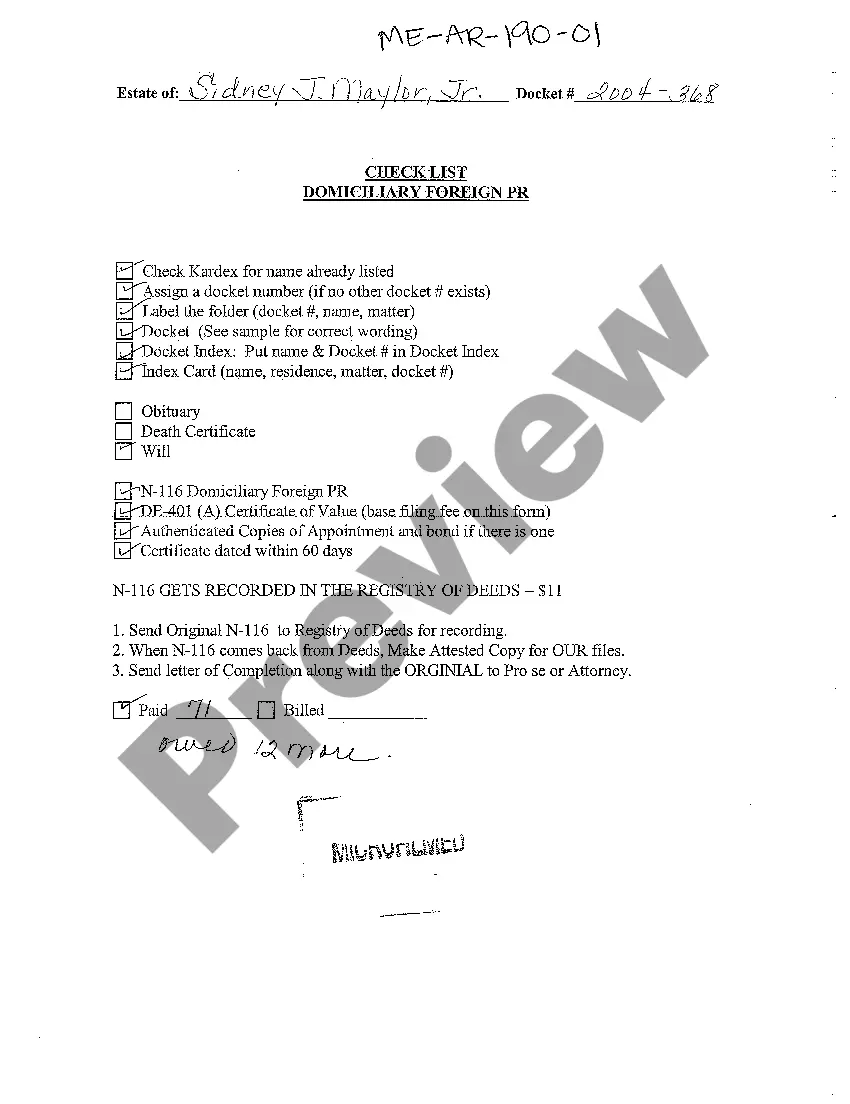

Maine Checklist for Domiciliary Foreign Personal Representative

Description

How to fill out Maine Checklist For Domiciliary Foreign Personal Representative?

Among hundreds of paid and free examples that you find on the web, you can't be sure about their accuracy. For example, who made them or if they are competent enough to deal with what you need these people to. Always keep relaxed and use US Legal Forms! Find Maine Checklist for Domiciliary Foreign Personal Representative samples developed by skilled attorneys and get away from the expensive and time-consuming procedure of looking for an lawyer and then paying them to draft a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you are searching for. You'll also be able to access all your earlier acquired documents in the My Forms menu.

If you are utilizing our website the first time, follow the tips listed below to get your Maine Checklist for Domiciliary Foreign Personal Representative quickly:

- Make certain that the file you discover applies where you live.

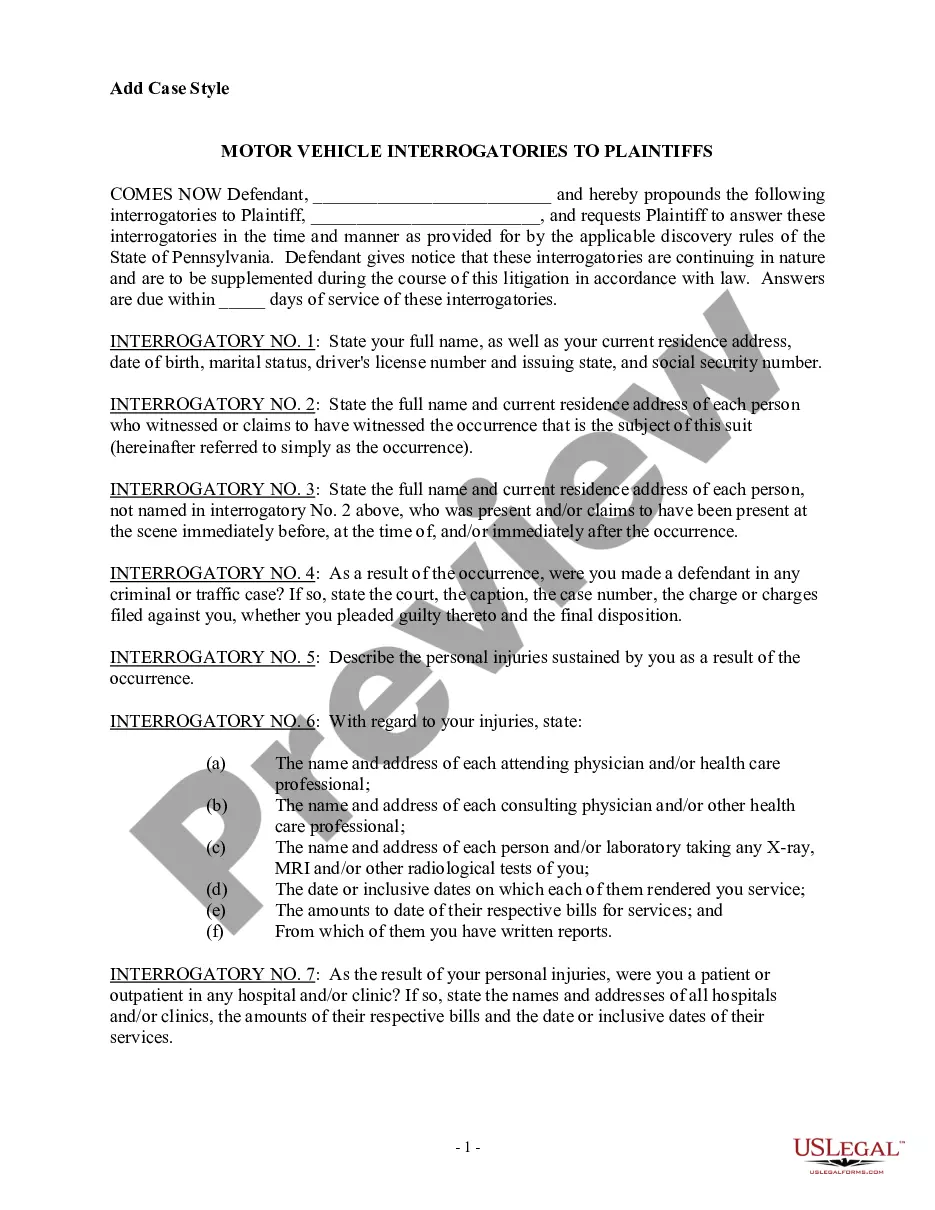

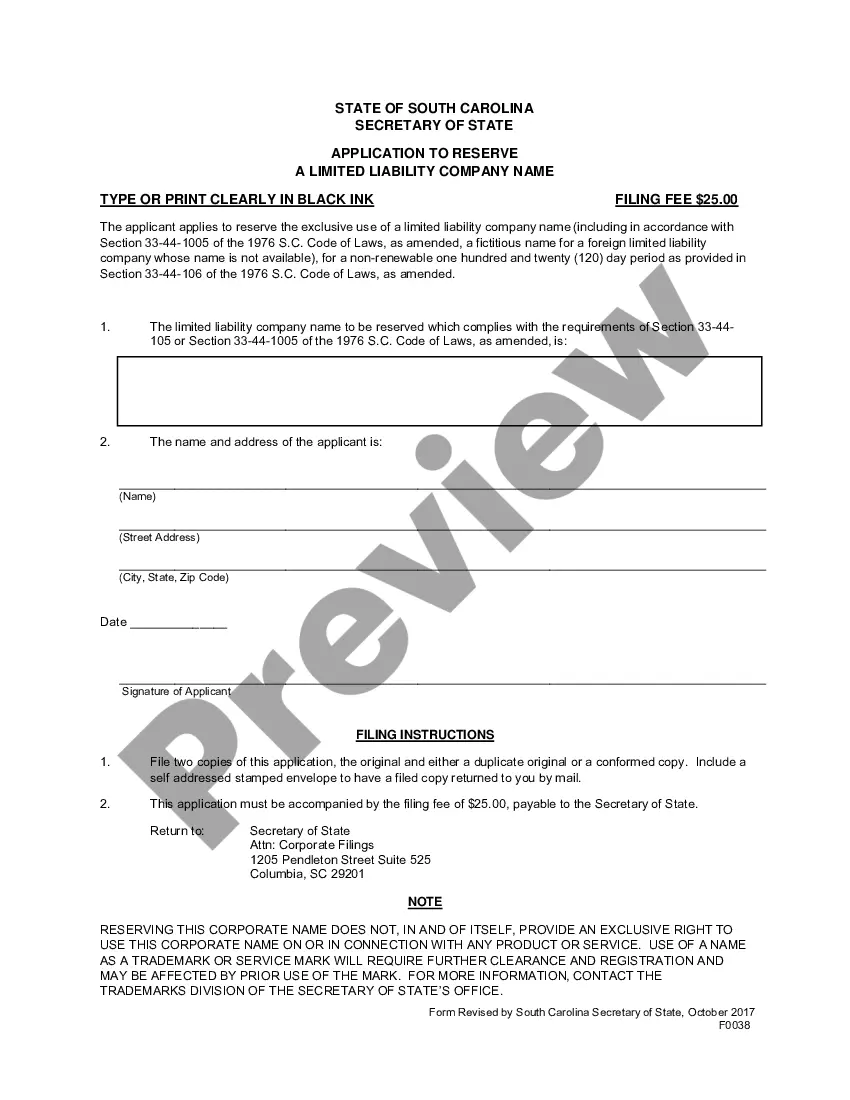

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or find another template using the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and paid for your subscription, you can use your Maine Checklist for Domiciliary Foreign Personal Representative as often as you need or for as long as it continues to be valid where you live. Revise it with your favorite editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

4% of the first $100,000. 3% of the next $100,000. 2% of the next $800,000. 1% of the next $9,000,000. 0.5% of the next $15,000,000. and reasonable compensation as determined by the California Probate Court for any amount above $25,000,000.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

This will most likely be your spouse or a close relative, but not necessarily the person in your life who is best suited to the task. When handling finances and personal affairs, you would like your personal representative to be someone close to you and honest, whom you can trust.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

A personal representative is the person, or it may be more than one person, who is legally entitled to administer the estate of the person who has died (referred to as 'the deceased'). The term 'personal representatives', sometimes abbreviated to PR, is used because it includes both executors and administrators.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.