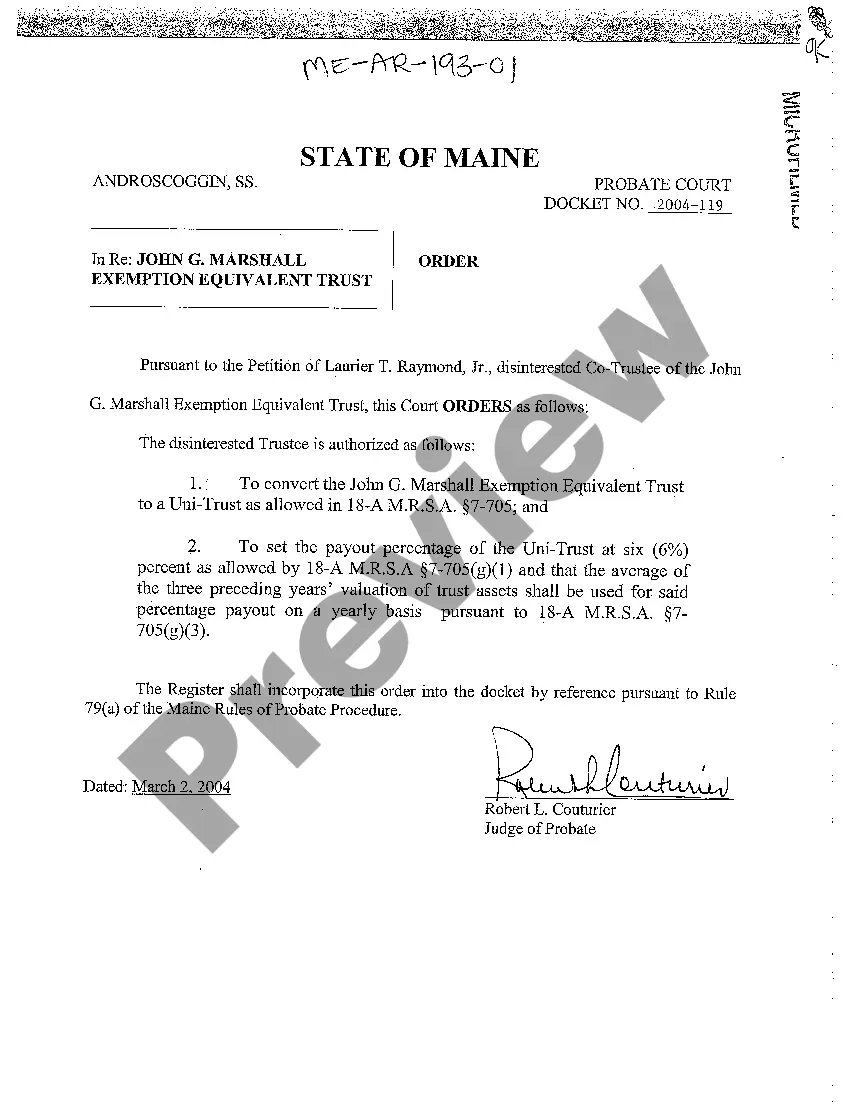

Maine Order to Establish a Higher Pay-Out Percentage of Unitrust

Description

How to fill out Maine Order To Establish A Higher Pay-Out Percentage Of Unitrust?

Among numerous paid and free samples that you find on the internet, you can't be sure about their accuracy and reliability. For example, who made them or if they are competent enough to deal with what you require them to. Always keep calm and utilize US Legal Forms! Discover Maine Order to Establish a Higher Pay-Out Percentage of Unitrust templates developed by professional lawyers and get away from the expensive and time-consuming procedure of looking for an lawyer or attorney and then paying them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all of your earlier saved samples in the My Forms menu.

If you’re utilizing our platform for the first time, follow the tips listed below to get your Maine Order to Establish a Higher Pay-Out Percentage of Unitrust quick:

- Make certain that the document you see applies where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another example utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and bought your subscription, you may use your Maine Order to Establish a Higher Pay-Out Percentage of Unitrust as often as you need or for as long as it stays valid in your state. Revise it in your preferred online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

The unitrust also may have limited usefulness as a marital deduction trust since it may not entirely qualify under the life estate, power of appointment exception to the nondeductible terminable interest rule. The authors wish to point out most emphatically that the unitrust is essentially an annuity trust.

A Flip-CRUT is a net income unitrust (either a net income with makeup charitable remainder unitrust (NIMCRUT) or a net income charitable remainder trust (NI-CRUT)) that switches to a standard charitable remainder unitrust (CRUT) upon a triggering event or date.

A standard unitrust provides an income based on a fixed percentage that is determined at the time you set up the trust. The percentage must be 5% or more, which is then multiplied by the fair market value of the trust assets at the beginning of each year.

A Total Return Unitrust is a variation of a fairly common estate planning device, the Charitable Remainder Unitrust. The current beneficiary receives a distribution of a specified percentage of the trust's value each year. The amount of the distribution is based on the value of the trust, not in its income.

The unitrust conversion permits that trustee to pay the income beneficiary of the trust a payout rate based on the net asset value of the trust. The rate ranges from 3-5%.For example, if the trustee seeks to apply a rate of 5% to the unitrust, the written consent of all remainder beneficiaries must be obtained.

: a trust from which the beneficiary receives annually a fixed percentage of the fair market value of its assets.

Unitrust amount means a distribution mandated by the terms of a trust in an amount equal to a fixed percentage of not less than three or more than five percent per year of the net fair market value of the trust's assets, valued at least annually.