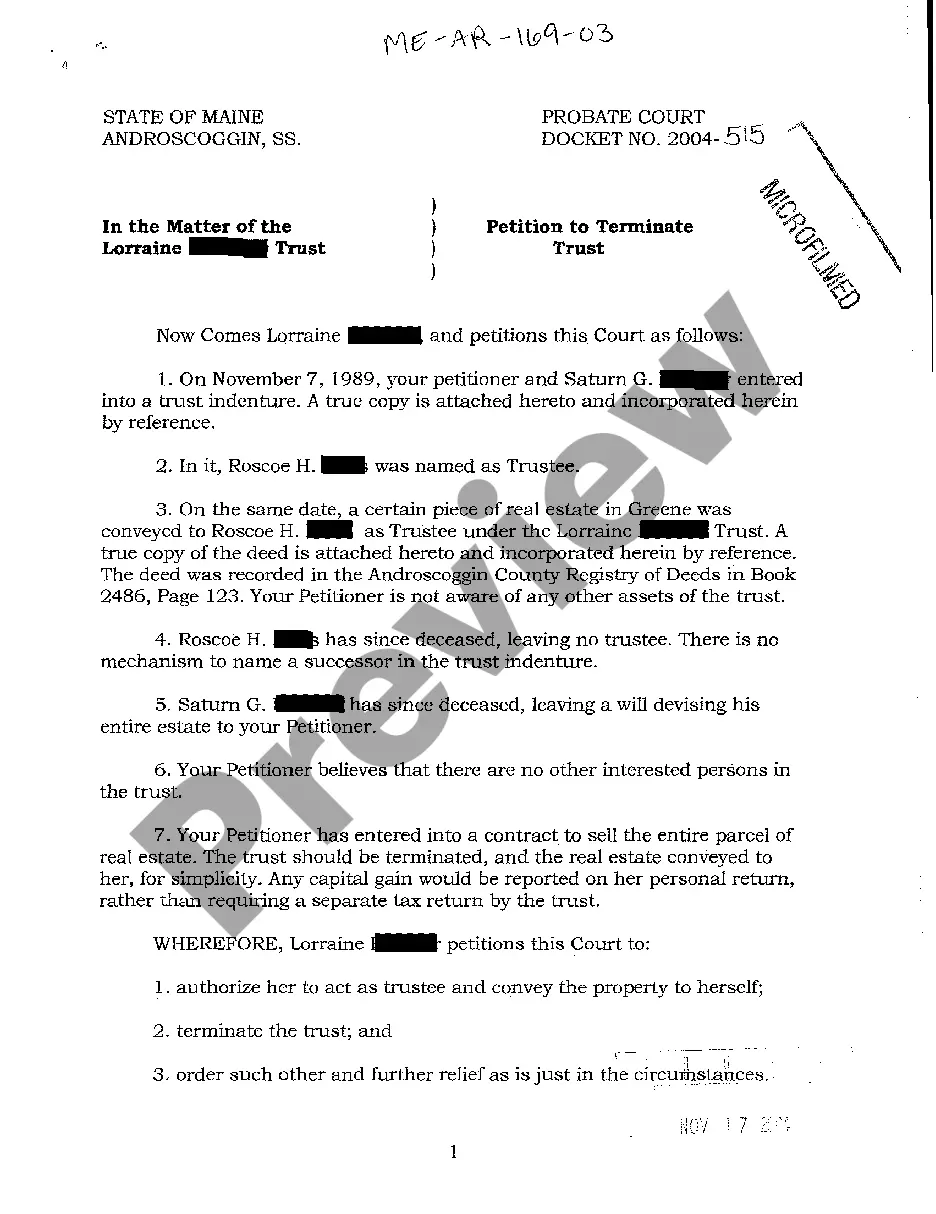

Maine Petition to Terminate Trust

Description

How to fill out Maine Petition To Terminate Trust?

You are welcome to the biggest legal documents library, US Legal Forms. Right here you will find any example including Maine Petition to Terminate Trust forms and download them (as many of them as you wish/need to have). Make official documents in just a few hours, instead of days or weeks, without spending an arm and a leg with an legal professional. Get your state-specific sample in a couple of clicks and feel assured understanding that it was drafted by our accredited attorneys.

If you’re already a subscribed customer, just log in to your account and click Download next to the Maine Petition to Terminate Trust you require. Because US Legal Forms is web-based, you’ll always have access to your saved templates, regardless of the device you’re utilizing. Locate them within the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check out our instructions below to get started:

- If this is a state-specific document, check its applicability in your state.

- Look at the description (if available) to understand if it’s the right template.

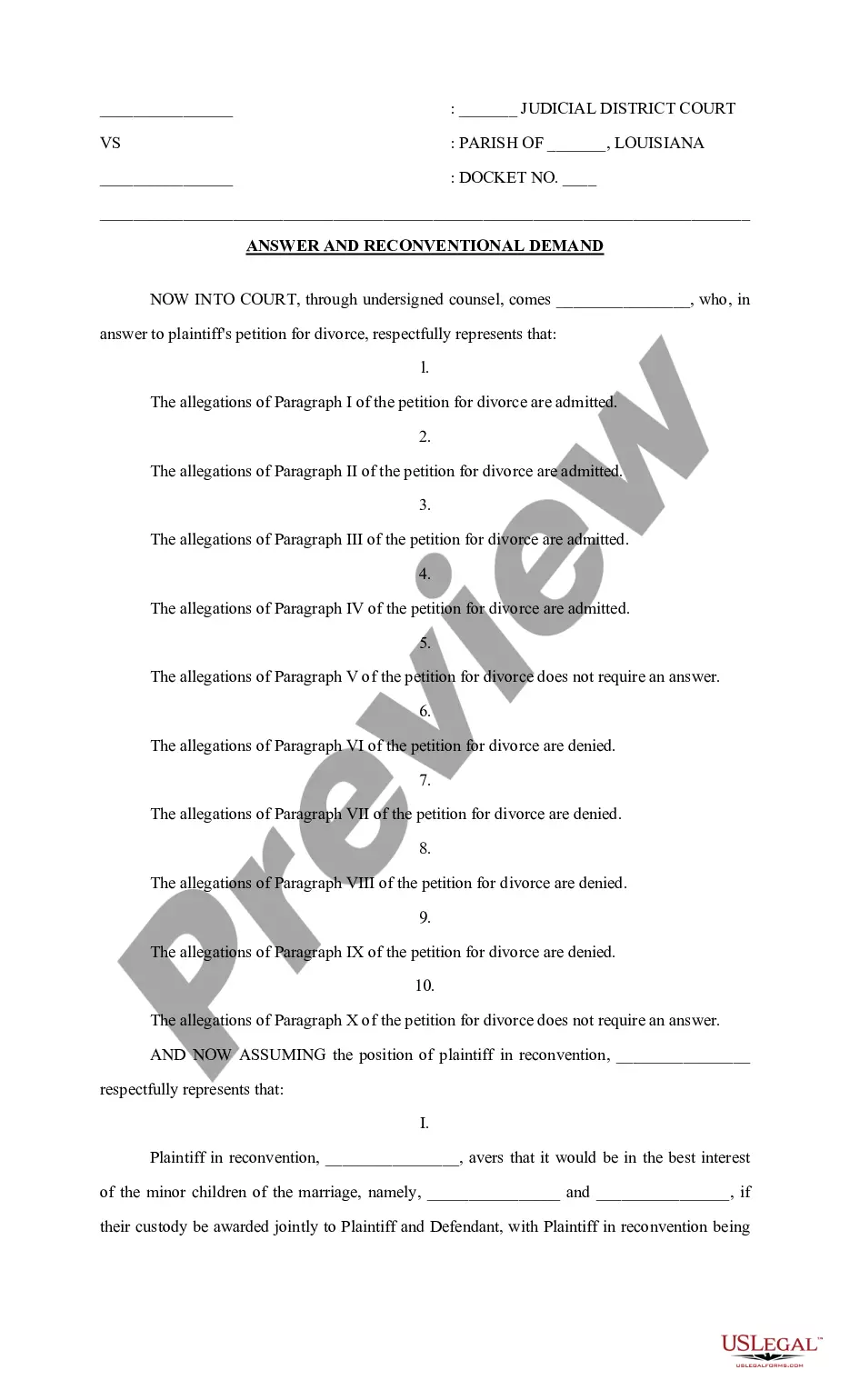

- See more content with the Preview option.

- If the document meets all of your requirements, click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Save the file in the format you want (Word or PDF).

- Print out the document and complete it with your/your business’s info.

Once you’ve filled out the Maine Petition to Terminate Trust, send out it to your attorney for confirmation. It’s an additional step but a necessary one for being confident you’re fully covered. Join US Legal Forms now and get thousands of reusable samples.

Form popularity

FAQ

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

Termination of a trust is like dissolution of a business organization.Usually, this means paying any outstanding trust obligations, liquidating assets, filing final income tax returns, preparing a final accounting for the benefit of the beneficiaries, and distributing trust assets to the appropriate beneficiaries.

An irrevocable trust is a trust with terms and provisions that cannot be changed. However, under certain circumstances, changes to an irrevocable trust can be made and a trust can even be terminated. A material purpose of the trust no longer exists.

In other words, a California court may now terminate an irrevocable trust if all beneficiaries of the trust agree despite the presence of a spendthrift provision in the trust as long as the court finds good cause to do so.

Irrevocable trusts can remain up and running indefinitely after the trustmaker dies, but most revocable trusts disperse their assets and close up shop. This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer.

An irrevocable trust is a trust with terms and provisions that cannot be changed. However, under certain circumstances, changes to an irrevocable trust can be made and a trust can even be terminated.

If you decide to set up a family trust but want to wait before you transfer your assets, the cost will be around $1,200, plus disbursements and other costs. A straightforward trust including asset transfer may cost around $2,400 to $3,000 to set up, but a more complex trust will cost more.

In most situations, beneficiaries can remove a trustee who is not doing his or her job. However, you will need to show that certain conditions have been met to warrant removal.

The irrevocable trust may be terminated by the consent of all beneficiaries and the court finds the termination is not inconsistent with a material purpose of the trust. Once the termination is approved by the court, the trustee is required to distribute the remaining assets as agreed by the beneficiaries.