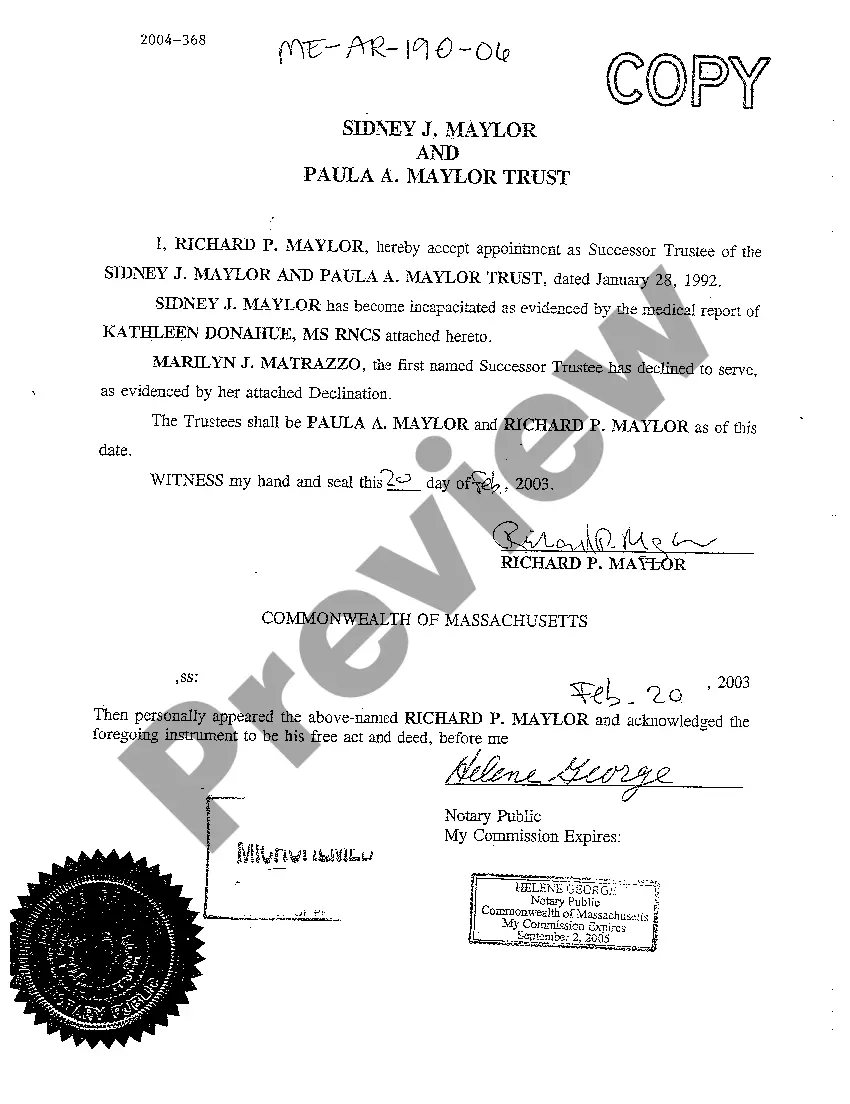

Maine Trustee Agreement

Description

How to fill out Maine Trustee Agreement?

Among countless paid and free templates that you’re able to get on the internet, you can't be sure about their accuracy and reliability. For example, who created them or if they’re qualified enough to take care of what you require them to. Always keep calm and use US Legal Forms! Get Maine Trustee Agreement samples made by skilled attorneys and prevent the high-priced and time-consuming process of looking for an lawyer or attorney and after that having to pay them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you are looking for. You'll also be able to access all of your earlier acquired samples in the My Forms menu.

If you’re making use of our platform for the first time, follow the guidelines below to get your Maine Trustee Agreement quickly:

- Ensure that the file you see is valid in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing procedure or find another example using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you’ve signed up and paid for your subscription, you can utilize your Maine Trustee Agreement as often as you need or for as long as it continues to be active in your state. Edit it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

If you are a beneficiary of a trust and you're entitled to receive money out of that trust, the trustee is supposed to follow the terms of the trust.The trustee is not supposed to refuse to give you any accounting information or financial information. They're not supposed to refuse to talk to you. They can't do that.

Trustee: a person or persons designated by a trust document to hold and manage the property in the trust. Beneficiary: a person or entity for whom the trust was established, most often the trustor, a child or other relative of the trustor, or a charitable organization.

The question typically asked is as follows: can a beneficiary sue a Trustee? The simple answer is Yes, you can sue a trustee of a trust if you feel they breached their fiduciary duty, but remember, there are a few crucial factors you must consider before attempting to incur cost and time.

In most cases, a trustee cannot remove a beneficiary from a trust. This power of appointment generally is intended to allow the surviving spouse to make changes to the trust for their own benefit, or the benefit of their children and heirs.

A trustee takes legal ownership of the assets held by a trust and assumes fiduciary responsibility for managing those assets and carrying out the purposes of the trust.

Trust agreements commonly have provisions that allow beneficiaries to remove or replace a trustee. Usually a majority vote of the beneficiaries is required. Often the trust agreement provides that a trustee may only be removed for cause.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

The Trustee can pay themselves from the trust funds based on the terms of the trust or the state's laws. Some trusts stipulate hourly or flat fees for trustee duties. Professional trustees can earn over $100 per hour, while corporate trustees make 1-2% of the trust's assets as annual compensation.

The owner, called the settlor, transfers the trust property to an intermediary, the trustee, to hold it for the beneficiaries.Either way, the deal between settlor and trustee is functionally indistin- guishable from the modem third-party-beneficiary contract. Trusts are contracts.