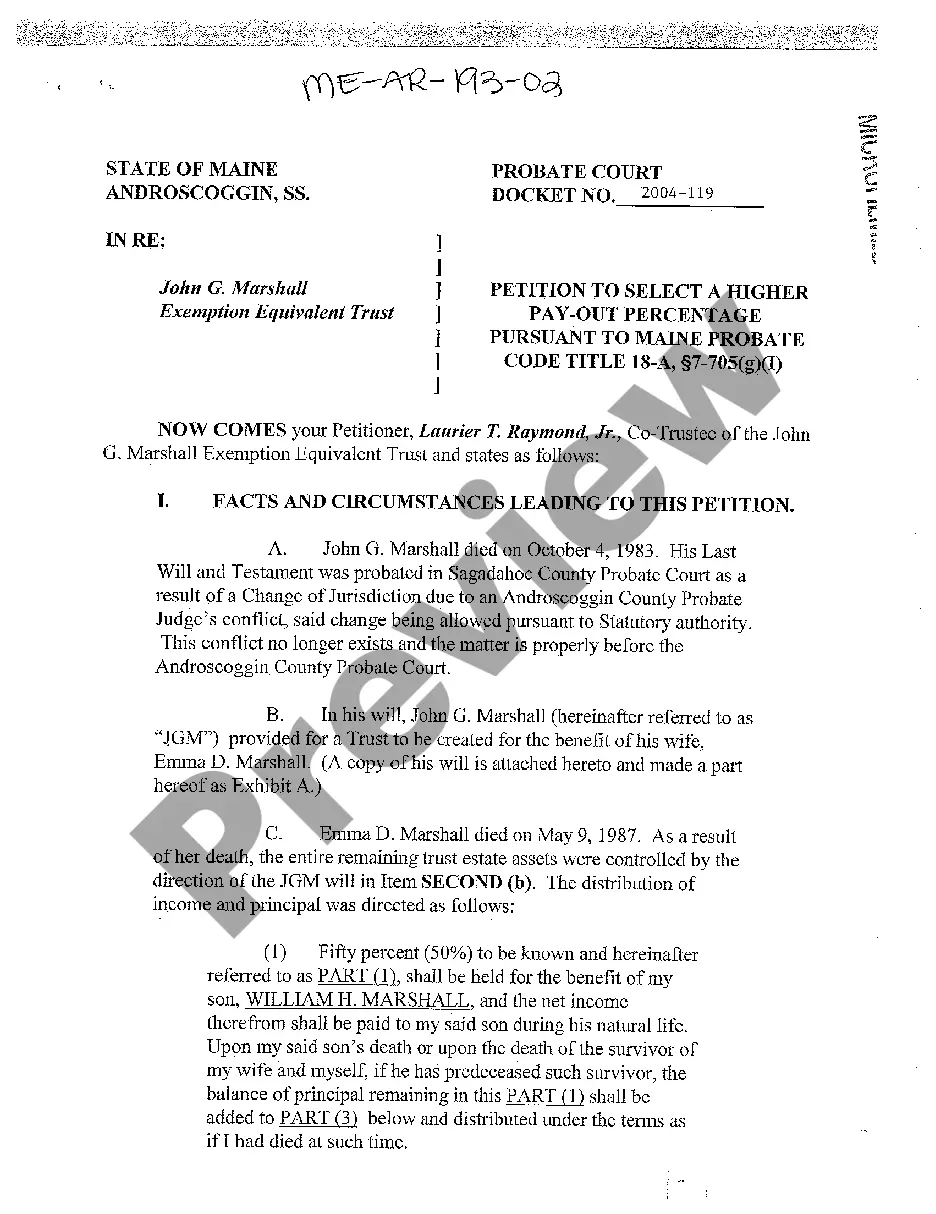

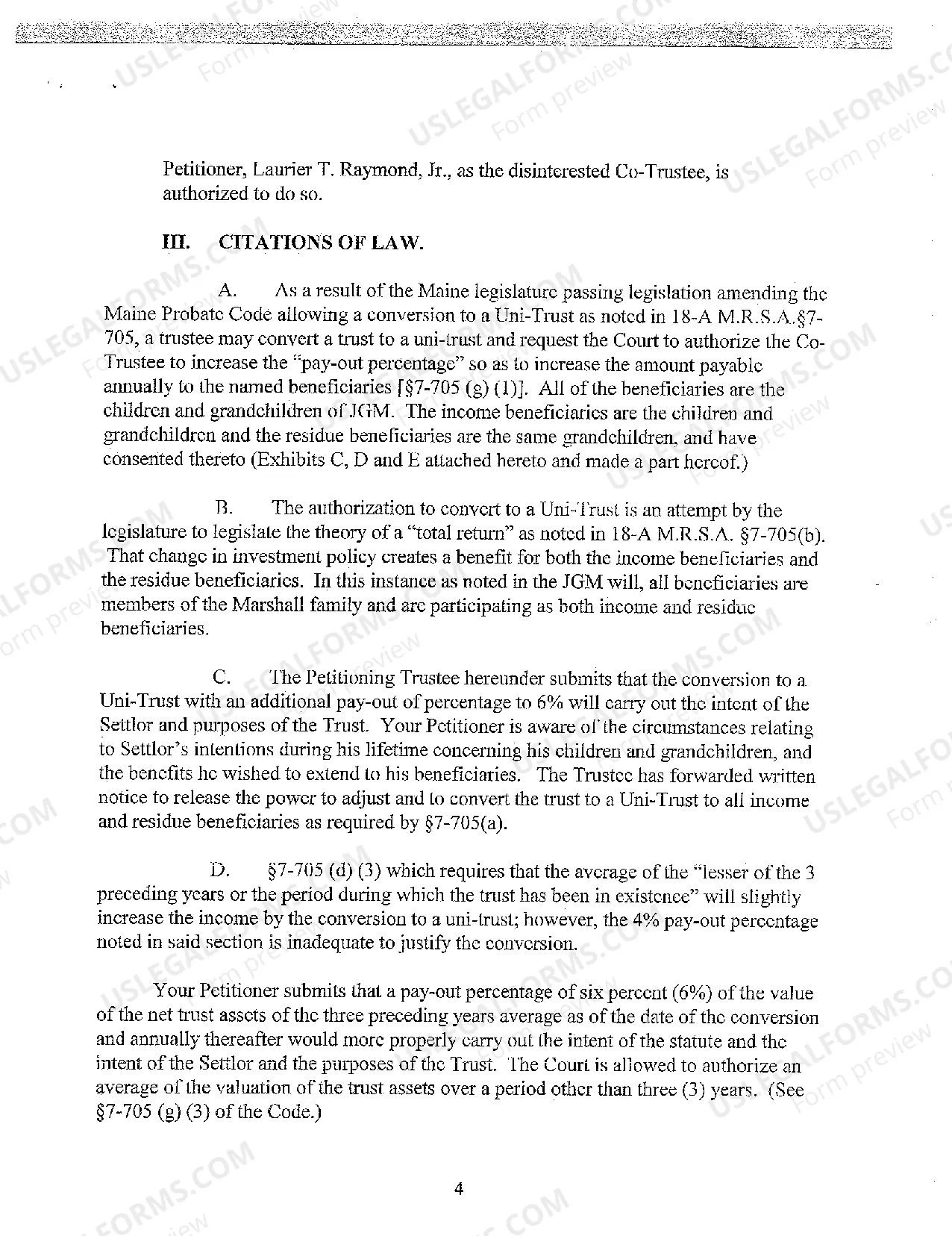

Petition to Select a Higher Pay-Out Percentage Pursuant to Maine Probate Code Title 18-A

Description

How to fill out Petition To Select A Higher Pay-Out Percentage Pursuant To Maine Probate Code Title 18-A?

Among numerous paid and free samples that you find on the internet, you can't be sure about their accuracy and reliability. For example, who made them or if they are competent enough to deal with what you require them to. Always keep calm and utilize US Legal Forms! Discover Petition to Select a Higher Pay-Out Percentage Pursuant to Maine Probate Code Title 18-A templates developed by professional lawyers and get away from the expensive and time-consuming procedure of looking for an lawyer or attorney and then paying them to draft a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access all of your earlier saved samples in the My Forms menu.

If you’re utilizing our platform for the first time, follow the tips listed below to get your Petition to Select a Higher Pay-Out Percentage Pursuant to Maine Probate Code Title 18-A quick:

- Make certain that the document you see applies where you live.

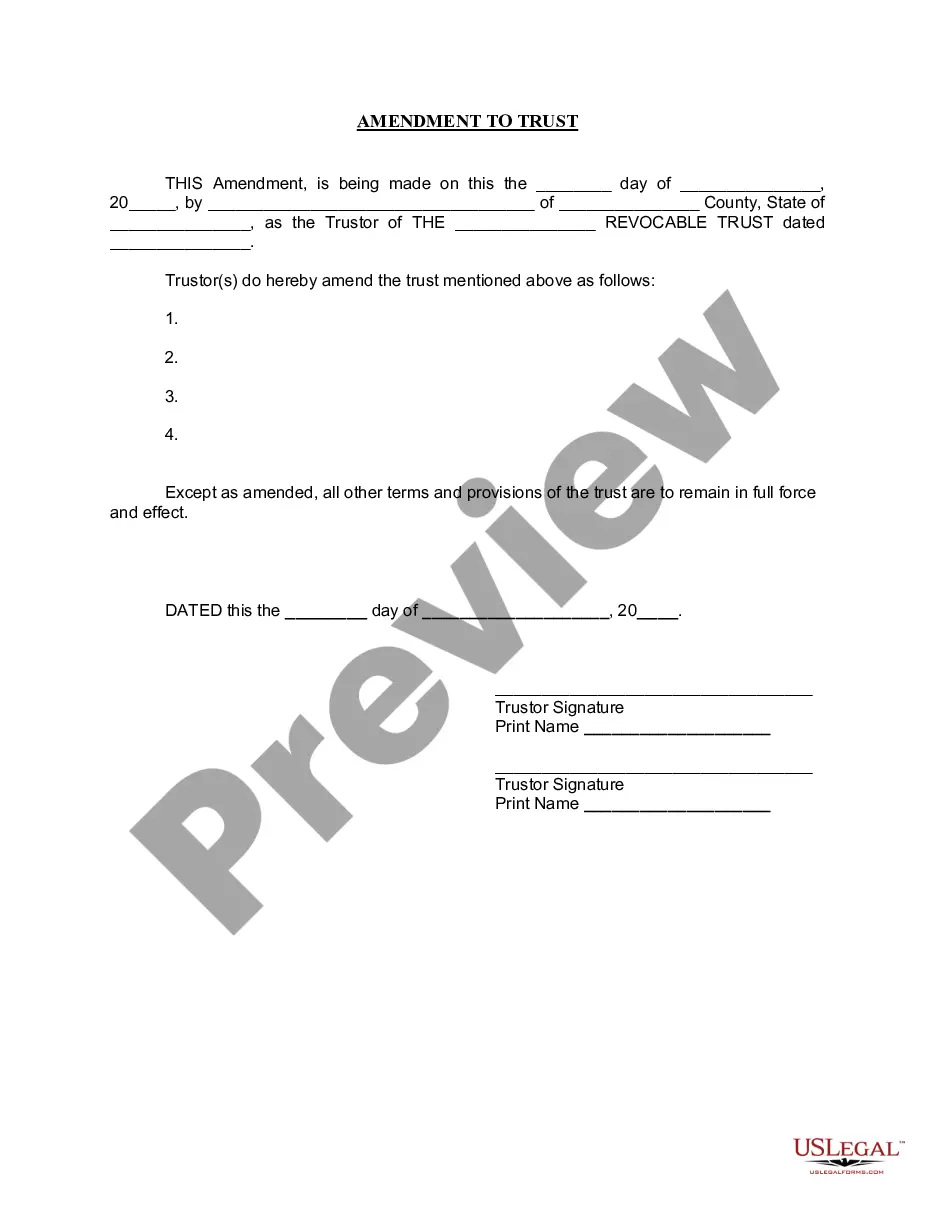

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another example utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and bought your subscription, you may use your Petition to Select a Higher Pay-Out Percentage Pursuant to Maine Probate Code Title 18-A as often as you need or for as long as it stays valid in your state. Revise it in your preferred online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

In the simplest of terms, under California intestate succession laws, the transfer of property after a death without a will in California generally will be divided among the spouse, children, parents, grandparents, siblings, cousins, aunts, uncles, nieces, and nephews of the deceased.

The threshold for Probate can range from £5,000 to A£50,000, depending on which banks and financial institutions are holding the deceased person's assets.

Review the estate planning document carefully to determine the identity of the heirs. Determine the status of the administration of the estate in probate court if you are distributing money from a will. Contact each heir by letter to inform them of the pending money distribution and the amount that they should expect.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

As the term suggests, this is the value the property would reasonably be expected to fetch on the open market if sold to a willing buyer. The probate valuation should be in line with the date of transfer, which is usually the day the deceased passed away.

In 2019 the current Probate filing fees for the Supreme Court, will depend on the estimated value of the assets of the deceased Estate that are located in NSW.For an Estate valued at less than $100,000 no filing fee is payable. For an Estate valued between $100,000 and $250,000 the filing fee is $761.

Probate is the court-supervised process of authenticating a last will and testament if the deceased made one. It includes locating and determining the value of the person's assets, paying their final bills and taxes, and distributing the remainder of the estate to their rightful beneficiaries.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

As the applicant, you must pay a filing fee based on the estimated value of the probate estate. The fee varies depending on the size of the estate from $20.00 for an estate of $10,000 or less to $950.00 for an estate of $2,000,000 plus $100.00 for each additional $500,000.