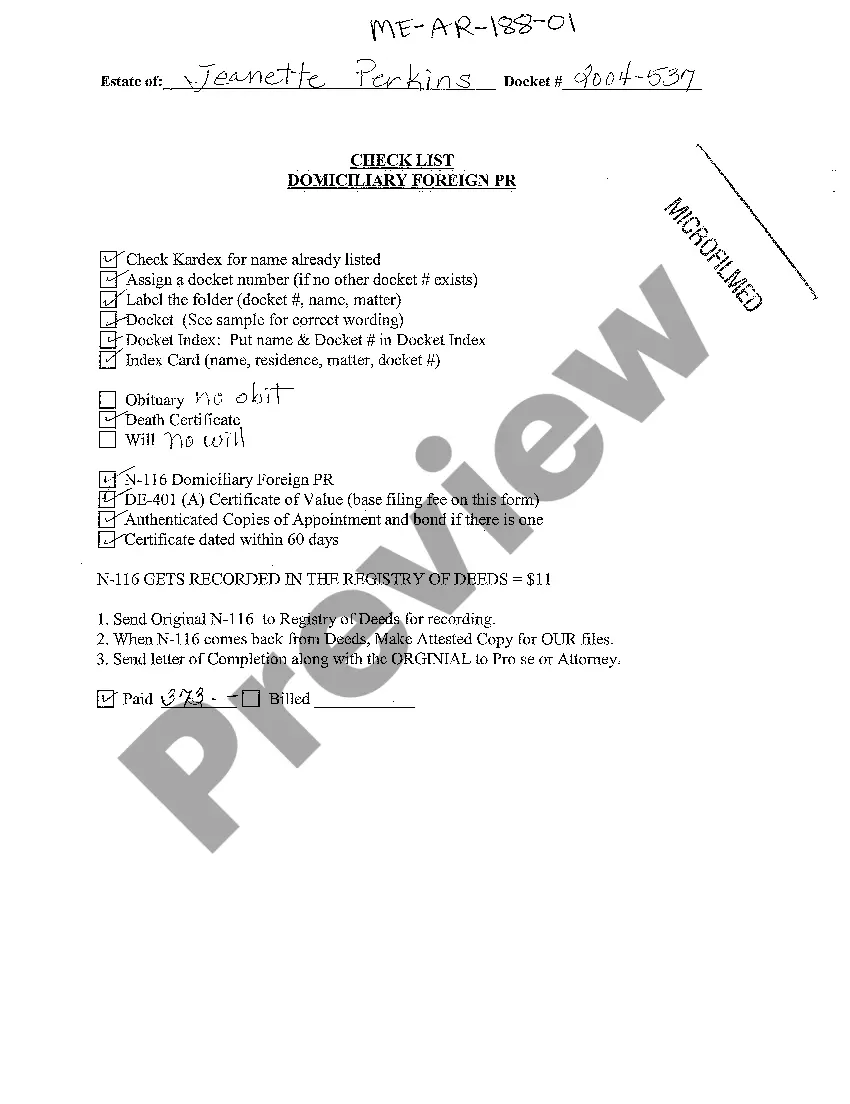

Maine Checklist for Domiciliary Foreign Personal Representative

Description

How to fill out Maine Checklist For Domiciliary Foreign Personal Representative?

Among countless free and paid samples that you’re able to find online, you can't be sure about their accuracy and reliability. For example, who created them or if they’re skilled enough to take care of what you require those to. Keep relaxed and utilize US Legal Forms! Get Maine Checklist for Domiciliary Foreign Personal Representative templates developed by professional lawyers and prevent the costly and time-consuming process of looking for an lawyer and then paying them to write a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you are seeking. You'll also be able to access all your previously acquired samples in the My Forms menu.

If you’re making use of our platform the first time, follow the instructions listed below to get your Maine Checklist for Domiciliary Foreign Personal Representative easily:

- Make sure that the file you find applies where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another example utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

As soon as you have signed up and bought your subscription, you may use your Maine Checklist for Domiciliary Foreign Personal Representative as often as you need or for as long as it continues to be active where you live. Revise it with your favored online or offline editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

By River Braun, J.D. If a will's executor dies or is unable to serve for other reasons, the court appoints another person. After your death, this person, also called an agent, personal representative, or fiduciary, handles your estate.

When a person dies, his or her property must be collected by the personal representative. After debts, taxes, and expenses are paid, the remaining assets are distributed to the decedent's beneficiaries.

If an Executor passes away before they are able to complete the duties required by them to settle the assets and estate, but after the court has granted the probate. The beneficiaries will need to find out if the executor has left a will.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

Personal Representatives is the collective name for either Executors or Administrators. Personal Representatives of someone who made a valid Will are called Executors. If someone dies without a Will (intestate) then the people in charge of their estate are called Adminstrators.