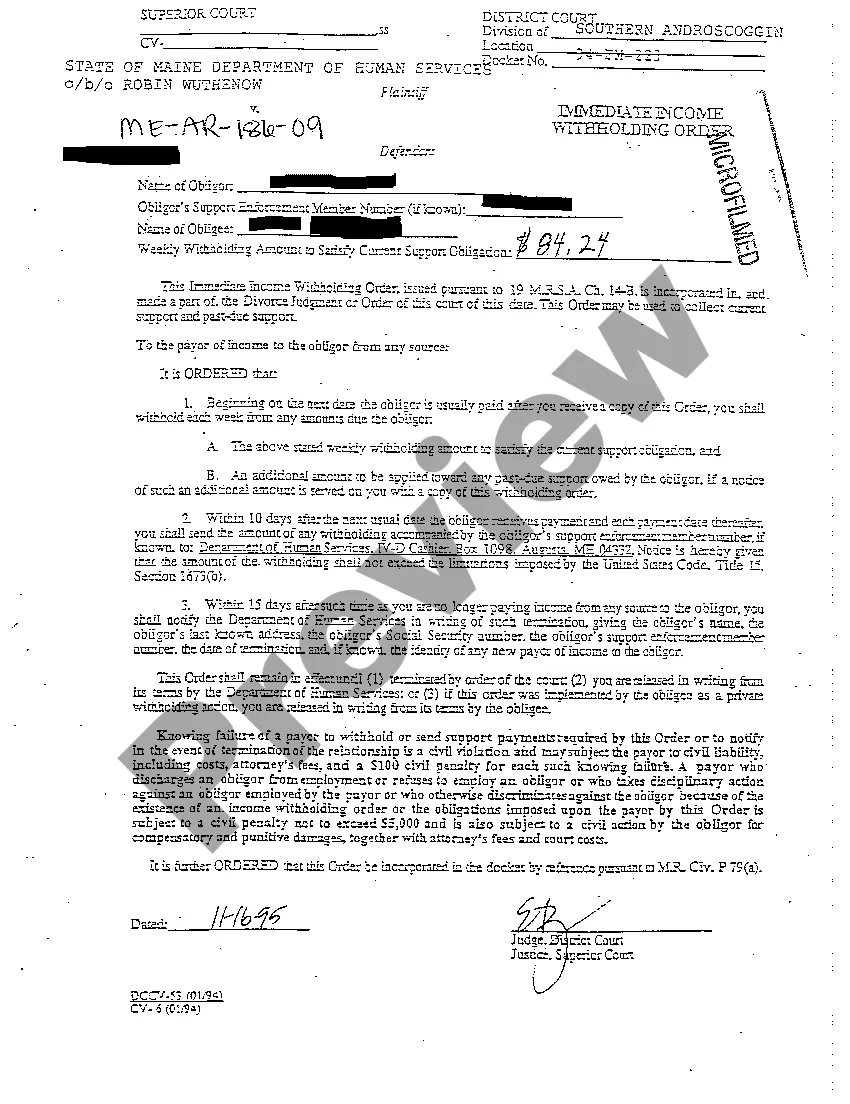

Maine Immediate Income Withholding Order

Description

How to fill out Maine Immediate Income Withholding Order?

Among hundreds of paid and free examples that you can find on the net, you can't be certain about their reliability. For example, who created them or if they’re competent enough to take care of what you need these to. Always keep calm and utilize US Legal Forms! Locate Maine Immediate Income Withholding Order samples created by skilled legal representatives and prevent the expensive and time-consuming procedure of looking for an attorney and after that paying them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the file you’re trying to find. You'll also be able to access your previously saved templates in the My Forms menu.

If you are utilizing our website the very first time, follow the guidelines below to get your Maine Immediate Income Withholding Order fast:

- Make certain that the document you find is valid where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and bought your subscription, you can use your Maine Immediate Income Withholding Order as often as you need or for as long as it remains valid in your state. Edit it with your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Once you receive an IWO, you should withhold child support as soon as possible. Most states require that you start withholding no later than the pay period beginning 14 days after the agency mailed the IWO. If you don't withhold child support after receiving an income withholding order, you will face penalties.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.

The following states have laws or case law that give courts the authority to order a non-custodial parent to pay for some form of college expenses: Alabama, Arizona, Colorado, Connecticut, District of Columbia, Florida, Georgia, Hawaii, Illinois, Indiana, Iowa, Maryland, Massachusetts, Mississippi, Missouri, Montana,

Questions? Call the Case Initiation Unit at 207 624-4100 or submit a question through our online form. This free, confidential service is available 24/7. If you are a parent afraid that the other parent of your child will harm you or your child, there is help available.

Thankfully, at least for the most part, your obligation to pay taxes stops after you die. But, dying won't get you out of support payments.

Regardless of state differences on the age of majority, once the child is officially considered an adult, the custodial parent will not be owed any new child support payments. However, any outstanding payments are still collectable provided the parent files a court order.

Fill out the income withholding order, mark the appropriate boxes, mark you're terminating support, file it with the court, get the order from the judge, and then serve it on the employer by certified mail. That's the way you would terminate the support.

Legal guidelines in all states allow child support to end when the child reaches the age of majority.In most states, child support ends when a child turns 18 or graduates from high school, whichever occurs first. In other states, the age may be 21.

In Maine, the obligation to pay child support ordinarily ends when a child turns 18. A court may extend the obligation until a child's 19th birthday if the child is still in high school, or special circumstances apply.