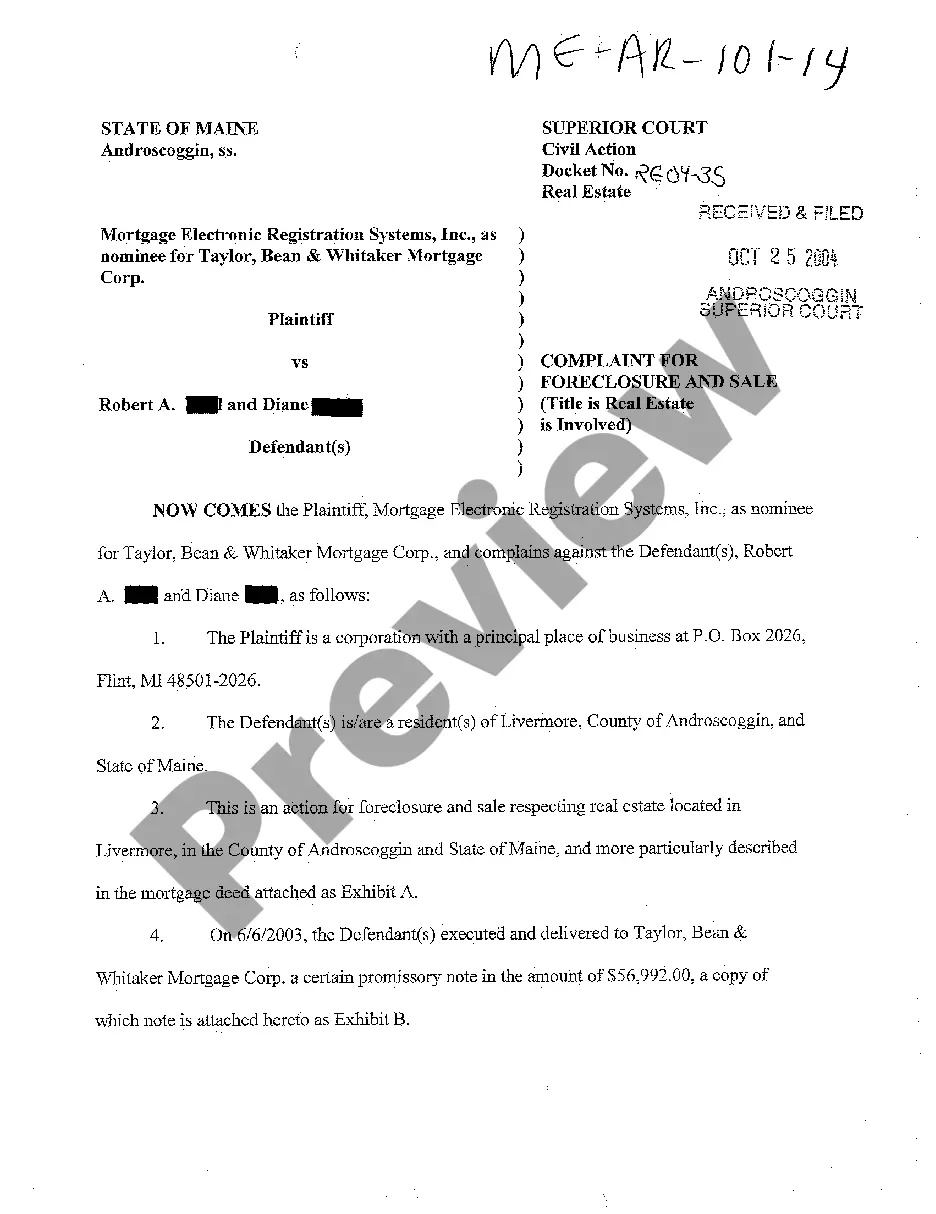

Maine Complaint For Foreclosure and Sale

Description

How to fill out Maine Complaint For Foreclosure And Sale?

You are welcome to the biggest legal documents library, US Legal Forms. Here you will find any template such as Maine Complaint For Foreclosure and Sale forms and download them (as many of them as you want/need). Get ready official files in a several hours, rather than days or even weeks, without spending an arm and a leg on an lawyer or attorney. Get the state-specific example in clicks and feel confident knowing that it was drafted by our state-certified lawyers.

If you’re already a subscribed user, just log in to your account and then click Download near the Maine Complaint For Foreclosure and Sale you need. Because US Legal Forms is online solution, you’ll generally get access to your downloaded templates, regardless of the device you’re using. Locate them inside the My Forms tab.

If you don't have an account yet, what are you waiting for? Check our guidelines below to begin:

- If this is a state-specific document, check its validity in the state where you live.

- See the description (if accessible) to learn if it’s the right template.

- See much more content with the Preview feature.

- If the sample meets all of your requirements, click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Save the template in the format you want (Word or PDF).

- Print the document and fill it with your/your business’s details.

When you’ve completed the Maine Complaint For Foreclosure and Sale, send out it to your legal professional for confirmation. It’s an extra step but a necessary one for making confident you’re completely covered. Join US Legal Forms now and get access to a large number of reusable examples.

Form popularity

FAQ

Pay what you owe. Some states like California allow you to satisfy your mortgage default within up to five days of the scheduled public auction.Stop the foreclosure sale on the same day by contacting your lender to arrange payment of all monies due.

Catch Up on the Mortgage. Pay the mortgage arrears in full, plus all legal fees that the lender incurred. Enter Into a Forbearance Agreement. Contact your lender if you cannot pay in full. Try a Loan Modification. Ask the lender for a loan modification. Get Permission for a Short Sale. Do a Deed in Lieu of Foreclosure.

A foreclosure sale that results in the property being sold to a third party can not be reversed in bankruptcy as a preference because the third party is almost never a pre-existing creditor of the homeowner. It is very common for the foreclosing lender to make a credit bid for some or all of the debt owed to it.

It takes several months for a lender to foreclose on a California property. If everything goes according to schedule, the process typically takes approximately 120 days about four months but the process can take as long as 200 or more days to conclude.

If the property doesn't sell at auction, it becomes a real estate owned property (referred to as an REO or bank-owned property). When this happens, the lender becomes the owner.If the previous owner doesn't vacate the property, the lender can start the eviction process.

Ideally, a foreclosed home will be repossessed and then resold quickly, usually at an auction sale. In California, lenders can sell homes they're foreclosing 21 days after they first officially notify subject homeowners that their properties are going to be sold off.

Will I Get Money Back After a Foreclosure Sale? If a foreclosure sale results in excess proceeds, the lender doesn't get to keep that money. The lender is entitled to an amount that's sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and salebut no more.

A short sale is an alternative to foreclosure. A short sale prevents you from having to go through foreclosure and eviction. A short sale does make a smudge on your credit report but is much less traumatic to your credit than a foreclosure.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.