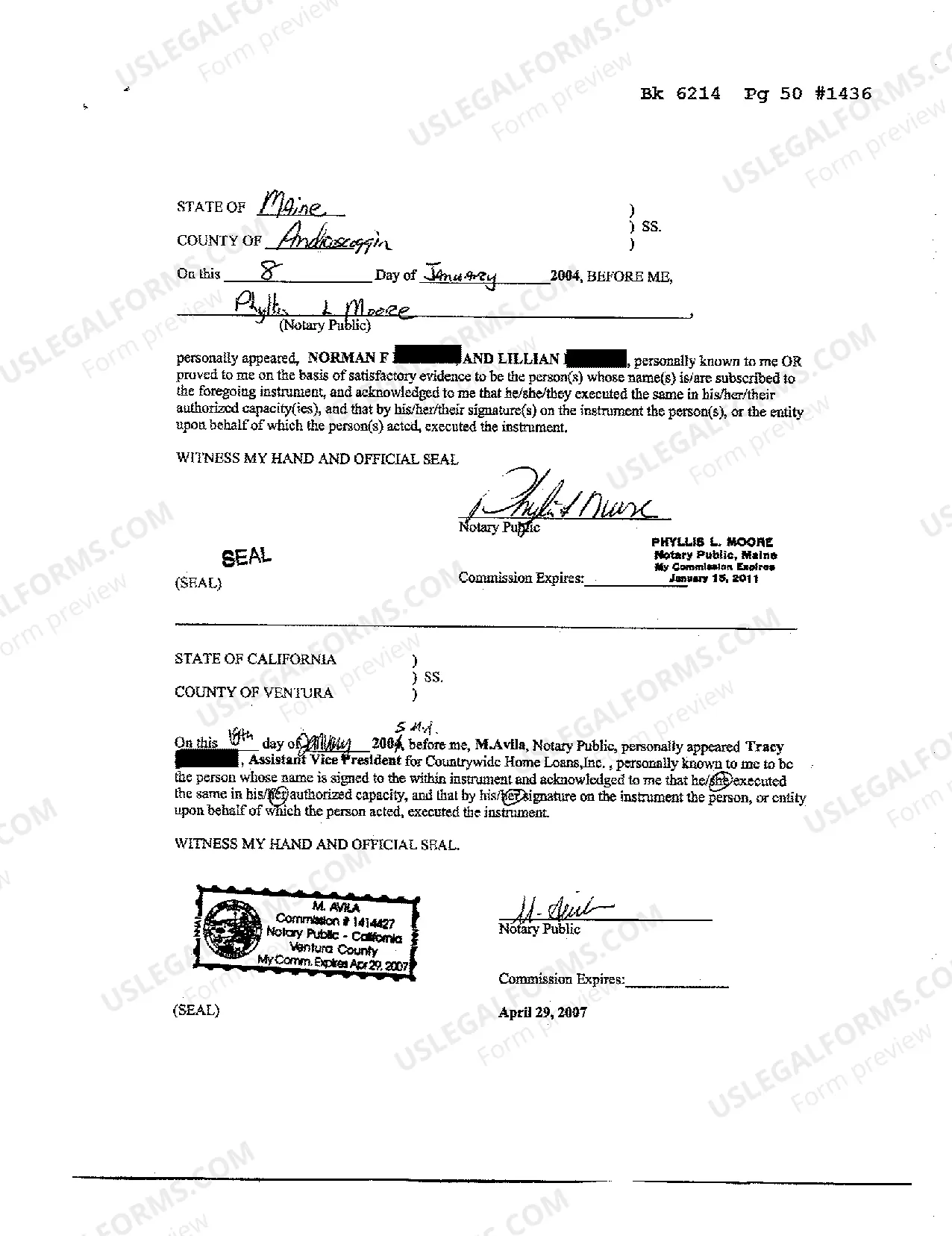

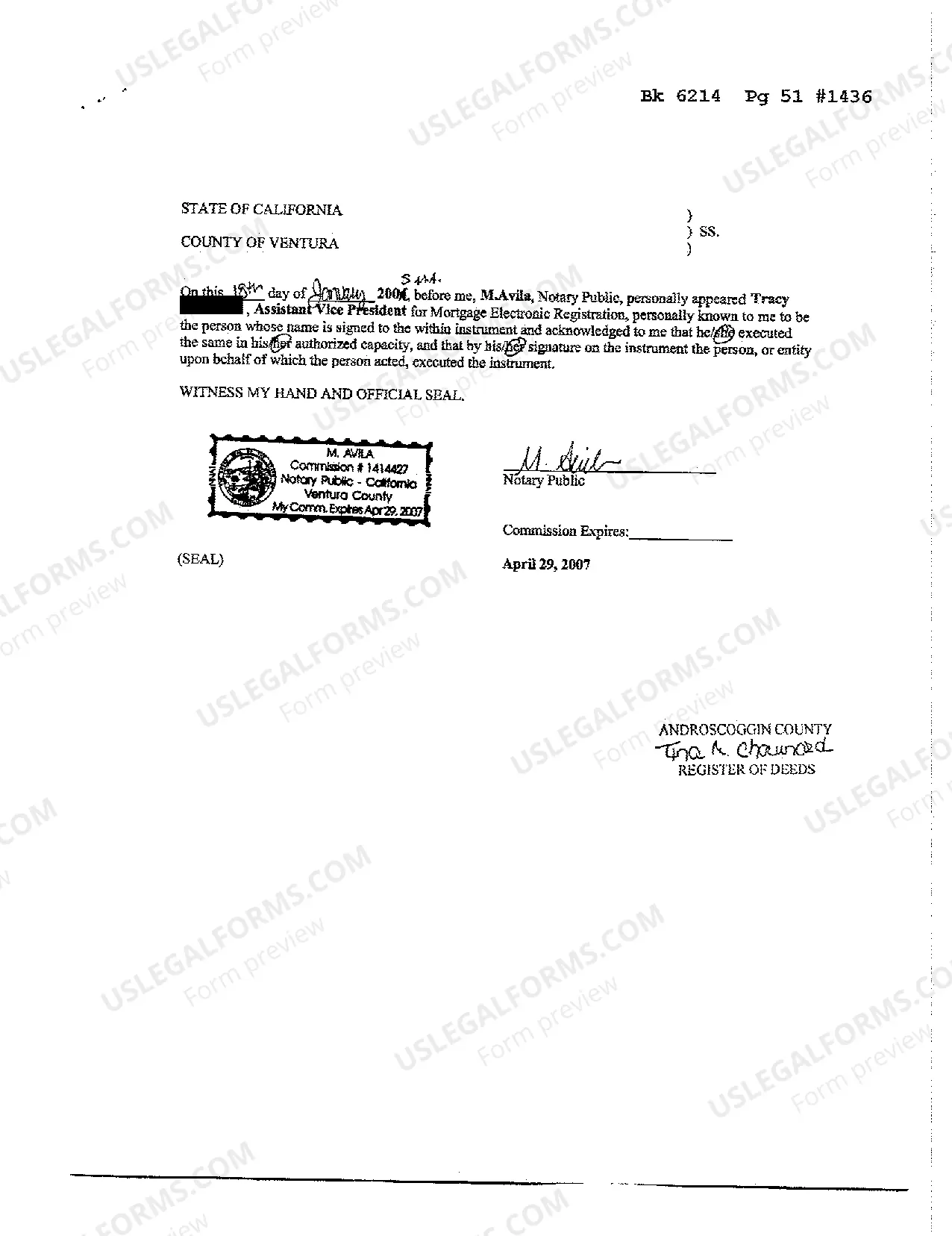

All modifications be in writing. All parties involved sign the modification. In appropriate cases, the modification should be recorded. The title company and attorneys be involved early in the process to properly structure the modification to protect the lender's interest at the lowest cost.

Conventional mortgage loan guidelines require that when trying to finance a new property you will need to have 12 months of payment history on the modification. So if you got a modification 12 months ago and have stayed current with every payment you are okay to apply for a loan on a new home.