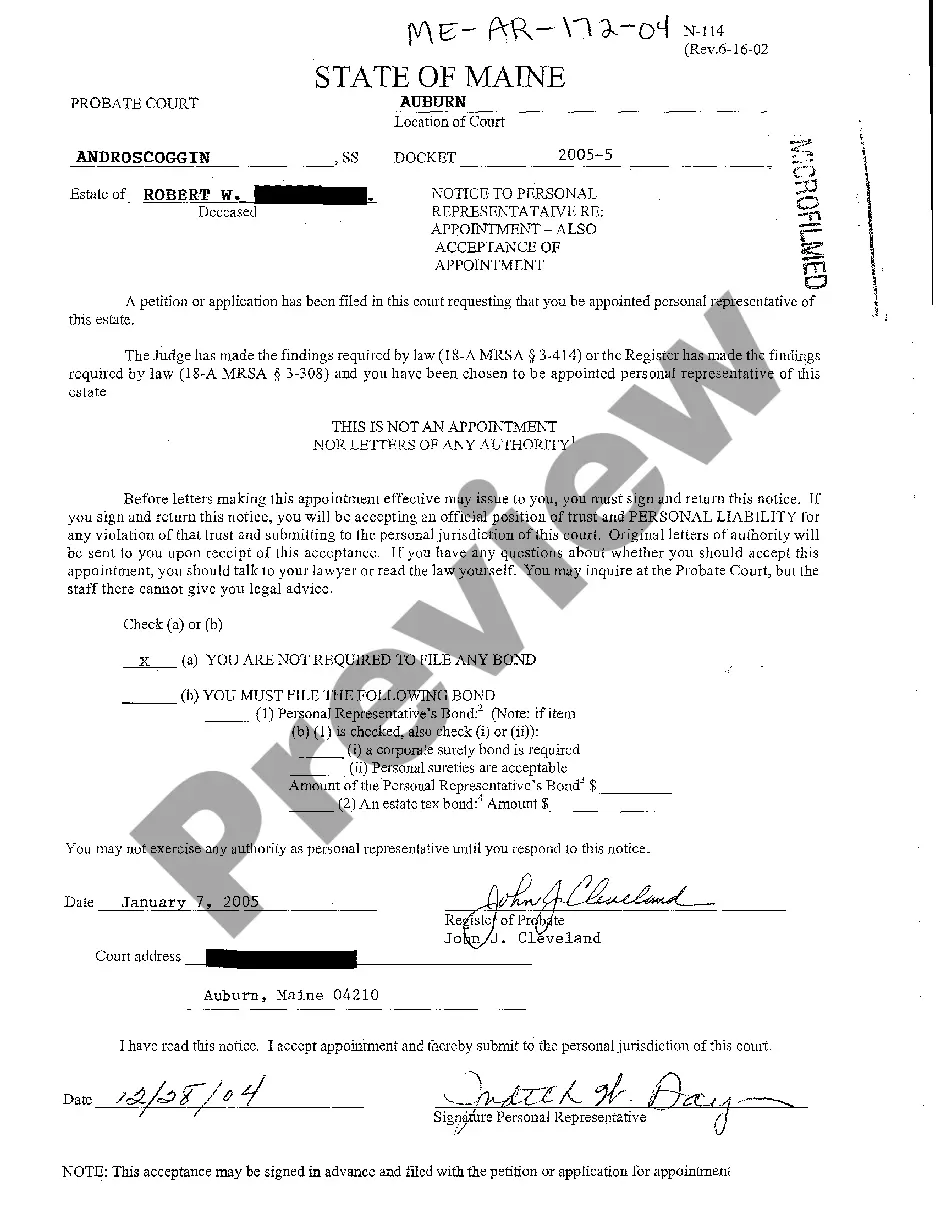

Maine Notice to Personal Representative Regarding Acceptance of Appointment

Description

How to fill out Maine Notice To Personal Representative Regarding Acceptance Of Appointment?

You are welcome to the greatest legal files library, US Legal Forms. Here you can get any sample including Maine Notice to Personal Representative Regarding Acceptance of Appointment forms and save them (as many of them as you wish/need to have). Prepare official papers in a couple of hours, rather than days or even weeks, without having to spend an arm and a leg on an attorney. Get your state-specific sample in a couple of clicks and be confident with the knowledge that it was drafted by our qualified legal professionals.

If you’re already a subscribed customer, just log in to your account and click Download next to the Maine Notice to Personal Representative Regarding Acceptance of Appointment you need. Due to the fact US Legal Forms is online solution, you’ll generally get access to your saved files, no matter the device you’re utilizing. Find them in the My Forms tab.

If you don't come with an account yet, just what are you awaiting? Check our instructions listed below to start:

- If this is a state-specific sample, check its applicability in the state where you live.

- Look at the description (if readily available) to learn if it’s the correct example.

- See a lot more content with the Preview option.

- If the sample matches all your needs, just click Buy Now.

- To create your account, pick a pricing plan.

- Use a credit card or PayPal account to join.

- Download the template in the format you require (Word or PDF).

- Print out the document and fill it out with your/your business’s info.

As soon as you’ve completed the Maine Notice to Personal Representative Regarding Acceptance of Appointment, give it to your lawyer for verification. It’s an extra step but a necessary one for being certain you’re fully covered. Become a member of US Legal Forms now and get access to a mass amount of reusable samples.

Form popularity

FAQ

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

Personal Representatives is the collective name for either Executors or Administrators. Personal Representatives of someone who made a valid Will are called Executors. If someone dies without a Will (intestate) then the people in charge of their estate are called Adminstrators.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

The executor is entitled to 5% of the first $200,000 of corpus; 3.5% of the excess over $200,000 up to $1,000,000; and 2% of the excess of the corpus over $1,000,000. From a practical standpoint, using my example of a $400,000 estate, my hypothetical executor would be entitled to a commission of $17,000.

In Maine, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The fee varies depending on the size of the estate from $20.00 for an estate of $10,000 or less to $950.00 for an estate of $2,000,000 plus $100.00 for each additional $500,000.

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims