The dissolution of a corporation package contains all forms to dissolve a corporation in Maine, step by step instructions, addresses, transmittal letters, and other information.

Maine Dissolution Package to Dissolve Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maine Dissolution Package To Dissolve Corporation?

You are invited to the finest legal document repository, US Legal Forms.

Here you will discover any template such as Maine Dissolution Package to Dissolve Corporation forms and retain them (as many as you desire/require).

Create official documents in a few hours, instead of days or weeks, without overspending on an attorney.

Explore additional content using the Preview feature. If the sample meets all your needs, click Buy Now. To establish an account, select a pricing plan. Use a credit card or PayPal account to register. Download the document in the format you require (Word or PDF). Print the paper and complete it with your or your business’s information. Once you’ve filled out the Maine Dissolution Package to Dissolve Corporation, provide it to your attorney for validation. It’s an additional step but a crucial one for ensuring you’re fully protected. Join US Legal Forms today and gain access to a vast collection of reusable templates.

- Obtain the state-specific form with just a few clicks and feel confident knowing that it was prepared by our state-certified legal experts.

- If you’re already a registered user, simply Log In to your account and click Download next to the Maine Dissolution Package to Dissolve Corporation you require.

- Since US Legal Forms is online-based, you will constantly have access to your stored documents, no matter the device you are using.

- Find them within the My documents section.

- If you don't possess an account yet, what are you waiting for.

- Follow our instructions provided below to get started.

- If this is a state-specific form, verify its relevance in the jurisdiction where you reside.

- Review the description (if available) to determine if it’s the correct template.

Form popularity

FAQ

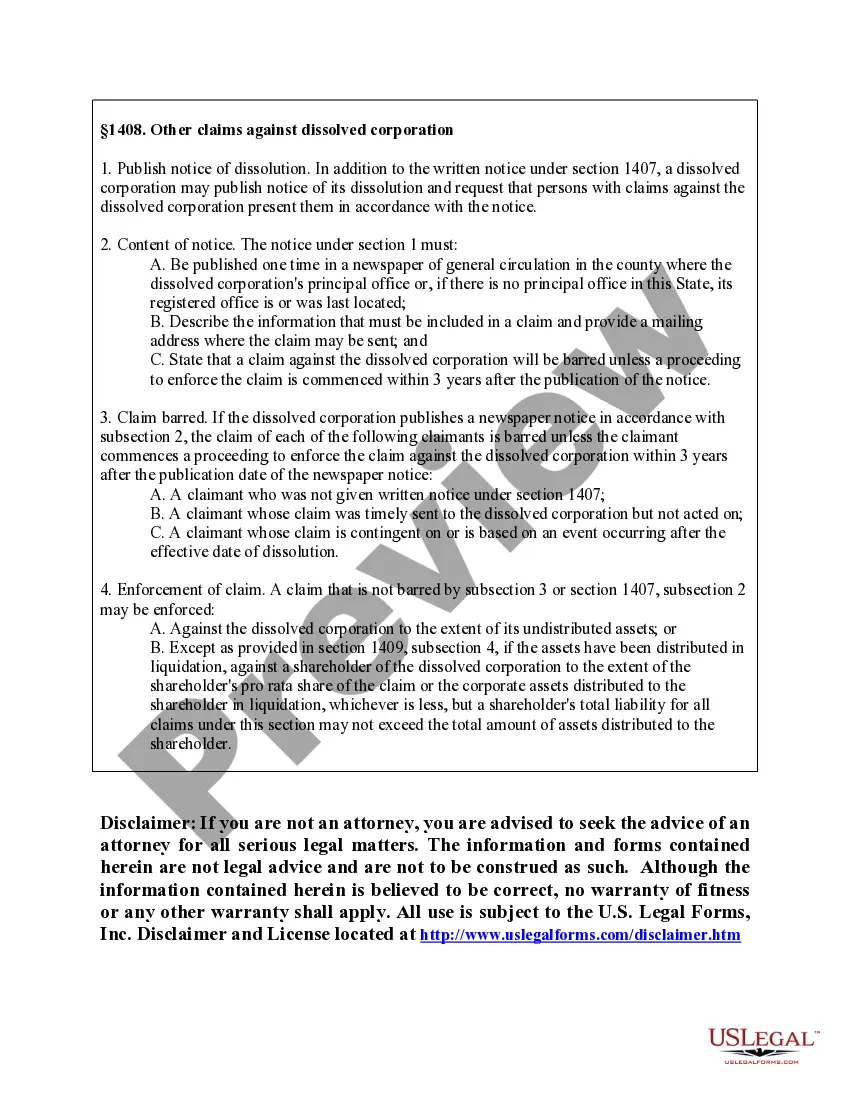

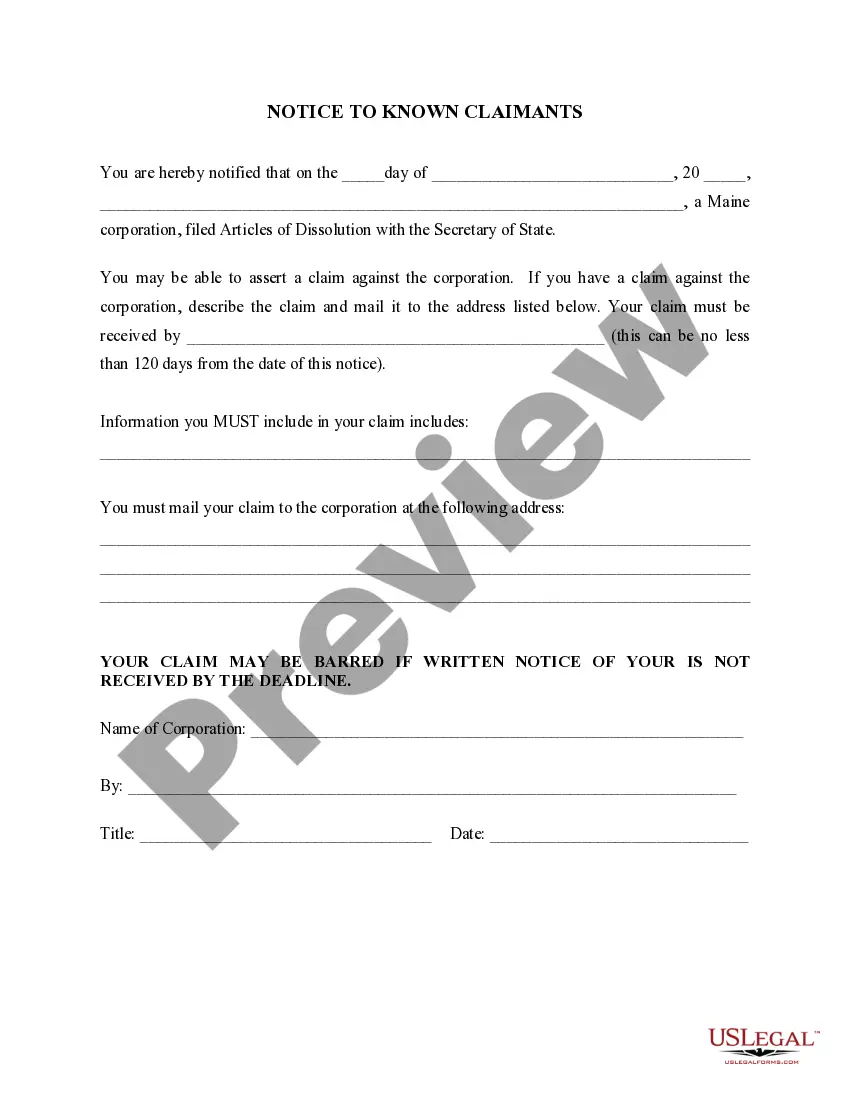

Dissolving a corporation involves a few key steps. First, you must prepare and submit your Maine Dissolution Package to Dissolve Corporation to the Secretary of State. This package typically includes forms that detail your intention to dissolve, as well as any required fees. After your application is processed, ensure all financial obligations are settled, and notify any interested parties about the dissolution.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

There is a no fee to file the certificate of cancellation by mail. However, if you deliver the certificate in person there is a $15 special handling fee.

Maine requires business owners to submit their Certificate of Cancellation by mail or in person. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

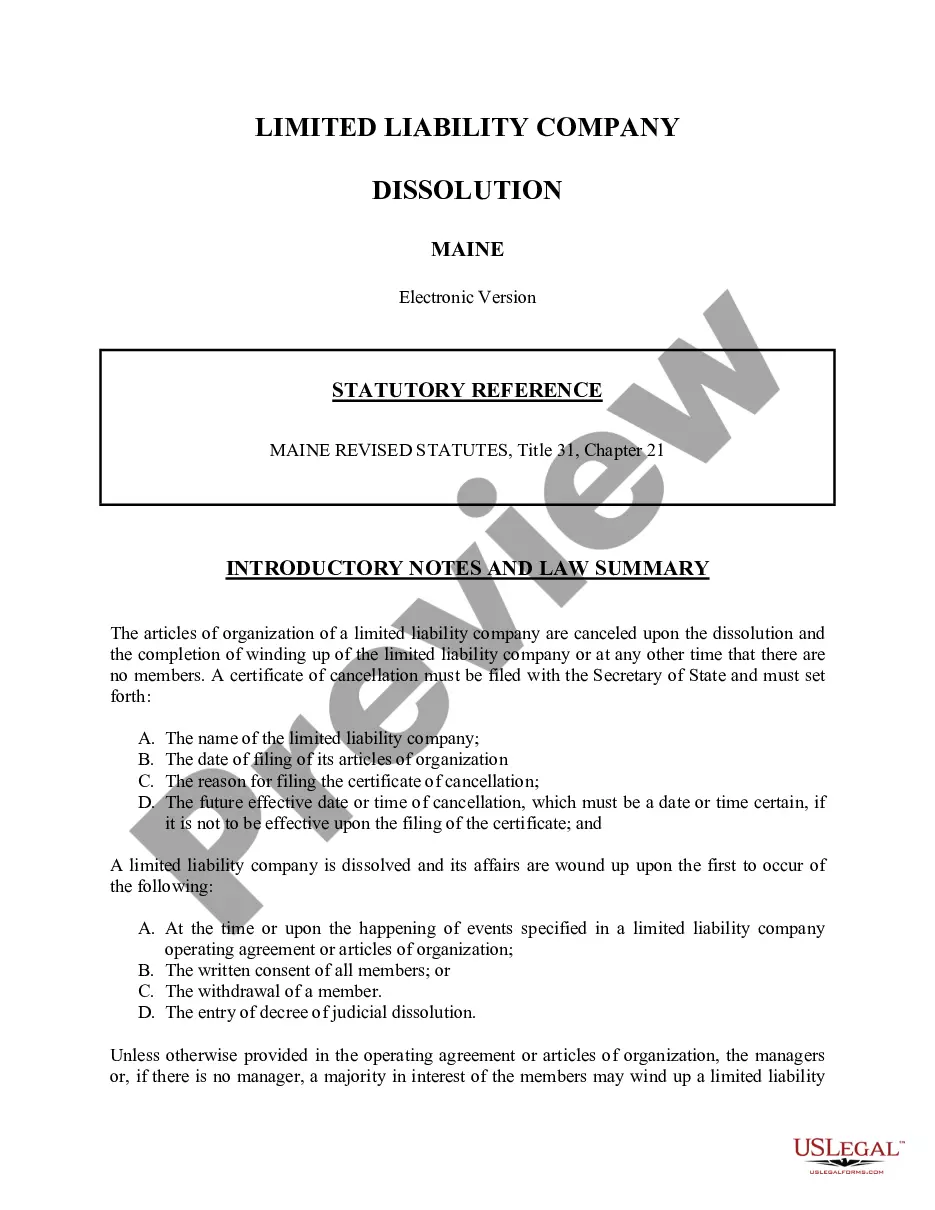

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

File dissolution documents with your state or local government to deregister a business's legal name. When you legally close your business, you also cancel its legal name. The process for dissolving a business differs by state, and some states do not require sole proprietors and partners to file dissolution documents.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.