The Annual Minutes form is used to document any changes or other organizational activities of the Corporation during a given year.

Maine Annual Minutes

Description

How to fill out Maine Annual Minutes?

Greetings to the largest legal document repository, US Legal Forms. Here you can acquire any template like Annual Minutes - Maine forms and download them (as many as you need). Create official documents within a few hours, instead of days or even weeks, without spending a fortune on a lawyer. Obtain the state-specific example in just a few clicks and feel assured knowing it was crafted by our certified legal experts.

If you’re already a registered customer, simply Log Into your account and then click Download next to the Annual Minutes - Maine you require. Since US Legal Forms is an online service, you’ll always have access to your stored templates, regardless of the device you’re using. Locate them within the My documents section.

If you haven't created an account yet, what are you waiting for? Review our instructions below to begin.

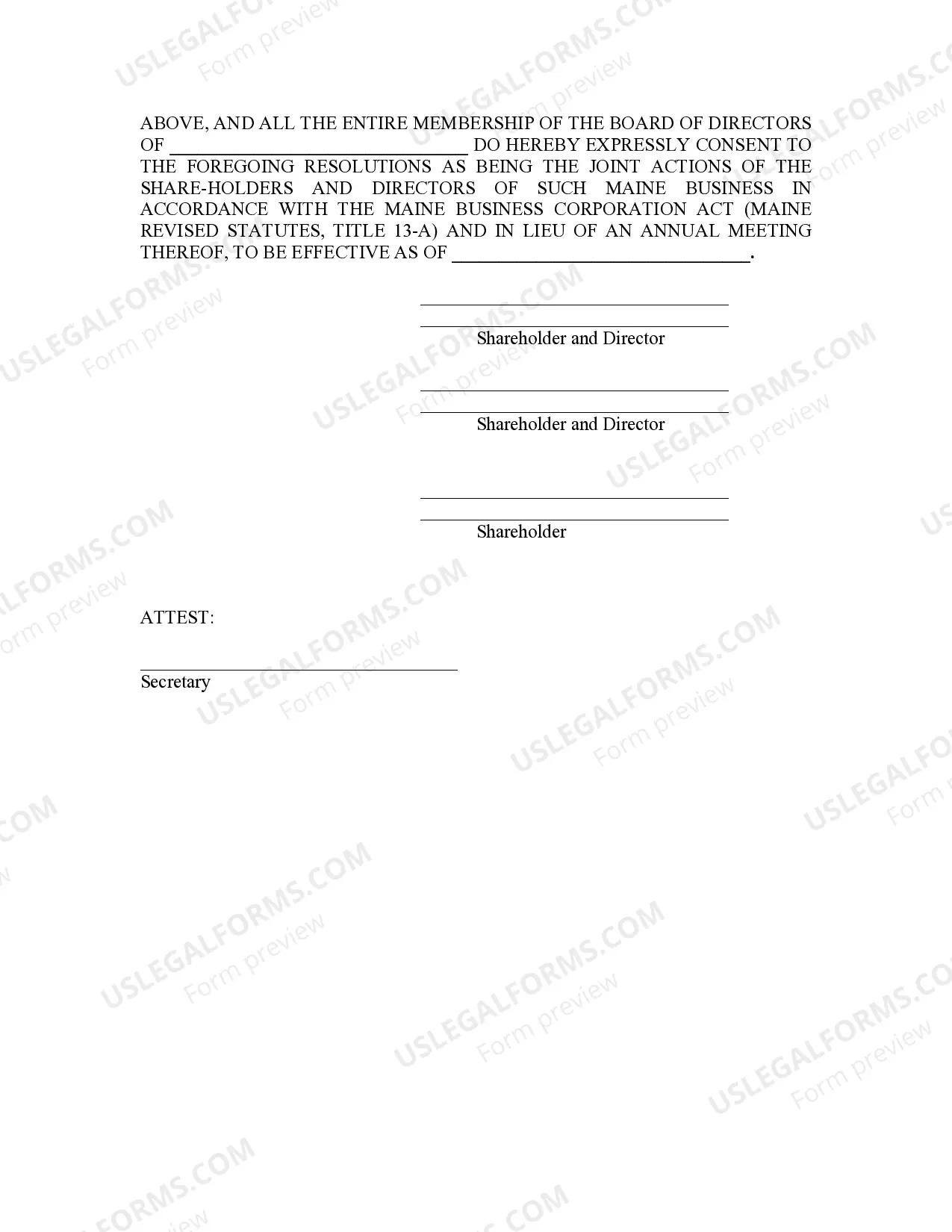

After you’ve completed the Annual Minutes - Maine, hand it over to your attorney for review. It’s an extra measure but an essential one to ensure you’re fully protected. Join US Legal Forms today and access a vast array of reusable templates.

- If this is a state-specific form, verify its relevance in your state.

- Examine the description (if available) to determine if it’s the appropriate template.

- See additional content using the Preview feature.

- If the template fulfills your needs, simply click Buy Now.

- To create your account, select a pricing option.

- Use your credit card or PayPal account to enroll.

- Download the template in the format you prefer (Word or PDF).

- Print the document and complete it with your/your business’s details.

Form popularity

FAQ

Unlike corporations, limited liability companies (LLCs) are not required by state law to hold meetings or record minutes of the meetings they do hold. Though they are not required by law, it is helpful for LLCs to keep minutes to help protect their business.

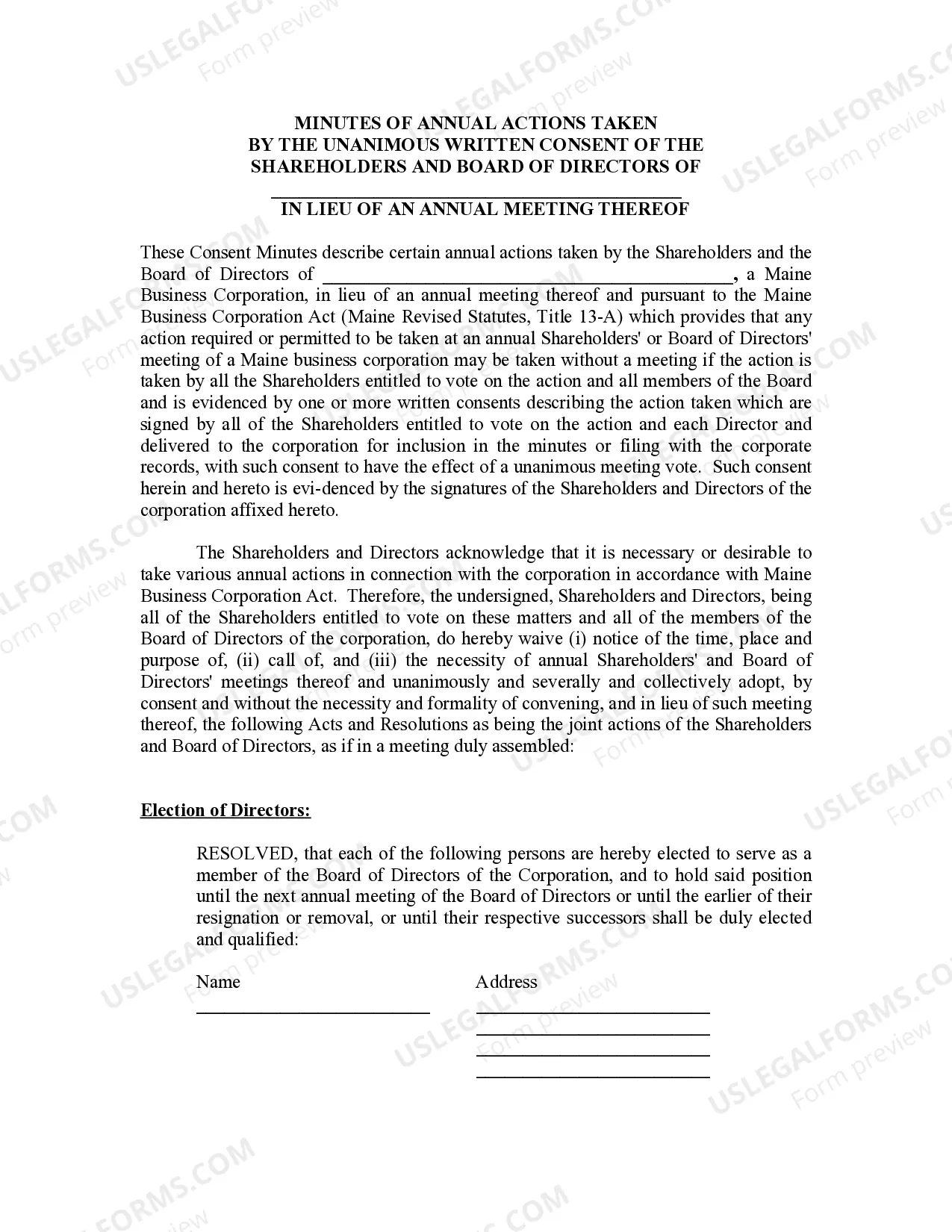

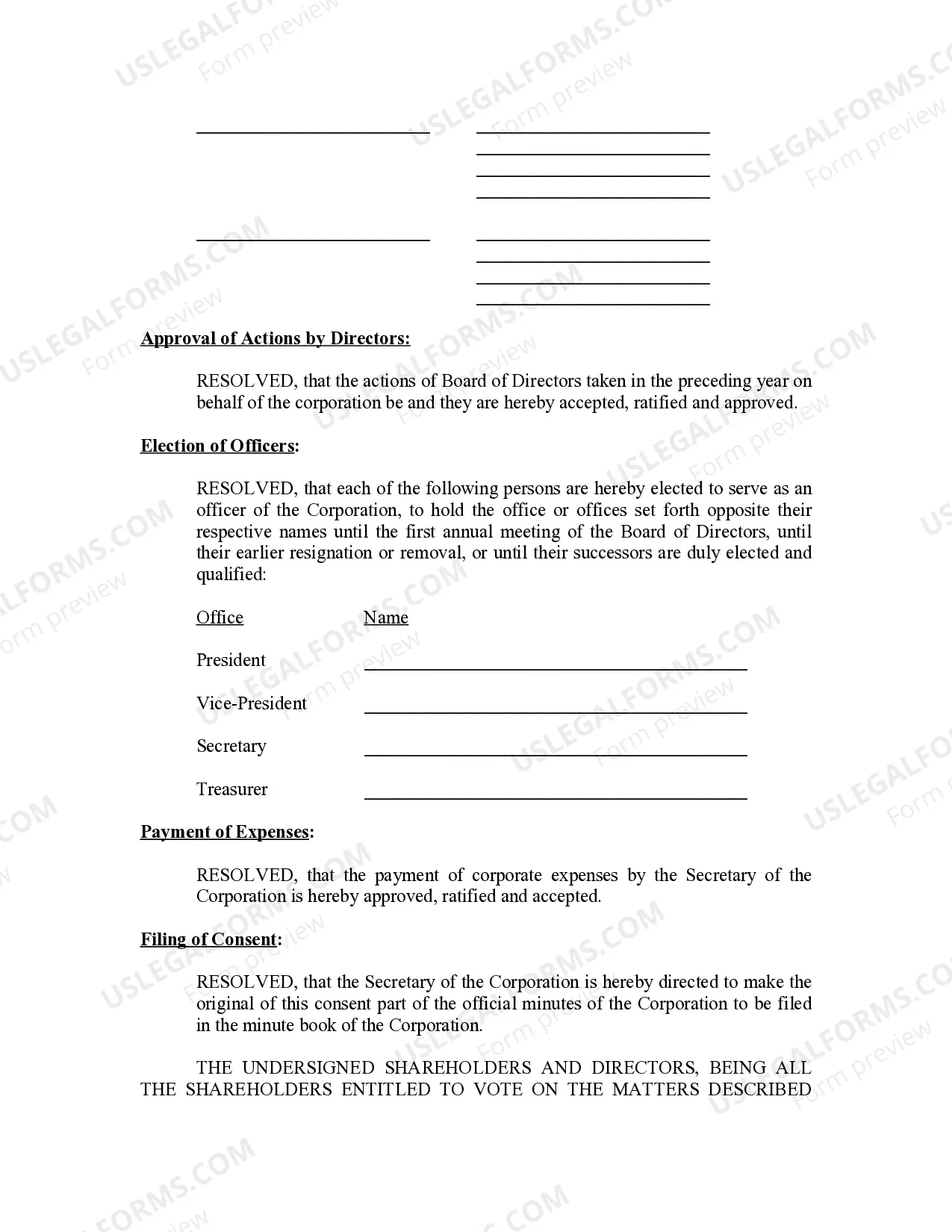

Date, time, and location. Minutes should include this basic information about when and where the meeting was held and how long it lasted. Creator. List of persons present. Topics list. Voting record. Review and approval.

One of the most important formalities required of corporations is to hold annual shareholder meetings and to keep detailed reports of these meetings, known as annual meeting minutes.While there's no statutory requirement for LLCs to hold meetings, it may be required by your LLC's own operating agreement.

Single member LLCs should have meeting minutes for any actions that its operating agreement calls for a vote. Often this includes decisions to add new members to the company, merge with another company or dissolve the company.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

A single-member LLC is a limited liability company with a single owner, and LLCs refer to owners as members. Single-member LLCs are disregarded entities. A disregarded entity is ignored by the IRS for tax purposes, and the IRS collects the business's taxes through the owner's personal tax return.

As long as you continue to operate as an LLC or corporation, you must maintain a registered agent. And, most states require that you file an annual report that supplies current information regarding your company.

Minutes typically include: Meeting date, time, and location. Names of attendees and whether they missed any part of the meeting. List of those absent. Agenda items and brief descriptions. Any voting actions and how each individual voted. Time that meeting was adjourned.

Minutes typically include: Meeting date, time, and location. Names of attendees and whether they missed any part of the meeting. List of those absent. Agenda items and brief descriptions. Any voting actions and how each individual voted. Time that meeting was adjourned.