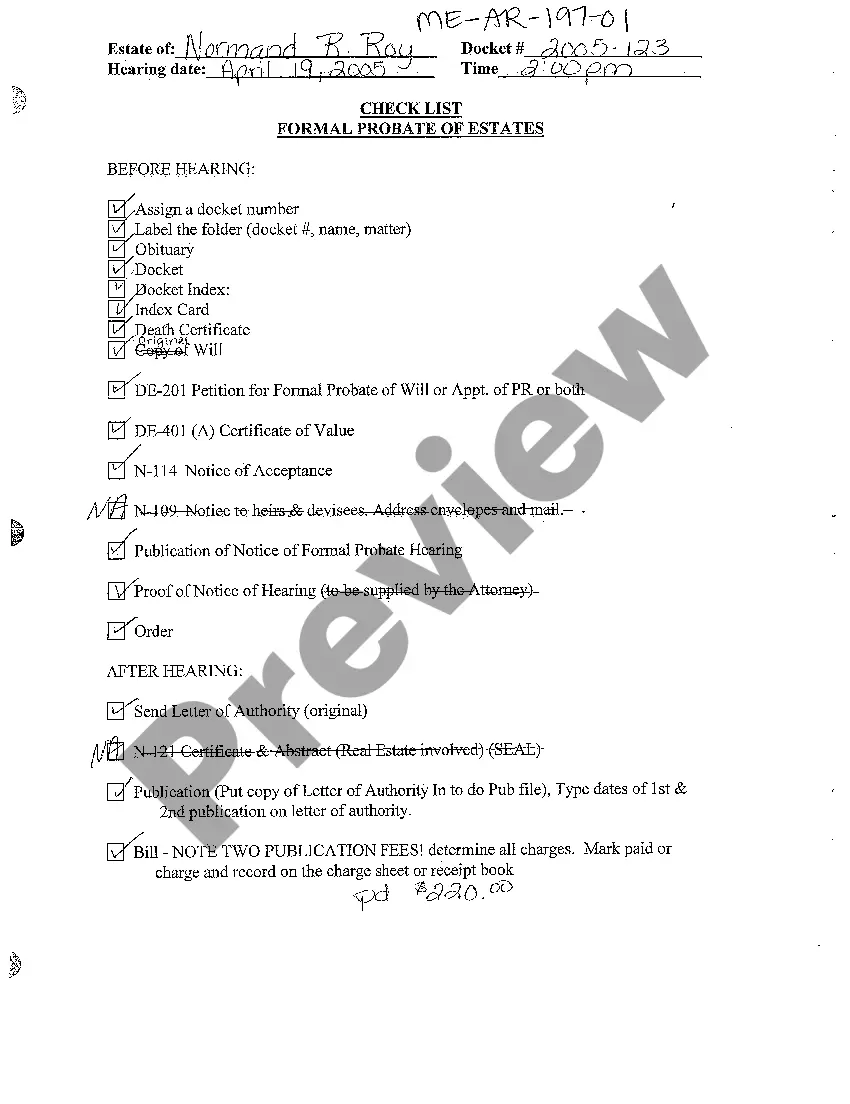

Maine Checklist - Formal Probate of Estates

Description

How to fill out Maine Checklist - Formal Probate Of Estates?

Among numerous paid and free examples that you’re able to find on the web, you can't be sure about their accuracy. For example, who created them or if they are skilled enough to take care of what you need these to. Always keep relaxed and use US Legal Forms! Discover Maine Checklist - Formal Probate of Estates samples made by skilled lawyers and avoid the high-priced and time-consuming procedure of looking for an lawyer and after that paying them to draft a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you’re searching for. You'll also be able to access your earlier acquired samples in the My Forms menu.

If you’re using our platform the first time, follow the guidelines listed below to get your Maine Checklist - Formal Probate of Estates fast:

- Make sure that the file you see is valid where you live.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template utilizing the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

As soon as you’ve signed up and purchased your subscription, you may use your Maine Checklist - Formal Probate of Estates as often as you need or for as long as it remains active where you live. Change it in your favorite editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

Gathering any assets, eg, money left in bank accounts. Paying any bills. Distributing what's left according to the will.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

To start the probate process, you need to file an Application for Probate in the probate court in the county where the decedent lived. In Maine, each county has its own probate court. If there is a Will, it needs to be submitted to the probate court. The probate judge will decide whether or not the Will is valid.

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.

Non-probate assets include assets held as joint tenants with rights of survivorship, assets with a beneficiary designation, and assets held in the name of a trust or with a trust named as the beneficiary.Your Will does not control these assets.

Pass real estate and other assets owned in joint tenancy to the surviving joint tenant. transfer bank accounts and securities registered in "payable on death" form to beneficiaries. transfer funds in IRAs and retirement plans to named beneficiaries.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.