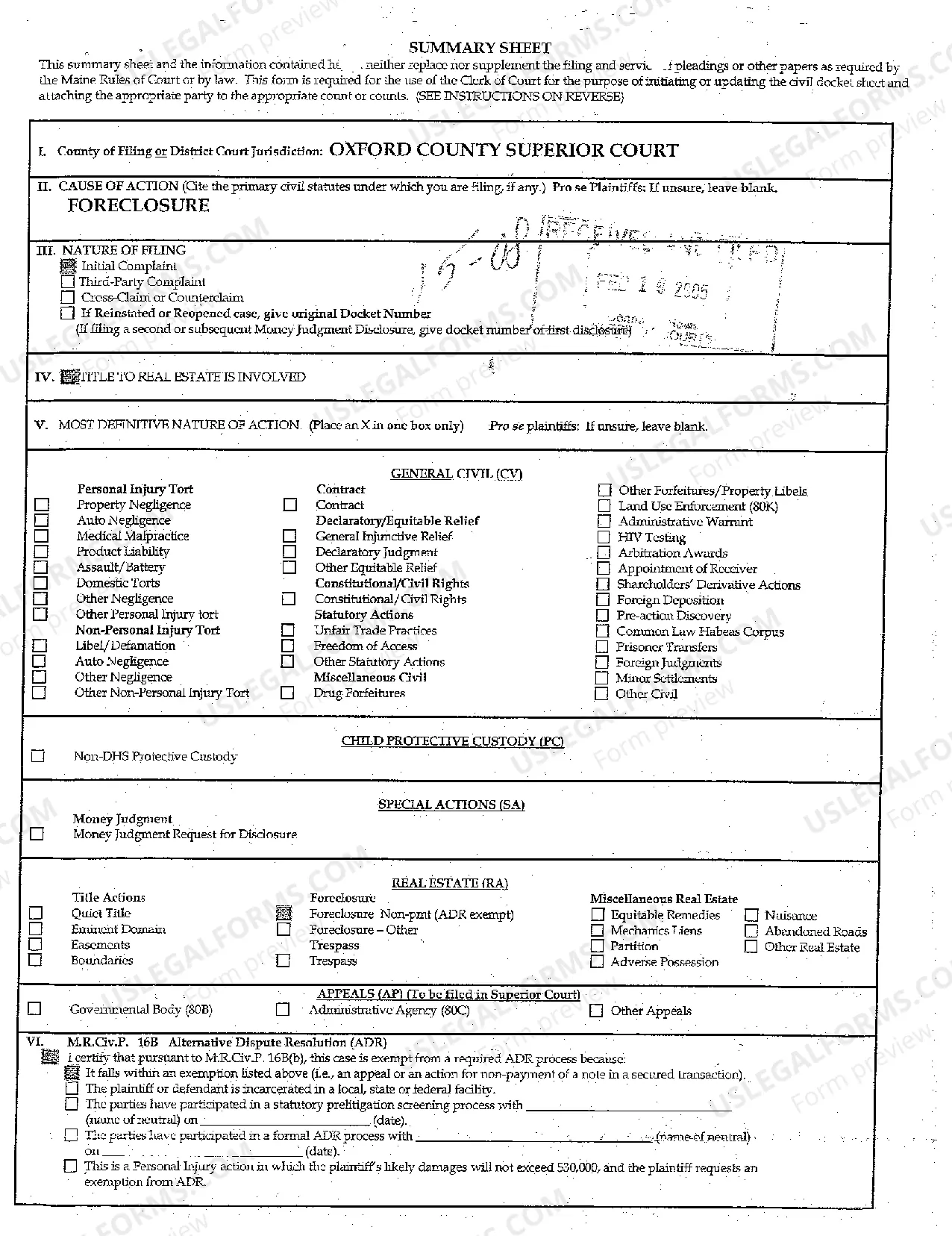

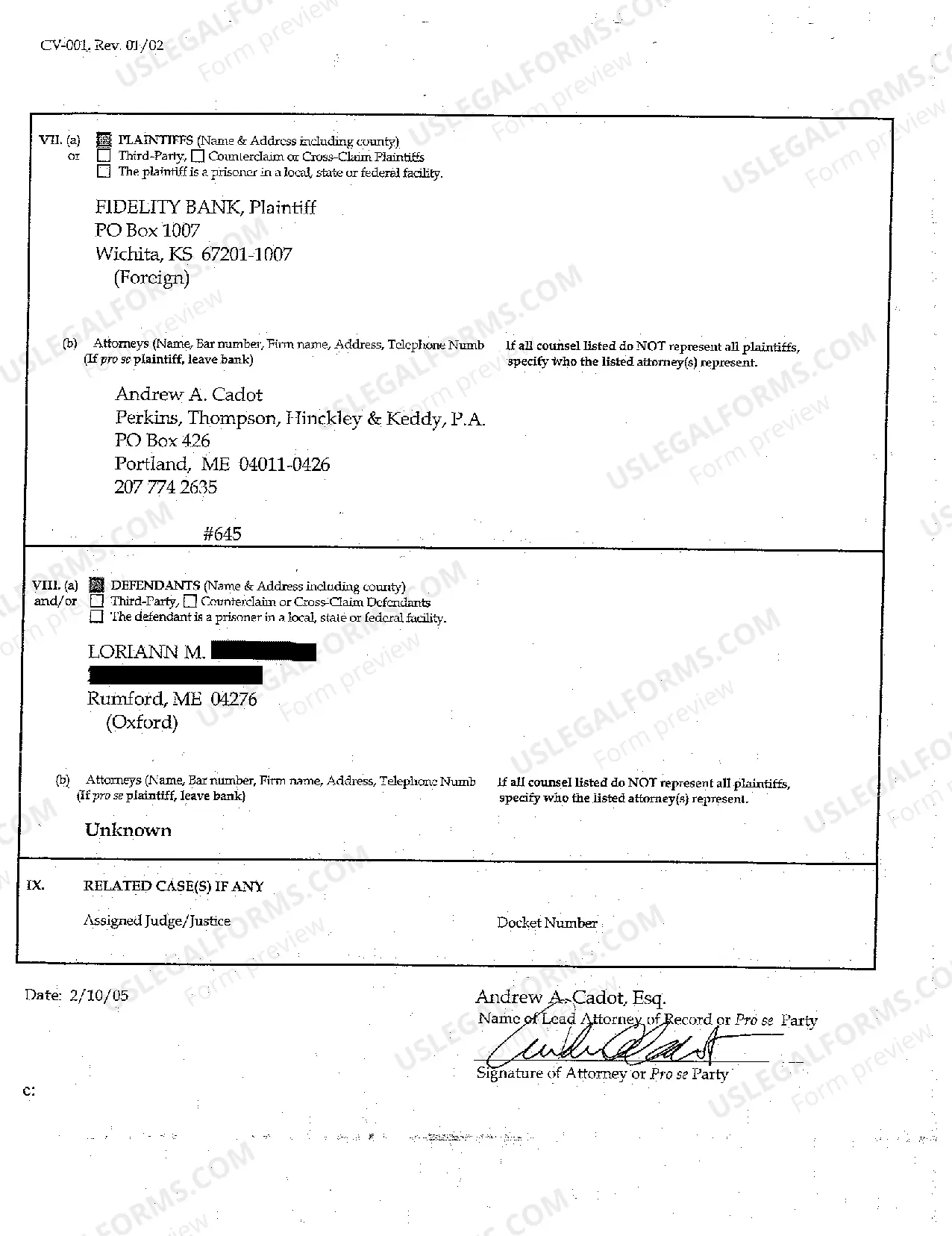

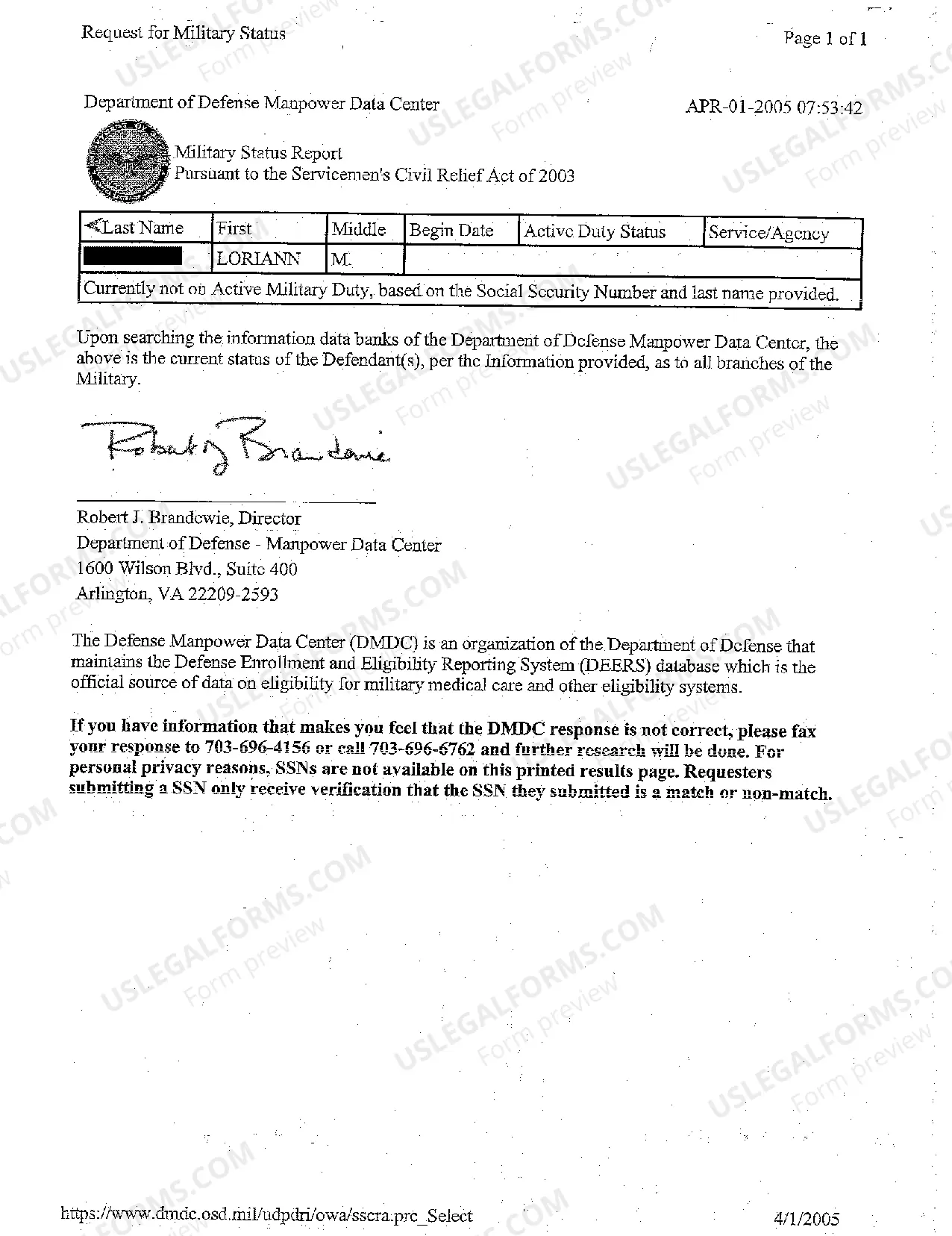

Maine Complaint for Foreclosure of Mortgage Title to Real Estate is Involved

Description

How to fill out Maine Complaint For Foreclosure Of Mortgage Title To Real Estate Is Involved?

You are welcome to the largest legal files library, US Legal Forms. Right here you will find any template including Maine Complaint for Foreclosure of Mortgage Title to Real Estate is Involved forms and download them (as many of them as you want/require). Make official papers in just a couple of hours, rather than days or weeks, without spending an arm and a leg on an attorney. Get the state-specific example in a couple of clicks and feel confident knowing that it was drafted by our qualified lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download next to the Maine Complaint for Foreclosure of Mortgage Title to Real Estate is Involved you want. Because US Legal Forms is web-based, you’ll always have access to your downloaded files, no matter what device you’re utilizing. Find them in the My Forms tab.

If you don't have an account yet, what are you waiting for? Check out our instructions listed below to begin:

- If this is a state-specific sample, check out its validity in the state where you live.

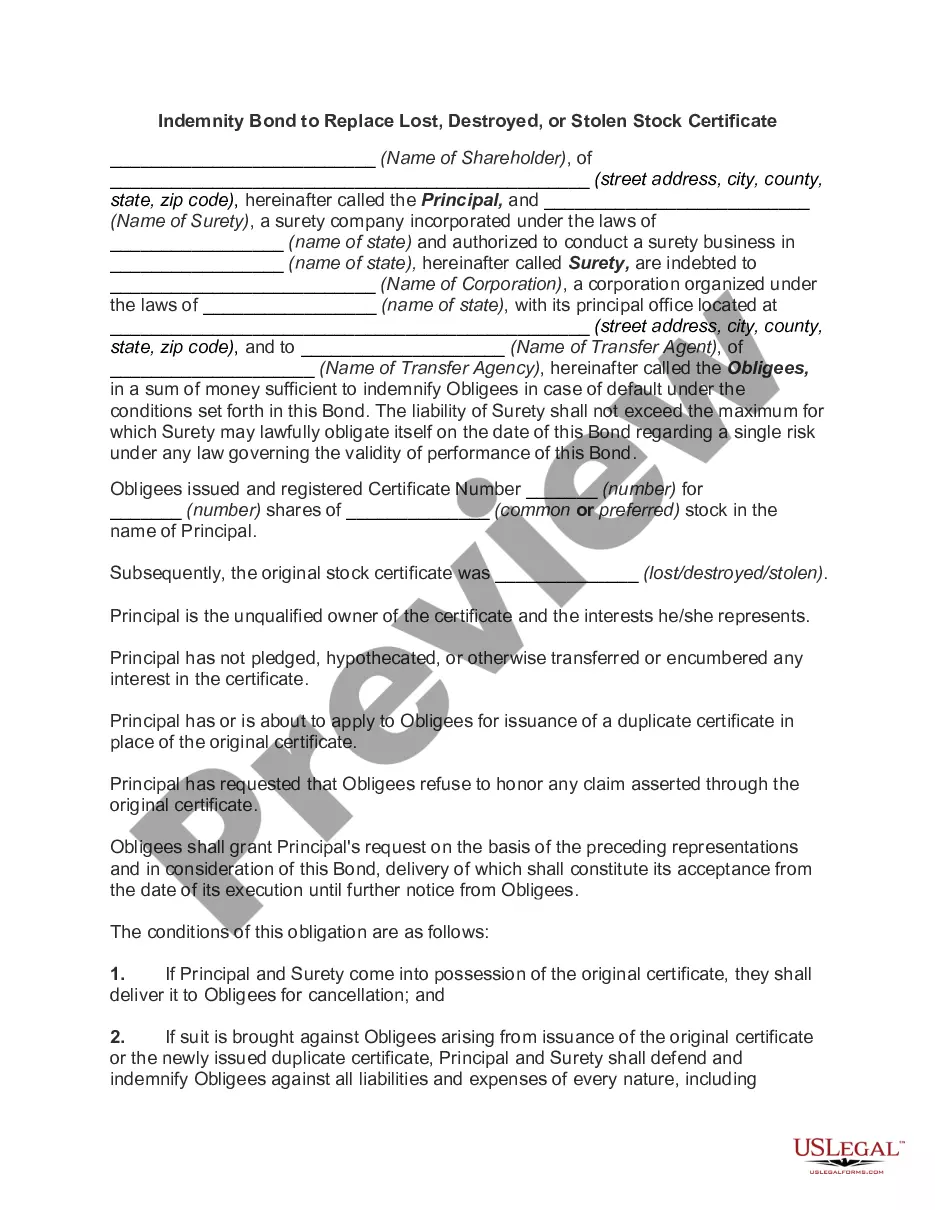

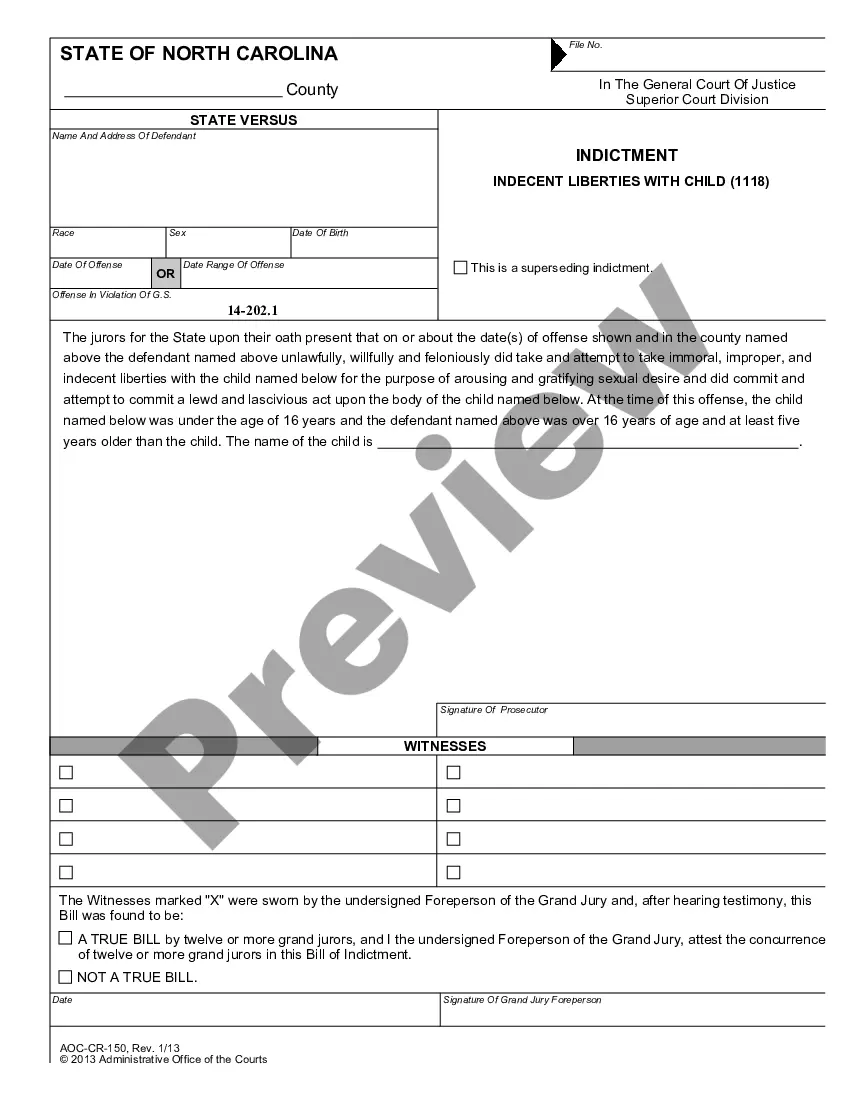

- Look at the description (if readily available) to learn if it’s the right template.

- See much more content with the Preview function.

- If the sample fulfills your needs, click Buy Now.

- To create an account, choose a pricing plan.

- Use a credit card or PayPal account to join.

- Download the file in the format you need (Word or PDF).

- Print out the document and complete it with your/your business’s info.

Once you’ve completed the Maine Complaint for Foreclosure of Mortgage Title to Real Estate is Involved, send out it to your lawyer for confirmation. It’s an additional step but a necessary one for being sure you’re completely covered. Sign up for US Legal Forms now and get a large number of reusable samples.

Form popularity

FAQ

Essentially, a judicial foreclosure means that the lender goes to court to get a judgment to foreclose on your home, while a non-judicial foreclosure means that the lender does not need to go to court.

Most people do not realize that they can stop foreclosure even if they stopped paying their mortgage. Absolutely! Many recent cases have been filed improperly and an experienced attorney can assist with the identification and filing of substantive and procedural defenses with the court and vigorously defend your case.

Foreclosure is what happens when a homeowner fails to pay the mortgage. More specifically, it's a legal process by which the owner forfeits all rights to the property. If the owner can't pay off the outstanding debt, or sell the property via short sale, the property then goes to a foreclosure auction.

Negotiate With Your Lender. If you found yourself in a situation where you are behind on mortgage payments, and believe that your lender can try to foreclose on your house, try negotiating a new payment plan. Reinstate Your Loan. Forbearance Plan. Sell Your Property.

As part of the lawsuit, the foreclosing party includes a petition for foreclosure that explains why a judge should issue a foreclosure judgment. In most cases, the court will do so, unless the borrower has a defense that justifies the delinquent payments.

Foreclosures are generally judicial in the following states: Connecticut, Delaware, District of Columbia (sometimes), Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana (executory proceeding), Maine, Nebraska (sometimes), New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma (if the

Maine is a Title Theory State which means that legal title is conveyed along with the mortgage subject only to the defeasance clause.

Most states allow lenders to sue borrowers for deficiencies after foreclosure or, in some cases, in the foreclosure action itself. Some states allow deficiency lawsuits in judicial foreclosures, but not in nonjudicial foreclosures.Your lender most likely won't sue you if they think they won't recover anything.

In Maine, lenders may foreclose on mortgages in default by using either a judicial or strict foreclosure process. Although Maine allows lenders to pursue foreclosure by judicial methods, which involves filing a lawsuit to obtain a court order to foreclose, it is only used in special circumstances.