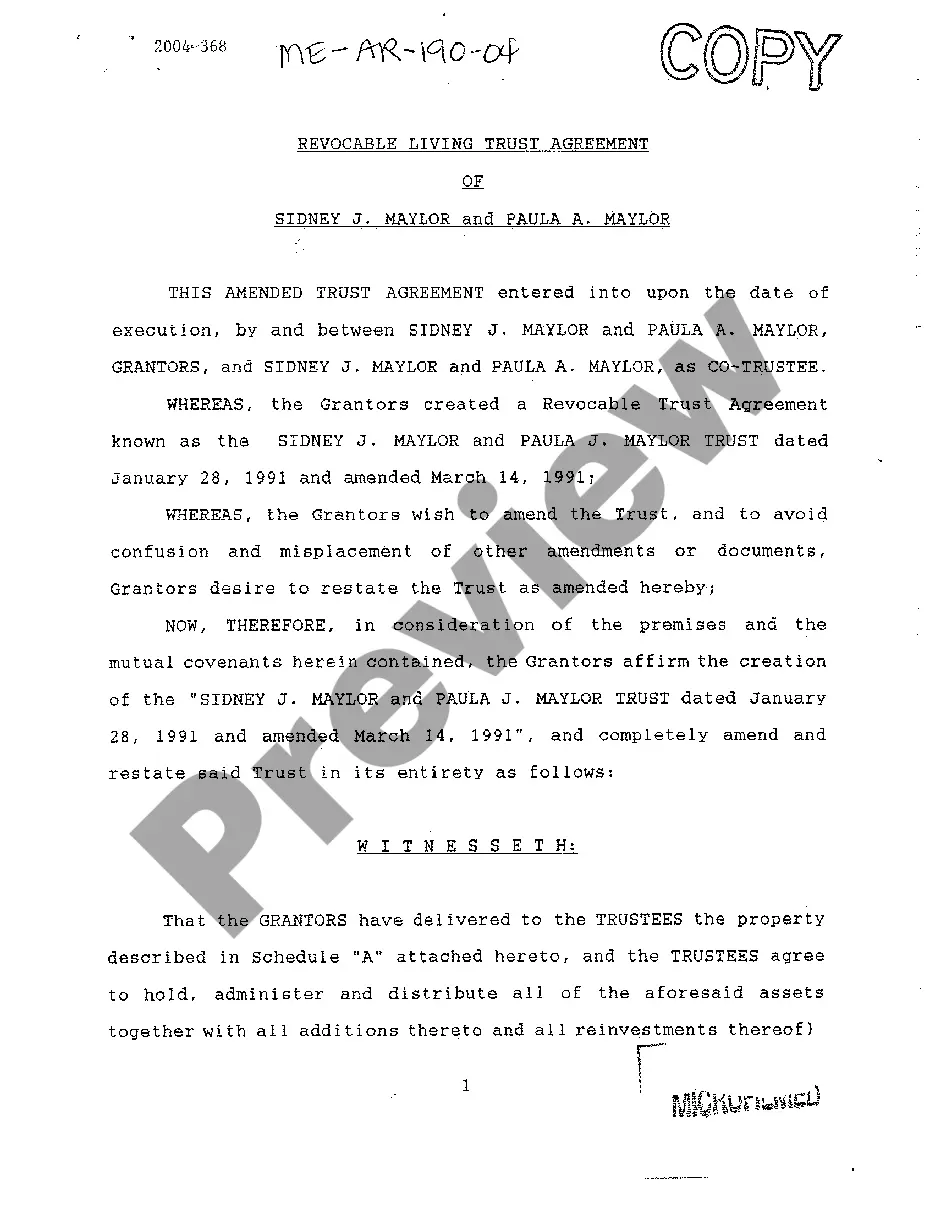

Maine Revocable Living Trust Agreement

Description

How to fill out Maine Revocable Living Trust Agreement?

Among numerous free and paid examples which you get online, you can't be sure about their accuracy. For example, who made them or if they’re qualified enough to take care of the thing you need these to. Always keep relaxed and use US Legal Forms! Discover Maine Revocable Living Trust Agreement samples created by professional legal representatives and get away from the costly and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to write a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the file you are trying to find. You'll also be able to access all of your previously downloaded documents in the My Forms menu.

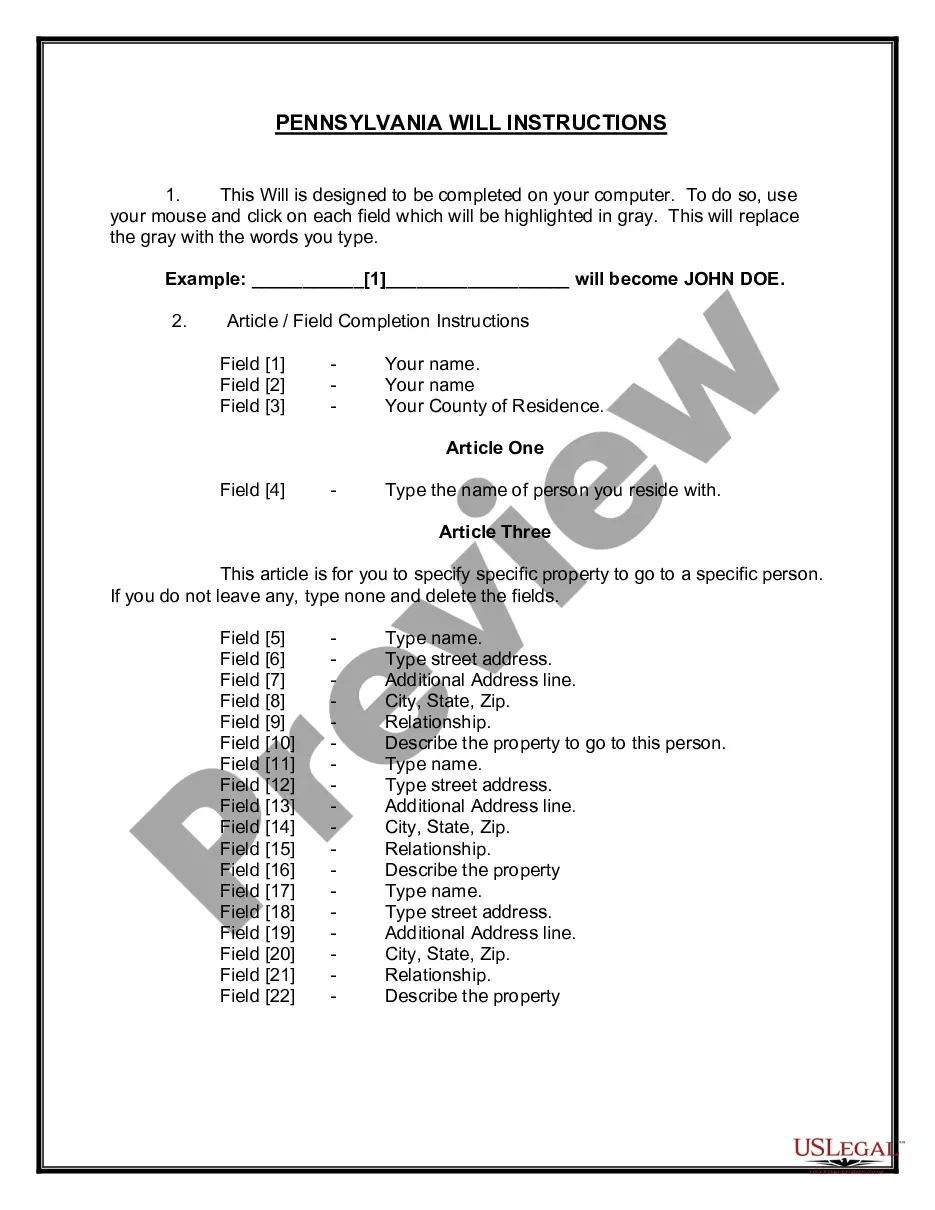

If you are using our service the very first time, follow the tips listed below to get your Maine Revocable Living Trust Agreement easily:

- Make certain that the document you discover applies in the state where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another sample using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you’ve signed up and purchased your subscription, you can use your Maine Revocable Living Trust Agreement as often as you need or for as long as it continues to be active where you live. Revise it with your favored online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

The Revocable Trust creates a legal relationship where there is a written trust agreement. A Trust of this type is often referred to as a Trust under agreement, Grantor Trust, or Living Trust. As its name implies, it is revocable.

As far as the Internal Revenue Service is concerned, trust property belongs to the grantor. The grantor names a trustee to manage the assets, but during their lifetime, most people name themselves in this position. A successor trustee is named to carry on when the grantor dies or becomes incapacitated.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time.Trusts are also a way to reduce tax burdens and avoid assets going to probate.

At the most basic level, a revocable living trust, also known simply as a revocable trust, is a written document that determines how your assets will be handled after you die.Assets you place in the trust are then transferred to your designated beneficiaries upon your death.

Personal trusts are further divided into either 1) Under Declaration of Trust (U/D/T) meaning the grantor and the trustee are the same person and the grantor controls the trust assets, and 2) Trust Under Agreement (U/A) meaning the grantor and the trustee are different persons and the trustee controls the trust assets.

The basic difference between a testamentary trust and a living trust is really just what it sounds like: A testamentary trust is provided for in a last will and testament, while a living trust is set up during the creator's lifetime. A testamentary trust is sometimes called a "will trust," or a "trust under will."

Revocable trusts are created during the lifetime of the trustmaker and can be altered, changed, modified or revoked entirely. Often called a living trust, these are trusts in which the trustmaker: Transfers the title of a property to a trust. Serves as the initial trustee.

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.

A revocable living trust is a trust document created by an individual that can be changed over time. Revocable living trusts are used to avoid probate and to protect the privacy of the trust owner and beneficiaries of the trust as well as minimize estate taxes.