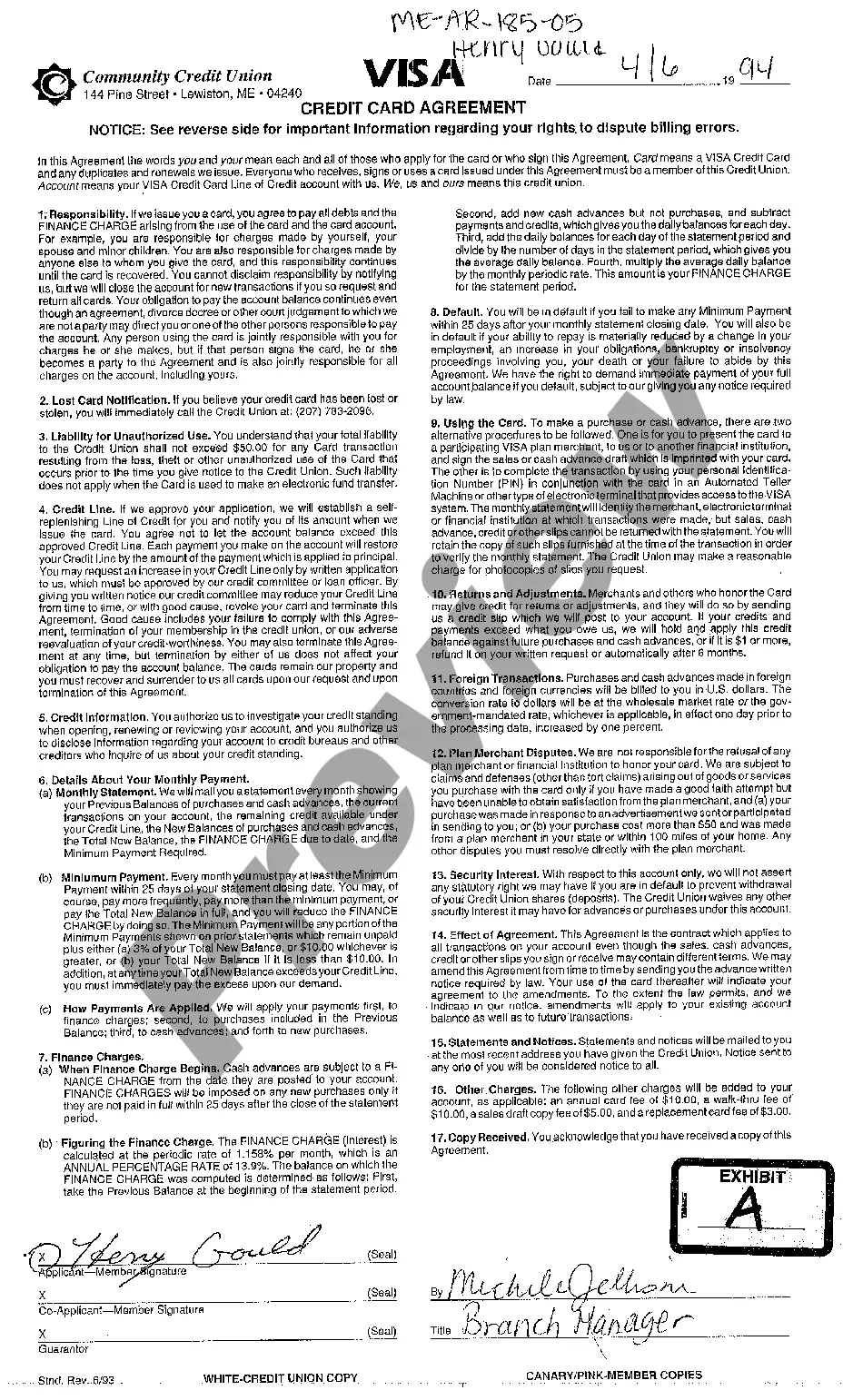

Maine Credit Card Agreement

Description

How to fill out Maine Credit Card Agreement?

Among hundreds of paid and free samples that you’re able to find on the web, you can't be certain about their reliability. For example, who created them or if they are qualified enough to take care of what you need these people to. Always keep calm and use US Legal Forms! Locate Maine Credit Card Agreement samples created by professional attorneys and get away from the expensive and time-consuming procedure of looking for an lawyer or attorney and after that paying them to draft a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you are seeking. You'll also be able to access all your earlier saved files in the My Forms menu.

If you’re using our service the first time, follow the tips listed below to get your Maine Credit Card Agreement easily:

- Make certain that the file you see applies where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing process or find another template using the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

Once you have signed up and purchased your subscription, you may use your Maine Credit Card Agreement as many times as you need or for as long as it stays valid where you live. Change it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

A federal law known as the Truth in Lending Act governs the minutiae of when card issuers should credit the payments you make.And Karen, it is not illegal for an issuer to place the sort of hold you mention. According to TILA, the issuer should credit your payment to your account the day it receives your funds.

If you are a current account holder and want a copy of your specific agreement, you can request one on the issuer's site or call the toll-free customer service number listed on the back of your credit card. The larger card issuers offer a wide variety of credit cards.

The rules of your credit card are outlined in your credit card agreement, a type of contract that outlines the terms, conditions, pricing, and penalties of the credit card.

Always Pay on Time. Pay More Than the Minimum Amount. Keep Balances Low by Using Your Card for Necessary Purchases. Common Credit Card Mistakes to Avoid.

A cardholder agreement is a legal document outlining the terms under which a credit card is offered to a customer. Among other provisions, the cardholder agreement states the annual percentage rate (APR) of the card, as well as how the card's minimum payments are calculated.

Can businesses refuse to accept cards? Any business is within its rights to refuse a method of payment. The question is whether this will affect their custom by doing so, especially as the use of non-cash payments is growing fast.

In California, the statute of limitations for a written contract is four years. Two-year statute of limitations for oral contracts. It is unlikely that your credit card agreement is an oral contract, meaning that you entered into a verbal agreement with the credit card company and did not write down the terms.

Ten states prohibit credit card surcharges and convenience fees: California, Colorado, Connecticut, Florida, Kansas, Maine, Massachusetts, New York, Oklahoma and Texas.

According to Nolo, if the original creditor is filing a lawsuit against you, it must produce the original contact, preferably signed. Because credit cards are commonly issued online, a signed contract isn't always available.