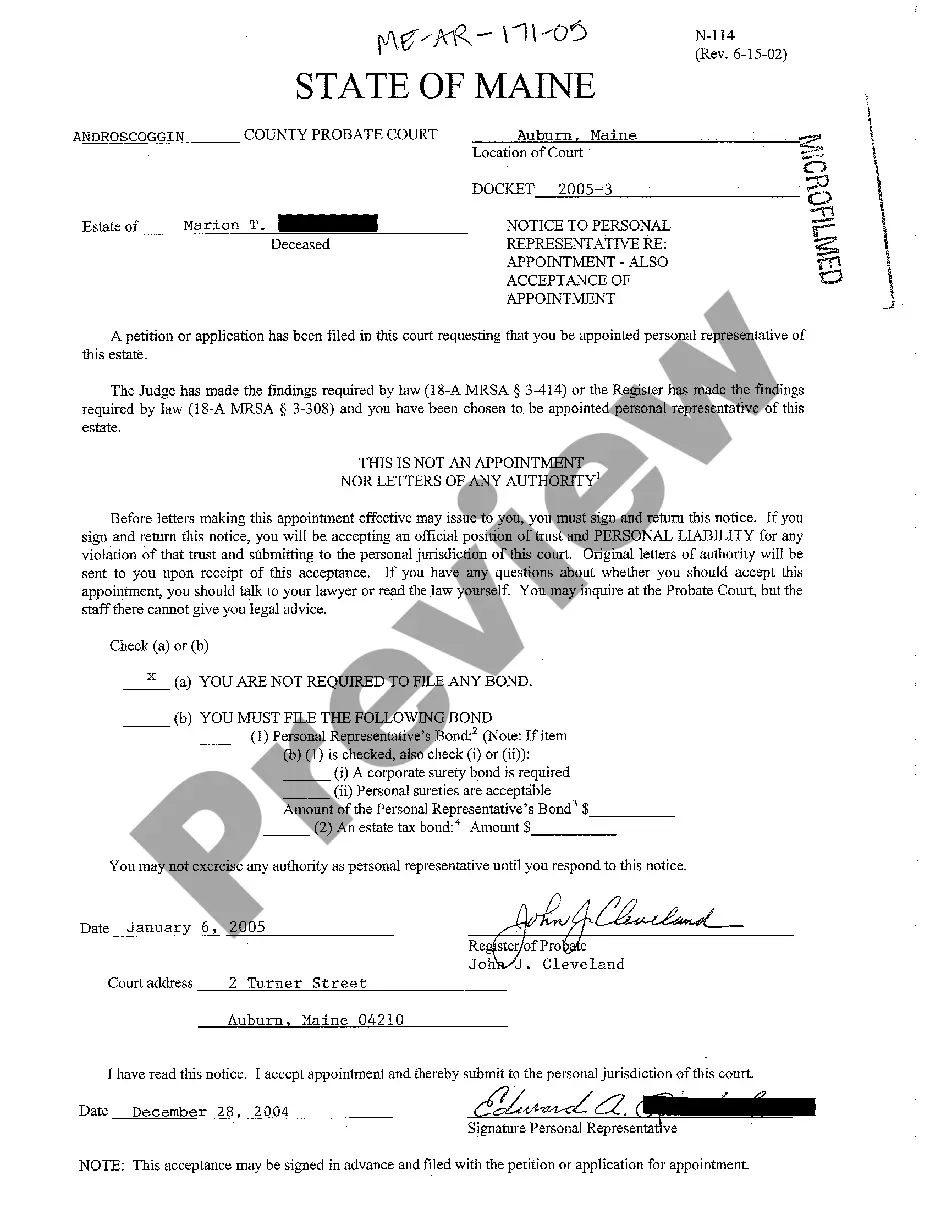

Maine Notice to Personal Representative - Also Acceptance of Appointment

Description

How to fill out Maine Notice To Personal Representative - Also Acceptance Of Appointment?

You are welcome to the largest legal documents library, US Legal Forms. Here you can get any template such as Maine Notice to Personal Representative - Also Acceptance of Appointment forms and save them (as many of them as you want/require). Prepare official papers in a couple of hours, rather than days or even weeks, without spending an arm and a leg on an legal professional. Get your state-specific example in a few clicks and be assured understanding that it was drafted by our state-certified lawyers.

If you’re already a subscribed consumer, just log in to your account and then click Download near the Maine Notice to Personal Representative - Also Acceptance of Appointment you need. Due to the fact US Legal Forms is web-based, you’ll generally have access to your downloaded files, regardless of the device you’re utilizing. Locate them within the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check out our guidelines listed below to begin:

- If this is a state-specific sample, check out its validity in your state.

- View the description (if readily available) to understand if it’s the proper example.

- See more content with the Preview feature.

- If the sample fulfills all your needs, just click Buy Now.

- To make an account, select a pricing plan.

- Use a card or PayPal account to subscribe.

- Download the template in the format you need (Word or PDF).

- Print the file and fill it out with your/your business’s information.

Once you’ve completed the Maine Notice to Personal Representative - Also Acceptance of Appointment, send out it to your lawyer for confirmation. It’s an extra step but an essential one for making sure you’re entirely covered. Become a member of US Legal Forms now and get access to thousands of reusable samples.

Form popularity

FAQ

However, being an executor can be a time-consuming job that can take weeks or even months. That's why most executors are entitled to receive some sort of payment for their services, either through the terms of the will or by state law.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

The executor is entitled to 5% of the first $200,000 of corpus; 3.5% of the excess over $200,000 up to $1,000,000; and 2% of the excess of the corpus over $1,000,000. From a practical standpoint, using my example of a $400,000 estate, my hypothetical executor would be entitled to a commission of $17,000.

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.

If a personal representative fails to act in the best interests of the beneficiaries to such an extent that the welfare of the beneficiaries is at risk, they can be removed by the Court.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

The fee varies depending on the size of the estate from $20.00 for an estate of $10,000 or less to $950.00 for an estate of $2,000,000 plus $100.00 for each additional $500,000.