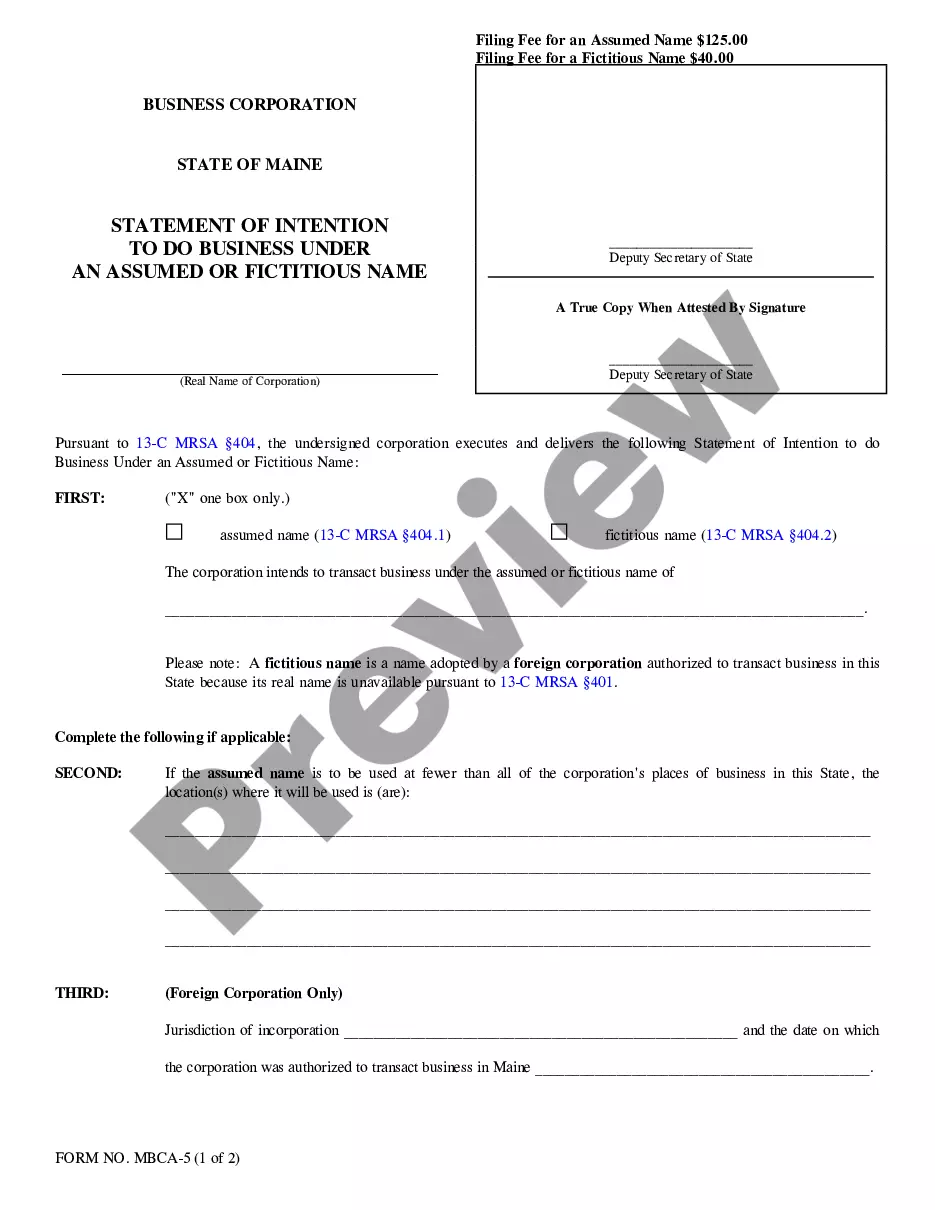

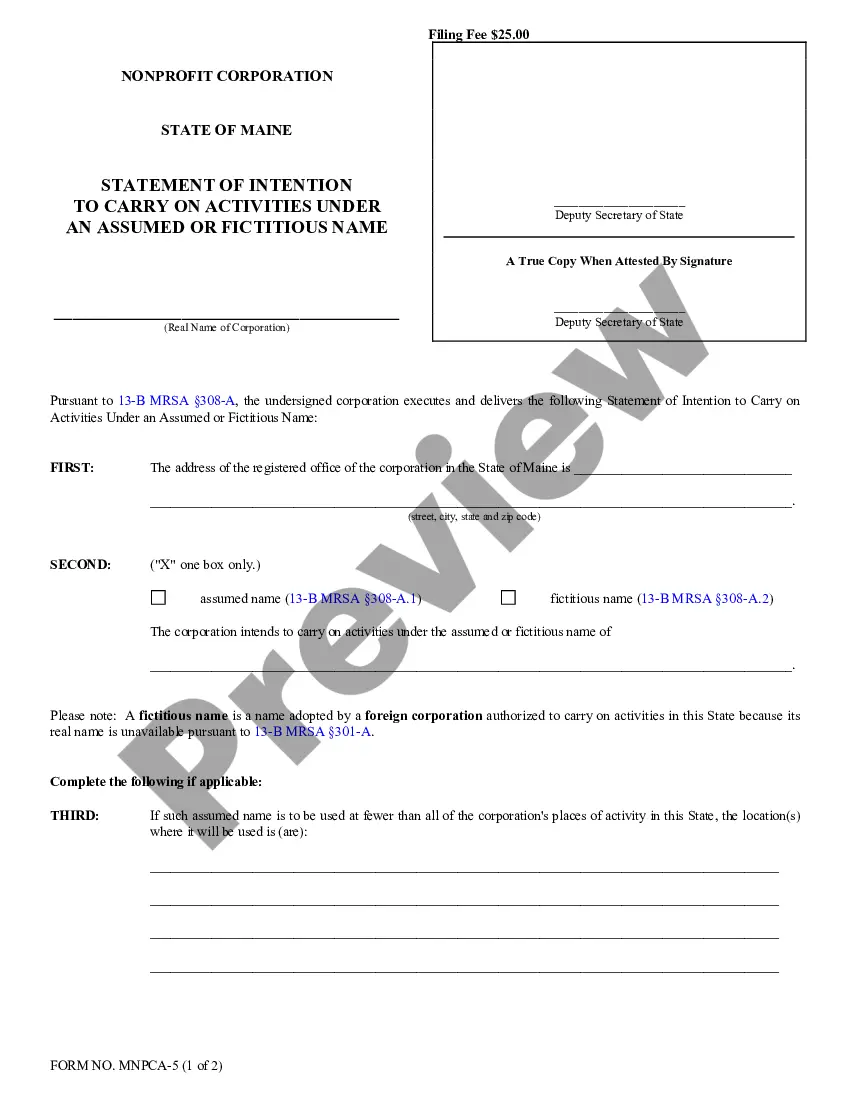

This form is required to be filed by a corporation doing business in the state using an assumed name. After completing and signing, it must be submitted to the Secretary of State, along with the required fee.

Maine Statement of Intention to Do Business Under an Assumed or Fictitious Name by a Corporation

Description

Key Concepts & Definitions

Statement of Intention to Do Business Under An Assumed Name: This is a formal declaration made by business entities, indicating their intent to operate under a name other than their legal business name. Business Assumed Name: Also known as a fictitious business name, used by companies to conduct business under a name that differs from the officially registered name.

Step-by-Step Guide to Registering a Fictitious Business Name

- Choose Your Business Name: Select a name that complies with state regulations and is not already in use.

- Check Availability: Use the Secretary of State's website or online name registration services to ensure the name is not already taken.

- File Your Statement of Intention: Complete the business name registration process by submitting the necessary forms, which can often be downloaded from the state's website.

- Pay the Required Fees: Submit the necessary fees for registering your fictitious name.

- Publish a Notice: Some states require publication of the new business name in a local newspaper for a set period.

- Start Using the Name: Once all legal requirements are fulfilled, begin using your new business name in all operations.

Risk Analysis

Using an assumed business name without proper registration can lead to legal disputes, including trademark infringement. Failure to comply with local publication requirements may result in the business being unable to legally enforce contracts under the assumed name.

Key Takeaways

- Registering a fictitious name is crucial for complacency and brand identity.

- Each state has different requirements and processes for registration.

- Regularly review business name compliance to adapt to any changes in state laws.

Common Mistakes & How to Avoid Them

- Not Researching the Name Thoroughly: Always use the Secretary of State's resources or trusted online name registration services to avoid legal issues.

- Ignoring State-Specific Requirements: Not all states have the same publication or filing requirements; understand and follow your states regulations.

- Delaying the Registration Process: Delay can lead to someone else registering your chosen name. Act promptly once you decide on a name.

FAQ

Can I change my company name to a different fictitious name later on? Yes, but you must go through the registration process again with your new name. What happens if I dont register my fictitious business name? You might face legal penalties, and you could be prevented from using that name in legal documents.

How to fill out Maine Statement Of Intention To Do Business Under An Assumed Or Fictitious Name By A Corporation?

Greetings to the largest legal document repository, US Legal Forms.

Here you can discover any template including Maine Statement of Intention to Conduct Business Under an Assumed or Fictitious Name by a Corporation samples and download them (as many as you desire or require). Prepare official documents within a few hours, instead of days or weeks, without spending a fortune on an attorney.

Obtain your state-specific document in a few clicks and rest assured with the understanding that it was crafted by our state-certified lawyers.

If the template meets all your needs, click Buy Now. To set up an account, select a pricing plan. Utilize a credit card or PayPal account to register. Download the document in the format you require (Word or PDF). Print the document and complete it with your or your business’s information. After you’ve finished the Maine Statement of Intention to Conduct Business Under an Assumed or Fictitious Name by a Corporation, send it to your attorney for confirmation. It’s an extra step but a vital one for ensuring you’re fully protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If you’re already a registered user, simply Log Into your account and then click Download next to the Maine Statement of Intention to Conduct Business Under an Assumed or Fictitious Name by a Corporation you prefer.

- Since US Legal Forms is internet-based, you’ll typically have access to your stored templates, regardless of the device you’re using.

- Locate them within the My documents section.

- If you haven't created an account yet, what are you waiting for.

- Follow our guidelines provided below to get started.

- If this is a state-specific document, confirm its validity in the state where you reside.

- Check the description (if available) to discern if it’s the correct template.

- Explore additional content with the Preview feature.

Form popularity

FAQ

You can only file your personal and business taxes separately if your company it is a corporation, according to the IRS.Corporations file their taxes using Form 1120. Limited liability companies (LLCs) can also choose to be treated as a corporation by the IRS, whether they have one or multiple owners.

To do business under a DBA, you must complete and file the appropriate DBA forms and pay a filing fee, after which point you receive a DBA certificate. Depending on the state you may be able to file with a local or county clerk's office, with a state agency, or both.

The DBA has to be filled out and notarized with no errors due to the fact that it is recorded with the County. Filing for a DBA allows you to do business under a different name.The name of your business is up to you, but it needs to be properly registered with the state of California.

Regarding doing business as form concerns, as a self-employed individual listed as doing business as (DBA), you only have to file these forms if appropriate to your self-employment business: Form 1040. Schedule C.

A DBA Is Reported on Schedule C The DBA is reported on your personal 1040 tax return. The business income and expenses will be entered in Schedule C. All profits from the DBA are subject to self-employment tax.

1Step 1 Obtain the Form. Get the Assumed Business Name registration form from the Municipal or Town Clerk.2Step 2 Fill out the Form.3Step 3 Notarize the Form.4Step 4 Submit the Form.

It is NOT a separate entity. A Sole Proprietor fills out Schedule C as part of your Form 1040. You will also fill out Schedule SE for your employment taxes on your net profit.

Depending on the jurisdiction, most DBA filings take 1-4 weeks with some exceptions. Is filing a DBA the same thing as filing for a Trademark? many jurisdictions, more than one applicant can file the exact same DBA. The only way to legally ensure exclusive rights to the use of a name is to register a trademark.

No Special Tax Benefits: Unlike a corporation, filing a DBA that is not part of an LLC or another 'corporate umbrella' will not give you any special tax benefits. Your business' revenues will be passed on to your individual tax return and taxed accordingly.