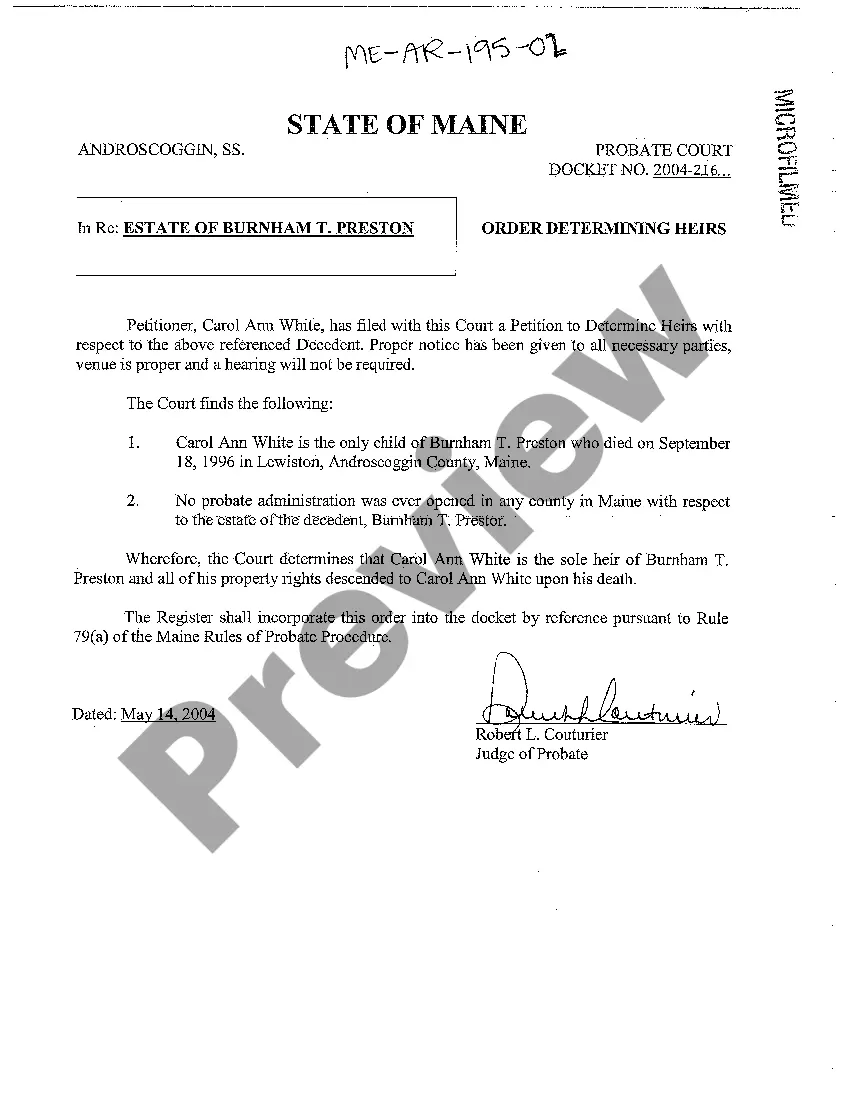

Maine Order to Determine Heirs

Description

How to fill out Maine Order To Determine Heirs?

Among lots of paid and free examples that you’re able to get on the net, you can't be sure about their reliability. For example, who made them or if they’re competent enough to take care of what you need these to. Keep calm and use US Legal Forms! Locate Maine Order to Determine Heirs samples created by skilled attorneys and avoid the expensive and time-consuming procedure of looking for an lawyer and after that paying them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the file you’re looking for. You'll also be able to access all of your earlier acquired samples in the My Forms menu.

If you are making use of our website the very first time, follow the instructions listed below to get your Maine Order to Determine Heirs quickly:

- Ensure that the file you discover applies where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another sample using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

As soon as you’ve signed up and bought your subscription, you can use your Maine Order to Determine Heirs as often as you need or for as long as it continues to be valid where you live. Change it in your favorite offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.

In many states, the required period is 120 hours, or five days. In some states, however, an heir need only outlive the deceased person by any period of time -- theoretically, one second would do.

Ask friends and family of the deceased. Advertise in a local newspaper for several consecutive weeks. Write to last known addresses. Search online. Search real and personal property index in the assessor's office in the counties where the heir resided.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Heirs-at-law An heir-at-law is the deceased's next of kin, and they are required to be notified whether there is a will or not even if they're specifically not named in an existing will.

In most cases, a deceased person's heirs-at-law are determined by the intestacy laws of the state in which she lived at the time of her death. But the intestacy laws of another state might apply if she owned real estate or tangible personal property there.

An heir is a person who is legally entitled to collect an inheritance, when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants or other close relatives of the decedent.